Founded in 2009, Quontic began as a community bank in New York City and has since become an online-only bank. Quontic Bank is Federal Deposit Insurance Corp. (FDIC)-insured, and a part of a fee-free ATM network made up of 90,000 ATMs across the country. It offers several checking accounts, savings accounts, certificates of deposit (CDs), and mortgage products.

All rates and fees are current as of May 8, 2024, and are subject to change.

Quontic Bank

| Checking accounts: | Starting at $0 per month |

| Savings accounts: | Open with as little as $100 |

| CD rates: | Earn up to 5.05% annual percentage yield (APY) |

Pros

- No monthly fees

- Competitive interest rates

- Strong customer service

Cons

- No customer support on weekends

- No physical branch locations

- No lending other than mortgages

- No business accounts

Who is Quontic Bank good for?

Quontic Bank is good for those who are comfortable banking completely online and want easy-to-use accounts with competitive interest rates and good customer service.

If you want to earn cash back but avoid credit cards, the Cash Rewards Checking earns 1% cash back on debit card purchases. Cash back checking accounts are hard to find, so this could be a great solution for you.

Who shouldn’t use Quontic Bank?

If you want in-person banking or to have all your banking in the same place, you’ll probably want to look elsewhere.

Quontic Bank is an online-only bank with strong checking and savings options. However, it doesn’t offer credit cards, auto loans, personal loans, or home equity lines of credit (HELOC), and it doesn’t offer business accounts. Therefore, if you bank at Quontic Bank, you’ll likely need another institution.

Quontic Bank rates and products

Quontic Bank offers several products, including checking accounts, savings accounts, CDs, and money market accounts (MMAs).

Checking accounts

Quontic Bank offers two different free checking accounts: the High Interest Checking and the Cash Rewards Checking. Neither charges a monthly fee and both require a minimum opening deposit of $100. Neither account has a checking account welcome bonus at this time.

Also, both checking accounts come with the Quontic Pay Ring. This is a physical ring you wear on your finger that allows you to make purchases with a tap. It’s similar to tapping your card or phone at the checkout, but you don’t need to take anything out of your pocket. It’s ideal when you are out and about but don’t want to carry anything, such as if you are going for a run.

Quontic Bank also has an extensive ATM network. There are no fees at Allpoint, MoneyPass, SUM, or Citibank ATMs located in Target, Speedway, Walgreens, CVS, Kroger, Safeway, Winn-Dixie, and Circle K. That’s over 90,000 ATMs.

The accounts also work with Zelle, Google Pay, Samsung Pay, and Apple Pay.

To earn the highest interest rate you’ll need to make at least 10 debit card transactions per statement cycle. These transactions must be point-of-sale (POS) purchases of at least $10. If you don’t meet this requirement, you’ll only earn 0.01% APY. So, it’s worth the effort.

POS transactions are purchases at a retailer, either online or in person. Transactions that don’t count include person-to-person transfers, such as Venmo, ATM transactions, transfers between accounts, and loan payments made with your debit card.

Instead of earning interest, the Cash Rewards Checking account earns cash back on debit card purchases. You can earn up to $50 per statement in cash back. That’s up to $5,000 in spending per month.

Qualifying transactions are purchases made at a retailer. Transactions that don’t qualify for cash back are person-to-person transfers, ATM transactions, transfers between accounts, loan payments, and funding another account with your debit card. Also, if you get cash back when checking out at a store, the cash back portion of the transaction will not qualify for cash back.

Savings accounts

The high-yield savings account from Quontic Bank offers a competitive APY with no monthly service fees and a minimum opening deposit requirement of $100. For easy access to your funds, you can request an ATM card. Note that it is not a debit card, but it will allow you to withdraw money at one of Quontic Bank’s 90,000 ATMs.

Interest compounds daily but is credited to the account on a monthly basis. Here’s more about how high-yield savings accounts work.

Quontic Bank savings rates compared to current top rates*

While Quontic Bank is a great option, some institutions offer higher interest rates. Compare the rates above to this list of competitors:

Money market accounts

Quontic Bank offers an MMA that earns 5% APY. It offers a debit card and paper checks, and you can also get the Quontic Ring with this account.

MMAs are a hybrid of savings accounts and checking accounts. Typically, they offer the higher rates of a savings account with the easy access to checking accounts. It’s not uncommon for MMAS to have transaction limits or other restrictions that prevent them from being used as a checking account. Here’s a quick primer on MMAs if you want to learn more.

However, Quontic Bank is different. For this account, there are no transaction limits. You could even use it as your primary checking account, which makes this a very valuable account.

To earn the top interest rate, you do not need to meet any balance or transaction requirements. You’ll also have access to mobile deposit, bill pay, Zelle, Google Pay, Samsung Pay, and Apple Pay.

Certificates of deposit

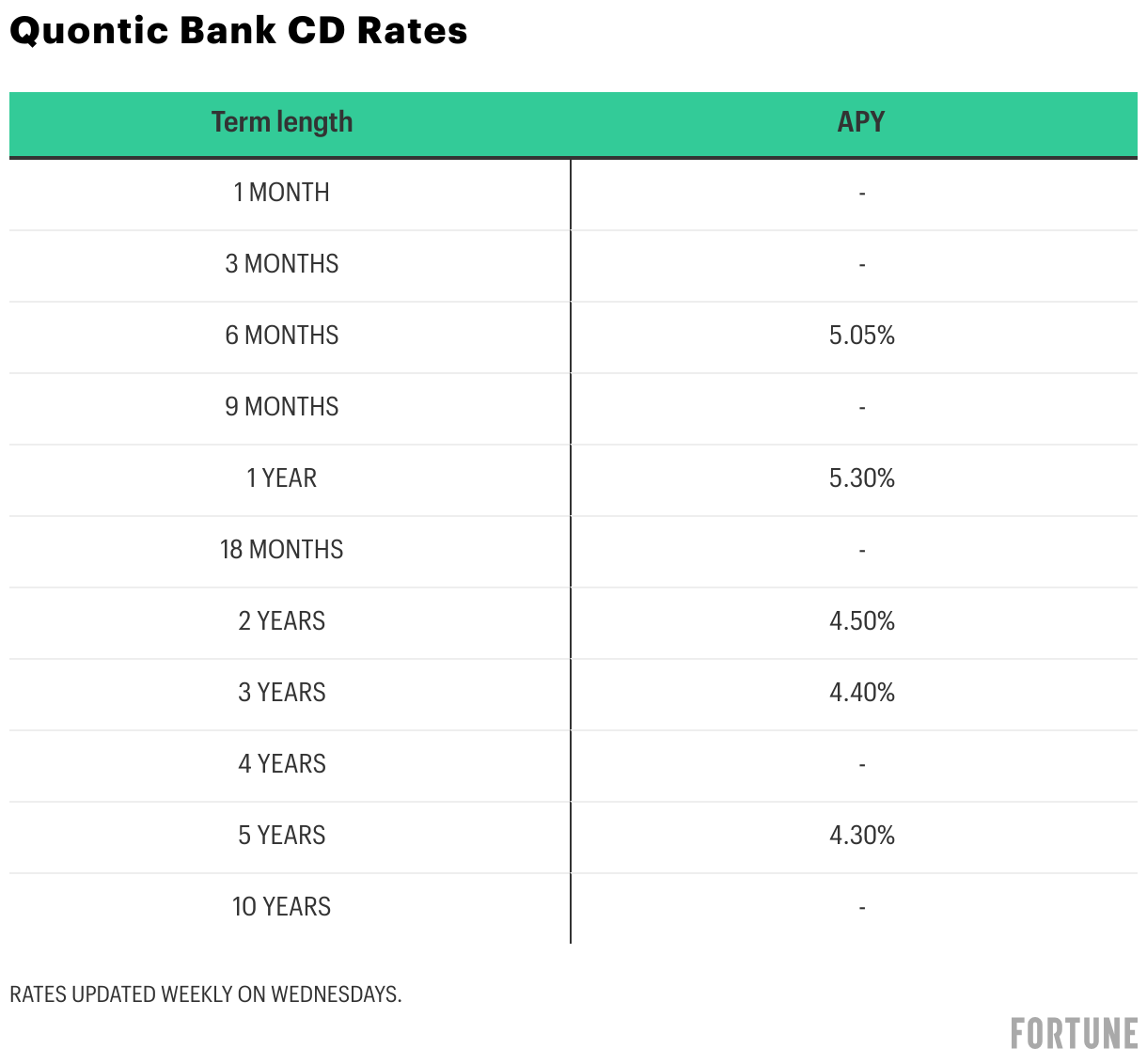

Quontic Bank also has CD accounts with terms that range from six months to five years, all with competitive interest rates.

Like most CDs, your money will be locked away for the term of the CD in exchange for a fixed interest rate. You can learn more about how CDs work here.

If you need your money before the end of the term, there will be an eary withdrawal penalty. If the penalty is more than the interest you’ve accrued, it will reduce the balance of your account. That means it’s possible to end up with less money than you started with. So, only open a CD if you are confident you’ll be able to hold the CD until the end of the term.

Other services Quontic Bank offers

- Mortgage loans: Quontic Bank offers various types of home loans, including conventional loans, Federal Housing Administration (FHA) loans, Veterans Affairs (VA) loans, and community development loans.

- Mortgage refinancing: Quontic Bank’s home refinance program can potentially benefit homeowners looking to secure a better rate on their mortgage.

- Equity loans: Home equity loans are a second mortgage on your home; however, it does not offer HELOCs.

The Quontic Bank platform and customer support

Quontic Bank offers online and mobile banking platforms. Its application is available for download on the Apple App Store and Google Play and has ratings of 4.4 and 3.3 stars, respectively.

You can contact a United States-based customer service representative via live chat, email, and telephone Monday through Friday between 9 a.m. and 6 p.m. Eastern time. While researching for this article, we contacted customer support via chat for clarification of its products. The wait to speak with a live representative was short, and the agent was friendly and knowledgeable.

Is Quontic Bank secure?

Quontic Bank is secure and it uses all the modern security measures you can expect from a bank. First of all, your money is FDIC-insured, which means you are protected from bank failure for up to $250,000 per owner, per account type. If the bank were to fail, the U.S. government would return any lost funds.

Quontic Bank also uses up-to-date technology to protect your account from fraud and data breaches and none of your information is shared with third parties.

To prevent fraud, they have multi factor authentication (MFA) to log into your accounts and never ask for account information via email or text. Both of these measures help stop thieves from gaining access to your accounts.

Quontic Bank user reviews

Quontic Bank has a 4.1-star rating on Trustpilot with around 570 reviews. Customers seem to love the stellar customer service they received, often naming employees by name and saying they went above and beyond. They also say the account setup was quick and easy.

The negative reviews mostly focus on its account applications being denied and being unable to set up an account.

Compare Quontic Bank alternatives

Is Quontic Bank right for you?

Quontic Bank could be right for you if you are comfortable banking solely online as there is no in-person banking option. It offers competitive interest rates on savings and CDs and it has options for earning interest on your checking account. Current customers report good customer service and easy-to-use accounts.

However, while it does have good options for basic personal banking, Quontic Bank doesn’t offer any business accounts. It also doesn’t offer credit cards, auto loans, or HELOC, so you’ll likely have to have accounts at other banks. If you want all your banking done in one place, Quontic Bank may not be for you.

Frequently asked questions

Is Quontic Bank a legitimate bank?

Yes. Quontic Bank is a legitimate, FDIC-insured bank. Deposits are protected up to $250,000 per depositor for each account ownership category.

Who started Quontic Bank?

Steve Schnall founded Quontic Bank in 2009.

Does Quontic Bank have any branch locations?

No. Quontic Bank is a digital bank that operates online. However, it does have loan offices in New York, Florida, and Arizona.