If Ajay Banga is confirmed as World Bank president he will have to meet the demands of a global south eager for change.

Major changes are afoot at the World Bank but few people seem to be paying attention. Beyond devising a new, greener mission, the bank is undergoing a leadership transition, with important implications for its relationship with the global south and the institution’s long-term relevance.

By the time David Malpass, the World Bank’s president, announced his resignation last month, tensions over the bank’s stance on climate change had been building for months. Chosen for the job by the administration of the former United States president, Donald Trump, Malpass faced considerable pressure when Joe Biden took over, with the US Treasury expressing dissatisfaction with the bank’s failure to show genuine climate leadership.

Criticism of Malpass escalated last September, after he refused to acknowledge the role of human greenhouse-gas emissions in driving climate change. While he subsequently did so, his backpedalling did nothing to diminish accusations that, under his leadership, the World Bank was not doing nearly enough to align its lending with global emissions-reduction goals.

A month later, a group of ten major economies—the G7, plus Australia, the Netherlands and Switzerland—submitted a proposal for a ‘fundamental reform’ of the bank that would lead to greater progress on this front. The bank’s climate action plan remains, according to many western countries, too short on ambition.

Our job is keeping you informed!

Subscribe to our free newsletter and stay up to date with the latest Social Europe content. We will never send you spam and you can unsubscribe anytime.

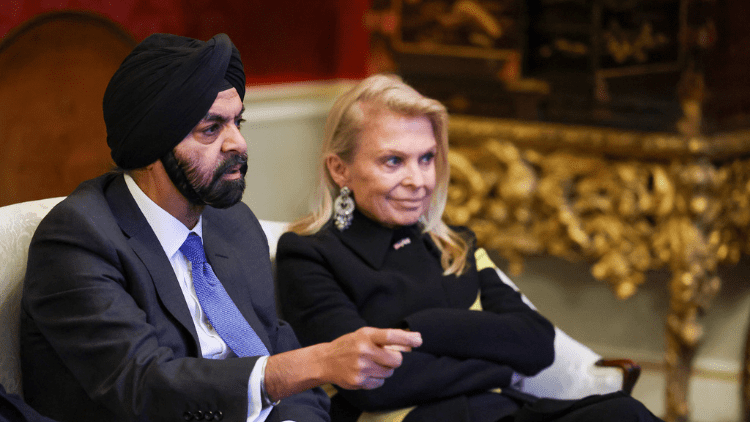

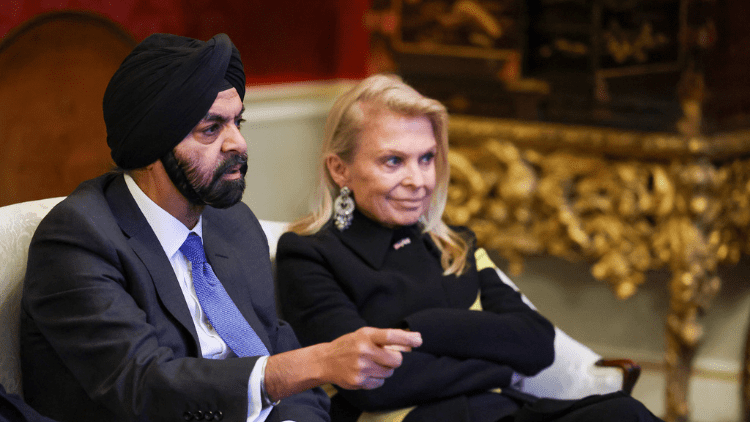

Malpass’ resignation was thus probably a relief—not least to the US. Almost immediately, the Treasury secretary, Janet Yellen, reiterated America’s commitment to ‘evolve the World Bank’ into an engine of the green transition. Soon after, Biden nominated Ajay Banga—the Indian-born former Mastercard executive who oversaw the firm’s emergence as a global payment platform—to succeed Malpass.

Not an obvious choice

Banga was not necessarily an obvious choice. The World Bank’s board of executive directors ‘strongly encouraged’ the nomination of women candidates, of whom there were several solid options with extensive development experience—including Gayle Smith, a former administrator of the US Agency for International Development, and the agency’s current head, Samantha Power. In the world of multilateral development institutions, Banga is an outsider.

But Banga’s selection may prove to be a shrewd move by Biden. Yes, his confirmation would uphold the longstanding tradition of the US—the World Bank’s biggest shareholder and the largest donor to its concessional arm, the International Development Association—handpicking the bank’s head. This custom, together with the tacit understanding that a European should lead the International Monetary Fund, has rightfully generated discontent in the global south, with countries there calling for more representative multilateral governance.

Banga does represent a nod to India and the global south more broadly. The question is whether this will translate into more effective leadership on development, including the climate trends that threaten it.

The World Bank was originally conceived as a tool for reconstruction. Development later became the Bank’s primary focus, thanks not least to its former president and key architect, Robert McNamara, who sought to promote the western model of economic development. Despite being a signatory to the Bretton Woods Final Act, the Soviet Union never joined the World Bank, not least because it viewed the bank as a platform for promoting the west’s free-market philosophy.

Contentious debates

What would it take to support prosperity effectively in the emerging world today? For starters, contentious debates about the possible expansion of the World Bank’s agenda—including how climate action fits into it—will need to be settled. At the same time, the bank will have to overcome internal disagreements on debt relief and restructuring for distressed countries. (As it stands, discussions are effectively paralysed by Chinese demands that the bank accept loan write-downs.)

While such discussions unfold—or stall—the crises fuelling them continue to escalate. The World Bank must mobilise adequate resources to help countries confront a perfect storm of climate, energy, food and debt crises. At a time of rising protectionism and global economic fragmentation, this will be especially difficult. Only a leader with both technical and political savvy can hope to succeed.

Ambition and scale will be crucial. A compelling case has been made for a far larger World Bank. But even barring such an institutional transformation, a dramatic increase in lending to clients across the income distribution is badly needed. Though the bank’s commitments have nearly doubled since 2019—reaching $115 billion—lending has been lagging behind global economic growth since 2017. Reforming lending policy is particularly important for the bank to regain influence in middle-income countries, which have long looked elsewhere to finance their development needs.

We need your support

Social Europe is an independent publisher and we believe in freely available content. For this model to be sustainable, however, we depend on the solidarity of our readers. Become a Social Europe member for less than 5 Euro per month and help us produce more articles, podcasts and videos. Thank you very much for your support!

Listening to developing countries

But more funding is just the beginning. The World Bank must also do a much better job of listening to developing countries. The Bridgetown Initiative of the Barbadian prime minister, Mia Amor Mottley—which recommends new terms for development financing and calls for increased funding for climate resilience, mitigation and post-disaster reconstruction—is one proposal worth considering.

If the World Bank fails to listen to the ideas and demands of developing countries, the west will lose them—with consequences that extend far beyond the bank. And rebuilding relationships with alienated allies is both difficult and costly. South Africa’s drift toward the Sino-Russian nexus—and resistance to the west’s hasty efforts to win it back—offers important lessons in this regard.

Banga is now on a ‘global listening tour’. But winning support for his candidacy is only the first step. As president, Banga will have to find ways to meet the demands of a global south that is eager for change or risk undermining the World Bank’s long-term viability and jeopardising the west’s ability to exercise its convening power.

Banga’s outsider status may work in his favour, as he attempts to shake up the institution and bridge its traditional mandate with a 21st-century agenda. But the ‘outsiders’ who really need to be brought into World Bank decision-making are the countries that have been kept outside far too long.

Republication forbidden—copyright Project Syndicate 2023, ‘The shakeup the World Bank needs’