Small business neobank Novo has built its platform around the notion that entrepreneurs want a central hub for their small business banking needs, an approach the fintech says has helped grow its user numbers three-fold over the last year and a half.

The fintech, which allows users to customize their banking services through an app marketplace, has grown from 60,000 accounts in March 2021, to its current count of 180,000, CEO Michael Rangel said.

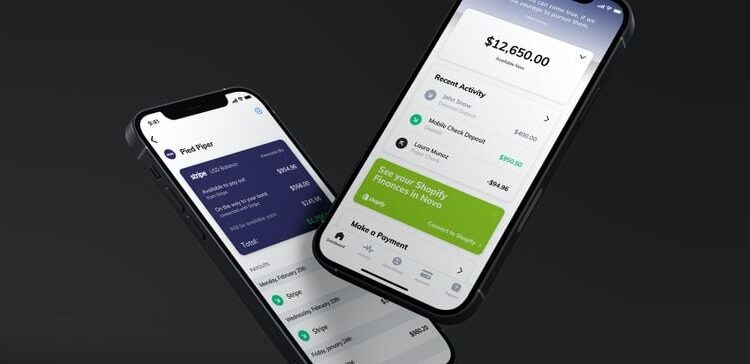

The Miami-based startup, which launched the marketplace functionality last year, said the feature offers its users over 1,000 connections to applications that help small businesses tackle everyday tasks, from sending out invoices to accessing cash-flow insights.

The result, Rangel said, is a small business ecosystem that provides small businesses with a centralized location to address a variety of needs.

“Our goal is to redefine the way that people think about the checking account by allowing people to customize and leverage their checking account and have it work for them instead of the other way around,” Rangel said.

The firm, which raised $35 million from GGV Capital last week, announced on Wednesday a new partnership with LegalZoom to provide entity formation services to Novo customers.

Novo said users who form an entity through the LegalZoom can receive a 20% discount on entity formation.

Integrating services in a single location for small business customers has helped the company grow accounts as other small business-focused fintechs have shuttered or stepped back from serving the segment.

Corporate spend management company Brex announced in June that it would no longer serve small business clients and instead focus on its core customer base of technology startups and larger companies.

And last year, BBVA USA decided to close its entrepreneur-focused neobank subsidiary Azlo, ahead of its $11.6 billion merger with Pittsburgh-based PNC.

That closure resulted in a bump for Novo, which gained 20,000 former Azlo customers in the 2½ months following the Spanish lender’s announcement.

In response to the new users, Novo expanded its product roadmap, launching new features including invoicing and budgeting — services Azlo had offered its customers.

“We built all of those different adaptations into our product to cater to them and create the best home for Azlo customers in the process, and it worked,” Rangel said. “A lot of them came over and have continued to use Novo, most of which are some of our most powerful and best customers.”

The central hub Novo has created for small businesses means the platform has access to key data points. That insight, Rangel said, can help the neobank eventually expand into lending.

“We allow SMEs to connect all of their tools to the central hub, the Novo account. By allowing them to do that, we see all the inflows and the outflows and we’re able to better underwrite them,” Rangel said. “We believe that we have access to data that’s going to allow us to extend credit to the right people at the right time.”

The neobank, whose sponsor bank is Middlesex Federal Savings, is currency piloting a lending program, which it plans to roll out more broadly in 2023, Rangel said.