(Bloomberg) — UK banks extended their record bid for cash from the Bank of England, replacing liquidity which is being drained as policymakers continue to sell bonds acquired through years of quantitative easing.

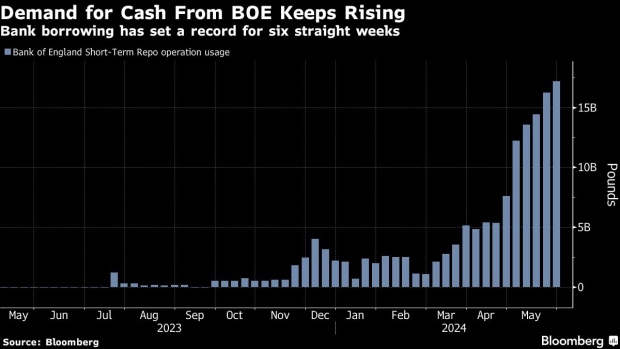

Banks took up £17.2 billion ($21.9 billion) in funding through one-week repurchase agreements, or repos. That’s up from £16.2 billion, and a sixth straight week of record demand.

The BOE’s bond sales have reduced the amount of spare cash in the economy to the lowest since 2021, and led many analysts to call for an end to the policy. They worry that if liquidity drops too much it will drive up borrowing costs in money markets, and impair the BOE’s ability to lower rates.

“We may have reached the point where reserves are tipping over from being ample to scarce,” said Peter Schaffrik, global macro strategist at RBC Capital Markets, adding “but it’s still not conclusive.”

But Governor Andrew Bailey has called the bid for cash “encouraging,” signaling he’s keen for the BOE to satisfy the financial system’s liquidity needs through repos rather than bond buying. Doing so would remove the interest-rate risk the bank takes on, and which is now causing losses on its holdings, he said.

So far, there is no evidence that the BOE’s quantitative tightening program, or QT as it’s referred to, is putting undue pressure on market rates. The premium over the Bank Rate that investors pay to obtain cash on the repo market is just one basis point, down from as high as 10 basis points at the start of the month.

(Adds quote in the fourth paragraph)

©2024 Bloomberg L.P.