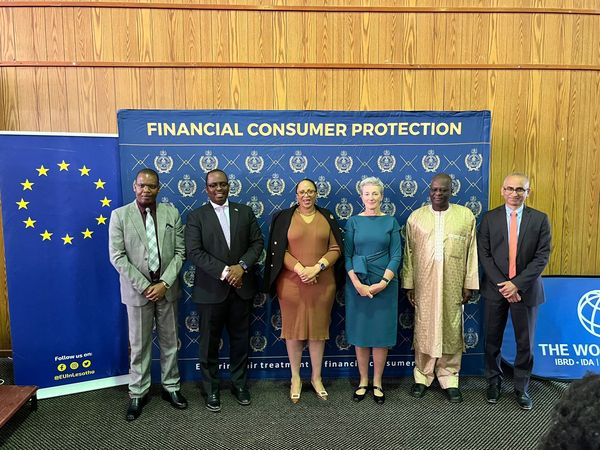

New Partnership Between the Ministry of Finance and Development Planning, Central Bank of Lesotho, World Bank and European Union to Support Financial Sector Development in Lesotho

Lesotho’s financial infrastructure is well poised for development, and a new partnership announced today by the Central Bank of Lesotho, Ministry of Finance and Development Planning, the European Union and the World Bank will leverage this potential, foster inclusive growth and expand access to financial services.

Lesotho’s financial infrastructure is well poised for development, and a new partnership announced today by the Central Bank of Lesotho, Ministry of Finance and Development Planning, the European Union and the World Bank will leverage this potential, foster inclusive growth and expand access to financial services.

The partnership, in which the European Union is investing a total of nearly LSL 6 million (USD 322,623), will harness the expertise of the World Bank to provide technical assistance to the Central Bank of Lesotho in three areas: a) the development of a Financial Sector Development Strategy (FSDS) II; b) the development of a road-map to increase electronic payment acceptance by merchants; and, c) just-in-time technical assistance for strengthening credit infrastructure. The FSDS II will set out a vision for 2030 for a stable, inclusive and resilient financial sector in Lesotho, and identify key policy reforms to be undertaken over five years to achieve this vision. It will draw on relevant diagnostics, including those undertaken by the World Bank and IMF through the Financial Sector Assessment Program in 2022, and build on other related strategies including the National Financial Inclusion Strategy and the National Financial Education

Strategy being currently developed.

The technical assistance that the Central Bank of Lesotho will be benefiting from, is part of the Rapid Response Window for Investments and Business Environment facility – a European Union-funded, demand-driven facility implemented by the World Bank for the Sub-Saharan Africa region. The objective of this Facility is to support Sub-Saharan Africa partner countries – including Lesotho – to unlock private investments with a specific focus on job creation for youth and women. To date, the European Union together with the World Bank has supported 13 countries in Sub-Saharan Africa to develop more resilient and effective financial services.

The support under this partnership will also complement ongoing support being provided under the World Bank funded Competitiveness and Financial Inclusion Project (CAFI) and technical assistance activities being provided by the World Bank with funding support from its G2Px facility and the WeFi program. “We are pleased to embark on this partnership which represents a significant commitment to the advancement of Lesotho’s financial sector. This is a testament

to our shared vision of fostering inclusive economic growth and stability. We are grateful for the support from the EU and expertise from the Central Bank of Lesotho that will contribute to the development of the five-year financial sector development strategy and the strengthening of the sector,” says Yoichiro Ishihara, Resident Representative, World Bank.

The technical assistance is also only one of the tools that the European Union has at its disposal to support the Central Bank of Lesotho and the Ministry of Finance and Development Planning. The European Union currently has a technical assistant embedded in the Ministry and supporting it with public finance management reforms, and, upon request, can also mobilise other facilities, including support to financial institutions with capacity-building on cyber security.

“But beyond the technicalities, the partnership between the Central Bank of Lesotho, Ministry of Finance and Development Planning, European Union and World Bank signifies a deeper commitment to development and progress. It reflects a shared vision of a future where every individual has access to financial services, where economic stability paves the way for growth and prosperity, and where institutions are equipped to meet the evolving needs of our society,” said

during her opening remarks H.E. Paola Amadei, the European Union Ambassador to Lesotho.

The Government of the Kingdom of Lesotho applauded the partnership between the three parties as the most effective and efficient way towards the same goal, “If there is a hindrance to development it is the duplication of efforts and working separately. There is no other way we can develop if we are working in silos. So, it is important to work together as it is the right move on the way forward,” by the Honourable Minister of Finance and Development Planning, Dr. Retšilisitsoe

Matlanyane.

The Central Bank of Lesotho also appreciated the support and cooperation of the EU and World Bank, “This partnership will go a long way in shaping the future of Lesotho’s Financial Sector. It has come at the right time when the Bank is developing the second Financial Sector Development Strategy: A blueprint for the development of Lesotho’s financial sector which seeks to create a more resilient, efficient and inclusive sector that benefits every member of our society. Our

people in the rural economy, in particular women and girls must be financially included. I challenge all of us to commit to implement strategic interventions in the sector not only for us but generations to come,” remarks by Dr. Emmanuel Maluke Letete, Governor of Central Bank of Lesotho.

Contacts:

Central Bank of Lesotho: emoremoholo@centralbank.org.ls

For more information about the Central Bank of Lesotho visit: https://www.centralbank.org.ls/

European Union Delegation to Lesotho: delegation-lesotho@eeas.europa.eu

For more information about the European Union Delegation’s work in Lesotho visit: https://www.eeas.europa.eu/delegations/lesotho_en

World Bank: Cheryl Khuphe, ckhuphe@worldbank.org

For more information about the World Bank’s work in Lesotho visit: https://www.worldbank.org/en/country/lesotho