UK banks face major payment delays – HSBC, Barclays and Nationwide banking apps down on crucial payday

On June 28, 2024, a digital banking meltdown left thousands of UK customers stranded without access to their funds on a critical payday.

Major banks like HSBC, Barclays, Nationwide, and Virgin Money grappled with widespread payment delays, exposing vulnerabilities in the digital banking infrastructure and causing significant frustration and inconvenience.

On June 28, 2024, thousands of customers across the UK faced significant disruptions as major high-street banks experienced widespread payment delays. HSBC, Barclays, Nationwide, and Virgin Money were among the affected institutions, leaving many unable to access their funds on a crucial payday.

The issues ranged from difficulties in accessing online banking services to delays in salary and pension payments.

The issues began early on the morning of Friday, with customers starting to report problems around 8:20 AM. By 8:45 AM, over 7,000 issues had been logged for HSBC, with similar spikes for Virgin Money, Nationwide, and Barclays.

HSBC and Virgin Money customers faced issues accessing online and mobile banking services, with some unable to view recent transactions or send payments. Barclays also acknowledged problems with transfers and payments. The payment delays affected thousands of customers across the UK on a critical payday for many workers, leading to widespread frustration and financial inconvenience.

HSBC confirmed the disruptions and began working on resolutions, advising customers to check transactions before resending payments. Nationwide promised resolution by the end of the day while Virgin Money and Barclays also communicated their efforts to restore services. By midday, most banks reported partial resolutions, though some issues persisted and the impact on customers was already profound.

The exact causes of the payment delays remain unclear, but initial reports suggest a “third-party payments issue” affecting multiple banks. HSBC mentioned ongoing IT problems, which hindered online and mobile banking services. Nationwide attributed the delays to issues with third-party payment systems, impacting the timely processing of salary and pension payments. Virgin Money and Barclays also faced similar disruptions, likely linked to the same underlying technical failures.

Many customers vented their frustration on social media, particularly noting the timing of the disruptions coinciding with payday. One Nationwide customer shared that this was not the first time they had experienced such delays.

Another Barclays customer complained about having “thousands of pounds worth of payments due in” but being unable to receive them.

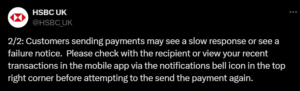

In response to the disruptions, the affected banks issued apologies and updates through their websites and social media channels.

HSBC acknowledged the issues and advised customers to check transactions before resending payments.

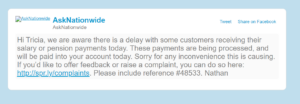

Nationwide assured customers that delayed salary and pension payments were being processed and would be completed by the end of the day.

Virgin Money and Barclays also communicated their awareness of the problems and efforts to restore services promptly.

Despite these communications, many customers felt the responses were insufficient, given the significant inconvenience caused.

The Financial Conduct Authority (FCA) and the Bank of England are expected to scrutinise the disruptions closely. Any findings could lead to recommendations or mandates to prevent future occurrences, safeguarding customer interests.

The financial industry and markets reacted with concern to the disruptions. Analysts noted potential impacts on the banks’ reputations and stock prices.

The incident underscored the need for more resilient digital banking systems, prompting discussions on industry-wide improvements to prevent future occurrences and maintain customer confidence.