RiverNorthPhotography/iStock Unreleased via Getty Images

This article was coproduced with Chuck Walston.

An oft-expressed truism is that banks benefit from rising interest rates. While higher rates do drive net interest income for banks, they can also serve as a double-edged sword: the marked surge in interest rates is weighing on mortgage banking as prospective buyers balk at the associated long-term costs. Investment banking has also taken a hit.

This likely explains why shares of The PNC Financial Services Group, Inc. (NYSE:PNC) dropped by 22% over the last twelve months while the S&P 500 (SP500) is only down by about 9%.

I think the market has it wrong.

PNC’s acquisition of BBVA USA is opening a long growth runway for the bank. PNC also has a successful acquisition history, and a record of consistent and conservative underwriting standards that place it atop the industry.

Add to that a total return over the last ten years that outperformed the S&P 500, a double-digit dividend growth rate, and a tier 1 ratio well above the required minimum, and you have the makings of a first-rate investment.

Understanding PNC

In terms of both total deposits and total assets, PNC is the 6th largest commercial bank and the 2nd largest regional bank in the U.S. The company operates 2,629 branches and 9,523 ATMs in more than 40 states across the nation.

As of the end of 2021, the primary source of the bank’s deposit base are the states of Pennsylvania (30%), New Jersey (9%), Texas (9%), and Ohio (9%). PNC has the largest deposit share in Pennsylvania and Kentucky and the second-largest share in Alabama and Indiana.

The bank offers retail banking, including residential mortgage, asset management services, and corporate and institutional banking. PNC has a strong retail business, but its diverse business model also provides fee income that constitutes around 40% to 45% of the bank’s net revenues.

PNC’s acquisition of Banco Bilbao Vizcaya Argentaria’s (BBVA) U.S banking operations in 2021 represented a pivotal moment for investors. With that deal, PNC added 2.6 million customers, $104 billion in assets, $86.4 billion in deposits, and $66.2 billion in loans, along with a network of 637 branches.

The two banks had very little overlap, so with the addition of BBVA, PNC now has a presence in 29 of the top 30 metropolitan statistical areas.

In the Lone Star state, BBVA ranked as the fourth-largest commercial bank, with more than $44 billion in deposits. Along with Texas, a large percentage of BBVA’s operations were located in Florida and Arizona, rapidly growing Sunbelt states. The deal also resulted in PNC adding branches in California, New Mexico, and Arizona for the first time.

When the deal was finalized, management projected it would be 21% accretive to earnings by 2022, and result in $900 million in cost savings, once BBVA is fully integrated into PNC. The bulk of those savings are expected to stem from branch consolidations, staff cuts, and the elimination of outside services.

Despite its wide reach and presence in rapidly growing metro areas, BBVA had a history of poor performance. Non-performing loans at BBVA made up 1.06% of total loans at the end of 2019, and by Q3 of 2020, non-performing loans had reached 2% of total loans. BBVA’s history in the U.S. was also marked by a $470 million goodwill impairment charge in 2019 and a $2.2 billion goodwill impairment in Q1 of 2020.

Considering BBVA’s past poor performance, it is reasonable to question whether the acquisition makes sense; however, PNC has a history of acquisitions that it quickly and effectively integrated. During the 2007-2008 financial crisis, a deal to acquire National City doubled the size of PNC. That deal was marked by a rapid, seamless integration of the two banks.

Then in 2021, PNC acquired RBC Bank (USA), the U.S. retail banking subsidiary of Royal Bank of Canada. PNC bought those assets for $3.45 billion, a $112 million discount to tangible book value. Within 90 days of the deal’s closure, PNC achieved 90% of planned cost savings.

It is also important to note that PNC funded the acquisition of BBVA through the sale of its stake in BlackRock (BLK). PNC originally invested $240 million in Blackrock back in 1995, and that position grew over the years to be worth $17 billion. The proceeds from the sale of the Blackrock investment funded the acquisition of BBVA. Consequently, PNC did not add debt or issue shares to execute the deal.

Notable Strengths Of PNC

A bank’s efficiency ratio is a widely used metric designed to measure a bank’s overall performance. The efficiency ratio is calculated by dividing a bank’s expenses by its net revenues and is expressed as a percentage. Consequently, a lower number represents a more profitable operation.

After PNC acquired BBVA, the bank’s efficiency ratio rose to 69%. A measure of the success of PNC’s integration efforts can be found in the improvement of the efficiency ratio to 59% at the end of Q3 2022.

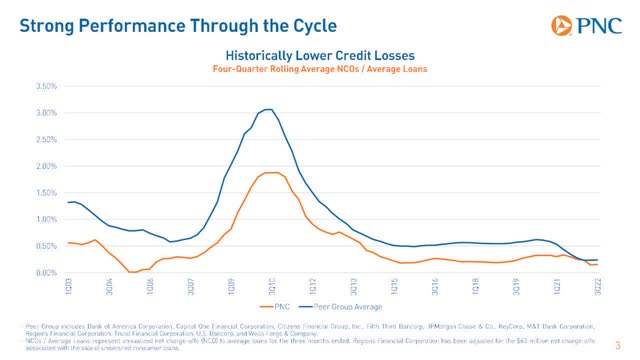

PNC also has a long record of superior underwriting in relation to peers. During the financial crisis, the bank routinely reported lower net charge-offs than peers. PNC’s net charge-off ratio peaked at 1.9% during that period versus 2.4% for its peer group.

PNC Investor Presentation

Furthermore, PNC is not classified as a global systemically important bank. That means PNC is not required to adhere to some of the rather burdensome regulatory requirements that banks in that category fall under. At the same time, as the second largest regional bank in the U.S., PNC has advantages of scale and a geographic footprint that give the bank a number of advantages.

What Recent Results Reveal

PNC provided Q4 2022 results last week. Adjusted EPS of $3.49 missed consensus of $3.96 by a wide margin. That also fell below Q4 2021’s $3.68 figure and last quarter’s $3.78; however, the bank recorded revenue of $5.76 billion, beating analysts’ estimates of $5.71 billion, and up from $5.55 billion in Q3 and $5.13 billion in Q4 2021.

The quarter saw net interest income increase to $3.68 billion, up year-over-year from 2.86 billion. Net interest margin was 2.92% up from 2.27% in the year-ago period.

Noninterest income dropped to $2.08 billion from $2.27 billion in Q4 2021.

Management guides for average loans to increase 1%-2% and net interest income to decline 1%-2% in Q1 2023 versus Q4 of 2022. Noninterest income is expected to drop by 3% to 5%, and net charge-offs are forecast at $200 million.

For FY 23, management forecasts average loan growth in a range of 6% to 8%, a similar increase in revenue, and a 2% to 4% increase in expenses.

Financial Profile, Dividend, And Valuation

The bank’s common equity tier 1 ratio was 9.1% at the end of the fourth quarter. That is well below PNC’s 7.4% required minimum.

PNC increased the dividend for 12 consecutive years. This includes during the 2020 pandemic when many banks froze or cut their dividends. The current yield is 3.77%, the Payout ratio is a bit above 41%, and the 5-year dividend growth rate is 16.47%.

PNC currently trades for $158.63 per share. The average 12-month price target of the 13 analysts covering the stock is $180.41. The price target of the 3 analysts that rated the stock after the last quarterly report is $177.66.

PNC’s forward P/E is 10.88x, significantly below the 5-year average P/E of 13.20x. The forward PEG is 0.35x, well below the sector median of 1.25x.

In Q4, PNC repurchased 3.8 million common shares for $600 million, and management targets quarterly repurchases of up to $500 million in 2023.

Is PNC A Buy, Sell, Or Hold?

Since the financial crisis, PNC has undergone a metamorphosis. The integration of National City doubled the size of the bank. That was followed by the acquisition of RBC, and now BBVA, which increased PNC by another 25%.

The effective integration of National and RBC should give investors confidence that the BBVA deal will give PNC a long growth runway. That perspective is strengthened by Q4 results, in which management reported record revenues, 10% above 2021, as well as an increase in average loans of 11%,

By selling its stake in Blackrock, PNC added BBVA’s assets without increasing debt or issuing additional shares.

The bank has a cost-cutting initiative known as the Continuous Improvement Plan (CIP). It works to reduce costs and improve efficiency. CIP reduced costs by $350 million in 2017, $250 million in 2018, and $300 million annually in 2019 through 2022. Management targets an additional $400 million in savings in 2023.

I believe PNC offers a clear and relatively long term growth path, prospects of double-digit annual dividend increases for the foreseeable future, and a degree of safety that few investments can match.

I rate PNC as a Buy.

I am dealing with the uncertain nature of the economy and the markets by initiating and/or adding to my investment in significantly smaller tranches than in the past. However, while conducting my investigation for this article, I invested in a full-sized position in PNC.

I readily acknowledge macroeconomic developments could send the share price lower. In fact, if it were not for those concerns, I would rate The PNC Financial Services Group, Inc. as a Strong Buy. However, if the share price falls markedly, I will simply increase the size of my holdings in the bank.