UK inflation – live: Tories call for cut to interest rates despite market gloom over rising prices

Tories are calling for the Bank of England to cut interest rates despite market gloom over new inflation data.

Analysts say the chances of a cut in June are now slim after inflation fell to 2.3 per cent in April from 3.2 per cent in March – the lowest level in nearly three years – but above the 1.9 per cent to 2.1 predicted by some analysts.

But Sir Jacob Rees-Mogg, the former Conservative business secretary, argued the Bank should have cut rates already because “inflation is a lagging indicator.”

Paul Scully, a former minister, said cutting the rate would “bring relief to many who are fixing their mortgages for the next few years”.

Paula Bejarano Carbo, NIESR economist, added said persistent core inflation and strong wage growth data suggested the Bank “may exert caution at its upcoming meeting and hold interest rates, despite today’s encouraging fall in the headline rate.”

Suren Thiru, economics director at the Institute of Chartered Accountants in England and Wales, said a June cut was now “unlikely”.

Key Points

-

Tories call for rate cuts despite gloom over inflation data

-

Bank may ‘exert caution’ on interest rates

-

June interest cut ‘unlikely’ – accountants

-

Sunak: Inflation figures are good news but more to do

-

Now not the time for ‘victory lap’, says Reeves

-

Rate of inflation falls to 2.3 per cent in April

-

What is inflation?

-

IMF says economy set for ‘soft landing’

11:38 , Matt Mathers

We’re finishing our live coverage of the latest inflation data.

The rate dropped to 2.3 per cent in April from 3.2 per cent in March – the lowest level in nearly three years – but remained above what some analysts had predicted.

Thanks for reading and join us again soon for all the latest updates on the economy.

Have a good rest of morning.

Welcome

Tuesday 21 May 2024 19:30 , Joe Middleton

Good evening, and welcome to our inflation blog that will cover analysis and reaction to the figures that are due to be released on Wednesday.

What is inflation?

Tuesday 21 May 2024 20:30 , Joe Middleton

The Bank of England (BoE) defines inflation simply as a term used by economists to “describe the increase in prices over time”.

Rising costs of goods and services on the UK high street indicate that the value of the British pound is in decline, which in turn means a reduction in consumers’ purchasing power and therefore their quality of life, as they are discouraged from spending more than they can afford.

This in turn eats into national economic growth.

April’s data could be ‘make or break’ for the Bank of England

Tuesday 21 May 2024 21:30 , Joe Middleton

Experts said April’s data could be “make or break” for the Bank, which has been waiting for firm evidence that CPI has reached its target level before it can cut interest rates.

James Smith, a developed markets economist for ING, said: “It’s no exaggeration to say that this week’s UK inflation data will make or break a June rate cut from the Bank of England.

“The result is that headline inflation will, we think, dip below the Bank of England’s 2% target in May’s data due in June and stay there for most – if not all – of this year.

“But in the very short term, there’s still some uncertainty over services inflation.

NewsBusiness UK inflation predicted to drop close to Bank of England’s 2% target

Tuesday 21 May 2024 22:30 , Joe Middleton

UK inflation could get close to the Bank of England’s target of 2 per cent when the latest figures are released by the Office for National Statistics (ONS) on Wednesday.

The Consumer Prices Index (CPI) dropped to 3.2 per cent for March, compared with the previous year, and forecasters polled by Reuters think inflation will drop to 2.1 per cent for April.

Pantheon Economics predicts a slightly lower figure of 2 per cent and Capital Economics thinks that it could dip even lower to 1.9 per cent. The Bank of England’s (BoE) own forecast is 2.1 per cent.

Joe Middleton reports.

UK inflation predicted to drop close to Bank of England’s 2% target

Watch: What is inflation?

Tuesday 21 May 2024 23:30 , Joe Middleton

How much is inflation expected to fall by?

Wednesday 22 May 2024 00:30 , Joe Middleton

CPI inflation is expected to fall to 2.1% in April from 3.2% in March, according to a consensus compiled by Pantheon Macroeconomics.

This would mark the lowest level since July 2021 when inflation was recorded at 2% – the Bank of England’s target level.

Lower gas and electricity prices compared with the prior year are expected to be the key driver behind price rises cooling last month.

What will happen to services inflation?

01:30 , Joe Middleton

Pantheon Macroeconomics said it expects services inflation to fall to 5.4 per cent in April from 6 per cent in March.

Luke Bartholomew, senior economist for Abrdn, said that services inflation will likely be more important for policymakers at the Bank of England than the overall inflation figure.

“While returning inflation to target is psychologically significant, and symbolic of how much progress has occurred since inflation peaked above 11%, it is unlikely to be the number watched most closely by the Bank of England and investors,” he said.

“If services inflation comes in line with expectations, this will keep a June rate cut in play.

“But a large upside surprise will likely see the market scale back its bets on a June cut, and start to look to August for the beginning of the easing cycle.”

Watch: What is inflation?

02:30 , Joe Middleton

UK inflation predicted to drop close to Bank of England’s 2% target

03:30 , Joe Middleton

UK inflation could get close to the Bank of England’s target of 2 per cent when the latest figures are released by the Office for National Statistics (ONS) on Wednesday.

The Consumer Prices Index (CPI) dropped to 3.2 per cent for March, compared with the previous year, and forecasters polled by Reuters think inflation will drop to 2.1 per cent for April.

Pantheon Economics predicts a slightly lower figure of 2 per cent and Capital Economics thinks that it could dip even lower to 1.9 per cent. The Bank of England’s (BoE) own forecast is 2.1 per cent.

UK inflation predicted to drop close to Bank of England’s 2% target

FTSE 100 nudges downwards on Tuesday

04:30 , Joe Middleton

The FTSE 100 nudged downwards on Tuesday as a broader sell-off reached European stocks after falls in Asia.

Global markets continued with their cautious tone this week, with BT, Vodafone and easyJet among the biggest fallers on the UK index.

The FTSE 100 finished 8 points, or 0.09%, lower at the close at 8,416 points.

It came after Federal Reserve officials said they were not ready to say inflation was heading towards the US central bank’s 2% target on Monday.

“It is too early to tell whether the recent slowdown in the disinflationary process will be long lasting,” Fed vice chairman Philip Jefferson told the Mortgage Bankers Association conference in New York.

IMF say economy set for ‘soft landing’

05:30 , Joe Middleton

The UK economy is set for a “soft landing” as it grows faster than previously expected following recession last year, according to the International Monetary Fund (IMF).

However, the global financial agency stressed that ambitious structural reforms to improve living standards “are urgently needed” ahead of a general election later this year.

It also cautioned against any pre-election tax cuts and indicated Government could bring in more funds from taxes linked to carbon usage or road vehicles.

The IMF said in a new report on the health of the UK economy that GDP (gross domestic product) in the country is expected to grow by 0.7% for 2024, following 0.6% growth over the first quarter.

It represents an upgrade from the IMF’s previous prediction of 0.5% growth for the year.

What will happen to services inflation?

06:30 , Joe Middleton

Pantheon Macroeconomics said it expects services inflation to fall to 5.4 per cent in April from 6 per cent in March.

Luke Bartholomew, senior economist for Abrdn, said that services inflation will likely be more important for policymakers at the Bank of England than the overall inflation figure.

“While returning inflation to target is psychologically significant, and symbolic of how much progress has occurred since inflation peaked above 11%, it is unlikely to be the number watched most closely by the Bank of England and investors,” he said.

“If services inflation comes in line with expectations, this will keep a June rate cut in play.

“But a large upside surprise will likely see the market scale back its bets on a June cut, and start to look to August for the beginning of the easing cycle.”

BREAKING

07:06 , Joe Middleton

The rate of Consumer Prices Index inflation fell to 2.3% in April from 3.2% in March, the Office for National Statistics said.

Sunak: ‘Major moment’ for economy

07:17 , Matt Mathers

Today’s drop in inflation is a “major moment” for the economy, Rishi Sunak has said.

“This is proof that the plan is working and that the difficult decisions we have taken are paying off,” the prime minister said.

“Brighter days are ahead, but only if we stick to the plan to improve economic security and opportunity for everyone.”

Reeves: Not the time for a ‘victory lap’

07:19 , Matt Mathers

Rachel Reeves welcomed the drop in inflation but warned now is not the time for a “victory lap”.

“Inflation has fallen, but now is not the time for Conservative ministers to be popping champagne corks and taking a victory lap,” the shadow chancellor said.

“After fourteen years of Conservative chaos families are worse off. Prices in the shops have soared, mortgage bills have risen and taxes are at a seventy year high.

“Rishi Sunak is now putting family finances at risk again with his £46 billion unfunded policy to abolish national insurance that will mean higher borrowing, higher taxes or the end of the state pension as we know it.

“It’s time for change. Labour’s first steps will deliver economic stability so we can grow our economy and keep taxes, inflation and mortgages as low as possible.”

Cost of living crisis not over – TUC

07:25 , Matt Mathers

The cost of living crisis “is not over – no matter how much ministers pretend it is,” a union has said.

“Prices are still going up. Food and energy bills are much higher than a couple of years ago. And many are being hit by soaring mortgage repayments,” TUC general secretary Paul Nowak said.

“While it’s good the inflation rate is lower, millions up and down the country are still having to cut back on everyday essentials as they struggle to makes end.

“That’s because household budgets have been decimated by the highest price rises in the G7 and wages have flatlined over the last 14 years.

“Pay packets are still worth less today than in 2008, with working people on course to end this parliament poorer than at the start.

“Make no mistake – the Tories have delivered the worst period for living standards in generations.”

Inflation drop ‘good news’ but wages still catching up

07:29 , Matt Mathers

The drop in inflation to near the Bank of England’s target of 2 per cent is “good news” but wages are still catching up with post-pandemic price increases, a think tank has said.

Carsten Jung, senior economist at IPPR said: “Inflation temporarily falling close to the Bank of England’s target is good news, but wages are still catching up with post pandemic price increases. This is why it’s important that the Bank does not hamper the UK’s nascent recovery by leaving interest rates too high for too long.

“The Bank has tightened the screws too much and this will hold back the economy and wage growth going forward. They recently admitted that inflation is falling faster than it originally thought, suggesting an earlier reversal in policy.

“Looking back, it is clear that the government could have done more to shield people from inflation. Other countries like France and Japan were more proactive in easing price increases and did more to stop firms from amplifying inflation via shielding their profits. Especially on profits there are still actions it can take.”

Bank may ‘exert caution’ on interest rate cut

07:55 , Matt Mathers

The lower than expected drop in inflation may lead the Bank of England to “exert caution” on cutting interest rates, a think tank has said.

Paula Bejarano Carbo, NIESR Economist, said: “Inflation has fallen to its lowest level in almost three years. This is positive news, however inflation remains above the Bank of England’s 2 per cent target and core inflation is still higher than its historical average at 3.9 per cent.

“Paired with last week’s strong wage growth data, we believe that elevated services inflation will remain an upwards risk to inflationary pressures in the second half of this year.

“As a result, the MPC may exert caution at its upcoming meeting and hold interest rates, despite today’s encouraging fall in the headline rate.”

Inflation figutes ‘set stage’ for interest rate cut – CBI

07:57 , Matt Mathers

The latest inflation data sets the stage for interest rate cuts in coming months, the Confederation of British Industry (CBI) has said.

Alpesh Paleja, CBI lead economist, said: “A big fall in inflation was always on the cards for April, given Ofgem’s 12 per cent cut to the energy price cap. Households and businesses will welcome a more benign inflationary environment, but it’s worth noting that many will still be struggling with a high level of prices, particularly in food and energy bills.

“Today’s data further sets the stage for interest rate cuts in the coming months. While the Monetary Policy Committee is likely to reduce interest rates over the summer, they are still holding out for more definitive falls in measures of domestic price pressures.

“It’s encouraging that pay growth is now a touch below the Bank of England’s forecast, but there’s still a long way for it to get closer to levels consistent with inflation at target.

“The Bank will also be mindful of growing upside risks to inflation in the near-term: with the growth outlook improving at home, and tensions in the Middle East threatening to stoke commodity prices and supply pressures globally.”

Nobody will be feeling better off after latest figures – Lib Dems

08:05 , Matt Mathers

Nobody will be feeling better off after the latest inflation figures, the Liberal Democrats said.

Responding to the latest inflation figures, Lib Dem Treasury spokesperson Sarah Olney said: “Nobody will be feeling any better off after today, with families still facing a £9 billion mortgage bombshell this year alone.

“Conservative ministers cannot celebrate today after presiding over the worst cost-of-living crisis in a generation.

“The aftershocks of this crisis will be felt for years to come, and the blame lies squarely with this incompetent government.

“The Conservative party should never again be trusted to manage the British economy.”

Martin Lewis explains what inflation fall means for interest rates

08:11 , Matt Mathers

Martin Lewis has predicted that the Bank will cut interest rates in August rather than June following the lower than expected drop in inflation.

Watch the clip below:

Sunak: More work to do despite drop in inflation

08:17 , Matt Mathers

Rishi Sunak has said there is still “more work to do” after inflation fell to its lowest level in three years but remained above what economists predicted.

“I understand that people are only just starting to feel the benefits of the improvements that we have made and that will take time for people to really feel them.” he said.

“But what we are now seeing is that everything is heading in the right direction.”

The prime minister added: “The economy grew in the first quarter of this year, faster than France, Germany and America.

“Wages have been rising faster than prices for almost a year now, energy bills are down hundreds of pounds now from where they were, mortgage rates are down from the peak and today’s news on inflation being back to normal is very welcome.

“If you put all of that together it shows we have got momentum, it shows that the plan is working but of course there is more work to do for people to really feel the benefits of all these things.

“That is why it is important that we stick to the plan. As I have said, these things don’t happen by accident.”

Recap: UK inflation falls less than expected to 2.3% in April

08:25 , Matt Mathers

UK inflation has fallen by lower than expected, despite falling gas and electricity prices, dashing hopes that the Bank of England will lower interest rates at its next meeting in June.

The figures released by the Office for National Statistics (ONS) on Wednesday morning showed that the consumer price index was 2.3 per cent in April, down from 3.2 per cent in March.

Full report:

UK inflation falls less than expected to 2.3% in April

Bank may want to see drop in service inflation before cutting rates

08:30 , Matt Mathers

The Bank of England may want to see a further drop in service inflation before it cuts interest rates, a management consultancy has said.

Matthew Chapman, associate partner at McKinsey & Company, said: “Service inflation remains high. And there may need to be further downward movements in service inflation, real wage growth and the labour market before the narrative on monetary policy can start to change.

“While sharp drops in energy prices and easing food costs have helped push the CPI reading to a three-year low, prices are still substantially higher than they once were. And households are likely to continue adjusting their budgets as the cost of some everyday staples continues to rise at more than double the current rate of inflation. For example, breakfast cereals are up 7.4 per cent and vegetables like potatoes are up 7.9 per cent with the cost of crisps also rising 7.7 per cent.

“A return to the stable dynamics that prevailed before the Covid-19 pandemic still seems unlikely. Inflation is likely to still persist, growth sluggish and high interest rates may continue to create downward pressure on margins. To protect balance sheets, companies will need to remain vigilant and create opportunities to proactively react to cost and demand changes.”

June interest rate cut now ‘unlikely’ – institute of accountants

08:36 , Matt Mathers

A cut to interest rates in June is “unlikely” after inflation fell less than expected, the Institute of Chartered Accountants in England and Wales has said.

Suren Thiru, ICAEW economics director, said: “This underwhelming drop in inflation suggests that the UK is rather stumbling back towards the Bank of England’s 2 per cent target, as lower energy bills had a smaller than expected impact on April’s headline rate.

“Concern over hotter than expected headline inflation is exacerbated by disappointing declines in core and services inflation, which suggest that the problem of underlying price pressures embedded in the wider economy have yet to be solved.

“The headline rate is set to drop markedly over the summer, once the expected decline in Ofgem’s energy price cap cuts people’s energy bills from July.

“Lingering concerns over underlying inflationary pressures mean a June rate cut is unlikely. However, these figures may convince more rate setters to vote to ease policy, providing a signal that a summer rate cut is still possible.”

Worst of cost of living crisis ‘not over’ – think tank

08:46 , Matt Mathers

Many people are still facing lower living standards, a think tank has said as it warned that the worst of the cost of living crisis “is not over”.

Ben Harrison, director of the Work Foundation at Lancaster University, said: “Workers across the country might be quietly relieved that their bills and shopping are rising at the lowest level since 2021.

“But even at 2.3 per cent, inflation remains above the Bank of England’s target and many people will be facing lower living standards for some time to come.

“The truth is the worst cost of living crisis for more than 40 years is not yet over – most workers continue to face energy, food and housing costs that are much higher than three years ago.

“The sting in the tail is interest rates remain at a 16-year high of 5.25 per cent. And while there is no guarantee the Bank of England will cut interest rates soon, low paid and insecure workers are particularly exposed to record private rent increases and higher mortgage payments.”

Government borrowing in April higher than forecast in blow to chancellor

08:57 , Matt Mathers

Chancellor Jeremy Hunt has been dealt a blow after official figures revealed borrowing for April overshot forecasts, hitting £20.5 billion, in the fourth-highest April since records began in 1993.

The Office for National Statistics (ONS) estimated that public sector net borrowing was £1.5 billion more than in 2023, partly pushed up by falling national insurance contributions.

Full report:

Government borrowing in April higher than forecast in blow to Chancellor

Hunt dodges question on whether he feels personally wealthier amid cost of living squeeze

09:05 , Matt Mathers

Jeremy Hunt said it was “nothing to do with me” when asked if he personally felt wealthier following the cost-of-living crisis.

Asked by BBC Radio 4’s Today programme if he felt wealthier, the chancellor said: “It is nothing to do with me. It is to do with my responsibilities as chancellor.

“What I know when I became chancellor is we had the Office for Budget Responsibility saying we were going to have the biggest fall in living standards ever.

“We had the Bank of England saying that we were going to have the deepest, the longest recession for a hundred years.”

He pointed to cost-of-living support the government had offered, adding: “The result of those difficult decisions, and they were difficult because in the end we had to put up taxes for those decisions, but the result is living standards have gone up since Rishi Sunak became prime minister.”

In a testy exchange, Mr Hunt could earlier be heard to insist “me too” when host Emma Barnett said she was interested in people’s household finances.

Chancellor acknowledges people still feeling worse off

09:18 , Matt Mathers

Jeremy Hunt has acknowledged that people were likely to be feeling worse off than they did a few years ago.

The chancellor said “two massive shocks” – the Covid pandemic and Russia’s war in Ukraine – were to blame for the drop in living standards.

Speaking to ITV’s Good Morning Britain programme, the chancellor said: “Do people feel better off now than a few years ago? No, because we have had something that you and I have never had in our lifetimes.

“We have had two massive economic shocks in quick succession so no, they don’t feel better than they felt a few years ago.

“The numbers show very clearly that since 2010 over a longer period of time living standards have improved, we have got four million more jobs, we have attracted more investment than anywhere in the world apart from China and the United States.

“The reason I am saying that is because this is an election year, people are going to make a choice about the future.

“When it comes to the important things that make a difference, the difficult decisions on having a flexible labour market, on getting taxes down so that we attract investment from overseas, a Conservative government will continue to take those difficult decisions.”

Watch some of the interview below:

After outlining a historic tax burden, high interest rates and increased use of food banks, @susannareid100 asks the Chancellor if he acknowledges that people are worse off under the Conservative government. pic.twitter.com/DfU9SnscMn

— Good Morning Britain (@GMB) May 22, 2024

Reeves: Labour will be ‘much more ambitious’ than government

09:25 , Matt Mathers

Labour will be “much more ambitious” on the economy than the government if it wins the election, Rachel Reeves has said.

The shadow chancellor said her party would bring “stability back to our economy” and invest more in renewables.

She said Labour would invest more in “home-grown renewables so we’re less reliant on Putin and dictators around the world for our basic energy needs and can bring energy bills down for families and pensioners”.

Hunt declines to be drawn on potential interest rate cut

09:35 , Matt Mathers

Jeremy Hunt declined to be drawn on when he thought the Bank of England would cut interest rates.

The chancellor said the central bank would cut rates when it was “confident that it is sustainably at its target”.

Analysts said the Bank was likely to be more cautious on a potential cut in June because inflation fell by less than expected.

Watch more below:

Economy ‘not out of the woods yet’ – shadow Treasury minister

09:48 , Matt Mathers

Today’s inflation figures show the economy is “not out of the woods yet”, Labour’s shadow Treasury minister Darren Jones has said.

The MP for Bristol North West said inflation was heading “in the right direction” but there was more work to be done.

He told Sky News: “Core inflation is still around 3.6 to 3.9 per cent, which is hotter than the markets were expecting it to be. This is not out of the woods yet. It is in the right direction but there is still much more to be done.”

Mr Jones pointed to Labour’s “securonomics” agenda, which includes measures to build “homegrown, secure, renewable energy”.

The shadow minister said: “The one reason that the headline rate of inflation has come down closer to 2 per cent today even though the cost of other things are remaining a bit too high is because of the energy bills.

“The problem there is if something happens in the world and gas prices rocket again, we are going to be back into that inflationary environment with very high bills.”

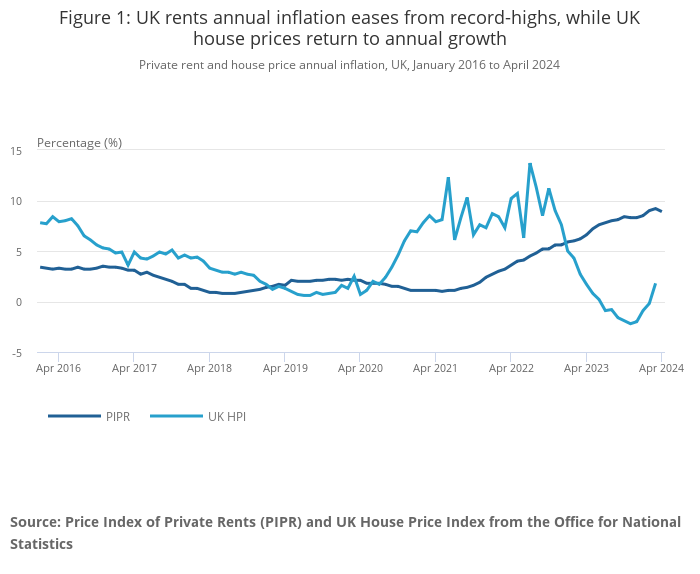

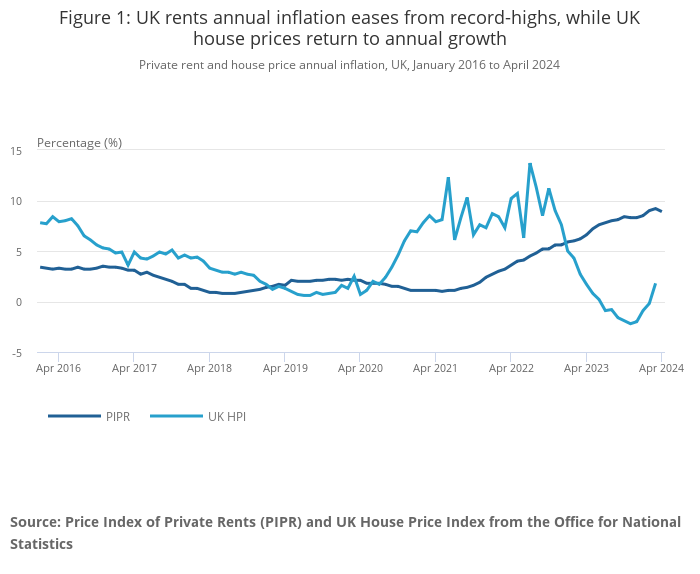

Average house price rises by 1.2%…as rents rocket 8.9%

10:00 , Matt Mathers

Average UK house prices increased by 1.8 per cent in the 12 months to March, according to official figures.

The Office for National Statistics (ONS) said it lifted the average house price across the UK to £283,000.

It represented a recovery in pricing after house prices had fallen by 0.2 per cent in the 12 months to February.

Meanwhile, the ONS also revealed that UK private rents increased by 8.9 per cent in the 12 months to April, as house price inflation slowed slightly from 9.2 per cent growth in the year to March.

ONS chief economist Grant Fitzner said: “Average UK house prices grew over the year for the first time since last summer.

“House prices saw an annual rise in every nation and region, except London and the South East, with Scotland seeing the fastest annual growth.

“After two years of unprecedented and generally accelerating annual growth, private rental price rises showed tentative signs of easing.

“Most nations and English regions saw a slowdown, with a notable easing in London.”

BT fined £2.8m over contract failures for 1.1m EE and Plusnet customers

10:06 , Matt Mathers

BT has been fined £2.8 million by the industry watchdog after EE and Plusnet failed to provide clear and simple contract information to more than a million customers before they signed up.

Ofcom said that since June 2022, BT’s EE and Plusnet businesses made more than 1.3 million sales without providing customers with a contract summary and information documents, which affected at least 1.1 million customers.

Full report:

BT fined £2.8m over contract failures for 1.1m EE and Plusnet customers

ICYMI: Martin Lewis explains what inflation fall means for interest rates

10:49 , Matt Mathers

Martin Lewis explains what inflation fall means for interest rates

Tories call for rate cuts despite gloom over inflation data

11:05 , Matt Mathers

Two Tory MPs are calling for interest rates to be cut despite market gloom over today’s inflation figures.

Sir Jacob Rees-Mogg, the former Conservative business secretary, argued the Bank should have cut rates already because “inflation is a lagging indicator.”

Paul Scully, a former minister, said cutting the rate would “bring relief to many who are fixing their mortgages for the next few years”.

‘Shaky start’ to year casts doubt on future tax cuts

11:31 , Matt Mathers

A “shaky start” to the financial year casts further doubt on the chancellor’s ability to cut taxes in a potential pre-election fiscal event, an economics company has said.

Alex Kerr, assistant economist at Capital Economics, said: “Overall, the chancellor will be disappointed that April’s figures do not provide more scope for tax cuts at a fiscal event later this year.

“Moreover, we expect slower nominal GDP growth and wage growth to dampen tax receipts growth later this year.

“And the rise in market interest rates since March’s budget alone suggests he may have even less fiscal ‘headroom’ (perhaps about £6.5bn) for tax cuts than the £8.9bn left over in March.”

Paula Vennells should be made homeless, postmaster suggests

14:27 , Matt Mathers

Rubina, a sub postmistress who was accused of taking £43,000 in 2010 and sentenced to a 12 months in prison, has suggested the only way Paula Vennells will “learn” anything from the Post Office scandal is if she’s stripped of her assets and made homeless, Archie Mitchell reports.

When asked whether she wants to see Paula Vennells go to prison, she told Times Radio: “I don’t want Paula Vennells to go to prison because she won’t learn anything.

“The only way she’ll learn is everything being stripped of her, her assets, her mark against her name so that she can’t get employment, made homeless. That’s how I want her to pay back what she did to us”.

“When people like [her] go to prison, they don’t learn anything. After three or four months or six months later they’ll be out”.