Europe’s banks and asset managers, with the support of the region’s politicians and regulators, must seize an opportunity to close the ‘competitiveness gap’ with their peers in the US and the rest of the world, a report commissioned by Luxembourg for Finance and published today by OMFIF urges.

‘Competitiveness of European financial services’ is a data study of financial competitiveness, assessing indicators such as size, diversification, profitability, pricing power and valuation. It reveals in stark terms the decline of European financial services firms on a global scale since the financial crisis of 2008.

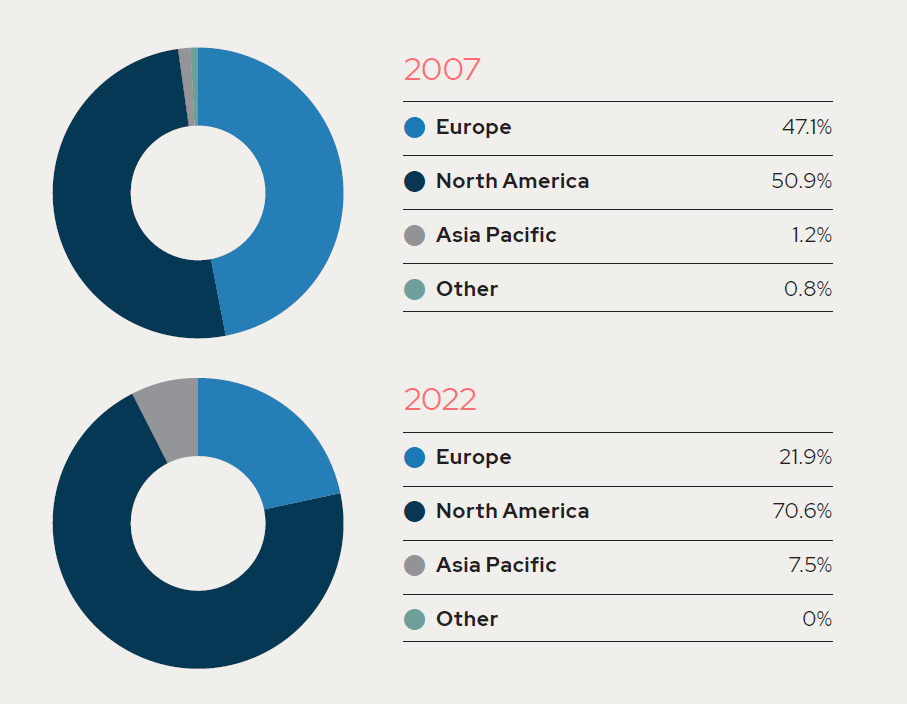

Fifteen years ago, the total market capitalisation of Europe’s banks was close to double that of US banks. Today, total US market cap is twice that of Europe’s. In asset management, Europe’s institutional investors represented 47% of the top 100 global firms by assets under management in 2007. In 2022, they accounted for just 22% of AuM, compared to 70% for US fund managers (Figure 1).

Figure 1. European funds have lost significant market share

Share of top 100 asset managers’ AuM by company’s region, %

Source: Investments & Pensions Europe, ‘Competitiveness of European financial services’

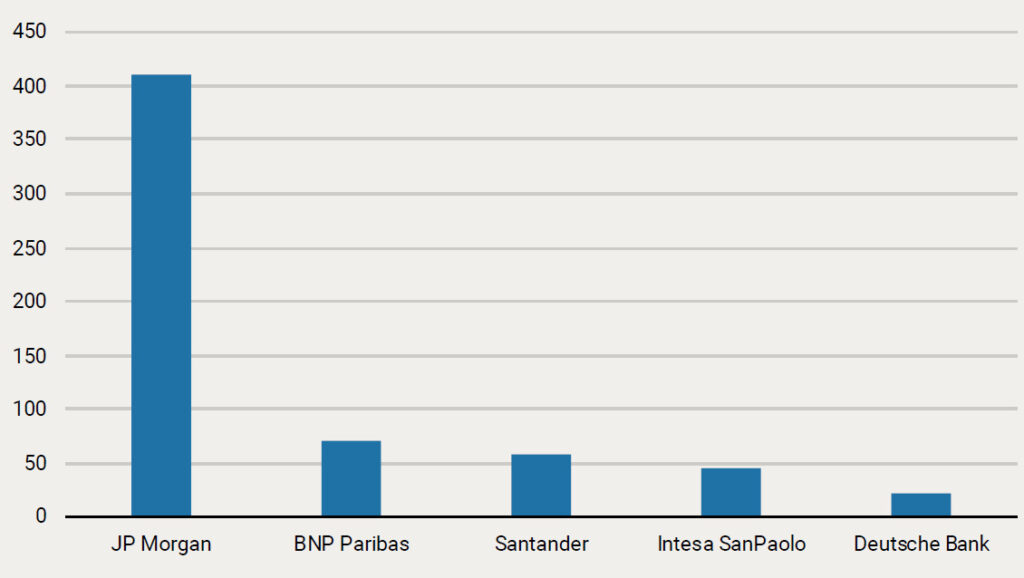

Last year, just two of the leading 20 global banks by market cap were headquartered in the European Union, as were just two of the leading 20 global fund managers. The market cap of JP Morgan, the US’s largest bank, is more than double the combined capitalisation of the four leading banks in Europe’s largest economies (Figure 2).

For much of the last decade, Europe’s banks and asset managers have been hampered by fragmentation, the absence of a working capital markets or banking union, a more severe regulatory environment, the implications of low interest rates and an overall lack of risk culture. How does Europe staunch and reverse this trend? There are no easy answers. Europe’s financial markets remain deeply fragmented and, its leading financial institutions would argue, regulated in a way that harms their ability to compete.

A new way of looking at all current and future financial regulation is urgently needed. Regulations should be viewed through a lens of what impact they have on the ability of banks to compete and provide the finance that the European economy needs.

Figure 2. Europe’s leading banks fall way short of JP Morgan

Market capitalisation, $bn

Source: OMFIF analysis, ‘Competitiveness of European financial services’

The good news on the regulatory front is that, after years of being penalised by Europe’s early adoption of the Basel III guidelines, US banks face being forced to raise their capital levels in the Basel III endgame. But European banks could still learn a thing or two about lobbying – the concerted and vociferous criticism of Basel III by US financial services’ chief executives is a lesson in harnessing the power and influence of the banking system. And it could still see the Federal Reserve water down some of its proposals.

Europe’s financial system will remain fragmented on national lines unless or until there is a change in political will at both EU and domestic levels. Fundamental change – in the form of banking and capital markets unions to provide an EU-wide, cross-border, frictionless financial services regime that matches the US for size and scale – can only come with consensus from the political classes.

The report is based on a series of interviews and discussions with senior executives at leading financial institutions, regulators and policy-makers – primarily in Europe but also from the US and Asia. They reveal a potential shift for the EU’s financial services sector. Many of Europe’s leading banks have returned to pre-2008 financial crisis levels of profitability, with returns on equity almost doubling in the past three years. Europe leads the way globally in a number of areas, such as green and transition finance and digitalisation of financial services.

And Europe has put competitiveness at the top of its agenda. European Commission President Ursula von der Leyen has appointed Mario Draghi to lead efforts to improve competitiveness in the EU’s economy and financial services. The new Belgian presidency of the Council of the European Union has commissioned another former Italian prime minister, Enrico Letta, to prepare a report on reinforcing the competitiveness of Europe’s internal market.

Europe needs to transition from a vicious cycle in financial services to a virtuous one. It can be done. Europe’s banks and asset managers will play a crucial role in financing the digital and environmental transformation over the coming years. That opportunity – if grasped by the political and financial sectors – could provide the economic growth that the EU desperately needs.

Download Competitiveness of European financial markets here. The key findings of the report will be discussed at a seminar hosted by Luxembourg for Finance on 23 January. Register for this event here.

Clive Horwood is Managing Editor and Deputy Chief Executive Officer of OMFIF.