Savings rates have increased for the first time this year as experts predict interest rates will continue to stay high.

Following seven months of cuts, the average one-year fixed saving rate has finally risen, according to analysis website, Moneyfacts.

It found the rate rose to 4.59 per cent, increasing for the first time since October 2023.

The news comes as the Bank of England is widely expected to keep interest rates at their current 16-year high of 5.25 per cent when the Monetary Policy Committee (MPC) meets on Thursday.

Last month, some signalled the possibility of a rate cut as early as June, but investors now see little chance of that following economic growth, wage expansion and services inflation all coming in higher than expected.

A cut in August is currently priced at around a 40 per cent possibility, rising to 80 per cent by September.

Usually, higher interest rates from the Bank of England means borrowing costs are more expensive, but interest on deposits is higher.

However, banks have been accused of not passing on higher rates to savers.

Last May, Harriett Baldwin MP, then chair of the Treasury Committee, said that the UK’s biggest banks were “continuing to squeeze record profits from their loyal savers”.

Some experts have more recently warned savers that they should consider locking their cash away in fixed accounts, that guarantee a set amount of interest for a fixed period of time.

This is because when the base rate does start to fall, savings rates are expected to follow.

Rachel Springall, Finance Expert at Moneyfacts, said: “Savers looking to invest in a fixed rate bond to guarantee the return on their cash may be delighted to see the average return on a one-year fixed rate bond rose month-on-month, halting seven consecutive months of rate cuts.

“Fixed rates have been rising due to volatile swap rates and lesser expectations of an imminent cut to the Bank of England base rate. However, it is widely anticipated that interest rates will come down in the future, so savers will need to decide whether now is the time to lock into a longer-term fixed bond instead.”

The average easy access rate rose month-on-month at 3.12 per cent for the first rise since March 2024 while the average longer-term fixed bond also rose to 4.13 per cent.

However, the average easy access ISA rate fell to 3.31 per cent while the average one-year fixed ISA rate fell to 4.4 per cent, now standing at its lowest point since June 2023 when it was 3.96 per cent.

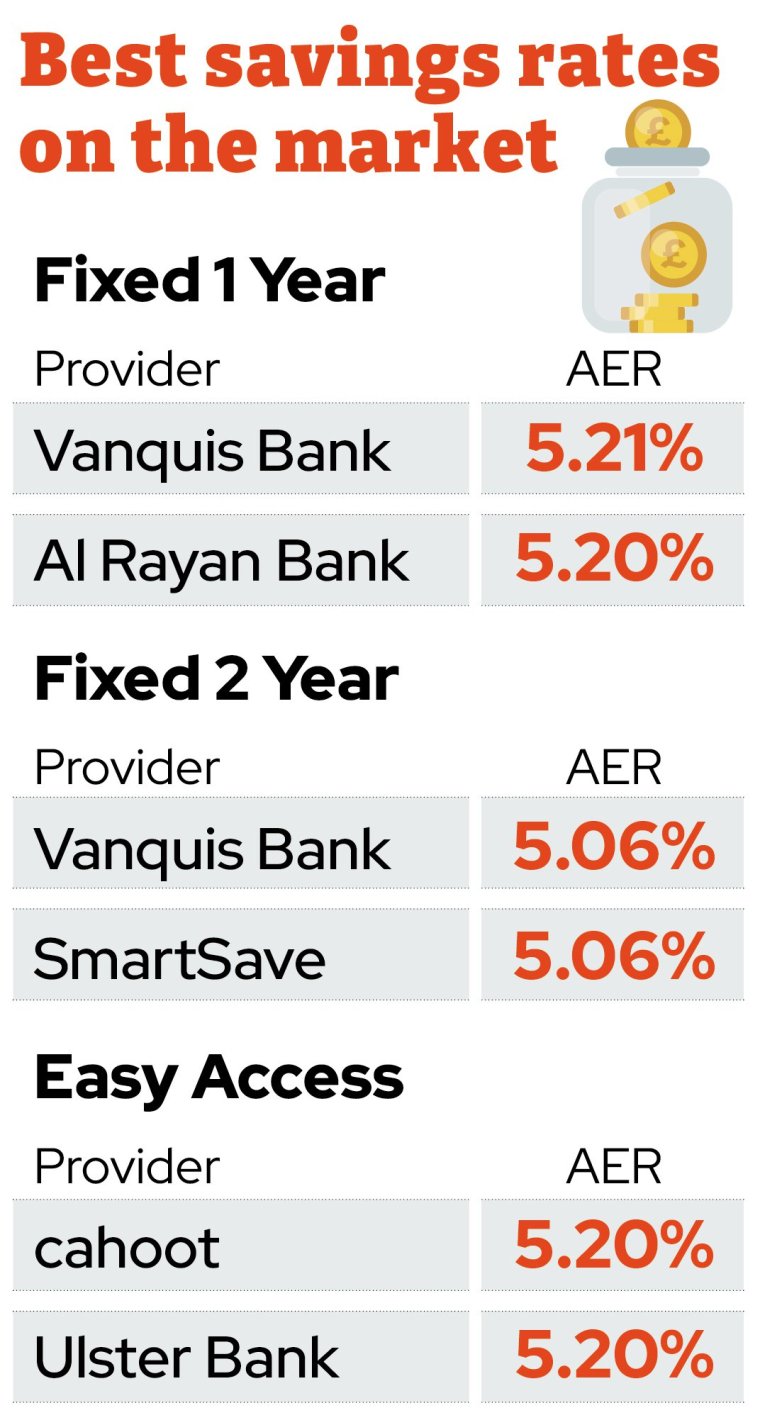

Currently, the best easy access rates are offered by cahoot and Ulster Bank at 5.2 per cent while the best one year fixed rate is with Vanquis Bank at 5.21 per cent.

Springall added: “Savers who have a simple easy access account may want to check to see if they are getting a decent return on their pot, as rates have improved due to provider competition. The average rate is above 3 per cent but the best deals pay much more, so it is clear there are many easy access accounts out there paying a poor return.”