Here is one side of the argument:

The reality is that the Fed and Treasury have a magic bullet here. They can back up the deposits and with the ‘held to maturity’ problem, they could exchange those bonds for cash and take them on their balance sheet in a kind of mini-QE.

If either of those things are announced, the questions about the US banking industry are solved.

Here’s the problem with that: Solving the problem works against the Fed’s main goal right now — curbing inflation.

If the US government backed up deposits or the Fed took bonds off bank balance sheets, that would be adding fuel to the fire. That money could go right back out the banks’ door in the form of loans and that would keep the economy running hot.

Instead, if the Fed and Treasury let the problems run their course, it will lead to banks hoarding deposits. That diminishes the credit impulse and will cool the economy without the Fed having to raise rates beyond 5.5% (and potentially not even getting that high). In addition, competition for deposits should also lead to banks raising deposit rates, which is an incentive for consumers and businesses to save rather than spend.

Said differently, what’s happening in the US banking sector right now is a different form of tightening. It means the Fed will need to do less old-fashioned tightening to get the same results.

The big risk

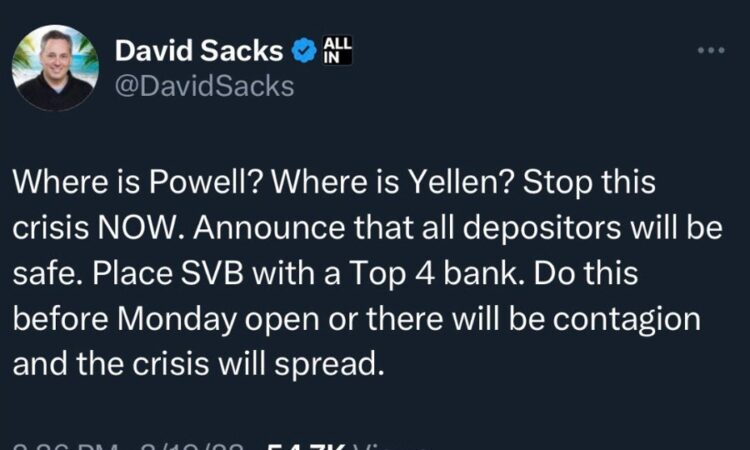

Now the risk here is a true run on deposits across the banking sector that causes a domino-effect of bank failures. If we see cascading problems like Silicon Valley Bank, then companies will be forced to sell ‘held to maturity’ bonds and that would undermine confidence in the whole banking system. Again, the Fed would still have a magic bullet but maybe it triggers some sort of black swan.

But I don’t think that’s a problem. There just aren’t that many people holding +$250K uninsured deposits at many banks.

Obviously, there’s some collateral damage here to companies who held deposits at Silicon Valley Bank but if the regulators were doing their jobs, the recoveries should be fast and close to par.

There are more good points here about deposits.

<a href=”

1/14$SVB fails two days after $SI fails. Why now? What was the catalyst?

tl:dr Their deposit rates are too low, and there is an effective run on the entire “low yielding” banking system.

The fix is simple – raise deposit rates to attract capital. But this hurts profits.

— Jim Bianco biancoresearch.eth (@biancoresearch) March 10, 2023 ” title=””>

1/14$SVB fails two days after $SI fails. Why now? What was the catalyst?

tl:dr Their deposit rates are too low, and there is an effective run on the entire “low yielding” banking system.

The fix is simple – raise deposit rates to attract capital. But this hurts profits.

— Jim Bianco biancoresearch.eth (@biancoresearch) March 10, 2023