The towns where the banks disappeared: Banking black holes are revealed after bosses shut down 6,000 branches in just nine years – leaving some facing a 20-mile round trip to access their accounts

Britons in areas with no banks said they are enduring 20-mile round trips to visit their nearest branch after it emerged that 6,000 have now closed in just nine years.

Consumer group Which? said eight Barclays branches were shutting for good today, taking the UK total by the end of the day to 6,005 amid an ‘avalanche of closures’.

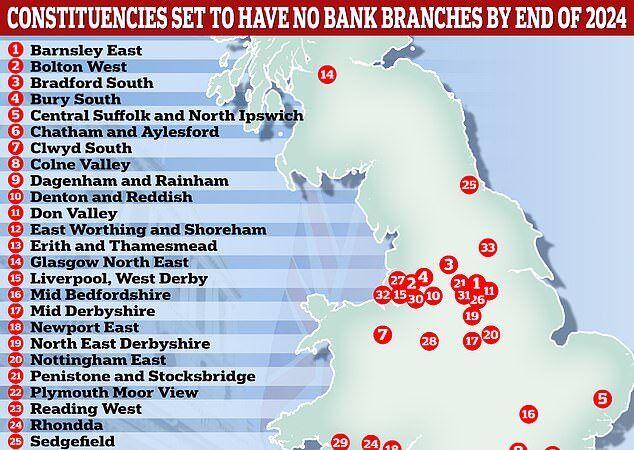

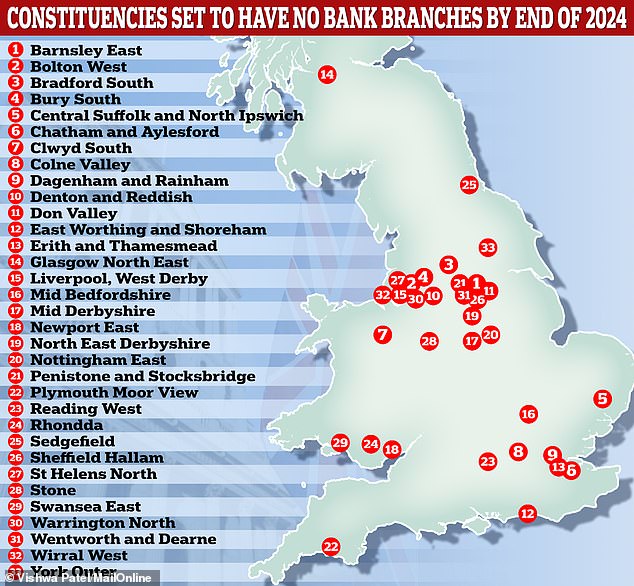

By the end of this year, 33 parliamentary constituencies will be without a single bank branch – including both Sedgefield in County Durham and Erith and Thamesmead in South East London, where MailOnline visited today to speak to affected residents.

Some locals said they needed to take two buses to get to their nearest bank, while others claimed the closures were about ‘control and monitoring people’s finances’.

Elderly people are being left feeling isolated by closures – with some saying they are not online, worry that using ATMs is unsafe and do not want to bank on their phone.

Other constituencies without a branch by the end of this year also include Bolton West, York Outer, Newport East, Reading West, Barnsley East and Swansea East.

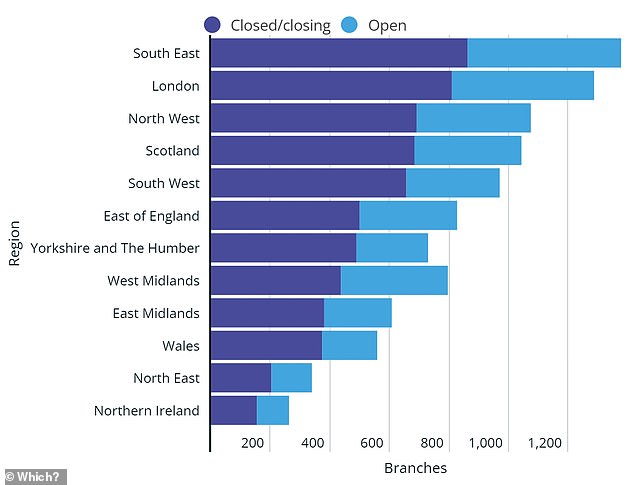

The closures since Which? began tracking them in 2015 equate to over 60 per cent of the UK total. Experts said the 6,000 mark highlights the impact on high streets and how replacement services are needed for millions of people who rely on banks.

While the rate of closures had initially appeared to slow down since it reached a peak in 2017, the researchers said that in ‘recent years there has been a troubling surge’.

In Sedgefield, healthcare assistant Kath Garnett (left), 63, fears the closure of the banks are paving the way towards a cashless society. Her friend Katy Schofield (right), 36, a fire technician, added that she understood why the ‘older generation like to carry cash’

A Post Office is attached to Sedgefield Convenience Store and is run by Abinaya Sivam, 31, and Aravinthan Alagaiah, 36. They said they help people but added: ‘We are not a proper bank’

Before and after: The Barclays branch in Sedgefield closed in 2018 and is now a dental clinic

Before and after: Erith town centre has no banks left since the Barclays closed six years ago

Before and after: A NatWest branch on Bexley Road within the Erith and Thamesmead constituency is now an estate agent

Bank bosses have been accused of ‘engaging in a race to close branches’ after the Government announced plans in 2020 for laws to protect access to cash, which could make it harder to close a branch if alternative cash provision is lacking.

Today, MailOnline spoke to people in the County Durham market town of Sedgefield, where pensioners are taking 20 mile round trips to withdraw money because they fear they may be mugged at the local cashpoint.

The town, which is former prime minister Tony Blair‘s old constituency, lost its last bank, a branch of Barclays, in 2018.

Residents are now forced to journey to outlying towns including Hartlepool, Durham City, Stockton and Bishop Auckland, all around ten miles away.

The local Post Office offers a welcome lifeline, allowing customers to withdraw and deposit cash – but people must travel elsewhere for larger sums of money and other services.

Retired miner David Thompson, 70, said: ‘I really miss having a bank in Sedgefield. My nearest branch is the Barclays in Durham City now. I live in Trimdon, and I am forced to take two buses to get there. I change at Sedgefield.

‘It can take up to two hours for a return trip if I have to wait a long time for the connection. I don’t use cash points because I don’t think they are safe. You might get robbed.’

Eleanor Thompson, 86, added: ‘I wish there was still a bank here. My nearest branch is Stockton. It’s only 15 minutes or so on the bus but it’s still inconvenient. There’s a cash point here but I don’t feel safe using it. I like to go inside to take my money out.

‘It’s much safer. Everybody says the same thing. It’s not just me. People are having to take lots of buses. You can get up to £50 cash back at the local Co-op but sometimes you need more than that and have to travel.

‘I am not online and I don’t like banking on the phone. Chatting face to face is much better.’

Retired childminder Diane Parrish’s nearest branch is Stockton. The 66-year-old said: ‘It’s not a huge problem for me because I go into town a lot.

‘Branches all over the country are closing down. They don’t have enough customers to stay open. But a lot of people miss them, especially those who are older.

‘Pensioners would go into the bank just to have a chat. It got them out of the house. It’s very sad.’

Sedgefield resident Eleanor Thompson, 86, said: ‘I wish there was still a bank here. My nearest branch is Stockton. It’s only 15 minutes or so on the bus but it’s still inconvenient’

Richard Nathan, 34, runs the Dun Cow Inn in Sedgefield. He said the inn is loved by pensioners who miss the bank and prefer to use cash at the bar

Retired miner David Thompson, 70, of Trimdon, says getting to his nearest bank can take up to two hours for a return trip if he has to wait a long time for the connection between two buses

The town, which is ex-prime minister Tony Blair’s old constituency, lost its last bank in 2018

Leafy Sedgefield, which has a population of 5,000, is still a busy hub despite the loss of its bank.

It is home to pubs, restaurants, independent shops and a few chains, such as Hays Travel and the Co-op, which has a cash machine.

Crucially, Sedgefield has a Post Office, which offers vital services, including withdrawing and paying in cash and checking bank balances.

It also stocks Euros, US dollars and travel money cards and enables customers to cash cheques.

The Post Office is attached to Sedgefield Convenience Store and is run by Abinaya Sivam, 31, and Aravinthan Alagaiah, 36.

Ms Sivam said: ‘We are really pleased that we are able to provide the services we do. People are happy and grateful to us for being here. However, there are some things that can only be dealt with at the bank.

‘If customers have reached their daily cash limit, for example, then they can’t get money here. We help as much as we can, but at the end of the day, we are not a proper bank.

‘It’s quite sad as people miss being able to go into their local branch. Pensioners, especially, prefer face to face dealings. Some have told me they don’t like to use the cash point. They don’t feel safe.

‘Businesses are also pleased we are here, as they need somewhere to deposit cash. It’s a big responsibility but knowing how grateful and happy the community is to have us here is lovely.’

Healthcare assistant Kath Garnett, 63, fears the closure of the banks are paving the way towards a cashless society. She said: ‘The bank closures are terrible.

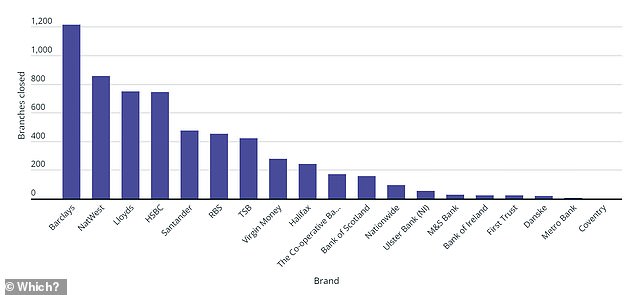

Bank and building society losses from January 2015 to the end of 2025 (including scheduled)

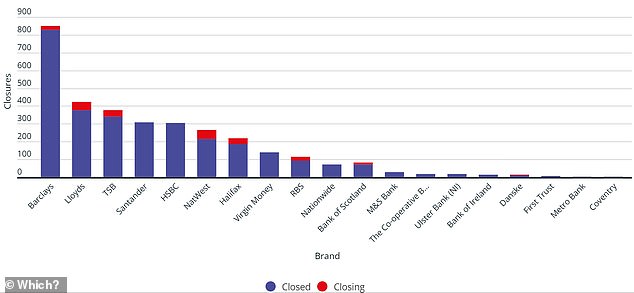

The number of closures (and scheduled) at each brand between January 2019 and end of 2025

The actual number of branches each bank and building society has closed since 2015

‘People need access to cash. The banks are forcing people to do everything online. If we need large sums of money then we have to travel to Hartlepool or Durham.

‘It’s all about control, and monitoring people’s finances. It’s paving the way for digital currency. I went to the theatre recently and I couldn’t get a drink at the bar because I didn’t have a card on me.

‘Cash should be accepted everywhere. The older generation definitely prefer to carry money. It can be more difficult to keep track of what you are spending when you use a card all the time.

‘Sedgefield is still busy, but it’s not just the bank. The hospital shut down, the pits shut down. The bank was the heart of the community. You knew everyone, you would chat to people. It’s not the same anymore.’

Her friend Katy Schofield, 36, a fire technician, added: ‘I actually prefer to use card. It’s easier. But I do understand why the older generation like to carry cash.’

Richard Nathan, 34, runs the Dun Cow Inn in Sedgefield. He said the inn is loved by pensioners who miss the bank and prefer to use cash at the bar.

Pensioner Kath Russell, 81, who lives in Erith in South East London, said: ‘We don’t half miss it, do we, that Barclays. You can only go to the Post Office here if you want to pay something in – and take money out’

He added: ‘For a while, there was no Post Office and no bank in the town. We had nowhere to go. We faced up to an hour-long round trip to deposit cash.

‘Now the post office is merged with the convenience shop. It reopened about a year ago. Things are much better. There are a lot of older folk here who like to go into a bank to speak in person.

‘But younger people all have online banking, and some don’t carry cash. Sedgefield has always been a bit of retirement village.

‘The closure of the bank has left some of the older people feeling isolated. We get pensioners coming in for a dinner, then they might not eat much for the rest of the day.

‘They pay in cash as they like to keep track of how much they are spending. They like to have that human contact. The pub’s been here for 40 years and we are glad to be able to provide that service.’

Retired chemist Frank Urwin, 87, added: ‘It’s a b***dy nuisance. I have to go to Barnard Castle in the car. It takes about 40 minutes to get there. But now that branch is closing as well.

‘There are some things you can only do in the bank, such as set up a direct debit. I rely on my daughter to help me. I miss the face to face interaction you get in a bank. There’s a cash machine here, but you feel a bit vulnerable withdrawing £100.’

In Erith today, Alan Down, 88 – pictured with his wife Pat Down, 86 – said: ‘Where we live, in Abbey Wood, we now have to get two buses because I can’t drive any longer, to go to a bank, to get our money. It takes about an hour and a half to get some money’

Nearly 300 miles away in South East London, residents of Erith are having similar problems – with the town centre not having any banks left since the Barclays closed six years ago.

Ann Pickford, 75, said: ‘It is a real pain, because I had fraud on my card a couple of weeks ago, so I had to go to Bexleyheath every Saturday to get money out.

‘I’m not very good on my feet. There are people worse off than me, elderly people, and they just don’t care.

‘We’re lucky the buses stop here and drop you off at the clock tower in Bexleyheath, but it’s getting on and off the buses that’s hard.

Pensioner Kath Russell, 81, added: ‘We don’t half miss it, do we, that Barclays. You have to go to Bexleyheath if you want personal stuff. You can only go to the Post Office here if you want to pay something in – and take money out.

‘If you want to actually see them and talk to them about something personal, you can’t do that, so we do really miss having them.

Tanvir Ali, 35, owner of Sabina Hair and Cosmetics in Erith, said: ‘It really affects me, because some people want to pay by cash and there’s no bank around’

‘You could actually talk to them if your statement is wrong, you can’t do that in the Post Office because they won’t look at your statement.

‘I’ve had my card cloned before, but the bank was open then, and I just came down and they gave me the money back, put the money back in the bank.’

Tanvir Ali, 35, owner of Sabina Hair and Cosmetics, said: ‘It really affects me, because some people want to pay by cash and there’s no bank around.

‘Many of the people don’t want to use their cards in the shops, and many of them, when they want to get out the cash, there’s only one cash machine, down there by the post office.

‘So, even if you deposit money you have to go to the Post Office, which always has a long queue. We have to go to another area, which takes like 45 minutes, half an hour.

‘I see many other people complaining about the bank, because they are struggling.

‘Every single day I see about 20 people asking me if there is a bank around, if there’s a cash machine around. It is frustrating.

‘I think it affects business, because I know many customers do not want to use card machines in the shops, they want to use cash, and it’s getting harder and harder.’

Sue Wright, 61, a former NHS worker, said: in Erith: ‘Everything is shut now, they shut my bank, Barclays, probably six years ago. I used to do my banking here’

Alan Down, 88, added: ‘Barclays have changed their banking system, the cards.

‘You always had a debit card and a savings card, a debit card you could use anywhere and go and draw money out, now it’s limited. And the savings card, you can’t go to any shop, you have to go to a bank to do your financials there.

‘Where we live, in Abbey Wood, we now have to get two buses because I can’t drive any longer, to go to a bank, to get our money. It takes about an hour and a half to get some money.’

His wife Pat Down, 86, also said: ‘What’s such a shame is the 180 never used to come here, but then when we changed its route we thought ‘oh lovely’, but of course the bank went, and there’s nothing here, is there?’

And John Cook, 77, said: ‘It is inconvenient sometimes, because the old Barclays bank used to be just there, so I have to go to Bexleyheath now.

‘I just jump on a bus, being an old age pensioner I’ve got a bus pass, so I go out for the day, go for a ride around. I can get up there, provided there’s not too many on the Bexleyheath bus, I can be back here in a half hour.

‘My card has been done a few times, and I think because it has been done a few times I just go up there and tell them. Apart from not having a bank, you’ve got all the shops here, everything’s here.

Ann Pickford, 75, said in Erith today: ‘It is a real pain, because I had fraud on my card a couple of weeks ago, so I had to go to Bexleyheath every Saturday to get money out’

‘When it was the old Erith, I was born here so I know what it was like, there was about four or five banks, and they were always busy, because you had the factories, it was an industrial area.

‘Because the factories have packed up, all those people who worked in the factories have moved away and that’s it.

‘All it is now is a little precinct, with a load of flats being built. As I said, the nearest bank is Bexleyheath, but how long will that be there?’

Sue Wright, 61, a former NHS worker currently taking a career break, said: ‘To be honest, I used to come to Erith a lot, because everything was open.

‘Everything is shut now, they shut my bank, Barclays, probably six years ago. I used to do my banking here, my shopping, but now I tend to go to Bexleyheath, which has still got the majority of the banks open.

‘We have a really good bus route here, I’ve got a choice of three to get there. I used to use the Post Office, I’m surprised that it’s open really. This is the first time I’ve been to Erith for six or seven months.

‘A lot of old people did rely on it, and it used to be really busy, sometimes they would queue out the door. But, now they’re closing all the shops down, I don’t feel such a need to come here.

John Cook, 77, said in Erith today: ‘It is inconvenient sometimes, because the old Barclays bank used to be just there, so I have to go to Bexleyheath now’

‘The banks probably did play quite a big part in it, because I suppose if people wanted to do their shopping, they’d go to the bank, get their cash out, then go and get their bits and pieces.

‘I’m more of a card person, I think that’s a slightly younger generation thing, but I think the older people probably do rely more on cash.’

There was also a Midland Bank in Erith before the whole site near the riverfront was redeveloped.

And there was a NatWest branch on Bexley Road in nearby Northumberland Heath, which is now an estate agent.

Across the UK, eight Barclays branches are closing today which has taken the national total above 6,000.

They are located at Alperton in North London; Streatham in South London; Andover in Hampshire; Bangor in County Down; Bracknell in Berkshire; Hornchurch in Essex; Inverness in the Highlands; and Liverpool.

Barclays has closed 1,216 branches; while NatWest Group, which comprises NatWest, Royal Bank of Scotland and Ulster Bank, has closed 1,360 branches, Which? said.

Lloyds Banking Group, made up of Lloyds Bank, Halifax and Bank of Scotland, has shut 1,146 sites, the consumer group added.

Pensioners in Erith said today that they can only go to the Post Office ‘if you want to pay something in – and take money out’

It also said 200 closures by various banks are already scheduled for the rest of this year.

These include 50 from Natwest, 43 from Lloyds, 28 from TSB, 26 from Halifax, 20 from RBS, 14 from Barclays, 14 from Bank of Scotland, four Danske branches and one Ulster Bank branch.

Currently, 24 more bank branch closures have been scheduled for 2025, although more are expected to be announced later this year and next, the group added.

While millions of consumers have made the switch to banking digitally, there remains a significant number of people who are not yet ready or willing to make that jump, underscoring the need for accessible alternatives, Which? said.

However, there are various initiatives to help plug gaps in the cash access network as bank branches close.

The 50th banking hub was recently opened. Banking hubs allow banks to share facilities, and they have a counter service operated by the Post Office, allowing customers to conduct routine banking transactions.

But Which? said the ‘rollout is progressing too slowly’, adding that this total was less than half of the recommended 130 banking hub locations to have opened so far.

The Post Office also recently reported that cash transactions at its branches totalled a record £3.48billion in April.

A closed former Lloyds branch in Caldicot, South Wales (file image). The number of UK bank branches to shut their doors in the past nine years will pass 6,000 today, according to Which?

A closed Lloyds bank branch in Plymouth, Devon

The Post Office has an agreement with many banks, allowing their customers to carry out everyday banking over its counters.

With a general election looming, Which? said it believes that the next government should commit to delivering at least 200 shared banking hubs in the first two years following the election.

It added that as bank branch closures are likely to continue in the coming years, any target may need to be revised upwards to keep pace.

Sam Richardson, deputy editor of Which? Money, said: ‘This milestone of more than 6,000 bank branch closures in just nine years underscores the seismic shift that has taken place in terms of our banking habits and the character of the British high street.

‘While some may hardly notice the closure of their local branch as they seamlessly switch to online banking, for others reliant on face-to-face services, the impact can be disastrous.

‘It’s not about halting closures altogether, but ensuring that essential banking services remain accessible to those who still rely on them.’

Which? also pointed out that some banks still insist on customers coming into the branch to carry out services such as registering power of attorney.

The building of a former HSBC bank up for let in Belper, Derbyshire

A closed Halifax branch in Maidenhead, Berkshire

It added that several high street banks have fared poorly when registering power of attorney, with waiting for in-branch appointments potentially adding delays to the process – and banking hubs not always offering such services.

A Barclays spokesperson said: ‘As visits to branches continue to fall, we need to adapt to provide the best service for all our customers.

‘Where levels of demand don’t support a branch, we maintain an in-person presence though our Barclays Local network, live in over 350 locations, based in libraries, town halls, mobile vans and our banking pods.

‘We also support access to cash with our cashback-without-purchase service, 24-hour deposit-taking ATMs and by working alongside the Post Office and Cash Access UK.’

A spokesperson for trade association UK Finance said: ‘An ever-increasing number of people are using telephone, mobile and internet banking and fewer people are visiting bank branches on a regular basis.

‘Balancing this change in the way we bank means firms have to make difficult decisions about maintaining their branches.

A closure notice for a Santander branch in Harwich, Essex

A closure notice on a former HSBC bank branch in Windsor, Berkshire

‘The industry has invested heavily in alternative services, including thousands of post offices where people can do a lot of their day-to-day banking.

‘Alongside this, the industry is working to roll out shared banking hubs to bring together different firms to support their customers.

‘There is also significant ongoing investment to ensure access to cash, including free ATMs and cashback without purchase. If you are concerned about your local bank branch closing, please contact them and they will help you find the best alternative for your needs.’

Stephen Noakes, retail director at Nationwide said: ‘Which? has helpfully put the spotlight on branches.

‘Our research shows nearly three-quarters of consumers of all ages are concerned about the rate of closures, with half of 16 to 24 (year-olds) left frustrated after finding their local branch closed.

‘Branches are valued for everyday banking but also for important moments like scam worries and transferring a large amount of money. That’s why we have promised that everywhere we have a branch today we will remain until at least 2028.’