(Bloomberg) — Polish banks suffered a potentially costly setback in the long-running saga over Swiss Franc mortgages after an adviser to the European Union’s top court said they can’t pass on extra fees to customers whose interest payments were deemed unfair.

Most Read from Bloomberg

In cases where contested mortgage deals are voided by local courts, lenders can’t claim payments beyond reimbursements of the loan principal, Advocate General Anthony Collins of the EU Court of Justice said in a non-binding opinion Thursday.

“A bank is not entitled to assert against a consumer claims that go beyond reimbursement of the loan capital transferred and payment of default interest at the statutory rate from the date of the request for reimbursement,” Collins said in his opinion in Luxembourg.

Lenders argue that no compensation leads to the scenario that clients get interest-free mortgages and may attract more lawsuits beyond the more than 50,000 cases that are already pending in Polish courts. Borrowers have fought against further remunerations for banks, arguing that banks that applied abusive clauses to arbitrarily set foreign exchange rates needed some penalty to prevent further such scenarios in the future.

Collins said consumers affected by annulled mortgage deals, on the other hand, could go after the lenders for additional sums beyond the cost of capital already repaid, which hasn’t been a common practice in these disputes till now. National tribunals will have to decide on each case. The top EU court’s final ruling normally follows within six months.

Banking stocks plunged in reaction to the opinion, with the Warsaw WIG-Bank index dropping as much 3.2%.

Santander Bank Polska’s brokerage said that the advocate general’s advice “could not be worse” for Polish banks. If the final ruling follows the same approach, it could cost lenders as much as 7 billion zloty ($1.6 billion) that weren’t included in market expectations, according to Maciej Marcinowski, Warsaw-based analyst at Trigon brokerage.

Still, the final ruling may be less pro-consumer, the Polish banking lobby ZBP said in an email. The key point is whether the top EU court will allow Polish judges to assess if banks can sue borrowers to compensate for interest and fees lost on basis of Polish law, it said.

Polish banks are still mounting legal issues stemming from some $12-billion worth of outstanding Swiss-franc home loans. A Warsaw court in 2021 sought the EU judges’ view on whether banks can continue to sue clients for additional payments. It’s been a way for the industry to recover lost interest, fees and also to deter future litigation, because banks have been losing most of the legal fights.

Explainer: Polish Banks Are at a Turning Point With Franc Loans

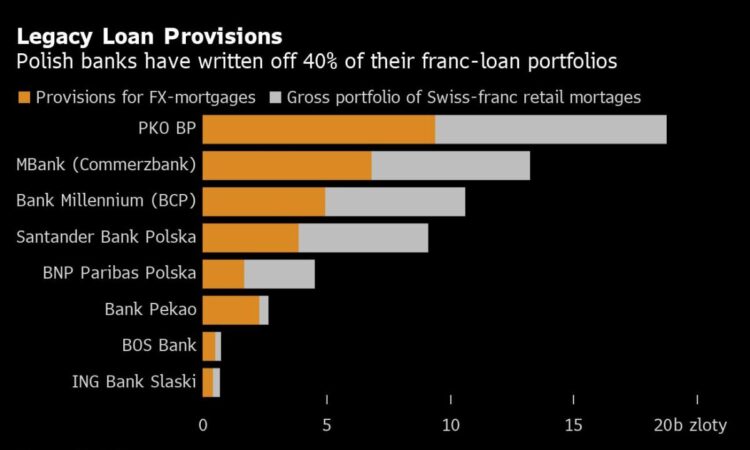

Polish banks have converted thousands of FX-mortgages to zloty loans via settlements with clients in a bid to reduce risk. A landmark ruling by EU’s top court in 2019 gave way to annulments of contracts that included unfair terms and the banking industry has since booked over 37 billion zloty in provisions.

While the Polish financial regulator warned last year that a negative verdict in the latest case may boost banks’ losses to 100 billion zloty, growing profits from high interest rates have made lenders more sanguine about potential outcome. It’s also fueled a rally on banking stocks.

Polish Banks Change Tune as Once-Feared EU Court Case Nears

At the heart of the disputes is what once seemed like a smart piece of financial engineering to boost mortgage sales before the 2008 financial crisis emerged.

Assuming that the zloty would indefinitely maintain its value-increasing run, mortgage holders were offered home loans indexed to the Swiss franc, with the benefit of lower interest rates than mortgages in the local currency. While banks offered similar products in several other European countries, Poland, which was dealing with a lack of homes, became most exposed.

When markets turned, the equation no longer worked. Polish borrowers sued for refunds after the depreciation of the zloty boosted the value of their loans, often to more than that of the property.

The case is: C-520/21, A.S. v. Bank M. SA.

(Updates with details of opinion and market response starting in the first paragraph.)

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.