Kamalita Abdool Head of Securities Services Americas and Global Custodian Coverage at Deutsche Bank explains that having a global approach to preparation is key to being ready for the May 2024 U.S. market implementation of T+1. Her team has been taking advantage of all the 21 testing cycles available, with the first in August of 2023. “These market testing cycles simulate a live environment and allow our team to engage other market participants to identify and remediate any challenges that arise along the journey to May 2024,” she says.

“A shorter time frame during which trades are pending … frees up space for all market actors to have better capital deployment”

Unsurprisingly, settlement compression was a core theme at Sibos, and perspectives varied according to region. As Euroclear CEO Lieve Mostrey put it in “T+1 – the impact of one – and only one – day to settle securities” panel, advantages include, “a shorter time frame during which trades are pending – this frees up space for all market actors to have better capital deployment, to have more transactions and have more business for the same resources committed”. She also pointed out that central securities depositary regulation (CSDR) is focussing on settlement efficiency having introduced penalties around it. Mandating T+1 to CSDs, however, is not the way forward, she cautioned, and holistic view needs to be taken with some product lines, clients and business models having space to do their rethinking. “Awareness is still a bit low in Europe and we have to work on this,” she reflected.

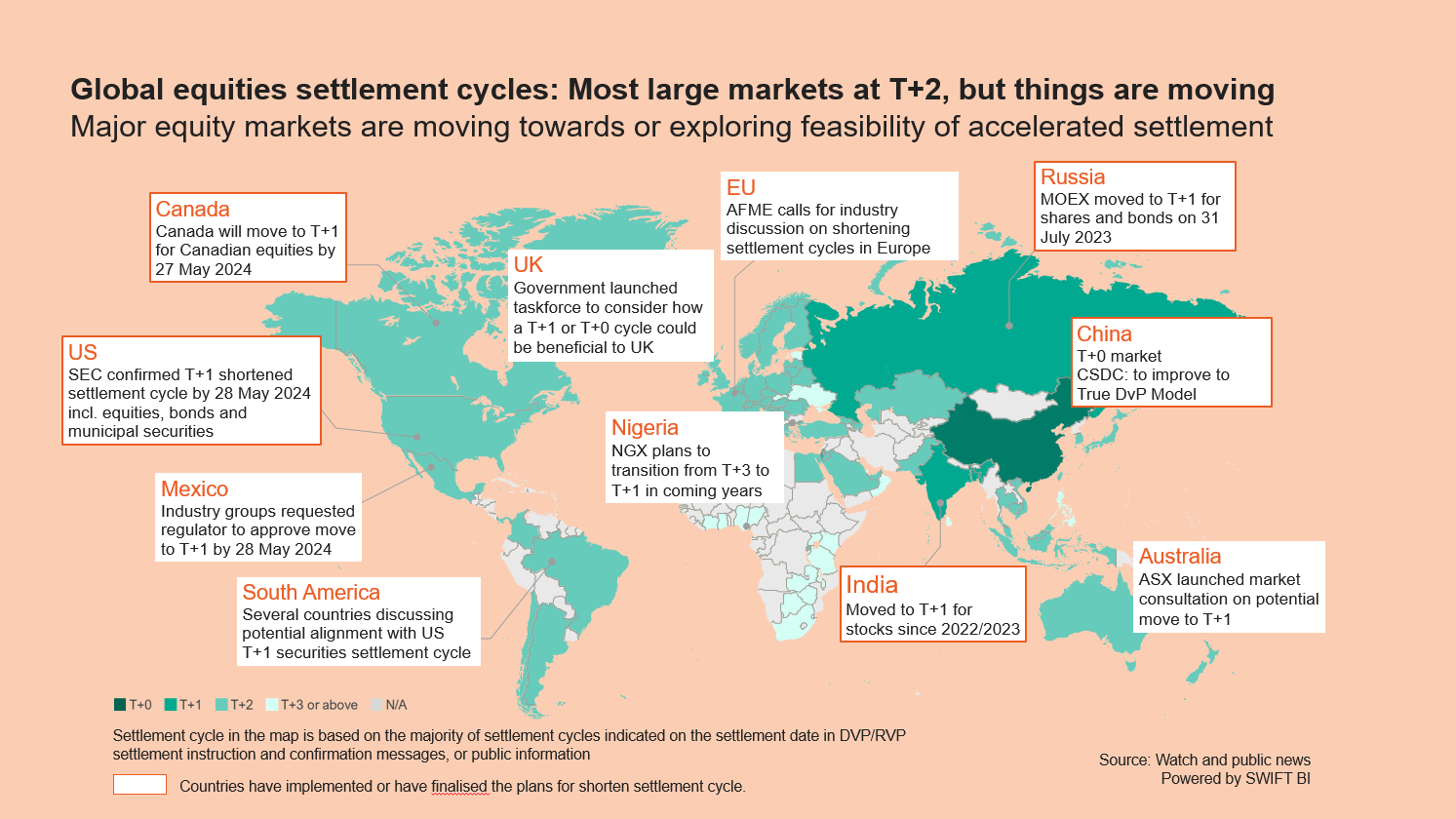

Figure 1: Global equities settlement cycles

Source: Swift BI

“T+1 is not insurmountable, nor is it as threatening as what has come before”

“Shortening the settlement cycle will help us de-risk our markets and make them more efficient, and this is probably a no regret move,” said Paul Maley, Managing Director, Head of Securities Services, Deutsche Bank, speaking on a Sibos Standards Forum panel –Shorter securities settlement cycles: How standards can turn challenges into Triumph, alongside Colin Parry, CEO of the International Securities Services Association (ISSA). Maley added T+1 could unlock a number of new commercial opportunities for providers. “One of those things I believe could be having FX liquidity spread over a greater number of time-zones rather than centred in Europe.”

Panel session: Shorter settlement cycles: How standards can turn challenges into triumphs. Left to right: Colin Parry (CEO, ISSA); Paul Maley, Head of Securities Services, Deutsche Bank

The audience heard that having dealt with extensive post-financial crisis regulation, T+1 implementation should be relatively straightforward for the industry. “If you think about what our industry has been through since the financial crisis with the introduction of Dodd-Frank, the Markets in Financial Instruments Directive II (MiFID II) and the Central Securities Depositories Regulation (CSDR), then T+1 is not insurmountable, nor is it as threatening as what has come before,” said Maley.

Circling back to the point made in The future of securities, the impact of higher interest combined with the move to T+1 leave little room for error. “If you are in a T+1 market and not sorted yourself out by T+0 you are in trouble. It will allow you to invest more if you are looking for a business case for investment in automation because the cost of failure is higher,” concluded ISSA’s Parry.

For many, T+1 will help mitigate market risk, especially during periods of volatility, as settlement duration will be shorter, meaning problems can be fixed more quickly and there will be fewer securities to deal with. Less risk translates into potential collateral synergies. As trading counterparties will have reduced exposure to each other during T+1, the Depository Trust & Clearing Corporation (DTCC) argues firms will no longer need to post as much margin, leading to substantial capital efficiency gains.1

According to the DTCC, there could be a 41% reduction in the volatility component of the National Securities Clearing Corporation’s margin requirements, corresponding into billions of dollars of savings for member firms.2 Whether these margin reduction rates will be the same at non-US central clearing counterparties (CCPs) is a question that remains unanswered for many at Sibos.