What’s going on here?

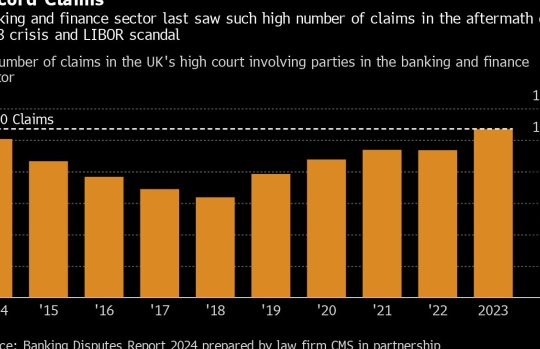

The European Central Bank (ECB) has given a stern warning to its member countries about their heavy and growing piles of debt.

What does this mean?

The ECB is telling its members to start cutting back on their spending bloat now because the future’s not getting any cheaper. Europe’s aging populations are already reducing the number of folks in the workforce, just as defense and climate change costs ramp up. While all countries will have to slash expenses by at least 0.5%, some will have to dig much deeper and cut them by as much as 10%. And that will be a particularly tough shave for the likes of France and Italy: they’ve already been running budget shortfalls well beyond the European Commission’s agreed 3% limit. It’s no wonder, then, that worries have been growing about the 20-nation bloc’s finances – especially in France, where surprise snap elections have stirred market chaos.

Source: European Central Bank

Why should I care?

Zooming out: Less isn’t always more.

Dealing with the debt challenges could cost countries a stomach-churning 5% or more of their total economic output. Plus, the latest reprimand could stir up fresh fears about potential spending cuts and financial instability – the kinds of worries that could drive borrowing costs higher for places like France and Italy. Those nations will probably have to cinch their belts by trimming their expenses or hiking taxes, which could hurt businesses and consumers, ultimately squeezing profit and stock prices.

The bigger picture: A chill is in the air.

It seemed like 2024 was going to be a comeback year for initial public offerings (IPOs) in Europe. But investor jitters and new volatility in the bond and stock markets are giving companies cold feet: fearing a flop, Italian luxury brand Golden Goose chickened out of its Milan stock debut this week, and Spanish fashion maker Tendam Brands also turned tail. After raising about $13.3 billion in the first half of this year – more than double the same period in 2023 – it looks like Europe’s IPO scene might now be on ice.