Even so, some economists believe Australia will get some rate relief this year, regardless of what the Fed does.

AMP is among the optimists, and expects a rate cut in June, though the time frame is currently under review.

“Central banks tend to use the Fed as a guide for what to do, but our interest rates have a different impact compared with the US,” noted Diana Mousina, a senior economist at AMP.

This is because Australian mortgages are based on variable rates, unlike in the US where they are fixed over 30 years.

Tapas Strickland, head of markets economics at National Australia Bank, said Australia was experiencing below-trend growth, which was unlike the US economy that JPMorgan chief executive Jamie Dimon last week described as “booming”.

In the December quarter, Australia’s economy barely registered any growth, because of the most aggressive tightening in decades. And it is not alone. Britain and New Zealand slipped into a recession and the eurozone has stalled, fanning expectations of rate cuts this year.

“You will start to see central banks go their own way on monetary policy and not follow the Fed,” said Angus Coote, co-founder of Jamieson Coote Bonds. “Take population growth out and Australia has been in recession since the start of 2023.” He expected the RBA to cut rates in August.

Angus Coote, co-founder of Jamieson Coote. Luis Enrique Ascui

Andrew Lilley, chief rate strategist at Barrenjoey, said that although the Fed usually influenced the RBA, the actions of other central banks also mattered.

“We’ll probably see the central banks of Canada, the UK and Europe all having cut before the RBA meets in November,” he said.

“So at that point, whether or not the Fed has cut is a marginal incentive.

A lack of a Fed cut won’t be an impediment for the RBA.”

Barrenjoey expected the RBA to lower borrowing costs in November.

Not all experts agree with these views. Tim Hext, head of government bond strategies at Pendal, said it was “unlikely the RBA will go first as central banks globally tend to move together”.

Warren Hogan, chief economic adviser at Judo Bank and the most accurate forecaster on the cash rate last year, also said the idea of the RBA cutting before the Fed “makes no sense” since the Australian economy was six months behind the US cycle and had been so for the past two years.

“If we are moving towards a stage of the cycle that warrants rate cuts, the US economy will get there before us,” he said.

What’s more, the pending tax cuts in Australia would give even less reason for the RBA to lower borrowing costs, which he estimated would be the equivalent of one or two rate cuts.

“An unknown factor will have to present itself to drive the RBA to rate cuts before the Fed,” Mr Hogan said.

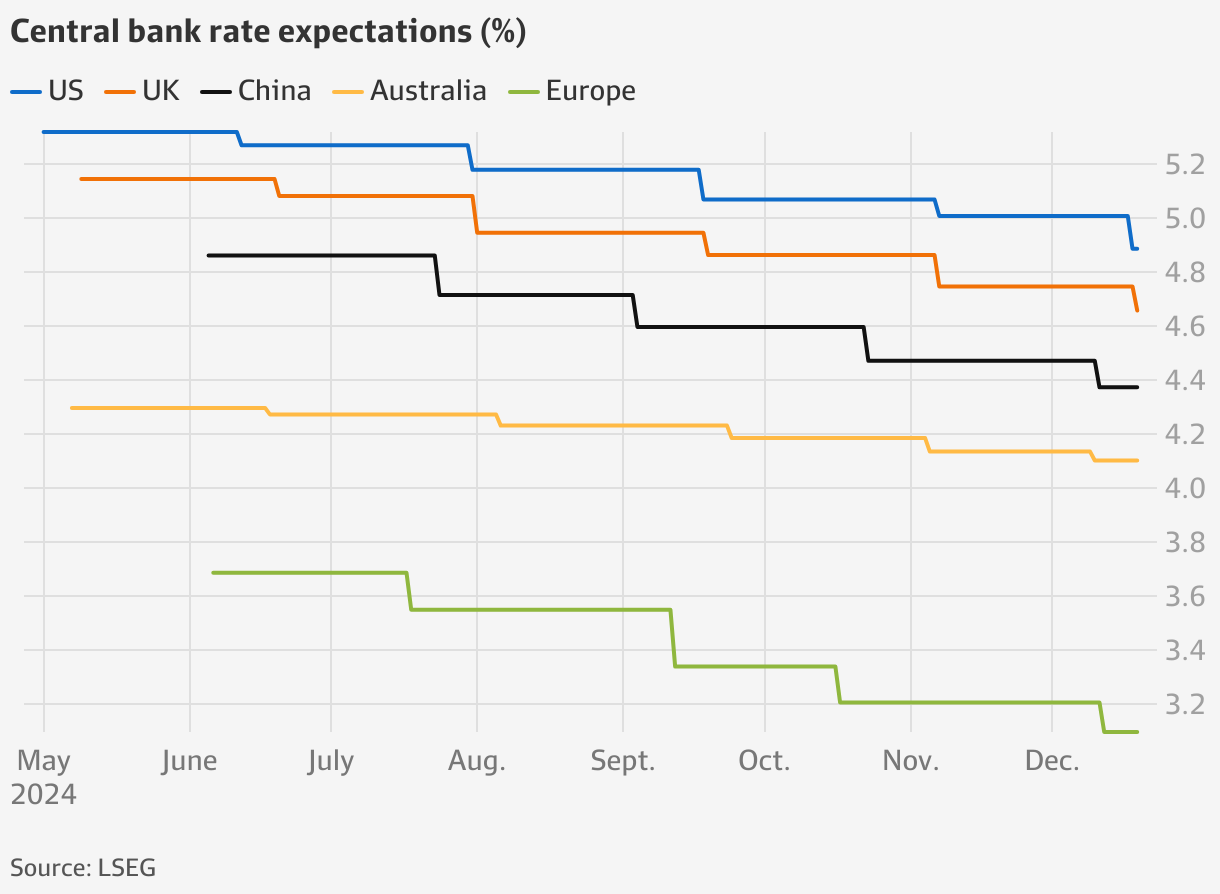

Regardless of whether Australia is dependent on the Fed, experts believe the RBA will be among the last to pivot on interest rates because it raised them less than its peers and inflation has not slowed as much.

UBS rate specialist Giulia Specchia predicts that the RBA will still cut in November. Even so, she warned that central banks could all delay easing if US inflation re-accelerated – “they will be concerned that another wave is coming their way”.