The US, Silicon Valley in particular, is known globally as a hub for innovation. Some of the greatest companies on Earth have been founded here, and the technology created has fundamentally changed our lives. This reputation has perhaps led to a false sense of security in terms of our position as a technology superpower. For over 60 years, the US led by example; introducing things like credit cards, ATMs and online banking. However, for the last decade, the APAC region has taken over global dominance through payment innovation, while other countries follow suit.

Today over 40 countries offer some form of instant payment, with the US falling behind many of them. Surprisingly, across the instant payments landscape, which represents a new frontier in fintech, no country has accomplished the adoption rate of the Pix system in Brazil. This system is estimated to be three to five years ahead of what US banks have achieved.

Carlos Netto, co-founder and CEO of Matera, a provider of instant payment and QR code technology for financial institutions, looks at how Pix has managed to position itself so far ahead.

Some perspective

In 2018, the Central Bank of Brazil embarked on an aggressive plan to modernise its economy. Part of this initiative was to mandate that all banks offer instant payments. There was a strong need to offer a digital alternative to cash and outdated payment methods like Boletos, to create an ecosystem that would encourage more competition and provide a payment method that brought measurable benefits to merchants and their customers (who are often underbanked) effectively.

Credit cards lacked the same appeal long enjoyed in the US because merchant fees were high, and funds weren’t available for up to 30 days. As such, many Brazilian merchants refused to take credit or debit payments. By 2019, 77 per cent of retail transactions came from cash, offering a huge opportunity to design a new payment scheme from scratch. In addition to converting traditional banking customers, a new system could also invite in the nearly 30 per cent of consumers who were unbanked.

Introducing Pix

Pix was officially announced in the summer of 2019 and accepted its first transaction on November 16, 2020. With Pix, payment is as simple as asking a consumer for their alias (e.g. phone number/email) or having them scan a QR code. Funds are then immediately transferred from one bank account to another. Money can move via Pix between two people, a consumer and a business, between two businesses and even between government entities and consumers.

Merchants and businesses enjoy lower acceptance costs than credit cards because the Pix transactional framework has fewer intermediaries. It is a clear win for all and the proof is in the numbers.

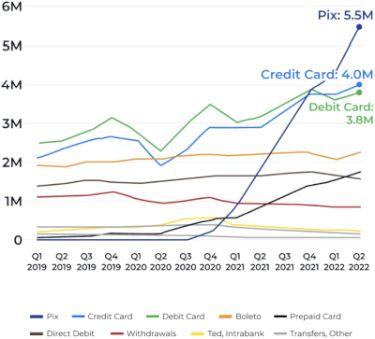

The total number of Pix transactions exceeded debit and credit transactions within one year of launch. Six months later, Pix had served nearly 120 million consumers. Remarkably, 70 per cent of Brazil’s adult population had either made or received a Pix transaction while 60 per cent of all businesses used Pix. Today, Pix processes nearly three billion transactions every month.

Instant payments in the US

The US does have person-to-person payments solutions that appear to be instant, but they don’t move money from bank account to bank account instantly and they are nothing close to the scope and scale of Pix. Moving money using services like PayPal, Venmo and Cash App simply involves a ledger entry making one account go down and the other goes up. Another transaction is required to move from these services to a consumer’s bank account and often takes days to settle.

Zelle improved on this experience by making money immediately available in a consumer’s bank account, but it leverages ACH, debit or wire and settles transactions in batches at the end of the day. ‘Zelle over RTP‘ creates an instant experience end-to-end, but is only used in a small percentage of Zelle transactions. Despite success with younger demographics in this limited purview, these services remain far below Pix adoption levels, even for person-to-person payments.

Payment rails in the US

Two instant payment rails exist or are being built in the US, but usage is low. The instant payments rail, RTP, operated by many of the largest banks in the US, was launched in 2017. Over 300 banks participate in RTP, but the monthly transaction volume is estimated at 15 million compared to 2.9 billion for Pix. FedNow is the other rail but is not operational yet. The launch is planned for mid-2023.

Among the reasons for the US’ delay in forging ahead with instant payments and QR code payments is a heavy dependence on credit cards. Unlike Brazil, Americans use cards, just as banks rely on their associated fees. In the second quarter of 2022 alone, Americans opened 233 million new credit accounts the highest number since 2008 during the last recession, according to the Federal Reserve Bank of New York. And the total number of credit cards ballooned to over 500 million for the first time last year.

But the tides are turning, as global markets have shown. This is also a fact that Jamie Dimon, CEO of JPMorgan Chase & Co, readily acknowledged. Just last year, he tasked his corporate and investment bank, the CIB, to work with JPMorgan’s consumer and community banking division, the CCB, to create a new system that could compete with innovative fintechs and ensure the long-term health of the company. Dimon is not alone as US banks scramble to create the right pay-by-bank instant payment solution.

What can US banks learn from Pix?

While the market and circumstances surrounding Pix’s incredible adoption are certainly different, there are lessons to be had. For example:

Pix is an open system. Roughly 150 banks operate in Brazil, but more than 700 financial institutions participate in Pix. By embracing an integration model, 85 per cent of Pix participants have been indirect (e.g. companies like PayPal), which increases participation while reducing technical burdens and costs. What this could mean for US instant payment adoption is that technology partners and integrations may be their best friends.

All consumers can use Pix. This has been crucial to adoption. More than 130 million Brazilians now use Pix. For around half of those people, it is the first digital payment tool they have ever used. In the US, there are approximately 5.9 million unbanked adults, but there are another 18.7 million households that are considered underbanked. If an instant payments network were established to meet their needs, it could change the lives of millions of economically disadvantaged people and improve the reputation of financial institutions.

Importance of good user experience

Pix has a great user experience. It’s consistent, simple, and fast. There are user interface requirements that drive this. The Pix button has to be on the first screen of a bank’s mobile app, for example. These are not traits commonly associated with U.S. banking systems, which often involve multiple steps, transaction delays, and a lot of frustration from merchants and consumers. For instant payment offerings to be successful, the experience must get exponentially better.

Not only does Pix make for a fantastic consumer experience, but it is also easy for businesses. With standardised API and QR code technology, banks and payment institutions seamlessly connect to POS software or online payment gateways. This makes it simple to change from one payment provider to another – the API integration is the same. It also encourages competition. Again, it all comes back to ease. With FedNow and RTP, there is an attempt at standardisation. But, with two options instead of one, will merchants be forced to choose?

What NOT to do

There are also important learnings about what NOT to do. Below are three examples of lessons learned and how they were successfully addressed.

- Fraud: In Pix’s early days, consumers were tricked into sending criminals money, and unlocked phones were being stolen. Issues were mitigated by education, limits on how much could be sent via Pix, and the option to claim fraud. Suspicious transactions could also be blocked.

- Mistakes: From time-to-time money was sent between banks accidentally with no recourse. The Central Bank created legislation that mandated a bank must return the money when requested by a bank that had made an error.

- POS solution providers (e.g. NCR) were slow to integrate. In the beginning, some merchants didn’t know how to confirm payment of a QR code due to a lack of integration. This created confusion, and in some cases, fraud. Merchants learned that confirmation was essential to receive payment.

Financial institutions in the US have been allowed to rest on their laurels and antiquated systems for far too long. Nimble fintechs are coming, armed with knowledge from other international markets. As such, it is time for banks to ‘innovate or die’ so to speak. They are not immune to disruption, and the next move is theirs. Will they seize the opportunity?