(Bloomberg) — Britain’s energy price slump is slowing down with traders seeing an increased risk of higher costs this winter and beyond, a possibility that’s likely to harm the Bank of England Governor Andrew Bailey’s effort to rein in inflation.

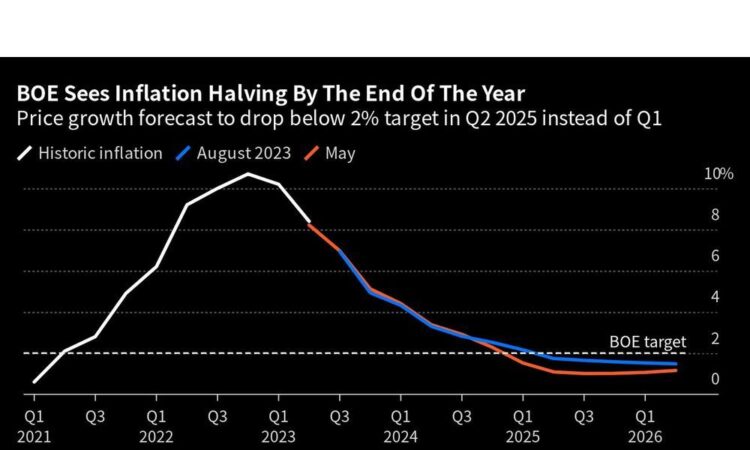

The huge decline in natural gas and electricity prices this year has helped the UK cut inflation to 7.9% in June from a 41-year high of late last year The Bank of England indicated earlier this month that the rate of inflation could fall by more than half this year, and toward its 2% target by 2024. But rising energy prices would slow down that trajectory.

This advertisement has not loaded yet, but your article continues below.

The energy price cap level, set by regulator Ofgem, is expected to ease slightly from October but to rise again in January, according to estimates from Cornwall Insights. Future gas contracts show wholesale prices rising more than 40% in January and again the following winter compared to today’s levels. Energy costs were flagged by BOE Chief Economist Huw Pill as a key factor that could derail interest rates.

UK gas costs have dropped more than 40% this year but the market is still fragile. Volatility is rife with intraday prices spiking more than 40% in Britain and Europe last week on fears that supply could be restricted by strikes at a key LNG facility in Australia. The possibility of extended cold weather this winter is also is risk for gas supplies.

Europe is still recovering from last year’s energy crisis, when Russian supply cuts left it highly exposed to shifts in the tight global market. A milder winter last year and strong storage levels puts the continent and the UK in a strong position to get through the winter. Energy executives are warning that supply shocks are still possible.

This advertisement has not loaded yet, but your article continues below.

Before taking into account future price spikes, the disinflationary effect from energy prices is already set to slow down, according to George Moran, European Economist at Nomura International Plc.

Since inflation peaked late last year at 11.1% the housing, water and energy component has contributed to 60% of the retreat. However, the economy still a way off the BOE’s target inflation rate of 2%.

At the same time, the energy price cap for households is set to plateau for the next 12 months at just below £2,000, a level that’s still too high for the millions of households that can’t afford to pay their bills. It also means the BOE will have to rely on other inflation components in the Consumer Prices Index to shrink.

The BOE raised its key lending rate to 5.25% earlier this month, a 15-year high, amid the threat from sticky prices and rapidly rising pay. Markets are betting on rates hitting 6% after strong wage data last week that suggests businesses may pass higher costs back to consumers.