A new text-based artificial intelligence (AI) tool called ChatGPT is making waves in the technology industry for its ability to accurately answer questions and complete a wide range of tasks, from creating software to formulating business ideas.

Launched on November 30, 2022 by OpenAI, the AI program has already impressed users and technologists with its ability to mimic human language and speaking styles, all the while providing coherent and topical information. In the span of just a couple of days, the service managed to cross the one million user threshold.

Now, industry observers and commenters are theorizing on the technology’s potential implications in the finance and banking sector.

According to Ethan Mollick, an associate professor of management at The Wharton School of the University of Pennsylvania, ChatGPT is a tipping point for AI and proof that the technology can be useful to a broader population of people.

In the business world, the ability to generate written content in a fast and accurate manner means that productivity can be increased in a variety of industries, Mollick wrote in a recent blog post on Harvard Business Review. This will help organizations save time and resources, and allow employees to focus on other important tasks.

“This is particularly beneficial for industries such as marketing and advertising, consulting, and finance, where high-quality written materials are essential for communicating with clients and stakeholders,” he wrote. “Overall, the use of AI in writing will greatly benefit businesses by allowing them to produce more written materials in less time.”

For Alex Lazarow, a global venture capitalist (VC) and author, AI models like ChatGPT will not only affect fintech thought leadership, but could also potentially deliver financial services.

For one, these tools can significantly improve customer support and power a new class of services and chatbots, Lazarow wrote in a Forbes post. They can also be used for investment research, allowing analysts to scale their work beyond a narrow number of stocks.

Finally, AI models can help tackle transaction complexity, he said. If these tools are able to formulate sophisticated answers to complex questions, they should also be able to do the same for legal drafting. This would help accelerate the fluidity of review for startup deals, but also all illiquid assets, Lazarow wrote.

Demand for AI among businesses has increased steadily over the past year. Data from the Global AI Adoption Index 2022, conducted by Morning Consult on behalf of IBM, reveal that 35% of the 7,500+ businesses surveyed last year used AI. The figure represents a four-point increase from 2021. Additionally, 42% of companies reported exploring AI.

IBM research also found that between the first and second quarter of 2022, there was an increase of 259% of job postings in the AI domain, Ana Paula Assis, IBM’s general manager for Europe, the Middle East and Africa (EMEA), told Euronews in December 2022.

In the UK, the central bank is currently looking at AI regulation amid accelerating use of machine learning (ML) by financial firms. A discussion paper was released in October 2022 to explore whether AI could be managed through clarifications of the existing regulatory framework, or if a new approach was needed.

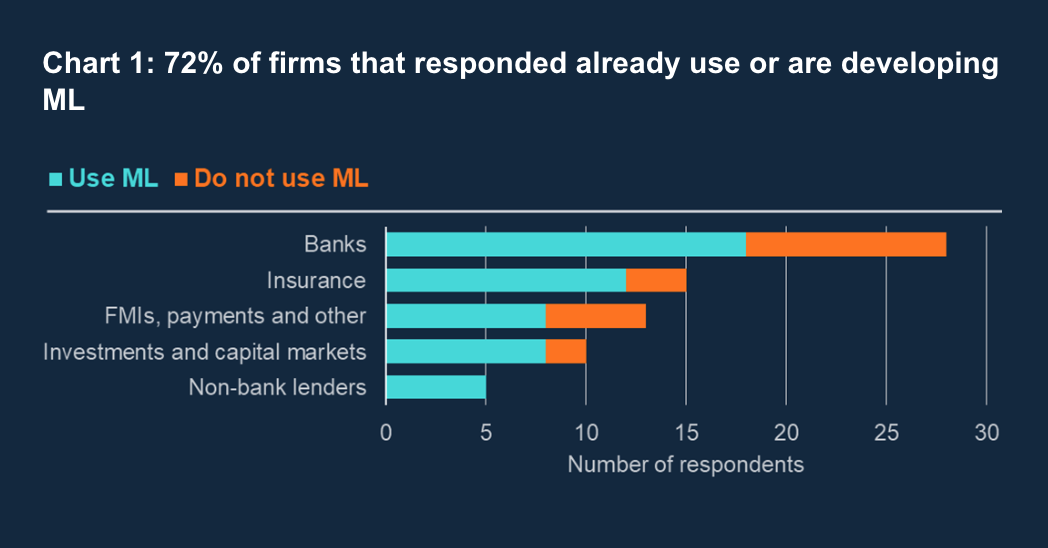

The paper was accompanied by the Bank of England’s second annual survey on the use of machine learning (ML), which found rising AI adoption. Of the financial institutions polled in the UK, 72% reported either using or developing ML applications. The figure represents a five point increase from 2019’s 67% adoption rate.

ML adoption among UK financial institutions, Source: Bank of England, Dec 2022

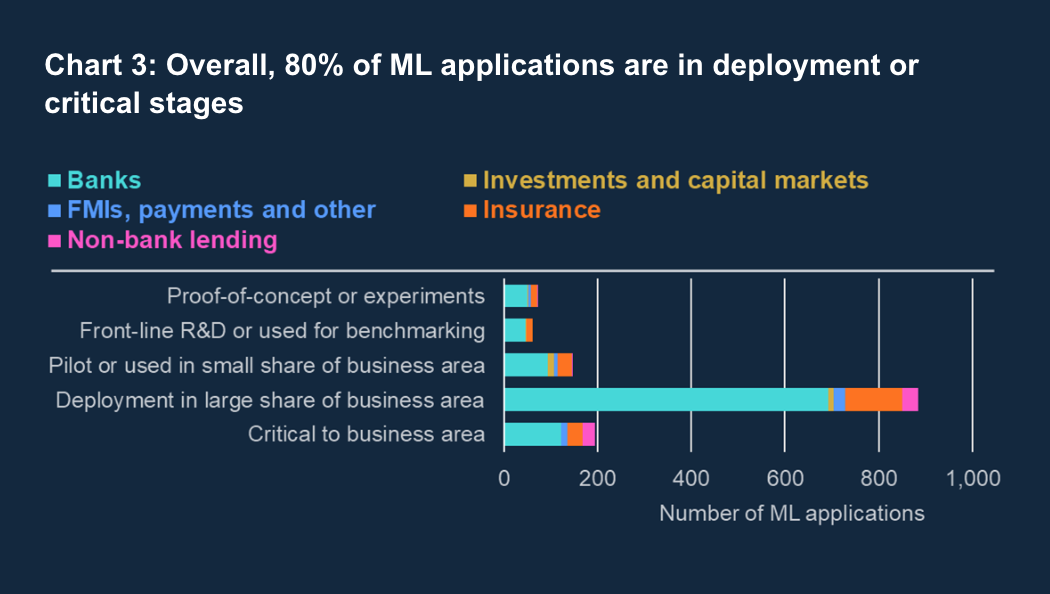

The study also found that ML applications are becoming increasingly widespread across more business areas in the UK’s financial sector. From the survey responses, 79% of ML applications were found to be in the latter stages of development. In particular, 65% of applications were already deployed across a considerable share of business areas, with a further 14% of ML applications reported to be critical to the business area.

ML applications stage of development, Source: Bank of England, Dec 2022

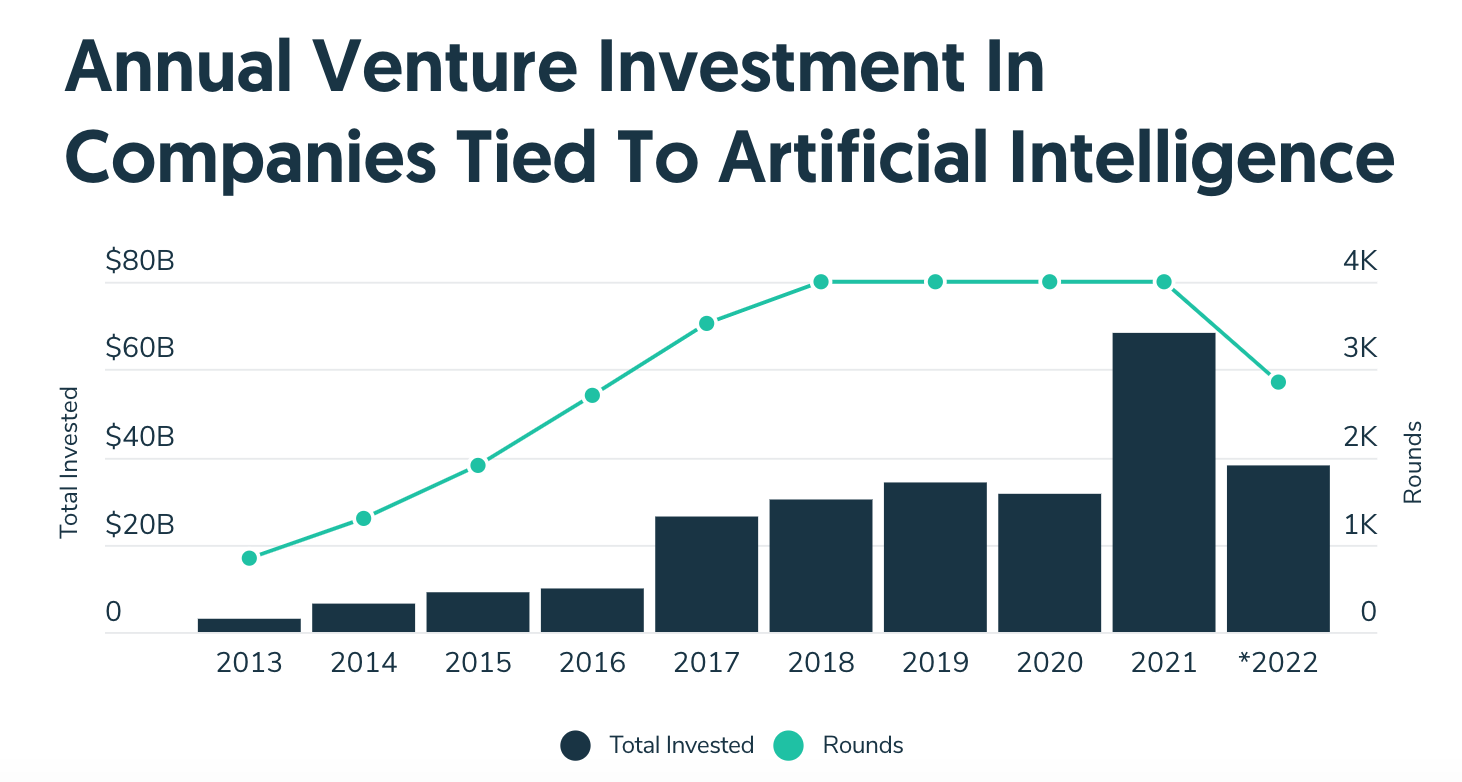

Funding to AI companies has increased considerably over the past decade. In 2013, companies using AI secured US$3 billion through fewer than 1,000 deals, according to Crunchbase. In 2021, that sum peaked at US$69 billion across over 4,000 rounds. In 2022, global AI funding totaled US$38 billion, as of late November.

Annual venture investment in companies tied to AI, Source: Crunchbase, Nov 2022

Featured image credit: edited from freepik