Revolut has been working to secure a banking license in the UK since 2021, but recent reports indicate that its efforts may be in peril. In the UK, the Bank of England has told the Treasury that it plans to reject the fintech giant’s application for a banking license.

In fact, a statutory warning may be in store for the country’s most successful fintech, so why does Revolut want a banking license? Has it secured its position as a bank anywhere in the world? And finally what’s keeping UK regulators on the fence?

Vying for a banking license: The value proposition for Revolut

Revolut already offers a slew of services in the UK including money transfers, store purchases, share trading, and pet insurance. However, the company sees a banking license as critical to its aim of disrupting incumbents by offering loans and overdraft protection. The firm’s CEO of Revolut Australia, Matt Baxby, also views the banking license as an important step in building confidence with Revolut’s customers as well, stating that “a bank license is still very much part of our plans. To be held to that regulatory standard would give our consumers confidence for the long haul.”

The company already operates as a bank in 10 markets across the European Union.

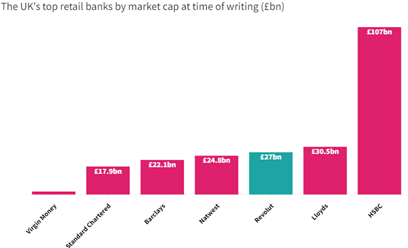

Despite not having a banking license, the company has done well for itself. Revolut reported revenue of £850 million in 2022 whereas other neobank competitors like Monzo reported £440 million. Unlike Revolut however, Monzo has a banking license. Similarly, the company’s valuation is above most retail banks in the UK, coming in third after HSBC and Lloyds, without having the revenue streams of a bank in the territory.

In the US, the company applied for its banking license in 2021, and the status of that application is unclear. However it is clear that motivations for Revolut moving into banking are alike across the pond.

“A US banking license would ultimately enable us to provide US customers with all the essential financial products and services they can expect from their primary bank including loans and deposits,” said CEO and co-founder Nik Stronsky.

Regulatory misgivings

U.K. regulators have a few bones to pick with Revolut. They have stated concerns over the company’s crypto trading unit as well as how it approaches KYC. Moreover, the statutory warning comes as a result of the company’s balance sheets. These concerns have emerged as the company’s own auditor cited concerns that “the majority of Revolut’s revenues may have been materially misstated”. The accounting firm BDO said that it was unable to vet Revolut’s revenues for 2021, due to issues with the company’s internal systems.

The war in Ukraine is also having an impact on the company’s standing. Co-founder and CTO Vladyslav Yatsenko is Ukrainian and the other founder and CEO Nik Stronsky is Russian, both own British passports, and the company has an office in Russia that is closing shop. After the Ukraine-Russia war began heating up, Stronsky renounced his Russian citizenship, but links to the Kremlin persist and stirred questions in the Lithuanian parliament in 2019.

The bearish sentiments on crypto are making things difficult for Revolut as well. Crypto trading has accounted for as much as a third of the company’s revenues but this has slid down to 10% given the market’s sentiments towards crypto.

If regulatory pressures persist, the company is threatening to move its hub from the UK to elsewhere in Europe. The decisions coming in the following weeks will clarify Revolut’s position both in the UK and may even foretell its chances of success in America.

Source link