UK high street banks are continuing to offer lower savings rates compared with challenger banks and building societies, Which? research has found.

Lenders are failing to make substantial improvements since the Financial Conduct Authority (FCA) set out a 14-point action plan for cash savings in July. The UK’s financial regulator had found that just over a quarter of recent Bank of England rate increases have been passed on to the most popular deposit accounts.

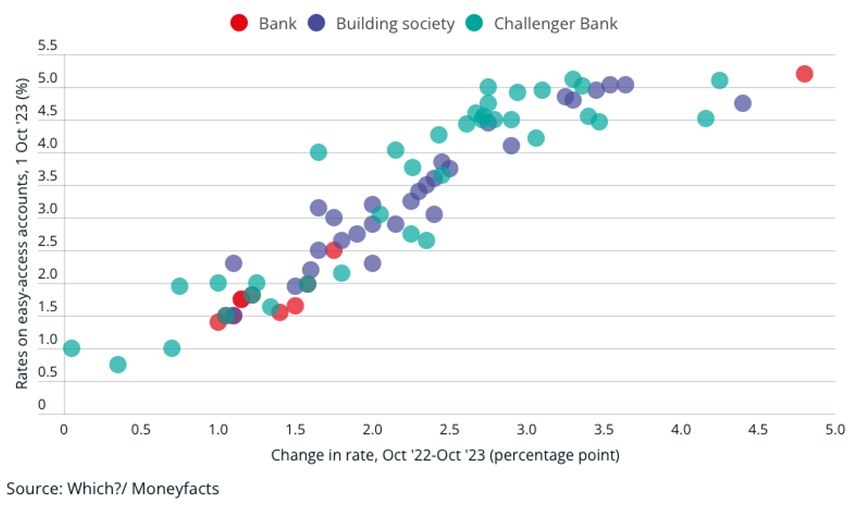

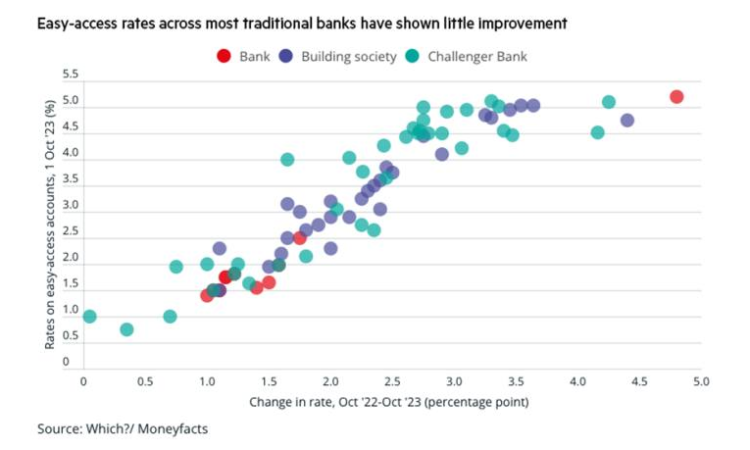

Easy-access rates across most traditional banks have shown little improvement

Between October 2022 and October 2023, the Bank of England hiked the base rate seven times, raising it by three percentage points from 2.25% to 5.25%.

Over the same period, the average easy-access rate offered by the big banks only grew by 1.56 percentage points, rising from 0.42% to 1.98%, according to Which?, a consumer association.

Instead, building societies raised their easy-access rates by nearly two percentage points on average (from 0.96% to 2.93%), while challenger banks made an increase of 2.31 percentage points (1% to 3.31%).

As of early November, Ulster Bank is also the only high street name to offer an above-average easy access rate with its Loyalty Saver offering 5.2% on balances of £5000 and above. Lloyds (1.4%), Halifax (1.5%), Barclays (1.65%) and HSBC (1.98%) all pay less than 2% on their easy-access accounts, the association finds.

The FCA’s new Consumer Duty, which came into force in July, sets higher and clearer standards of consumer protection across financial services. This means firms must regularly review their products to demonstrate that they offer fair value while those that fall short of this requirement should expect action from the regulator.

Consumers across the UK collectively hold around £1.5tn in savings accounts, says the FCA.