Introduction

Despite reassurances from financial regulators and bankers such as Jamie Dimon that the banking system remains strong, uncertainty continues to impact the banking industry. Shares of PacWest Bank, a smaller regional lender, dropped by almost 50% after confirming reports that it was considering “strategic options,” including the possibility of selling the company.

PacWest stated that it was not experiencing any unusual deposit withdrawals and still plans to sell some assets to free up cash. However, investors fear that PacWest’s fate may resemble that of First Republic Bank, which failed after weeks of searching for a buyer.

Other regional banks also came under pressure, including Western Alliance, which denied reports that it was considering strategic options. The higher interest rates have prompted depositors to move their money into higher-paying certificates of deposit and money market funds, which has had implications for the regional banks. While the Fed chair believes that the recent bank stress will likely cause other banks to tighten lending, continued turbulence due to regulatory and economic uncertainty is still a possibility.

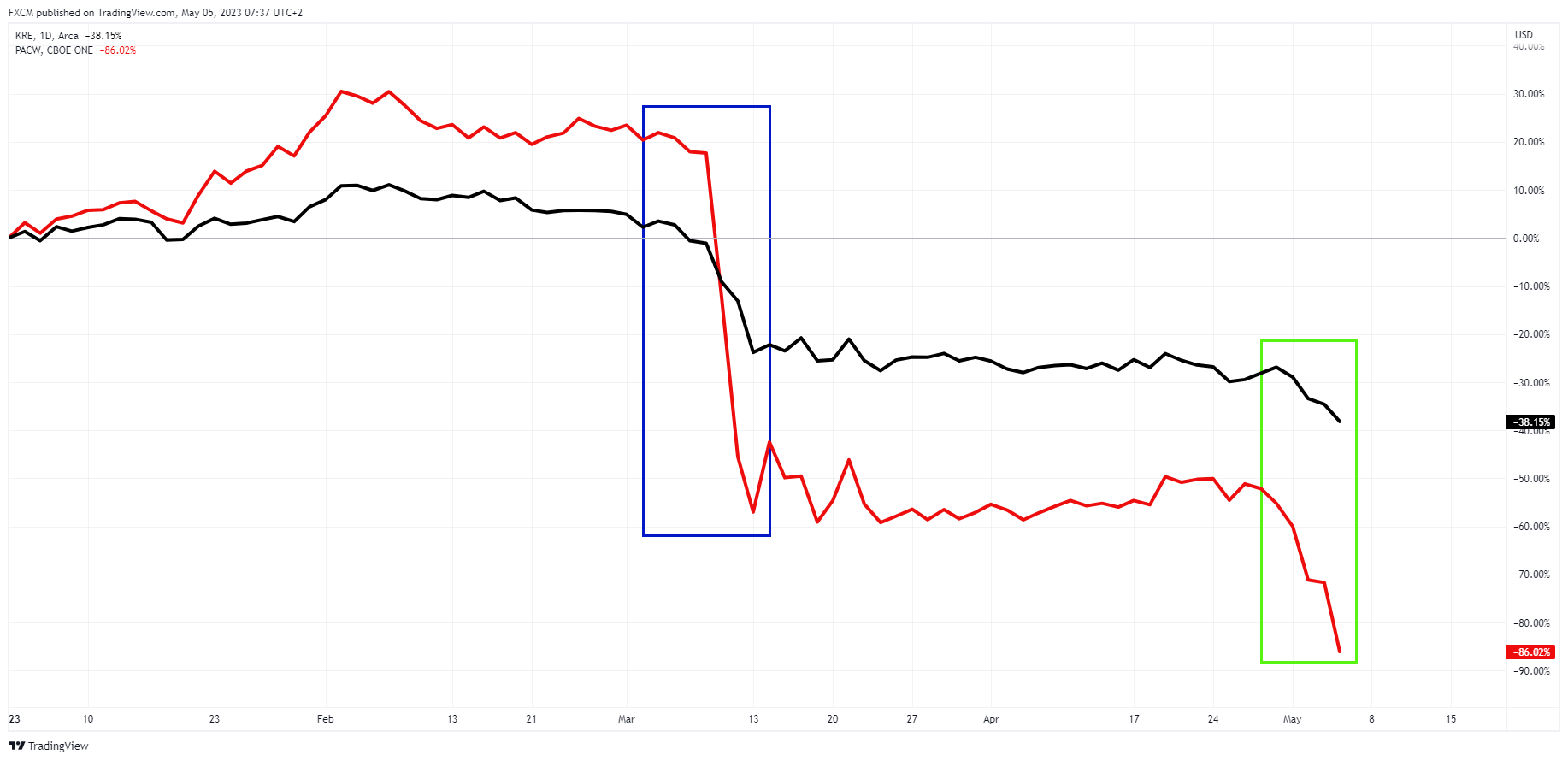

Regional Bank ETF vs PacWest

Source: www.tradingview.com

- The black line chart is the S&P regional banking ETF (KRE), and the red line is PacWest’s (PACW) price.

- The period between 8 March and 13 March (blue vertical rectangle) indicates a period of significant capital loss.

- KRE lost 22.96% and PACW lost 63.46% of their respective values.

- 27 April to current (green vertical rectangle) is a second period of turmoil.

- KRE is down 13.95% and PACW has lost a further 70.8% of its value.

Regional Bank ETF and US.BANKS Basket

Source: www.tradingview.com

- The top chart shows KRE.

- The chart underneath is FXCM’s US.BANKS basket.

- The red horizontals show the periods 8March to 13 March, and 27 April to current.

- The bottom indicator is the correlation coefficient (CC) between KRE and US.BANKS.

- There was a period when the US.BANKS was outperforming KRE (green rectangle). However, this was short lived.

- In general, the CC shows a strong correlation and the current reading is 70%.

- This indicates that the regional bank turmoil is rippling through to the larger banks that make up the US.BANKS basket.

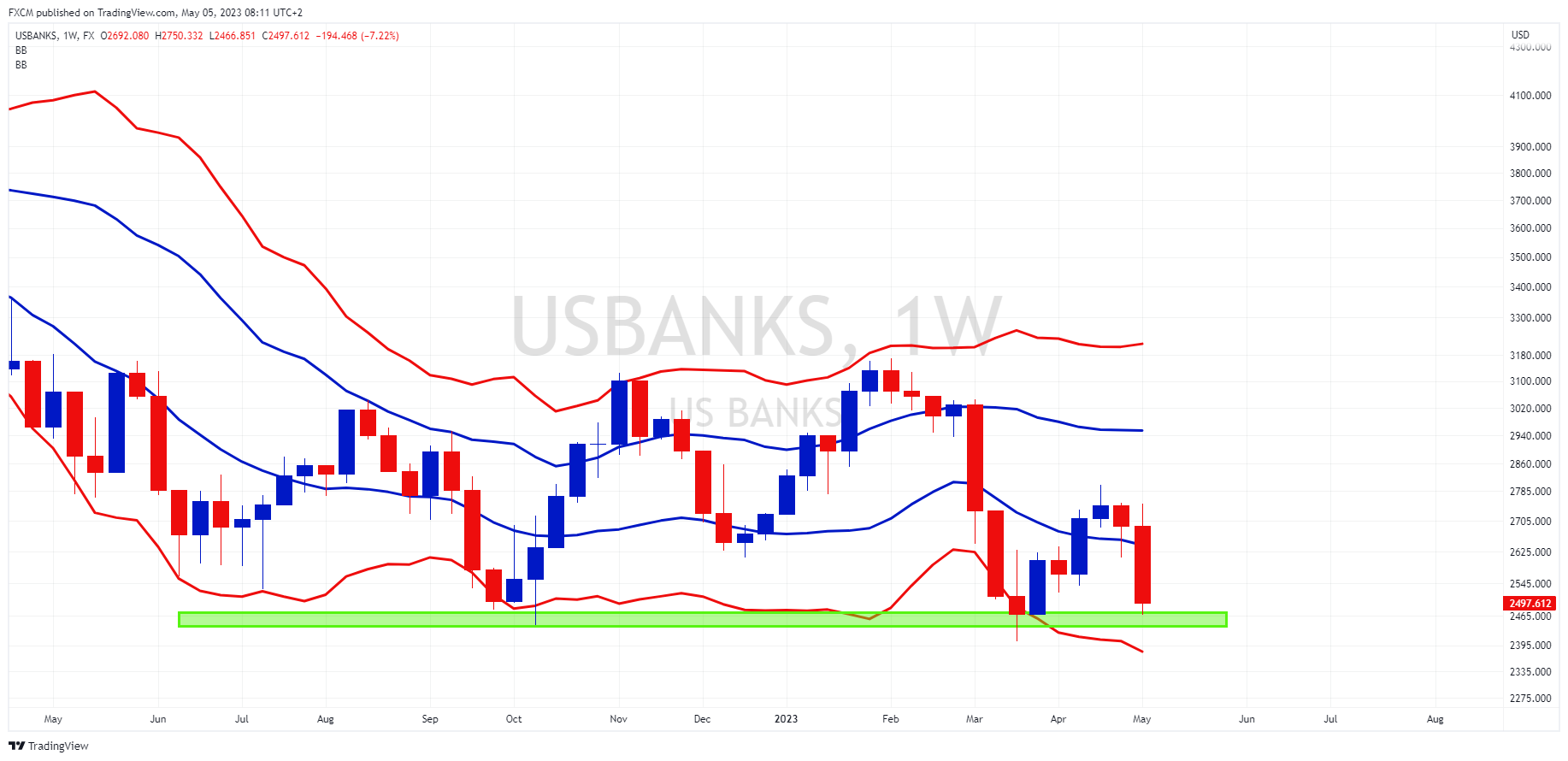

US.BANKS Basket Weekly Analysis

Source: www.tradingview.com

- FXCM’s US.BANKS basket is trading in its weak channel between the lower blue and red bands.

- The current candle (still to complete) indicates a decline of 7.22% for the week.

- The basket has dropped to a significant level of support (green shaded horizontal).

- The longer the basket maintains in its bearish zone, the greater the likelihood that the underlying support will be breached to the downside.