(Bloomberg) — Four of Britain’s biggest lenders shared a £5.3 billion ($6.6 billion) windfall last year in transfers from the Bank of England that were ultimately covered by the UK taxpayer.

Documents released by lawmakers on the House of Commons Treasury Committee reveal that NatWest, Lloyds Banking Group, Barclays and Santander UK earned £9.23 billion of interest on BOE “reserves” created to fund its £895 billion quantitative-easing program.

The sum was up from £3.93 billion in 2022, an increase which largely dropped straight through to profits. The income boost came as banks attempted to resist political pressure to pass on higher rates to savers, which they have since done.

The figures were provided to the Treasury Committee by the UK bosses of the four lenders.

“What this data shows is the staggering scale of unanticipated income high street banks are bringing in, with no work required, as a result of increased interest rates,” said Harriett Baldwin, chair of the cross-party panel.

The BOE created “reserves,” a form of current account deposit for commercial banks, to buy assets between 2009 and 2021 to support the economy through the financial crisis and the pandemic.

Initially, QE was profitable due to low interest rates, which remained below 1% for the entire first 12 years. However, the increase to 5.25% has made the program loss-making, as the BOE pays more in interest on reserves held by high street banks than it earns on the assets, which are now exclusively government bonds.

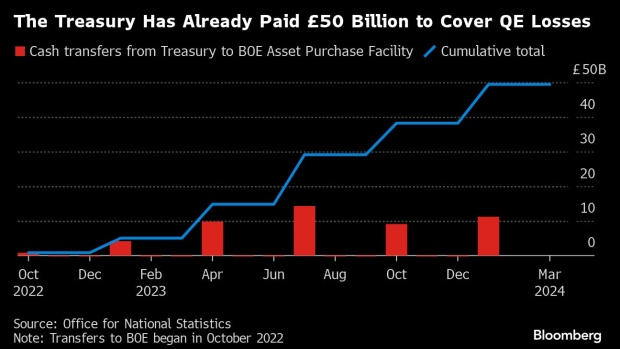

The losses, which have totalled £50 billion since rates rose above 2% in late 2022, are covered by state – ultimately the taxpayer – under a guarantee signed when the program began.

Between 2009 and 2022, QE generated £124 billion in profit – all of which the government has spent. On Thursday, the BOE published figures that showed it expects overall losses to be far greater and the net lifetime cost of QE to be about £115 billion.

The New Economics Foundation, a left of center think tank, has proposed reducing the interest rate paid on reserves to save taxpayer money. Positive Money, a pressure group, has suggested a windfall tax on the banks to capture excess profits. A YouGov poll commissioned by Positive Money last September found that 58% of UK adults support a windfall tax.

The profits made by the four banks emerged in correspondence published by the Treasury Committee. NatWest made £2.85 billion in interest on its central bank reserves in 2023, up from £1.64 billion in 2022. Lloyds made £2.6 billion, up from £800 million. Barclays made £1.88 billion, from £820 million. Santander UK made £1.9 billion, from £670 million.

Their reserves are held at several central banks but the vast majority are with the BOE. Lenders can change the amount they hold in reserves and have historic hedges in place that affect returns.

In a report earlier this year, the Treasury Committee urged the Treasury and the BOE to ensure QE delivers “value for money” for the taxpayer alongside its primary monetary policy objective of helping to bring inflation back to 2% from its 2022 peak of 11.1%.

Last month, 44 lawmakers in the ruling Conservative Party wrote to Chancellor of the Exchequer Jeremy Hunt, expressing “deep concern” about the way the BOE is handling the policy.

The BOE has shrunk the portfolio to £704 billion since 2022 and is continuing to unwind QE. The quantity of reserves shrinks roughly in line with the reduction in QE.

The BOE has stressed it has no intention of changing its treatment of reserves as they are the mechanism through which interest rates are passed into the economy.

Governor Andrew Bailey has said on several occasions that any decision to recover any ongoing losses related to QE is for the Treasury. Hunt said in March that changes to the treatment of reserves is not under consideration.

(Adds 2022 income in third paragraph)

©2024 Bloomberg L.P.