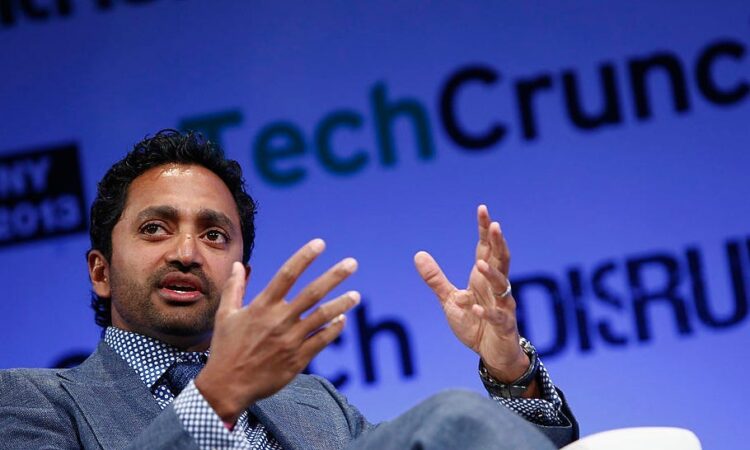

There’s no threat to the dollar’s global dominance and central banks are still banking the US currency ‘like nobody’s business,’ Chamath Palihapitiya says

-

The dollar’s dominance is under no threat, according to SPAC king Chamath Palihapitiya.

-

The venture capitalist pointed to the dollar’s widespread and stable use as a foreign reserve currency.

-

That means the greenback is likely to stay dominant in global markets, he said on the “All-In Podcast.”

The US dollar will likely keep its dominance in global foreign exchange markets, according to venture capitalist Chamath Palihapitiya.

The “SPAC King,” who took 10 blank-check firms public during the IPO craze, dismissed fears of the US dollar being replaced by a rival currency. That’s largely because the greenback has dominated global foreign exchange reserves for decades, only suffering minor fluctuations from year to year, he said in a recent episode on the “All-In Podcast.”

“Foreign reserves are up. These guys are banking US dollars like nobody’s business,” Palihapitiya said of so-called BRICS nations, which include Brazil, Russia, India, China and South America.

But it’s unclear what data he was referencing, as International Monetary Fund data shows a slight decline of foreign reserves held in US dollars in recent years.

Changes in the use of the dollar are relatively minor in absolute terms, he later added, reiterating his view that it would remain the king in global financial markets.

“In general, the anchor currency for governments and central banks has been, will be, and will likely be in the future the United States dollar,” Palihapitiya said.

That comes amid growing fear that the dollar could be toppled by a rival currency, particularly as developing economies rally their efforts to find alternatives.

China, in particular, as set up its yuan to become a potential rival to the US dollar by strengthening its relationships with key allies, which have boosted the yuan’s use in foreign reserves and global trade.

But even the yuan is pegged to the US dollar, Palihapitiya said, referring to China’s dollar reserves to back its own currency. In effect, that makes the yuan just a “proxy dollar” in global markets, he said.

The yuan isn’t strictly pegged to the dollar. Rather, it trades in a 2% range around a midpoint against the greenback, fixed daily by the People’s Bank of China.

Experts have also argued that de-dollarization fears are largely unfounded. Though the use of the dollar in foreign reserves has slipped over the past two decades, the greenback still outstrips all other currencies in the foreign exchange market.

It’s also difficult to replace the dollar as a dominant currency, economists told Insider, since the dollar has a reputation of safety that will continue to incentivize its use by other countries.

Read the original article on Business Insider