% Less than $15,000 minimum daily balance We reward you for banking with us, not the other way around. Like digital envelopes, spending buckets set money aside for ongoing expenses like rent and groceries. Similar to our popular savings buckets , they give you a clearer picture of your spending habits – and an opportunity to create better ones. Deposits are insured by the FDIC up to the maximum allowed by law. Lock, set notifications, and limit your spending within our mobile app. All you need is your smartphone and the check. Take a photo and you’re all set. Use Zelle® for a fast, safe, and easy way to pay your friends and family. You shouldn’t be nickel and dimed for using your own money. Compare the cost of banking somewhere else. Our Annual Percentage Yields (APYs) are accurate as of . Keep in mind, these rates are variable and may change after the account is open. Fees may reduce earnings. The APYs for other banks are provided by mybanktracker.com and are accurate as of . The APYs in this table are for the state of California. A tier is a range of account balances. Less than $15,000 = 0.10% Annual Percentage Yield (APY) $15,000 or more = 0.25% Annual Percentage Yield (APY) Get your account up and running in minutes. We’ll need some personal info, like your address and Social Security number. The faster you fund, the sooner you’ll earn interest. No minimum deposit required. Start exploring (and enjoying) everything we have to offer. People like it here. We think you will, too.

Your money, FDIC-insured.

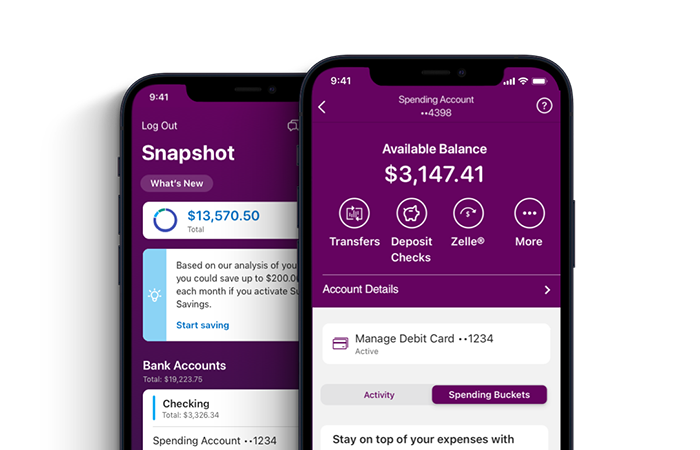

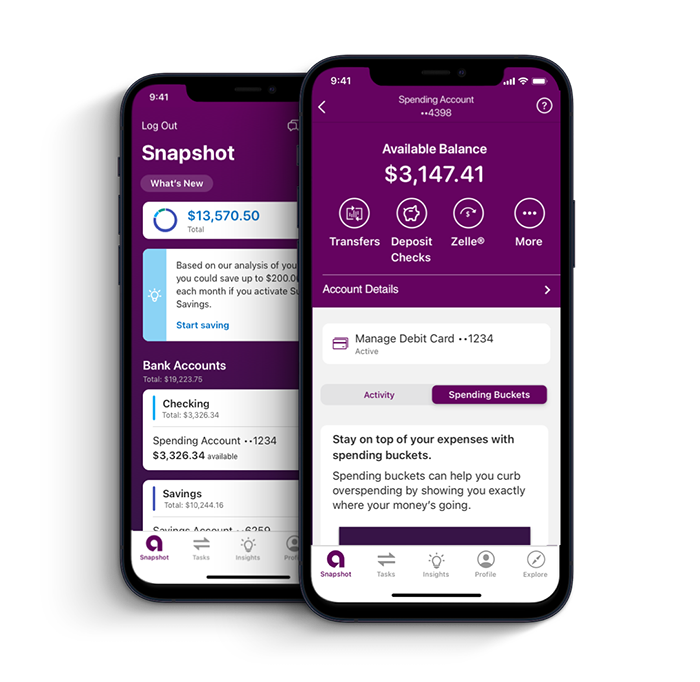

Manage your debit card.

Deposit checks remotely with Ally eCheck DepositSM.

Send and receive money – no extra app needed.

![]()