Dan Kitwood/Getty Images News

A Poorly Timed Acquisition

Royal Bank of Canada (NYSE:RY)(TSX:RY:CA) is proposing to buy HSBC Canada for $13.5 billion. HSBC Canada is the seventh largest bank in the country, and this would be the largest domestic bank acquisition in Canadian history. This, at a time of extraordinary debt levels in the Canadian financial system, looks like a terrible move by Royal Bank.

British Columbia’s HSBC customers aren’t happy about this acquisition, with many saying they value HSBC’s global network. Royal Bank is attempting to console these customers, reporting, “You can expect the types of international capabilities that HSBC Canada’s clients value.”

Moreover, I think Royal Bank is overpaying. At a $13.5 billion dollar valuation, Royal Bank would be paying 2.3x HSBC Canada’s book value ($5.9 billion) and 17x earnings ($792 million) as of the end of 2022. This is a hefty price to pay.

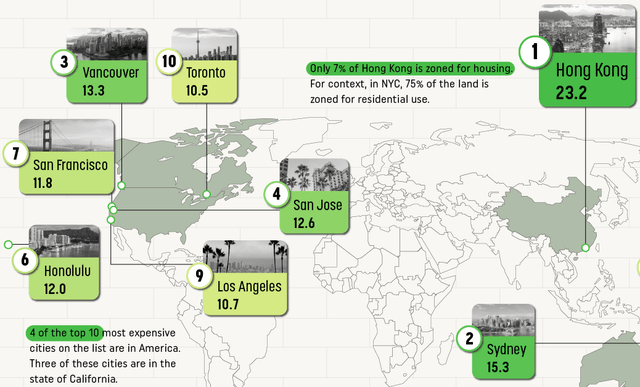

HSBC Canada has huge exposure to what looks like a Canadian housing bubble, doing the vast majority of its business in BC and Ontario where home prices are quite extreme. Vancouver, BC and Toronto, ON ranked number 3 and number 10 among the world’s least affordable housing markets:

10 Least Affordable Housing Markets (Visual Capitalist)

This, after crazy bidding wars broke out in 2020 and 2021, sending home prices in these cities soaring.

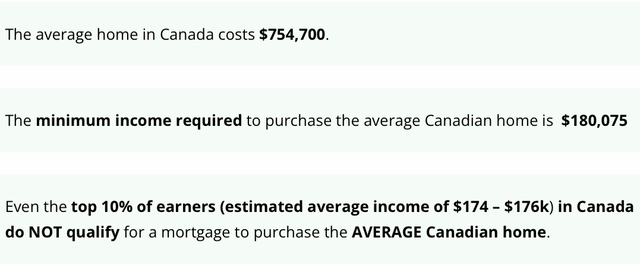

Here’s another telling set of statistics:

Affordability Of Canadian Homes (DollarWise)

I suspect higher interest rates could pop the debt bubble in Canada as the household debt service ratio (14.9%) is now higher than that of the United States in early 2008.

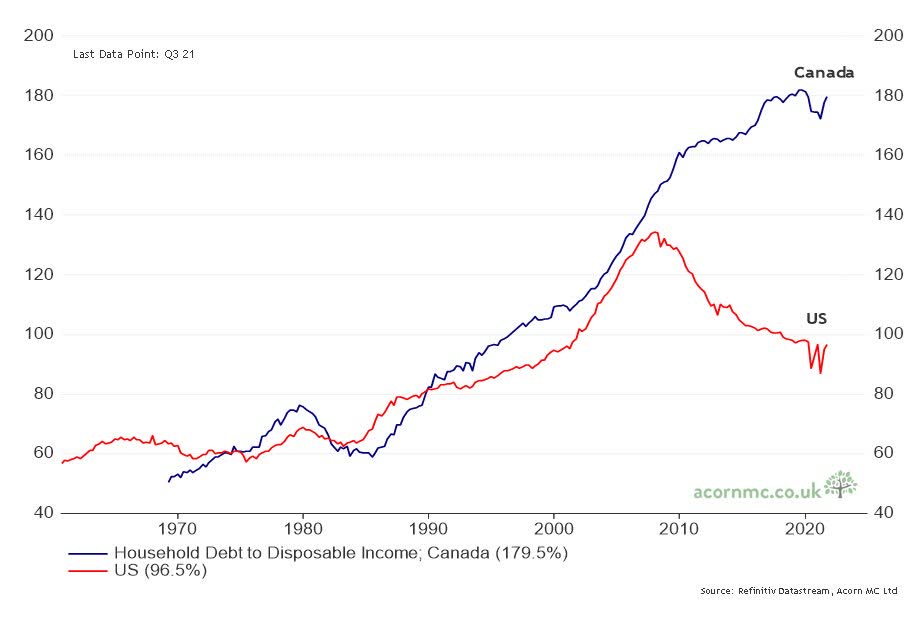

While the United States hit the end of its long-term debt cycle in 2008, Canada’s household debt to disposable income has kept on climbing, signaling the potential severity of the next downturn:

Canada Vs. U.S. Household Debt To Income (Refinitiv Datastream)

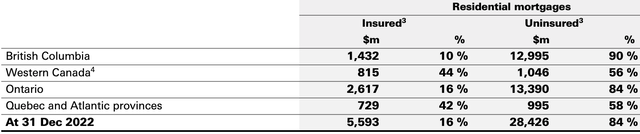

HSBC Canada has a large chunk of its loan portfolio in residential mortgages, with 25% of its mortgages stretching out beyond 35 years and huge portions of its mortgages being uninsured:

HSBC Uninsured Mortgages (2022 Annual Report – HSBC Canada)

The highlight of the above graphic is that 90% of HSBC’s mortgages in British Columbia are uninsured.

This deal with HSBC Holdings Plc (HSBC) is set to close in Q1 2024, but needs to be approved by Canadian regulators.

Balance Sheet Liquidity

I really don’t like the position of HSBC Canada’s balance sheet, it is highly levered at an inopportune time:

| ___________________ | Royal Bank | HSBC Canada |

| Liquidity Coverage Ratio | 135% | 164% |

| CET1 Ratio | 13.7% | 11.6% |

| Loans To Deposits | 69% | 91% |

| Assets To Equity | 17.4 | 21.7 |

Royal Bank is in a slightly better position, and both banks clear the Canadian regulatory requirements of a 100% liquidity coverage ratio and a 11% CET1 ratio. I believe The Toronto-Dominion Bank (TD)(TD:CA) has one of the strongest balance sheets in nation; check out my article on TD and Scotiabank here to compare and contrast.

Back to Royal Bank, Analyst John Aiken told BNN Bloomberg that there’s a chance Royal Bank may not be able to meet the new CET1 buffer of 11.5% come November 1st. The acquisition of HSBC is expected to decrease Royal Bank’s CET1 ratio, increasing risk for shareholders.

Risk To The Dividend

Further, I think that Royal Bank could actually report negative earnings in the next recession because it has not put enough aside as an allowance for loan losses at only 0.5% of its loan book. If Royal Bank reports negative earnings, this would be a further drag on its CET1 ratio and could force the bank to cut its dividend or issue shares. For Royal Bank to report deeply negative earnings, you would only need about 10% of its $836 billion loan book to go bad, averaging losses at 30% of principal. This would result in a $21 billion loss (in excess of the loan loss allowance).

Long-term Returns

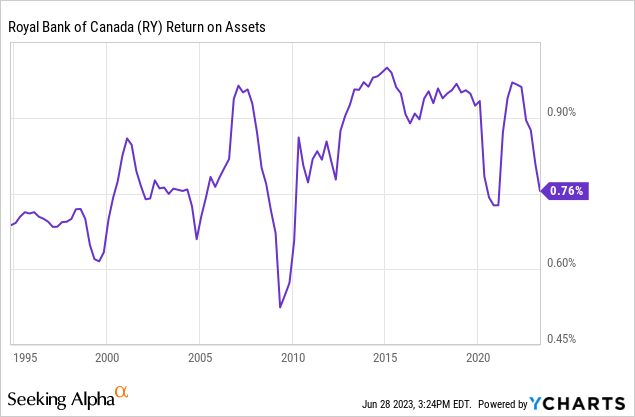

Royal Bank’s returns on assets are now hovering around their 30-year average, meaning current EPS is a good starting point for valuing RY:

In the decade ahead, I estimate total returns of 5.5% per annum for RY:

| Current EPS | $7.62 |

| Current Dividend | $3.96 |

| Compound Annual Growth Rate | 1.5% |

| Year 10 EPS | $8.85 |

| Terminal Multiple | 12x |

| Year 10 Price Target | $106 |

| Annualized Returns (Dividends Reinvested) | 5.5% |

Note: This is a base-case scenario. The “compound annual growth rate” is for dividends and earnings.

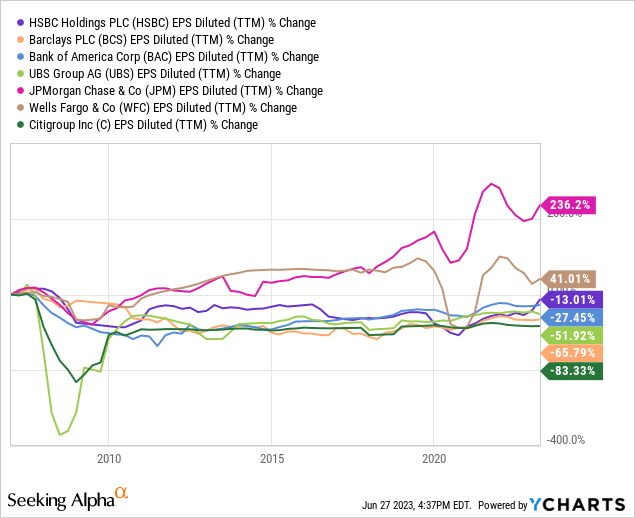

My projected growth rate for earnings and dividends looks low, but this is in-line with what we’ve seen from European and U.S. banks, which faced the end of a long-term debt cycle in 2008:

YCharts

When debt stops growing faster than income, growth suffers. Royal Bank’s EPS growth may also be impaired if the company has to dilute shareholders due to loan losses and/or the HSBC acquisition. Moreover, I would not be surprised to see trading fees come under pressure given the industry move toward zero-commission trades.

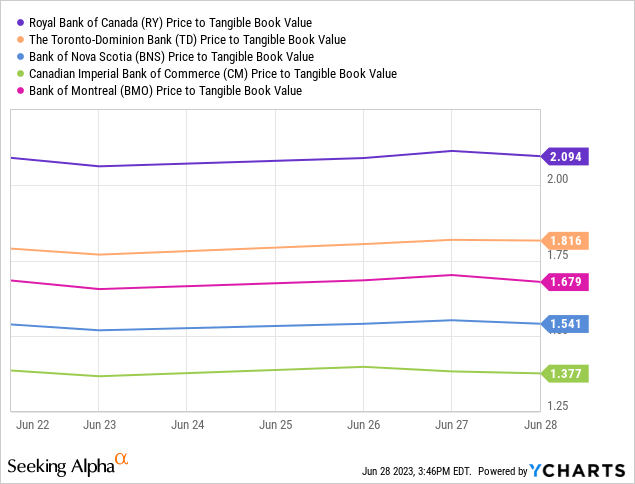

To corroborate my gloomy outlook, I would say that Royal Bank is expensive compared to its peers:

Risks To The Thesis

If the HSBC Canada acquisition falls through, it would actually improve the outlook for Royal Bank, in my view. Also, if the deleveraging in Canada is less severe than I expect and Royal Bank doesn’t have to dilute shareholders, EPS growth could surprise to the upside.

Remember, RBC (Royal Bank) isn’t a bad bank. It has a great brand name and a great position in wealth management. I think its brand is comparable to JPMorgan Chase in the United States, which helps keep its cost of deposits low and its fees high.

In Conclusion

The HSBC Canada acquisition could be a huge negative for shareholders, at an inopportune time. Canada is nearing the end of its long-term debt cycle as high interest rates collide with excessive debts. HSBC Canada is not well capitalized, in my view, and looks to have a lot of risk on its books. It doesn’t help that Royal Bank is proposing to pay 2.3x book and 17x earnings to acquire it.

Royal Bank appears to have under reserved for loan losses, given my outlook for a hard landing. This, and the HSBC deal, could cause Royal Bank to dilute shareholders in the next recession, if not cut its dividend. Consequently, I maintain a “Sell” rating on RY and RY:CA.

Investors may find better opportunities in other banks. For more on that, check out my articles on Bank of America (BAC) and Citigroup (C). Links are in the names.

Until next time, happy investing!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.