Pound hits 15-month high as UK economy shrinks less than feared in May – business live | Business

ONS: Factories and builders blame Coronation for reduced output

A range of manufacturing industries and construction businesses cited the additional bank holiday for the Coronation of King Charles III, on Monday 8 May, as a reason for reduced output during the month.

But, the ONS reports that other sectors of the economy benefited from the festivities.

Today’s GDP report says:

On the positive side, we had comments suggesting industries in the arts, entertainment and recreation sector benefitted from the extra bank holiday.

There were also comments on both increased and reduced output received in the accommodation and food services sector.

Key events

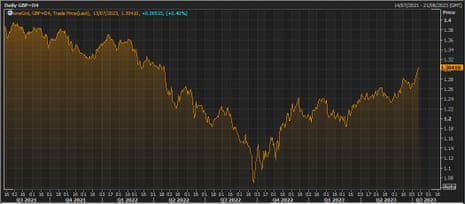

Pound at new 15-month high

The pound has hit a fresh 15-month high this morning, after the UK economy shrank by less than expected in May.

Sterling traded at $1.306 against the US dollar for the first time since April 2022, up 0.5%.

The rally follows this morning’s GDP report showing a smaller contraction than feared in May despite the extra bank holiday to mark King Charles’ coronation and ongoing strikes.

The pound has gained almost 8% against the dollar this year, lifted by the prospect of rising interest rates to cool inflation.

Yesterday it hit $1.30 for the first time in 15 months, after a surprisingly large fall in US inflation raised hopes that the US Federal Reserve could soon end its cycle of rate increases.

A new high for the UK Pound £ for the year as it passes US $1.30 #GBP

— Shaun Richards (@notayesmansecon) July 13, 2023

As covered earlier, the smaller-than-feared drop in GDP in May could encourage the Bank of England to keep raising interest rates.

Victoria Scholar, head of investment at interactive investor, says:

The pound hit a 15-month high this week against the US dollar after US CPI fell to 3% in May while the UK still struggles with sky-high price pressures with growing potential interest rate differentials boosting the allure of sterling.

GBPUSD is in the green this morning, trading above the key $1.30 handle and the pound is also higher against the euro.”

UK mortgage rates have risen again.

The average 2-year fixed residential mortgage rate today is 6.75%, Moneyfacts reports, up from the 15-year high of 6.70% yesterday.

The average 5-year fixed residential mortgage rate is now 6.27%, up from 6.20% on Wednesday.

UK lenders expect mortgage supply and demand to fall

Just in: UK lenders expect to curb the availability of mortgages and consumer credit in the next three months.

The Bank of England’s latest Credit Conditions Survey also showed lenders expect demand for mortgages to fall sharply in the third quarter.

Lenders told the BoE that they had curbed the availability of secured credit (such as a mortgage) to households in the three months to the end of May, and expect this to decrease further over the next three months to the end of August.

The availability of unsecured credit to households was unchanged in the last quarter, and was expected to decrease slightly in June-August.

Lenders reported that demand for secured lending for house purchase and remortgaging increased in the last quarter, but was expected to decrease in Q3 – likely due to the impact of higher interest rates.

IEA cuts 2023 oil demand forecast as economic headwinds rise

Just in: the International Energy Agency has trimmed its forecast for oil demand this year, due to the headwinds hitting the global economy

The IEA still believes oil demand will hit a record high this year but factors such as interest rate hikes mean the increase will be slightly less than anticipated.

Global oil demand is projected hit 102.1 million barrels per day, a new record, and an increase of 2.2 million barrely per day.

But, the IEA says a “deepening manufacturing slump” means it has cut its 2023 growth estimate for the first time this year, by 220,000 barrels per day.

In its monthly oil report, the IEA says:

World oil demand is coming under pressure from the challenging economic environment, not least because of the dramatic tightening of monetary policy in many advanced and developing countries over the past twelve months.

Growth in 2023 has been revised down for the first time this year, to 2.2 mb/d from 2.4 mb/d expected previously, with China poised to account for 70% of the total.

Here’s Darren Morgan, director for economic statistics at the ONS, on the UK May GDP report released this morning:

“GDP fell slightly as manufacturing, energy generation and construction all fell back, with some industries impacted by one fewer working day than normal.

“Meanwhile, despite the coronation bank holiday, pubs and bars saw sales fall after a strong April. Employment agencies also saw another poor month.

“However, services were flat overall with health recovering, with less impact from strikes than in the previous month, and IT also had a strong month.”

Poundland sales keep rising

UK customers continue to flock to discount retailer Poundland, in the cost of living crisis.

Parent company Pepco Group has reported that like-for like sales at Poundland jumped by 9% in the three months to 30 June, due to strengthening demand for fast moving consumer goods (FMCGs).

Trevor Masters, CEO of Pepco Group, said:

“As we highlighted at our interim results in June, the macro-economic climate continues to be challenging, particularly in Central Europe, due to elevated levels of inflation.

Recruitment firm Hays has reported a slowdown in hiring by UK companies.

Fees at Hays, which makes money by finding new staff to fill vacancies, fell by 7% in the UK and Ireland in the April-June quarter.

Fees for filling permanent positions fell by 15% as “activity levels slowed”, Hays told the City this morning.

It blamed “reduced client and candidate confidence”, with employees less willing to change jobs in the current economic climate, as the ‘great resignation’ stalled.

But, fees continued to be supported by positive profit margins and wage inflation,

Income from private sector companies fell 12%, but there was an 8% rise in fees from the public sector. Fees in London decreased by 10%.

Economic research institute NIESR fears that UK growth will remain ‘anaemic at best’ in the months ahead.

Paula Bejarano Carbo, NIESR associate economist, points out that interest rates (now 5%) are suppressing demand:

“Today’s data indicate that #GDP remained flat in the three months to May, in line with our previous forecast, and consistent with the longer-term trend of low economic growth in the UK. Monthly GDP fell by 0.1 per cent in May following growth of 0.2 per cent in April,

1/2

— National Institute of Economic and Social Research (@NIESRorg) July 13, 2023

driven by a fall in #production output and no growth in the #services sector. With the #BankRate now at 5 per cent, suppressing demand, UK growth will continue to be anaemic at best in the coming months.” 📉

⚡️Our full analysis will be out shortly⬇️

— National Institute of Economic and Social Research (@NIESRorg) July 13, 2023

The “harsh reality” is that the UK economy has barely grown for a year and a half, points out Ed Monk, associate director for Personal Investing at Fidelity International.

After the small fall in May, GDP remains only a fraction above where it was before the start of the pandemic more than three years ago, Monk point out, adding:

“Recession has been held at bay so far – let’s see what the rest of the year holds – but pressures are building in several areas. Both construction and production fell in May, and services only avoided falling because medics were on strike for fewer days than the month before.

“The Bank of England has spelled out the strain mortgage borrowers will come under in the next two years. Unemployment is now rising and vacancies for jobs are now beginning to fall back too.

“Yet despite stagnant growth, inflation remains stubbornly high with nominal wages still accelerating – albeit at a slower rate than price rises. You have to worry that the UK will experience a more sudden deterioration in the economy at some stage soon.

Once the rate rises are felt more widely, and house prices fall further and employers cut their budgets for pay rises, sentiment could quickly unwind.”

Pressure on Bank of England to keep raising interest rates

News that the UK economy shrank a little in May will not deter the Bank of England from raising interest rates again to fight inflation, City experts say.

Neil Birrell, chief investment officer at Premier Miton Investors, explains:

“As expected, the UK economy shrank in May, but not as much as expected. Admittedly, we are a month on from that now and the economy could be weaker still, but this would not have been the picture the Bank of England wanted to see.

With inflation still rife, this keeps the pressure firmly on the Bank to keep raising interest rates, putting even more pressure on the consumer in particular.”

UK interest rates are currently 5%, and the money markets indicate they will have risen to over 6% by next spring.

Nicholas Hyett, investment manager at Wealth Club, fears the economy could be “running out of gas”.

Hyett says:

The housing market seems to be slowing, with less construction activity in housebuilding, and recruitment is seeing weakness too – potential canaries in the coal mine that suggest the economy has reached a turning point and is sliding from growth to contraction.

We suspect the Bank will take no chances and continue to hike rates, but the job of balancing inflation and economic growth isn’t getting any easier.”

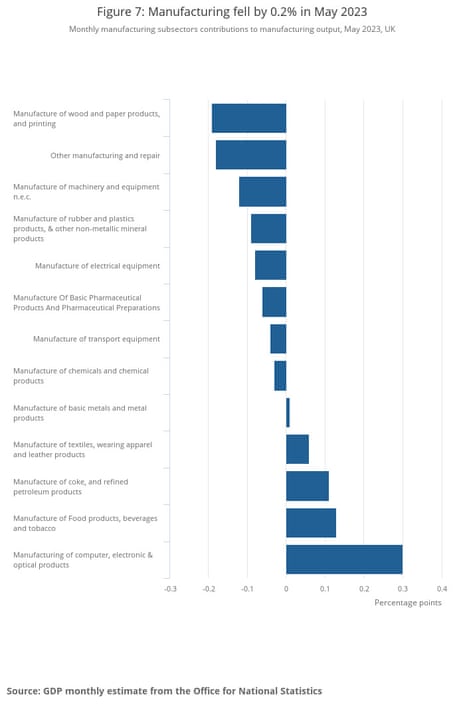

Britain’s manufacturing sector shrank by 0.2% in May, as output was hit by the three bank holidays during the month.

Eight of the 13 subsectors in manufacturing contracted, led by ‘manufacture of wood and paper products, and printing’ which fell by 3%.

Hunt: extra bank holiday and inflation hit growth in May

Chancellor of the Exchequer, Jeremy Hunt, says that bringing down inflation will help the economy:

“While an extra bank holiday had an impact on growth in May, high inflation remains a drag anchor on economic growth.

“The best way to get growth going again and ease the pressure on families is to bring inflation down as quickly as possible.

“Our plan will work, but we must stick to it.”

That plan includes resisting pressure for public sector pay increases, which has led to the longest industrial action in the history of the NHS which starts today as junior doctors go on strike for five days.

ICAEW: Floundering economy putting PM’s growth pledge at risk

May’s GDP report shows that the UK economy was “floundering” even before the impact of recent interest rate rises are fully felt, says Suren Thiru, economics director at ICAEW (the Institute of Chartered Accountants in England and Wales).

The extra bank holiday for the Coronation curbing output in May, points out Thiru, who warns that Rishi Sunak’s growth pledge is at risk.

Thiru says:

“While the economy may rebound in June, the significant squeeze on activity from high inflation, stealth tax hikes and rising interest rates means the Prime Minister may struggle to meet his pledge to get the economy growing.

“These GDP figures are unlikely to prevent another rate rise in August. However, given the long time lag between rate rises and its effect on the real economy, tightening further risks damaging our growth prospects by overcorrecting for past errors.”