Investors Push UK Banks for Higher Profitability Targets Amid Underperformance

In a development that has sent ripples across the financial sector, UK banks are facing increasing pressure from investors to set higher profitability targets. The call for action comes as existing return on equity (ROE) falls short of the cost of equity, causing a drop in the value of bank stocks. A practice backed by financial literature, companies are expected to generate returns higher than the theoretical cost of their equity to maintain their value. However, major UK banks’ ROE targets are not meeting this standard, as evidenced by their low price-to-earnings and price-to-book ratios.

Barclays and NatWest: Case Studies of Underperformance

Barclays, a key player in the UK banking sector, has aimed for a return on tangible equity (ROTE) above 10 percent since early 2021. Yet, with the cost of equity now hovering around 20 percent, this target appears inadequate. NatWest, despite its more ambitious ROTE target of 14-16 percent, is also undervalued. Its shares are trading below tangible net worth, further highlighting the discrepancy between banks’ profitability targets and the actual cost of equity.

Strategies for Enhancing Bank Profitability

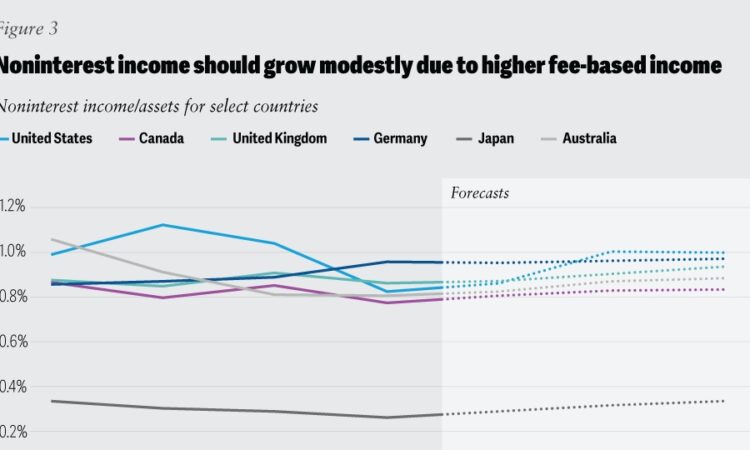

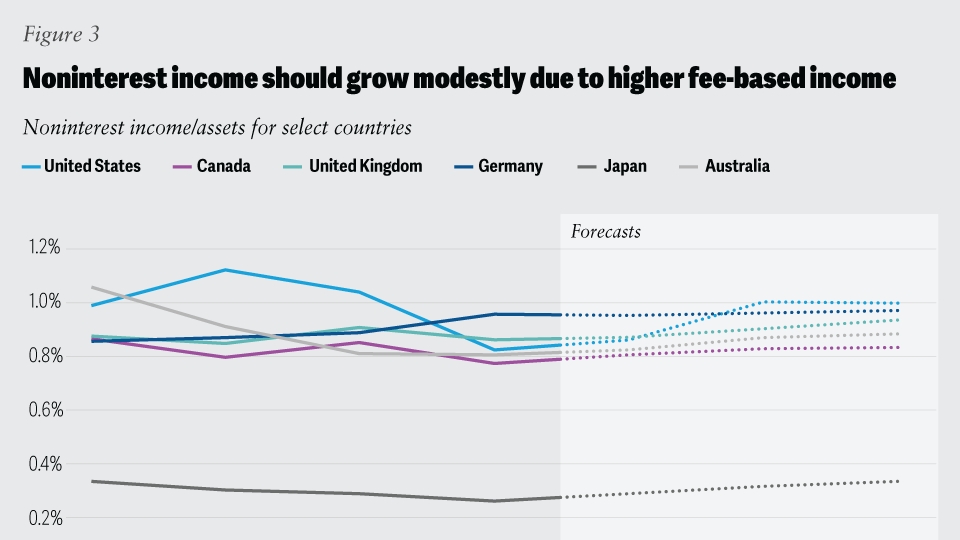

Bank executives are turning over every stone in their quest to boost profitability. Measures include cost-cutting initiatives, identifying new sources of fee income, and increasing dividend payouts and share buybacks. There is also a concerted effort to reduce the amount of regulatory capital required—a factor that depresses ROTE. One strategy in this regard is sharing credit risk with specialist investors. This approach is likely to gain momentum in the face of stricter Basel III capital requirements. However, the pace of change may be slow due to the necessity of regulatory reviews.

Impacts on Landlords and Digital Banks

As the banking sector grapples with these challenges, approximately 150,000 buy-to-let landlords in the UK are poised to see their monthly mortgage payments increase by up to 3 percent when they refinance at the end of their fixed deals in 2024. The impact of higher rates on landlords is further exacerbated by reductions in tax relief on buy-to-let mortgages, compelling them to raise rents to cover these costs. On the other hand, digital banks in the UK, striving to offer low-friction, high-volume banking services, are navigating a complex regulatory environment. They face hurdles in attaining scalability and profitability, while ensuring customer data protection and compliance with stringent financial regulations.