A UK startup founded by executives from Apple, Monzo, and open banking fintech Bud which aimed to disrupt the rental market is shutting down.

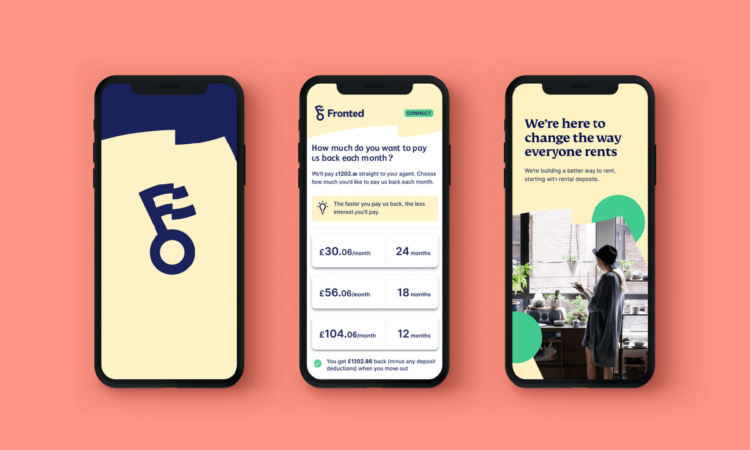

Fronted, founded in 2019, used open banking and other financial technology to offer credit products to help renters finance deposits.

The fintech, which received more than £20m in funding, hoped to offer renters cheaper and more sophisticated options than existing options, like credit cards and overdrafts.

Fronted was set up by CEO Jamie Campbell, formerly of open banking firm Bud, Simon Vans-Colina, previously of Monzo, and Anthony Mann, a former Apple executive.

A notice on the Fronted website says: “After an incredible journey together, we’re saying farewell to Fronted. Thank you for being part of our journey, your support made it all possible.”

Describing the difficult decision to close the fintech, Campbell said: “I have put a lot of time and personal money into the organisation. It is important to me.

“When I could see the headwinds and knew this was happening, my main focus was on making sure everyone who worked at Fronted could walk into another job.”

Fronted is closing as it was hit by rising capital costs which went “through the roof” late last year, Campbell said.

Repeated interest rate rises, meaning higher borrowing costs, coupled with other economic difficulties, mean many startups and SMEs are struggling.

At its biggest, Fronted had 12 staff, all of which have found new jobs.

The fintech’s first product was a 12-month deposit loan to renters to cover their rental deposit, with renters paying back the loan monthly with interest.

Fronted then pivoted to another product, which Campbell said was where the real “pain point” was for renters.

The “deposit that moves home with you” was designed for renters who need to pay a second deposit before receiving the old one from their previous tenancy.

It worked by securing the return of the renter’s old deposit to Fronted who financed the new deposit in full. Renters would then pay off the loan at a cost of £50. Fronted used “custom-made API infrastructure” to verify users.

Campbell says: “The real reason behind the issue is that in September of last year, our cost of capital went through the roof which really impacted our ability to offer the product at a price that consumers would pay for it.

“We knew that we had good results when customers were paying around about £50 for it, but the shift in the market meant we couldn’t offer it for less than £100, and the price elasticity for our customers just wasn’t there.”

Fronted had the lofty goal of introducing liquidity to the market “to improve social mobility”.

While ultimately the fintech has failed, Campbell said Fronted had some successes.

As examples, he pointed to Fronted signing distribution deals with estate agent software firms and that at its peak it was working with 40,000 rental moves a month.

He said Fronted had helped renters move out of homes with abusive partners and elevated people out of social into private housing.

He also pointed to the Conservative Party policy pledging a lifetime deposit scheme for renters, indicating that Fronted was tapping into a hot issue, although the policy has yet to materialise.

In hindsight, he says: “If we had shifted to the model of working with partners who already had significant scale earlier, then we would have been able to distribute our product at the price that we wanted to.

“We were never able to go to market with the product that we wanted at the price we wanted.”

That said, he adds: “A lot of companies probably didn’t expect such a dramatic change in the cost of capital at the back end of last year.

“We had just signed a really large deal, the mood in the camp was really good.

“And suddenly we couldn’t go to market with the product that we knew was doing ok, because we had to more than double the price.”

Fronted started life as a London-centered business but over time shifted to remote working.

Fronted received around £22m in funding, including around £2m in equity and around £20m in debt financing to fund its deposits.

Its investors are Fasanara Capital, Passion Capital, TrueSight Ventures and the government’s Future Fund.

Companies House shows that Fronted was dissolved at the end of May this year.