Quintet Private Bank Europe S.A. Acquires Stake in The Mosaic Company, Demonstrating Confidence in Agricultural Industry Leader

Quintet Private Bank Europe S.A. has recently acquired a new stake in shares of The Mosaic Company, according to the company’s Form 13F filing with the Securities & Exchange Commission. The bank purchased 36,906 shares of the basic materials company’s stock, which are valued at approximately $1,693,000.

The Mosaic Company (NYSE: MOS) is a well-known player in the global agricultural industry, specializing in the production and marketing of crop nutrients. Established in 2004 through a merger between IMC Global Inc. and Cargill’s crop nutrition division, Mosaic has become one of the world’s largest producers and marketers of concentrated phosphate and potash crop nutrients.

In its most recent earnings report on August 1st, Mosaic reported an earnings per share (EPS) of $1.04 for the quarter. This figure fell slightly short of analysts’ consensus estimate of $1.07 by ($0.03). Despite this slight miss, the company generated revenue worth $3.39 billion during the period, surpassing market expectations set at $3.13 billion.

However, it is worth noting that Mosaic witnessed a decline in revenue compared to the same quarter last year by about 36.8%. This dip can be attributed to various factors such as lower demand for agricultural products and challenging market conditions that impacted fertilizer sales volumes.

Despite these challenges, Mosaic maintains a healthy return on equity (ROE) of 20.21% and a net margin of 12.89%. These figures demonstrate the company’s ability to generate strong returns for its shareholders despite prevailing market conditions. Additionally, analysts project that Mosaic will post an EPS of 3.89 for the current fiscal year.

The acquisition of shares in The Mosaic Company by Quintet Private Bank Europe S.A indicates its belief in the company’s long-term growth potential within the agricultural industry. By diversifying their investment portfolio, the bank is positioning itself to benefit from Mosaic’s future success.

Investors and industry experts will be closely monitoring Mosaic as it navigates through changing market dynamics and works towards increasing its market share in the crop nutrients industry. The company’s ability to adapt to evolving consumer demands and capitalize on emerging opportunities will play a crucial role in determining its future performance.

As the agricultural sector remains a critical component of global food production, companies like The Mosaic Company play an essential role in providing the necessary resources to support sustainable farming practices. With Quintet Private Bank Europe S.A.’s recent acquisition, all eyes are on Mosaic as it continues to make strides in this vital industry.

Institutional Investors Show Confidence in Mosaic’s Potential for Growth

On September 4, 2023, various institutional investors and hedge funds engaged in extensive buying and selling of shares in Mosaic, a leading basic materials company. Among the notable buyers was High Net Worth Advisory Group LLC, which acquired a new stake in the company during the 1st quarter valued at approximately $33,000. Similarly, Heritage Wealth Management LLC increased its stake in Mosaic by 100% in the fourth quarter, resulting in ownership of 600 shares worth $26,000. Penserra Capital Management LLC also purchased a new stake in Mosaic during the first quarter for approximately $44,000.

Another investor that demonstrated confidence in Mosaic’s potential was Quent Capital LLC, which raised its stake by 50% during the same period. As a result, they held 705 shares valued at $32,000. Furthermore, Carolinas Wealth Consulting LLC exhibited significant support by boosting their holdings of Mosaic stock by an astounding 3,186.4% during the first quarter. This acquisition meant that Carolinas Wealth Consulting now owns 723 shares worth $48,000.

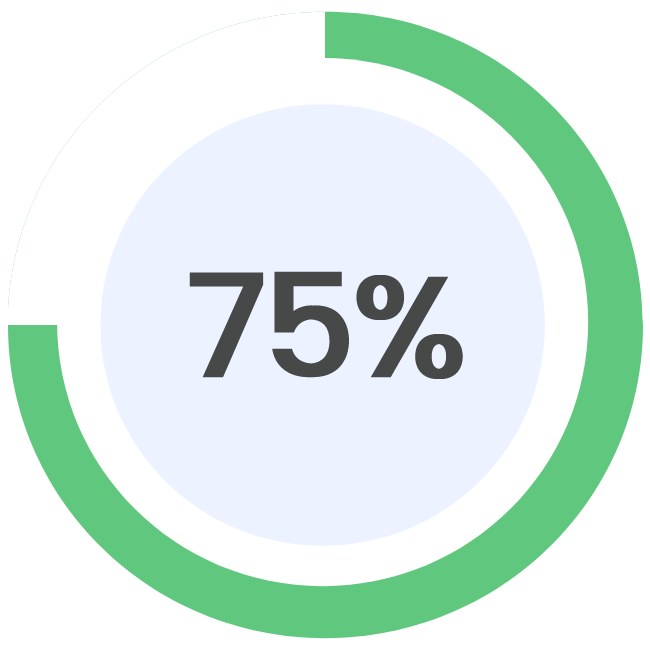

It is interesting to note that hedge funds and other institutional investors collectively own over 84% of Mosaic’s stock. This level of ownership indicates a high degree of trust and belief in the company’s performance and potential for growth.

Analyzing recent trading activity on Monday, it can be observed that Mosaic stock traded up $1.00 to reach $39.85 during regular trading hours. The stock had a trading volume of approximately 2,597,400 shares on this day alone, compared to its average daily volume of 4,119,261 shares. It is also worth mentioning that Mosaic has experienced fluctuations throughout recent months concerning its moving averages. At present time, its 50-day moving average stands at $38.39 while its two-hundred day moving average is slightly higher at $40.97.

Looking at Mosaic’s financial health, the company has a quick ratio of 0.53 and a current ratio of 1.18. In addition, its debt-to-equity ratio stands at 0.19, indicating that the company relies on relatively low levels of debt to finance its operations. With regards to its stock performance, Mosaic has experienced a fifty-two week low of $31.44 and a fifty-two week high of $57.46.

In terms of market cap, Mosaic currently boasts a valuation of $13.24 billion. The price-to-earnings ratio (PE) stands at 6.30, suggesting that the stock is undervalued compared to the company’s earnings potential. Furthermore, Mosaic has a price-to-earnings-growth (PEG) ratio of 1.46, signifying an optimistic outlook based on future earnings growth expectations. Lastly, the stock has a beta of 1.52, indicating that it is expected to be more volatile than the overall market.

Another recent development worth mentioning is Mosaic’s announcement regarding quarterly dividends. Stockholders who were recorded as owners on Thursday, September 7th will receive a dividend payment of $0.20 per share on Thursday, September 21st. This translates to an annualized dividend payout of $0.80 per share and provides investors with a dividend yield of approximately 2.01%. Notably, Mosaic’s payout ratio currently stands at 12.64%, indicating that the company allocates a modest portion of its profits towards dividends for shareholders.

Several research reports have been issued concerning MOS in recent times by reputable institutions such as Morgan Stanley and Royal Bank of Canada (RBC). Morgan Stanley reiterated their “equal weight” rating on Mosaic shares while setting a target price of $40 per share on July 25th this year.