What’s the latest news from the savings market? We monitor all the latest moves and keep you updated regularly with the key developments.

9 February 2023: Time-Limited Offer Pays Up To £10 A Month

Nationwide current account customers will automatically earn cashback on supermarket spending from today, writes Bethany Garner.

Account holders will earn back 5% of what they spend – up to a maximum of £10 a month – when using their debit card at supermarkets and convenience stores.

Supermarket fuel is excluded, however.

The offer applies across all of Nationwide’s adult current accounts – FlexAccount, FlexPlus, FlexDirect, FlexStudent, FlexGraduate and FlexBasic.

The scheme will run either until 30 April 2023 or until £99 million has been paid out to customers —whichever is sooner.

Cashback will be paid directly into the customer’s current account. The minimum cashback payment is £3, which means account holders must spend at least £60 a month to qualify. Earning the maximum £10 cashback requires a monthly supermarket spend of £200.

The offer is available to both new and existing current account customers.

Tom Riley, director of retail products at Nationwide, said: “Food costs have risen sharply and many households now think carefully about how and where they shop. We’re helping members with £10 monthly cashback on supermarket spending.”

In launching the scheme, Nationwide joins the ranks of banks and building societies, such as Chase and Santander, offering cashback to their current account customers. At 5%, albeit capped at £10 per month, Nationwide’s cashback rate is a competitive first foray into this arena.

7 February: Chunky Rise From 3% On New 3-Year Bond Issue

NS&I, the government-backed savings bank, has launched a new issue of its three-year Green Savings Bond paying 4.20% AER, writes Bethany Garner.

This new rate is up from the 3% AER offered when the bond was last issued in August 2022, and places it just below the current market leader, Gatehouse Bank, which offers a three-year bond paying 4.45% AER.

Laura Suter, head of personal finance at AJ Bell, commented: “The [Green Savings Bonds] rate now is a far cry from the paltry 0.65% interest paid on these accounts when they were first launched almost 18 months ago.

“Someone who put £5,000 into the bonds at launch will be earning just £32.50 a year in interest, compared to the £210 a year that a new customer will be getting now. If they had invested £20,000 that difference in interest jumps to more than £700 a year.”

Savers can invest between £100 and £100,000 in the latest Green Savings Bond issue, and interest is credited to the account once a year. Cash held in the bond can’t be accessed until it matures after three years.

The bonds will help finance sustainability projects across the UK as part of the Government Green Financing Framework, which aims to achieve net zero greenhouse gas emissions by 2050.

Projects include improving energy efficiency, developing sustainable energy sources and tackling pollution.

Ian Ackerly, chief executive of NS&I, said: “This is an excellent new opportunity for savers who want to grow their funds over the next three years, at the same time knowing their investment will make a difference by helping finance the government’s green projects.”

6 February: Stock Market Bond To Pay 6.25%

The Royal Masonic Benevolent Institution Care Company (RMBI) has launched a six-year investment bond with an interest rate of 6.25%, writes Bethany Garner.

The minimum investment is £500, and subsequent investments must be multiples of £100. Savers can purchase bonds until 28 February 2023 – no further investments are allowed beyond this date.

RMBI – a charity that provides elderly and dementia care services across England and Wales – is issuing the bonds to support its work, including the replacement of six of its care homes.

Paying a fixed annual interest rate of 6.25%, it outstrips the most competitive fixed rate bonds on the market. However, as a retail bond it differs from bonds offered by banks and building societies in a number of ways.

First, as an investment rather than a savings account, it must be purchased through an investing platform. Platforms including AJ Bell and Hargreaves Lansdown are listing the RMBI bond.

Investors can also sell bonds before they reach maturity, and their value can go down as well as up. The RMBI bonds are expected to be admitted to the London Stock Exchange in March.

Interest on the bonds is paid in two instalments per year – each equivalent to 3.125% of the sum invested – on 7 March and 7 September. The first payout is scheduled for 7 September 2023, and the bond will mature on 7 March 2029.

Mark Lloyd, managing director of RMBI Care Co. said: “A successful bond issuance will enable us to become even more innovative in meeting the wider needs of our communities and increase the number of people we can support.”

The bonds are issued by RBC Bonds PLC, which has previously issued bonds for 12 other charities, raising £377 million.

1 February: NS&I 4% Offer Highest Since 2010

NS&I, the government-backed savings bank, is offering one-year fixed rate bonds for the first time since 2019, writes Bethany Garner.

The one-year Guaranteed Growth Bond will pay 4.00% AER, while the one-year Guaranteed Income Bond will pay 3.97% AER.

Today’s new rates are the highest NS&I has paid on these products since 2010.

Savers can invest a lump sum of between £500 and £1 million into a bond. Interest is calculated daily and paid monthly — into the bond itself or a linked current account, depending on whether savers choose the Guaranteed Growth or Guaranteed Income Bond.

When 12 months have elapsed, the cash can be withdrawn or reinvested.

NS&I is also raising rates across its two, three, and five-year fixed rate products, which are only available to existing customers whose product is about to mature.

The bank’s two and three-year Guaranteed Growth Bonds will pay 4.20% AER from today, up from 3.56%, while its five-year Guaranteed Growth Bond rate will rise from 3.80% to 4.25% AER.

Ian Ackerly, NS&I chief executive, said: “It continues to be an exciting time for savers and I’m pleased that we are able to bring back on general sale our popular one-year fixed-rate Bonds with two new Issues.”

Mr Ackerly added that around 494,000 existing customers could also benefit from these rates should they choose to reinvest when their bond or certificate matures.

24 January: Rates Rise For NS&I Savers ‘To Highest In A Decade’

National Savings and Investment (NS&I), the government-backed savings bank that oversees premium bonds, is increasing the number of available prizes for the second time this year, writes Bethany Garner.

Interest rates have also increased on several of its savings accounts, reflecting the direction of rates across the market in recent months.

From February 2023, NS&I will add around £15 million to the premium bonds prize fund, creating almost 3,000 extra prizes in the monthly draw.

The majority of new prizes will be worth £50 and £100, but the number of larger prizes is also rising. There will be three additional £100,000 prizes, six more £50,000 prizes, and 12 more £25,000 prizes.

There will continue to be just two £1 million prizes in each monthly draw, and the odds of winning will remain at 24,000 to 1.

These changes will increase the effective prize fund from 3.00% to 3.15% – the amount of interest paid in total on the fund. It is possible, of course, to hold premium bonds and never win a prize.

Ian Ackeryl, NS&I chief executive, said: “Today’s changes will provide a welcome boost for savers of all ages across the country, with more premium bonds prizes and some of the highest interest rates we’ve seen in over a decade.”

NS&I has increased interest rates on four of its variable rate savings products from today, affecting roughly 870,000 customers.

The bank’s Direct Saver and income Bonds now pay 2.60% AER (variable) — up from 2.30% — while its Direct ISA rate has risen from 1.75% AER (variable) to 2.15%.

Its Junior ISA rate has also risen from 2.70% AER (variable) to 3.40%.

Myron Jobson, senior personal finance analyst at Interactive Investor, said: “NS&I savings rates have been given another shot in the arm following successive base rate increases.

“They represent marked increases, especially on the Direct ISA and Junior ISA, which bodes well for savers — but the rates are far from market-leading.”

January 17: Transactions And Amounts Withdrawn Increase In 2022

The number of cash machines fell last year, despite a rise in transactions and average amounts withdrawn, according to data from Link, the ATM network, writes Jo Thornhill.

The report from Link shows customers withdrew £83 billion from cash machines last year, compared to £79 billion in 2021. There was also a 5% increase in the total number of ATM transactions – rising from just over 1 billion to 1.024 billion.

But overall the number of cash machines fell from 52,547 to 51,253, driven by a fall in the number of charging ATMs. The number of free-to-use machines increased slightly by 13.

The average amount withdrawn during 2022 was £1,564 per person last year (up from £1,462 in 2021). Northern Ireland is the most heavily cash-reliant UK nation, where consumers withdrew an average of £2,266 last year (the figure was £2,070 in 2021).

The government announced plans to protect access to cash for all communities in May last year and is working with the Financial Conduct Authority and the banking industry to address cash access issues.

Graham Mott, director of strategy at Link, said: “These numbers aren’t surprising. It’s easy to forget that there was quite a significant lockdown at the beginning of 2021 and therefore 2022 was the first year we’ve had since 2019 where there were no interruptions.

“What we know is that our relationship with cash and ATMs has changed. While many people are now happy to use contactless or digital payments, our research shows there are very few people that are completely cashless. We also know that people are visiting cash machines less often, but on average take out more cash.

“It’s extremely good news that the government is introducing legislation to help protect free access to cash. There are still over five million people who rely on access to cash and face-to-face banking services.

“Digital payments and banking may be fantastic for some, but at the moment, they don’t work for all, which is why this legislation is so important.”

16 January: Upward Trend On Bond Rates Stalls As Stability Returns

Returns for savers looking to lock away their cash may be as good as they are going to get – for now, writes Laura Howard.

Average interest rates on fixed rate bonds failed to rise in January for the first time in 12 months, according to the latest savings trends report from Moneyfacts, the market analyst.

Returns on the average one-year fixed bond remained unchanged at 3.51%. Longer-term fixed bond returns dropped to 3.85% from 3.89% in December – the first fall since March 2021.

Rachel Springall, finance expert at the data provider, said: “The savings market appears to have entered a period of stability – a notable contrast from recent months of volatility.

“The average one-year fixed bond rate remained unchanged for the first time in a year and the average shelf life of fixed accounts overall rose by two days to 29 days.”

Variable savings rates – paid on easy access and notice accounts as well as the equivalent cash Individual Savings Accounts – continued to rise for the 11th consecutive month. However, the proportion of accounts that pay above the Bank rate – currently at 3.5% – fell.

The next interest rate decision will be taken by the Bank of England on Thursday 2 February.

11 January: Cash Withdrawals Fifth Higher Last Year

Cash withdrawals from Nationwide building society ATMs soared by 19% in 2022 – the first annual increase in 13 years, writes Jo Thornhill.

Nationwide data shows 30.2 million cash withdrawals were made from its 1,200 ATMs last year – up from £25.4 million in 2021 – as more households turned to using physical cash to help with budgeting in the cost of living crisis.

The average cash withdrawal amount was £105 – down 2% on the previous year, but an increase of 25% on 2019, before the pandemic.

The use of cash has steadily declined in recent years, most sharply at the start of the pandemic, when the number of withdrawals at Nationwide cash machines, for example, dropped by more than 40%.

Otto Benz, director of payments at Nationwide, said: “For the first time in years we are seeing a natural rise in cash withdrawals as people return to using cash to help avoid getting into debt from the rising cost of living.

“ATMs play a vital role in society, enabling people to easily access cash. However, over the years, they have offered greater capability for people to manage their money, whether that’s checking their balance or paying a household bill.

“Far from the end for cash, it shows that the future of money management is constantly evolving. Taking advantage of the additional services that ATMs provide can be a speedy and convenient experience.”

9 January: Post Office Reports Surge In Cash Withdrawals

The volume of personal cash withdrawals across the Post Office’s 11,500 branches increased by 6.7% in December compared to the previous month, writes Bethany Garner.

Account holders withdrew £892 million during December – 11% more than in December 2021, according to the latest Post Office Cash Tracker report.

The rise in cash withdrawals may be connected to the growing number of consumers using physical cash as a budgeting tool amidst the cost-of-living crisis.

According to a separate survey from LINK – the UK’s largest ATM network – 9% of shoppers expect to use more cash in the next six months, while 13% said that keeping track of their finances was more challenging when using card payments rather than cash.

As high street banks continue to close branches, consumers who rely on cash may also be turning to Post Office services. According to consumer group Which?, more than 5,300 branches have closed since 2015.

While the volume of personal withdrawals grew in December, business deposits have dipped. The value of deposits made by businesses at the Post Office dropped by 2% month-on month, from £1.11 billion to £1.09 billion.

The drop may be linked to the recent tightening of money laundering controls, which limit the amount of cash some businesses can deposit at its branches.

Martin Kearsley, banking director at the Post Office, said: “December was a torrid month for the hospitality sector amongst others, with strikes and freezing weather reducing footfall and cash takings across pubs, cafes and restaurants especially; and in turn contributing to a fall in deposits at Post Offices.

“Over-zealous limits imposed on the amount they are able to deposit is resulting in more businesses no longer being able to accept cash, impacting both their ability to trade as they would like, as well as their customers who need to or choose to budget using cash.”

Throughout 2022, the Post Office handled £32.1 billion in cash deposits and withdrawals — an increase of 19.6% compared with 2021.

A further 193 bank branch closures are scheduled for 2023.

20 December: Regulator Imposes £49m Sanction After Botched IT Project Harms Customers

Total fines levied by the Financial Conduct Authority (FCA) so far this year have reached £214m across 25 businesses that have fallen foul of its rulebook, writes Andrew Michael.

Nearly half this figure came from a £108 million penalty imposed on Santander UK earlier this month relating to the risk of financial crime in the retail banking sector.

The latest institution to face a hefty penalty is TSB, which has been fined a combined £48.65m by the FCA and its sister regulator, the Prudential Regulation Authority, for failures in risk management and governance following a botched IT upgrade that affected branches and blocked customers from accessing its services in 2018.

Although TSB completed a data transfer, the company’s IT platform immediately experienced technical failures. This led to disruption in the continuity of the bank’s services including branch, telephone, online and mobile banking.

All of TSB’s branches and a significant proportion of its 5.2 million customers were affected by the initial issues, and some customers continued to be blighted for several months after the initial problems arose.

TSB has already paid £32.7m in redress to those who suffered detriment from impaired services.

Mark Steward, the FCA’s executive director of enforcement and market oversight, said: “The failings in this case were widespread and serious which had a real impact on the day-to-day lives of a significant proportion of TSB’s customers, including those who were vulnerable.”

Other organisations fined by the FCA this year include Metro Bank (£10m), Citigroup Global Markets (£12m) and Julius Baer International (£18m).

According to the FCA, total penalties imposed last year totalled £568m, although nearly half of this, £265m, was a fine levied by the courts on NatWest Bank following the regulator’s successful prosecution of the bank for failing to comply with money laundering regulations.

The FCA levies fines according to a five-step formula laid out in the regulator’s handbook in a section on penalties.

The five steps cover ‘disgorgement’ – where the regulator seeks to deprive a firm from any benefit derived from a breach of the financial rulebook – along with the seriousness of the rule breach in question, mitigating and aggravating factors, adjustment for deterrence and a settlement discount.

Each FCA enforcement notice explains its reasoning for a particular level of financial penalty, plus a calculation about how it decides the final amount.

In terms of what is done with the money raised from the fines imposed by the regulator, an FCA spokesperson said: “We recoup some of our costs and the rest goes to HM Treasury.”

14 December: NS&I Ups Savings Rates And Increases Number Of Prizes

National Savings and Investment (NS&I), the Government-backed savings bank that oversees Premium Bonds, is increasing the number of prizes available from the New Year – and has hiked up savings rates on several accounts, writes Bethany Garner.

From 1 January 2023, NS&I will add around £80 million to the Premium Bonds prize fund, creating 15,750 extra prizes in the monthly draw.

Most of the new prizes will be worth £50 and £100, but the number of larger prizes is also rising.

The number of £100,000 prizes will increase from 18 to 56, while the number of £50,000 prizes will increase from 36 to 112. The number of £25,000 prizes will rise from 71 to 223.

There will continue to be just two £1 million prizes in each monthly draw, and the odds of winning will remain at 24,000 to 1.

The change will increase the effective prize fund from 2.20% to 3.00%.

Ian Ackerley, chief executive of NS&I, said: “The New Year increase to the Premium Bonds prize fund rate will mean that customers will have seen the prize fund rate triple in less than a year. This means a bigger prize pot and more higher value prizes for our customers.”

NS&I has also increased interest rates on three of its variable rate savings products with immediate effect affecting more than 570,000 customers.

The bank’s Direct Saver and Income Bonds now pays 2.30% AER (variable) — up from 1.80% — while its Investment Account rate has risen slightly from 0.40% to 0.60% AER (variable).

9 December: ‘Edinburgh’ Reforms Aim To Boost UK Competitiveness

Jeremy Hunt, Chancellor of the Exchequer, has unveiled wide-ranging plans to repeal and reform City regulations in a move that will significantly re-draw the UK’s financial services rule book, Andrew Michael writes.

Mr Hunt said that today’s proposals, dubbed the “Edinburgh reforms” after the location of a meeting between Mr Hunt and banking chiefs, are designed “to seize the benefits of Brexit”.

He added that the deregulation drive would help to “turbocharge growth” in the UK and place it in a strong position to compete with international rivals.

The Treasury believes that many of the proposed changes are only possible because of “freedoms” gained by the UK from leaving the European Union.

The Chancellor unveiled 30 reforms spanning a wide section of the UK’s financial services interests.

These include a relaxation of the so-called ‘ring-fencing’ rules that apply to banks – drawn up in the aftermath of the 2008 global financial crisis – to a consultation about the potential for a new central bank digital currency.

Ring-fence rules for banks that have both retail and investment arms were introduced after the 2008 crash to keep the two parts separate. This was designed to reduce risk and prevent banks from the risk of contagion and collapse.

Many problems in the 2008 financial crisis were caused by difficulties in investment banking operations resulting in unmanageable stresses in the retail equivalent, causing the whole bank to be damaged.

The current rules require lenders with more than £25 billion in deposits to formally split consumer operations from their investment banking subsidiaries to protect retail customers.

Implementing the rules has been expensive, with some lenders arguing that their introduction risked “ossifying” the banking sector. Ring-fencing itself has also been called into question, given that investment banking was virtually non-existent at several of the UK lenders caught up in the financial crisis.

Any relaxation, however, is also likely to attract criticism. Former deputy governor of the Bank of England, Sir Paul Tucker, told the Financial Times earlier this year that “ring-fencing helps protects citizens from banking Armageddon”.

Mr Hunt said there are also plans to change the tax treatment of investment trusts in the property sector, and to reform the rules around short selling, where traders bet that the price of an asset such as a company’s shares will fall.

The government also published today its first consultation on proposals to modernise the Consumer Credit Act with the intention of “simplifying the regime to encourage innovation in the credit sector and cutting costs for consumers and businesses”.

Matt Barrett, head of Adaptive Financial Consulting, said: “The government’s announcement of a loosening of financial services regulation to increase competition is welcome in principle. However, in practice, it will need to be executed carefully to ensure financial institutions that have spent many years and a significant amount of investment preparing for the implementation of EU-wide regulations are not caught offside.”

Chris Cummings, chief executive of the Investment Association, said: “The Investment Association shares the government’s vision for an open, sustainable and internationally competitive financial services industry that serves the interests of investors and the wider economy.

“Today’s Edinburgh Reforms are a very welcome acknowledgment of the need for reform to boost the UK’s place as a leading global financial services hub, and importantly, recognises the place of investment management at its heart.”

Myron Jobson, senior personal finance analyst, at Interactive Investor, says: “The reform of the Consumer Credit Act will mark the biggest shake up in consumer credit in generations. Attitudes to credit have changed since the Act was introduced half a century ago. The growth in digital lending is happening due to changes in consumer behaviour. Safeguards will likely be updated to account for this trend.

“It is also important that the language around credit is made clearer. The reason many borrowers get into difficulty is because they don’t fully understand the consequences of what they’re taking on.”

1 December: First Direct Doubles Regular Saver Rate To Market-Leading 7.00%

First Direct is doubling the interest rate on its Regular Saver account from 3.50% to 7.0% AER, writes Bethany Garner.

It is the highest savings rate the market has seen since January 2013, when a 8% regular saver was available, also from First Direct, according to Moneyfacts.

The new market-leading rate will be fixed for 12 months. It’s only available to First Direct current account holders, and to new customers who can currently earn a £175 incentive when they make a full switch of their current account.

The Regular Saver allows savers to pay in between £25 and £300 each month, with interest calculated daily and paid on the anniversary of the account’s opening. If savers don’t pay in the maximum £300 one month, they can carry over the unused subscription into future months.

It does not allow partial withdrawals. Customers who want to access their cash must shut down the account completely. If this is before the end of the 12-month period, savers only earn 0.65% AER, which is First Direct’s Savings Account Variable Rate.

First Direct is also raising rates across its other savings accounts. The rate on its easy access deal has been increased from 0.50% to 0.65% AER (variable), its cash ISA rate has risen from 1.40% to 2.30% AER, while its one-year Fixed Rate Saver now pays 3.50% AER – up from 2.25%.

Chris Pitt, chief executive of First Direct, said: “We are committed to giving savers a good return on their money, particularly in the context of the increases in the cost of living and the current high inflation environment.”

Rachel Sprignall at Moneyfacts, added: “Regular savings accounts are rigid than easy access accounts and harsh penalties can be applied if payments are missed or withdrawals are made, so they are most suitable for savers who need a strict savings plan and who wish to avoid dipping into their cash early.

“Savers will need to compare regular savings accounts carefully, as some are only available to current account customers or even local customers.”

29 November: Halifax Launches £175 Switch Incentive

Halifax is the latest bank to offer new current account customers a generous cash incentive when they switch, writes Bethany Garner.

From today until 19 December 2022, the bank will pay a welcome bonus of £175 to non-Halifax customers who switch to its Reward Current Account or Ultimate Reward Current Account.

In order to claim this incentive, customers must make a full switch using the Current Account Switch Service.

In launching the offer, Halifax joins several other providers vying for new customers with cash incentives.

At time of writing, HSBC is offering a £200 welcome bonus to new Advance Account customers — provided they have not held an HSBC account or opened a First Direct account since 1 January 2019.

Nationwide is also offering £200 to switch to its FlexAccount, FlexPlus, or FlexDirect accounts. To be eligible for the bonus, customers cannot have switched to a Nationwide current account since 18 August 2021.

First Direct is offering new customers £20 when they open a 1st Account, or £175 for a full switch. To qualify for the £175 bonus, switchers cannot have previously held a First Direct account, and cannot have opened an HSBC current account since 1 January 2019.

Cash bonuses are not the only perk banks are using to attract new customers. Santander, for example, recently launched a current account that offers cashback up to £20 a month.

The Santander Edge current account costs £3 a month to maintain, and pays 1% cashback on bills, and 1% cashback on groceries.

Customers can earn up to £10 a month in each category, and cashback is earned on both debit card spending and direct debits.

Account holders can also open a linked easy access savings account paying a competitive 4.00% AER on balances up to £4,000. This includes a bonus rate of 0.50% that expires 12 months after opening.

Santander Edge has replaced the bank’s 1|2|3 Lite current account.

Meanwhile, Lloyds Bank has launched two new package accounts — Silver, and Club Lloyds Silver.

The Silver account, which comes with a £10 monthly fee, includes European family travel insurance, AA roadside breakdown cover and mobile phone insurance for two devices.

The Club Lloyds Silver account offers the same benefits, as well as interest on balances up to £5,000 and occasional perks such as cinema tickets, magazine downloads or movie rental. Maintaining the account also costs £10 a month, plus a monthly Club Lloyds fee of £3.

The Club Lloyds fee is waived each month customers pay in at least £1,500.

29 November: Deposits in fixed rate savings accounts hit record

The nation’s savers paid a record £11 billion into fixed rate savings accounts in October – a huge increase from the £3 billion deposited in the previous month and the highest level on record, writes Jo Groves.

On average, interest across all fixed rate savings accounts – also known as fixed rate bonds – climbed to 3.3%, according to the latest Money and Credit report from the Bank of England, attracting savers seeking higher returns in the face of soaring inflation.

Laura Suter, head of personal finance at AJ Bell, said: “People made the most of a leap in savings rates and shifted their money into fixed-term accounts in their droves in October. Rates leapt up following the mini-Budget and fierce competition in the savings market.”

Fall in popularity of easy access accounts

However, October also saw a £5 billion net outflow from easy access savings accounts. And contributions to the government’s NS&I accounts fell to their lowest level since January as the cost-of-living crisis prompted households to dip into savings to make ends meet.

Returns on easy access savings accounts continue to lag behind the Bank rate, which currently stands at 3%.

The average interest rate on existing accounts in October was just 0.52%, a small increase from September’s average rate of 0.43%. However, much better returns are available for savers prepared to shop around.

Interest rates on fixed rate bonds

Savers are being rewarded for locking their money away, with the best returns on fixed rate bonds with terms of two years or more currently paying in excess of 4.50% AER.

Laura Suter said: “The average rate on two-year fixed-rate bonds hit 3.55% in October, the highest since 2009, while three-year bonds also hit a 13-year high.”

Some experts have suggested this may be ‘almost as good as it gets’ for fixed rate savings. Sarah Coles, senior personal finance analyst at Hargreaves Lansdown, said:

“Predictions of a recession may well mean interest rates don’t rise as much in the coming months, and are likely to fall as we go through a difficult year or so.

“This is factored into fixed rates, so there’s a growing chance that rates won’t go much higher from here.”

24 November: Rates Nudge Up On Tax-Friendly Savings Accounts

The interest rate lever is one of the few devices that the Bank of England can pull to head off the effects of steepling inflation on the UK’s finances, writes Andrew Michael.

More formally referred to as the ‘Bank rate’, this crucial figure affects both the cost of borrowing, as well as the returns on savings and it has increased no less than eight times over the past year.

In December 2021, Bank rate stood at a lowly 0.1%. Today (24 November), the figure is 3%.

While the worst of the economic turbulence – during the former Prime Minister Liz Truss’ time in office – has subsided, inflation rose in the 12 months to October to 11.1% which represents more than five times the government’s target.

Soaring inflation makes it more likely that the Bank’s rate-setting Monetary Policy Committee will impose a further interest rate rise when it next convenes on 15 December.

While this would be further bad news for mortgage customers on variable rates – as well as those coming to the end of their current fixed rate deal – it’s music to the ears of savers.

What’s more, amid all this year’s turmoil, cash individual savings accounts – often shortened to cash ISAs – have been making a comeback, with the top easy access accounts paying up to 2.80% AER with interest rates in excess of 4% available for customers prepared to lock away their cash for two years.

Large numbers of savers had abandoned these tax-friendly accounts when interest rates plunged in the wake of the 2008 financial crisis. But cash ISAs are now steadily regaining their appeal – and with good reason.

According to savings data from HM Revenue & Customs, 8.1 million cash ISAs were opened during the 2020/21 tax year (the latest figures available).

Although this figure was significantly down on 2019/2020, which saw 9.7 million accounts taken out, the figure was on a par with 2018/19 and a million more than the 7 million cash ISAs that were opened during the 2017/18 tax year.

Personal Savings Allowance

In recent years, government figures show that around one-in-10 people paid tax on the interest earned from their savings after the personal savings tax allowance was introduced in 2016.

This concession from HM Revenue & Customs means that around 27 million UK basic-rate taxpayers can earn up to £1,000 a year from a high street savings account without paying tax.

The allowance is reduced by half, to £500, for the UK’s five million or so higher-rate taxpayers. Additional tax rate payers do not receive a personal savings allowance which means they pay tax on all savings interest earned in traditional accounts.

With interest rates rising significantly this year, savers in regular high street accounts risk using up their personal savings allowance much more quickly compared with very recent history when interest rates were closer to zero.

This strengthens the case for cash ISAs because they allow savers aged 16 or over to shelter up to £20,000 each year from tax.

What is a cash ISA?

Cash ISAs come in a range of varieties including easy access, those which require some notice – say, 30 days – as well as fixed-rate accounts that can offer terms of between 12 months and five years.

Although you can spread your £20,000 allowance across several different types of ISA , you can only open one cash ISA each tax year.

There are various pros and cons associated with cash ISAs:

Pros

- Easy to open and run

- Provides fixed rates over up to five years

- Allow you to avoid paying tax on savings interest worth £1,000 or more a year

- Covered up to £85,000 by the Financial Services Compensation Scheme

- Can be inherited by a partner or spouse without affecting their own ISA allowances.

Cons

- Returns likely to fall short of those achieved by higher risk products such as stock and shares ISAs

- Can offer inferior interest rates compared with regular savings accounts

- If you earn less than £1,000 in interest a year, there’s no real tax benefit and a higher-rate regular savings account may be a better choice.

Choosing a cash ISA

The interest rate on offer is the main consideration for most savers choosing a cash ISA. But there are other factors to consider:

Withdrawal rules. Some products allow penalty-free withdrawals at any time, but those offering superior returns may impose a lock-in requirement of between two and five years

Rate and term. Fixed-rate cash ISAs with set terms tend to offer higher rates. But where interest rates are continuing to rise, it’s worth considering whether it makes sense to lock away your cash

Ease of use. Rules differ amongst cash ISAs from being opened and managed online, to requiring a branch visit. Other stipulations may include a minimum opening balance, the need to keep up regular payments, and the notice required for withdrawals

Many cash ISAs are described as ‘flexible’ which means you can replace any funds you withdraw in the same tax year without affecting your annual ISA allowance.

14 November: Savers See Interest Rates Rise For Ninth Consecutive Month

Saving rates have risen for the ninth consecutive month, with some accounts now paying decade-high rates, writes Bethany Garner.

The average easy access savings rate has surpassed 1% for the first time since 2012, while fixed rate bonds of 18 months or longer currently pay a 12-year high of 3.77%.

The data from Moneyfacts UK Savings Trends Treasury Report also revealed that one-year fixed rate bonds have reached 3.29% – their highest average rate since 2009.

Rachel Springall, finance expert at Moneyfacts, said: “The average longer-term fixed rate has risen to its highest point since February 2010, but considering consecutive rises in interest rates, whether savers are prepared to lock away their cash for longer than a year is debatable.”

But while rates climb across the board, ISAs (Individual Savings Accounts) continue to lag behind. The average notice ISA now pays an interest rate of 1.72%, compared with the 1.91% paid by non-ISA equivalents.

Similarly, the average one-year fixed rate ISA pays 2.98% — 0.79% lower than the average for one-year fixed rate bonds (3.77%).

Easy access cash ISAs are the exception, paying 1.26% on average compared with the 1.16% average paid by standard easy access accounts.

Ms Springall commented: “These are encouraging signs for savers who wish to utilise their ISA allowance.

“However, it remains the case that the rate gap between fixed ISAs and bonds is obvious, so savers will need to weigh up any tax-free allowance they have before they commit.”

While rate increases may be welcome, continued high inflation is eroding returns on savers’ cash. Annual inflation, as measured by the Consumer Price Index (CPI), hit 10.1% in September.

The onus is on savers to compare deals and find the highest-paying account for the access required to their cash.

25 October: Rates Rise For Over 2.7 Million NS&I Savers

National Savings and Investment (NS&I), the government-backed savings bank, is raising rates for over 2.7 million savers, writes Bethany Garner.

From today, the interest paid on its variable-rate Direct Saver and Income Bond accounts will rise by 0.60%, to 1.80% AER — the highest rate these accounts have offered in over a decade.

The rate NS&I pays on its Direct ISA has also risen from 0.90% to 1.75%, while its Junior ISA interest rate is up from 2.20% to 2.70% AER.

From 1 December, NS&I will increase rates on 10 fixed-rate accounts.

Every fixed-rate account NS&I has earmarked for an increase will see interest rates rise by at least 1%. Its one-year Guaranteed Growth Bond will see the steepest rise, from 1.85% to 3.60% AER.

Ian Ackerly, chief executive of NS&I, said: “The changes come in the same month that we increased the Premium Bonds prize fund rate. Some of the rates we’re now paying – including on Premium Bonds – are the highest they have been in over a decade, which is great news for our savers.”

21 October: Cash ISAs Make A Comeback

Amid all the recent economic turmoil, cash individual savings accounts – cash ISAs – have been making a comeback.

You can find out more about cash ISAs and the best rates here.

Large numbers of savers abandoned these tax-free accounts when interest rates plunged in the wake of the 2008 financial crisis. But cash ISAs are now steadily regaining their appeal, and with good reason: savings elsewhere are becoming increasingly vulnerable to tax on the interest they generate.

Government figures show that only around one-in-10 people paid tax on the interest earned from their non-ISA savings accounts after the personal savings tax allowance was introduced in 2016.

This allowance means the UK’s 27 million basic-rate (20%) taxpayers can earn up to £1,000 a year from a high street savings account without paying tax. For five million higher-rate (40%) taxpayers, the allowance is reduced by half, to £500.

Additional tax rate (45%) payers do not receive a personal savings allowance which means they pay tax on all savings interest earned in traditional non-ISA accounts.

With interest rates rising significantly this year, savers in regular high street accounts risk using up their personal savings allowance much more quickly compared to when interest rates were closer to zero.

This strengthens the case for cash ISAs because they allow savers aged 16 or over to shelter up to £20,000 each year from tax.

When do I start paying tax on non cash ISA savings?

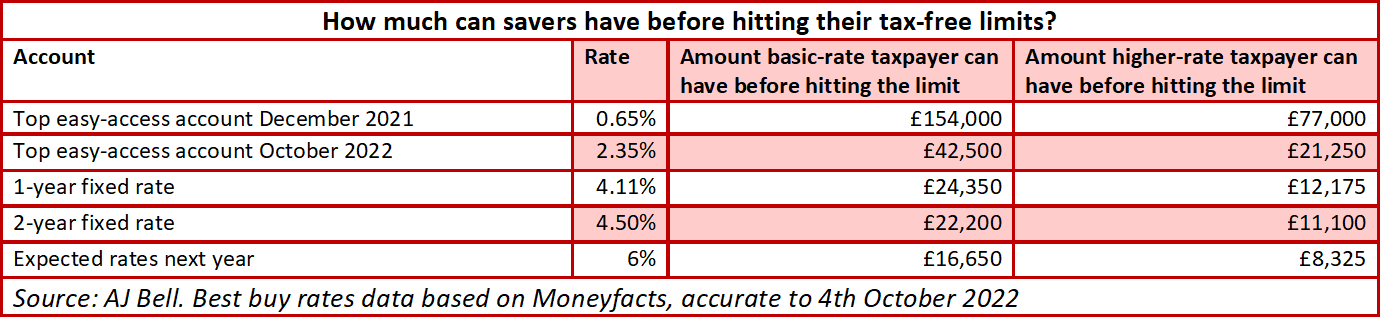

So how much can you have in a non-ISA cash account before your interest starts attracting tax?

Laura Suter, head of personal finance at AJ Bell, said: “When the Bank rate was 0.1% [as recently as last December], if your savings were earning that amount of interest, a basic-rate taxpayer would need to have £1 million in cash savings to hit their £1,000 tax-free limit.

“However, fast forward to today, and with the top easy-access savings account paying 2.35%, that same basic-rate taxpayer would only need to have £42,500 in savings to hit the limit. Someone in the higher-rate income tax bracket would only have a £500 tax-free savings limit, meaning they would need to have £21,250 in savings before they hit their limit.

“Those putting their money in fixed rate accounts are getting far higher rates, but this means they face a tax hit even with more modest savings. The top two-year bond at the moment pays 4.5%, meaning a basic-rate taxpayer with £22,200 would hit their tax-free limit, while a higher-rate taxpayer could only have just over £11,000 before they would have to pay tax.”

What is a cash ISA?

Cash ISAs come in a wide range of products, including easy-access, as well as variable-rate and fixed-rate accounts that usually offer terms that last between one and five years.

Although you can spread your £20,000 allowance across several different types of ISA , you can only open one cash ISA per tax year.

There are pros and cons associated with cash ISAs:

Pros

- easy to open and run

- good short-term (up to five years) home for savings that require

- allow you to avoid paying tax on savings interest

- covered up to £85,000 by the Financial Services Compensation Scheme

- can be inherited by a partner or spouse without affecting their own ISA allowances.

Cons

- over the longer term, returns may fall short of those achieved by products such as stock and shares ISAs

- may offer inferior interest rates compared with regular savings accounts. If you earn less than £1,000 in interest a year, there’s no real tax benefit and a higher-rate regular savings account may be a better choice.

Choosing a cash ISA

The interest rate on offer is the main consideration for most savers choosing a cash ISA. But the right account will also depend on:

- Withdrawal rules Some products allow penalty-free withdrawals at any time, but those offering superior returns may impose a lock-in requirement of between two and five years.

- Rate and term Fixed-rate cash ISAs with set terms tend to offer higher rates. But where interest rates are continuing to rise, it’s worth asking if it makes sense to lock away your cash

- Ease of use Rules differ amongst cash ISAs from being opened and managed online, to requiring a branch visit. Other stipulations may include a minimum opening balance, the need to keep up regular payments, and the notice required for withdrawals.

Many cash ISAs are described as ‘flexible’ which means you can replace any funds you withdraw in the same tax year without affecting your annual ISA allowance.

19 October: Savers Urged To Be Proactive As Inflation And Returns Rise

The top rate for easy access savings accounts has more than doubled since last year, but with inflation stubbornly high, savers must be proactive in finding the best deals, writes Bethany Garner.

Although rising interest rates are welcome news for savers, inflation — which hit 10.1% in the 12 months to September according to figures today from the Office for National Statistics — continues to erode the value of cash.

Rachel Springall at Moneyfacts, said: “It’s imperative savers do not become apathetic to switching at a time when competition in the top rate tables is rife.

“Top fixed rate bonds are reaching heights not seen for many years as challenger banks compete to entice savings deposits. But this has also seen deals change within a short time frame, so swift movement is wise to grab a top rate savings deal.”

The top rate easy access accounts currently pay 2.55% AER, while the highest rate savers could access a year ago was just 0.65% AER, according to Moneyfacts. Interest on the top one-year fixed rate bond is up 1.89 percentage points compared with October last year.

The latest provider to boost its rates is Nationwide. The building society is upping returns across a range of savings accounts by up to 1.20 percentage points for existing customers from 1 November.

Personal Savings Allowance

But higher savings rates are also pushing more savers beyond their Personal Savings Allowance – the threshold at which tax begins to be charged on interest earned.

Figures from investment platform AJ Bell show that, in December 2021, when Bank rate stood at 0.1%, basic rate taxpayers – who can earn £1,000 of interest tax-free a year – could hold £154,000 in a top easy access account before paying tax. As of 4 October 2022, this balance had dropped to just £42,500.

Higher rate taxpayers – who can earn £500 of interest tax-free a year – could hold up to £77,000 in a top-paying savings account, which compared to £21,250 on 4 October.

If the Bank of England continues to hike interest rates and institutions pass on the increase in full or in part to their customers, more savers will be hit with tax on their interest – many for the first time.

Laura Suter, head of personal finance at AJ Bell, said: “If the Base rate hits the 6% it’s expected to next year, and easy access savings rates matched that, then a basic-rate taxpayer could only have £16,650 in their account before they hit the limit — and for a higher-rate taxpayer this would drop to £8,300.”

To avoid paying tax on their interest, Ms Suter expects savers will turn to ISAs – a savings ‘wrapper’ in which individuals can save up to £20,000 each tax-free.

However, since ISAs typically pay lower interest rates, savers may be faced with the choice between higher rates or a lower tax bill.

13 October: First Direct To Double Cash ISA Rate

First Direct is doubling the interest rate on its cash ISA from 0.70% to 1.40% AER (variable) on 20 October, writes Bethany Garner.

The mobile-first bank is also raising rates across three other savings products. Its easy access Savings Account will pay 0.50% AER (variable) from 20 October — up from 0.40%.

Its Bonus Savings Account will pay up to 1.65% AER on balances below £25,000, and 0.75% AER on balances above £25,000. The account rewards savers for not accessing their cash. If they make a withdrawal, the new rate drops to 0.50% AER for that calendar month.

From the later date of 28 October, First Direct’s one-year Fixed Rate Saver will rise by a full percentage point, from 1.25% to 2.25% AER.

First Direct is the latest of several providers to increase rates on its savings accounts in response to consecutive Bank rate hikes.

While news of increases is welcome, stubbornly high inflation is still eroding any real returns on savers’ cash. With annual inflation running at 9.9%, the onus is on savers to compare deals and find the highest-paying account for the access required to their cash.

5 October: Barclays Rainy Day Saver Pays Up To 5.12% AER

Barclays has launched a linked savings account paying a top rate of 5.12% AER (variable), writes Bethany Garner.

The bank’s new Rainy Day Saver is an easy access account which allows eligible savers to make unlimited deposits and withdrawals – and can be opened with just £1.

At 5.12% AER, the returns on the account are more than double those offered by leading open-to-all easy access savings accounts.

However, only Barclays current account holders who are signed up to the Blue Rewards scheme are eligible. Blue Rewards charges a monthly fee of £5 but, providing your Barclays current account is credited with at least £800 a month and has at least two outgoing direct debits set up, this fee is repaid into your Rewards Wallet. This can be accessed and managed online or on the Barclays app.

The top rate of 5.12% AER only applies to balances of up to £5,000. Any balances above this threshold earns a much lower 0.15% AER (variable).

You can hold up to £10 million in the Rainy Day Saver but savers with more than £5,000 who don’t need access to their cash will find higher returns from a fixed rate savings account.

For example, £10,000 deposited in a fixed rate bond paying 4.50% AER would earn £450 in 12 months. The same deposit left untouched in Barclays’ Rainy Day Saver for 12 months would earn £263 of interest.

5 October: Headline Rate Hits 4.75%

Nationwide Building Society is launching three fixed rate online bonds and raising interest rates for several other accounts, writes Bethany Garner.

The UK’s largest building society is now offering:

- one-year fixed rate bond paying 4.00% AER

- two-year fixed rate bond paying 4.50% AER

- three-year fixed rate bond paying 4.75% AER.

Each account can be opened and managed exclusively online or through Nationwide’s mobile banking app. The minimum opening deposit is £1.

Meanwhile, the interest paid on Nationwide’s existing fixed rate accounts is set to rise by 0.50%:

- one-year fixed rate bond will now pay 3.25% AER

- two-year fixed rate bond will now pay 3.50% AER.

Nationwide has also announced it will increase rates on its triple access savings accounts.

The One Year Triple Access Online Saver will pay 2.10% AER — up from 1.75% — and the One Year Triple Access Online ISA will now pay 2.00% AER, up from 1.50%.

These accounts allow up to three withdrawals throughout their 12-month term. If any additional withdrawals are made, the interest rate drops to 0.30% AER.

Nationwide’s Flex Instant Saver account, which allows unlimited deposits and withdrawals, will see rates doubled from 1.00% to 2.00% AER over the next 12 months. This account is available to Nationwide current account holders only.

The society is offering a £200 switching incentive to those who switch to its current accounts from other banking providers.

Tim Riley, director of banking and savings at Nationwide, said: “We understand there are plenty of savers who are happy to lock their money away for a period of time, which is why we will be offering highly competitive rates on our bonds.”

29 September: Family Building Society Offers Premium On Bank Rate

The Family Building Society has launched a Two Year Tracker Rate Bond — a savings account with a variable interest rate that moves in line with the Bank of England Bank rate.

Currently at 2.60% AER (gross), the account’s interest rate is set at 0.85% above the current Bank rate. It changes to track the Bank rate as it stands on the first day of each month.

The Bank rate rose from 1.75% to 2.25% in September, so the bond will pay 3.10% AER from 1 October.

To open the account, savers must deposit at least £5,000. Once 15 days have elapsed, no additional deposits can be made. Withdrawals are not permitted until the account matures two years after opening.

It’s worth nothing that some fixed-rate savings accounts are currently paying higher rates. For instance, the 2-Year Fixed Term Deposit from Investec offers an AER of 4.25% (gross) on balances from £1,000.

However, if the bank rate continues to rise – it has risen seven times since December 2021 – the Family bond could outpace these top-paying accounts.

With annual inflation at 9.9% eroding the value of savings, an account that passes on bank rate rises to consumers without requiring them to shop around could be beneficial.

If the bank rate goes down, though, savers locked into this two-year fixed term account could miss out on better returns elsewhere.

27 September: NS&I Adds £76 Million To Premium Bonds Prize Fund

National Savings and Investment (NS&I), the Government-backed savings bank that oversees Premium Bonds, is raising its prize fund from 1.40% to 2.20% from 1 October 2022.

The change will add around £76 million to the Premium Bonds prize fund, creating 97,752 new prizes in the monthly draw.

Most of these will be cash sums of £50 or £100, but the number of larger prizes is also rising. From October, the number of £100,000 prizes will increase from 10 to 18, while the number of £50,000 prizes will rise from 20 to 35.

There will continue to be just two £1 million prizes each month.

Overall, the odds of each Premium Bond being a winner will improve from 24,500 to 1, to 24,000 to 1.

Ian Ackerley, chief executive of NS&I, said: “This is the second increase to the Premium Bonds prize fund rate that we have made in less than six months.

“These changes have helped us ensure that Premium Bonds remain attractive, while also ensuring that we continue to balance the interests of savers, taxpayers and the broader financial services sector.”

Premium bonds are held by over 21 million people in the UK. Instead of earning interest, bond holders are entered into a monthly prize draw for tax-free cash sums, which range in value from £25 to £1 million.

Each £1 invested in Premium Bonds equates to one entry into the prize draw, but the minimum investment level is £25. Savers can choose to cash out all or a portion of their bonds at any time.

Although winning a large cash prize may help some savers beat inflation, they could equally win nothing.

Laura Suter, head of personal finance at AJ Bell, said: “Savers shouldn’t cling to the ‘projected prize fund figure’ as many Premium Bonds holders get zero return on their savings.“Most savers would be better off with a standard easy-access savings account that pays out a guaranteed rate of interest.”

26 September: Over 11 Million Brits Have Less Than £100 In Emergency Funds As UK Savings Week Gets Underway

An estimated 11.5 million UK adults have less than £100 in emergency savings, according to research by the Building Societies Association (BSA) – the organisation behind the inaugural UK Savings Week which starts today.

The campaign aims to raise awareness of the importance of saving habits, and offer guidance to consumers on reaching their saving goals.

Andrew Gall, head of savings and economics at BSA, said: “While the midst of a cost-of-living crisis might seem like an odd time to launch activities encouraging good savings habits, those who are able to save can benefit from building their resilience to future shocks.”

The BSA’s research, which surveyed 2,000 UK adults in August 2022, revealed that a growing number of consumers are dipping into savings to meet everyday expenses.

According to the survey, 36% of consumers are turning to savings to meet the mounting cost of essentials. A further 55% of savers say they are setting aside less due to cost-of-living pressures, while 35% have stopped saving altogether and 13% have no savings at all.

However, the research also found that 64% of respondents, who currently have no savings, say they would be able to set aside £10 a month.

A significant portion of consumers may not be getting the best returns, however. Almost a quarter (23%) of savers do not check interest rates before opening an account, while a third (33%) check rates but do not compare them with other accounts.

While some savings providers have begun passing on the benefit of the latest interest rate rise to savers in the form of more competitive savings accounts, many have yet to do so.

And with annual inflation running at 9.9%, effectively eroding the value of cash more quickly, the onus is on savers to compare deals and find the highest-paying account for the access required to their cash.

22 September: Returns Inch Higher But Savings Still Battered By Inflation

Savers were handed positive news today when the Bank of England’s rate-setting Monetary Policy Committee (MPC) raised interest rates for the seventh time in a row. At 2.25% the Bank rate is now at its highest level in 14 years.

Yorkshire Building Society was quick off the mark following the announcement. Within minutes of the news, it confirmed it will raise interest rates on all its variable rate savings accounts – but by 0.30 percentage points compared to the 0.50 percentage point increase in the Bank rate.

The society’s easy access Internet Saver Plus Issue 12 will pay 1.80% AER from October. The rate on its Loyalty Regular Saver Issue 2 will rise to 5.3% AER.

The rates will be applied to accounts automatically on 5 October. Other banks and building societies are expected to pass on rises to customers in the coming days.

Marcus by Goldman Sachs has also announced it will be raising rates on both its variable rate accounts — the Online Savings Account and Cash ISA – by 0.30%.

Both accounts are currently paying 1.80% AER, which includes a 12-month bonus rate of 0.25%. Remember this bonus rate will drop off on the anniversary of opening the account, so it may be worth checking whether better options are available after the first year.

While news of increases is welcome, stubbornly high inflation is still eroding any real returns on savers’ cash. Inflation, as measured by the Consumer Prices Index (CPI), hit 9.9% in the 12 months to August – which was over 14 times more than the average easy access savings rate over the same period, according to research from investment platform interactive investor.

Any delay between the latest hike and increase in savings rates will further widen the gap between inflation and returns.

Becky O’Connor, head of pensions and savings at interactive investor, said if the rise in the Bank rate is passed on to savers and has the effect of bringing down inflation, cash savings could, once again, start to look attractive: “This could be especially welcomed by older people, who often have more built up in savings, and also often prefer the lower risk of cash compared to the stock market for their life savings.

“People with savings have had years of low returns and this latest rate rise, which is significant, could really turn the tables back in their favour.”

21 September: Competitive Offers Prompt Increase In Guaranteed Rates

Savers are turning to fixed-term savings accounts to lock in increasingly competitive rates.

Investment platform Hargreaves Lansdown reported a 40% uptick in the number of new fixed-term deposits it has received over the last 12 months.

Fixed-term savings accounts offer guaranteed interest rates for a set period in exchange for forfeiting access to your cash.

Tom Higham, acting head of savings at Hargreaves Lansdown, said: “We’re seeing considerably more clients using fixed term deposits over easy access. Up to 80% of all new flows are heading into fixed term deposits, up from around 50% a year ago.

“People are cashing on fixed terms because the rates are higher than they’ve been for a decade or more.”

At 1.75%, the Bank of England Bank Rate currently stands at a 14-year high. Bank rate is expected to rise further tomorrow (September 22) when members of decision-making Monetary Policy (MPC) hold their next meeting.

Mr Higham expects banks and building societies to continue passing on increases in Bank rate to savings accounts.

However, he added that savers are only looking to fix in their cash for a maximum period of two years as they are anticipating interest rates to continue to rise until inflation starts to fall.

25 August: NS&I Pays 3% AER On Latest Green Bond Issue

National Savings & Investments, the government backed savings institution, has launched the third issue of its Green Savings Bond, which will pay interest at 3% a year for a three-year fixed term.

Higher rates are available for this length of fix – JN Bank is paying 3.45%, for example – but the NS&I bond guarantees that deposits will be used to help finance green initiatives as part of the UK Government Green Financing Framework.

This will include projects to tackle climate change, improve sustainability and increase renewable energy capacity.

Interest at 3% AER over three years on a £10,000 deposit would yield a profit of around £930. Deposits are permitted in the range £1,000 to £100,000 but it is important to remember that the money cannot be accessed during the term.

Customers need to be 16 or over to purchase the Bonds from NS&I.

The new rate compares to the 1.30% paid on the second tranche of Green bonds issued in February.

NS&I announced increased rates across its fleet of savings products in July after increasing the Premium Bonds prize fund in June.

The organisation contributed £1.3 billion to government coffers in the first quarter of the financial year 2022/23. All savings and investments lodged with NS&I benefit from a 100% government guarantee.

Its products rarely have market-beating rates so as not to unfairly disrupt competition in the commercial market.

24 August: One-In-Three Adults Have No Access To ‘Rainy Day’ Cash

More than half of UK adults are set to use money put aside for an emergency because of the worsening cost-of-living crisis, writes Andrew Michael.

Research from wealth manager Charles Stanley shows that nearly three-quarters of adult Brits (71%) have a ‘rainy day’ fund that would last the average saver just shy of five months.

But due to the challenging economic climate, more than half of respondents (54%) told the company they are worried about using up their emergency savings, leaving them unprepared for any future financial crises.

Charles Stanley found the average emergency fund would last its owner four months and three weeks. Just over a quarter of people (28%) said their reserves would cover them for between two weeks and two months, while 10% said they would run out of money after a fortnight.

Of those with emergency savings, a quarter (25%) of respondents said they have never needed it, while just under one-in-10 (9%) said they dip into it less than once a year.

One-in-eight people (12%) said they have never further topped up their reserves, although more than a third (36%) claimed they added monthly amounts to their savings. One-in-10 (10%) of respondents said they topped up their emergency stash on a weekly basis.

Charles Stanley said nearly one-in-three individuals (29%) do not have a reserve fund. Nearly two-fifths of workers (38%) earning less than £20,000 a year said they do not have a reserve fund. This proportion fell to just over a quarter (28%) of employees paid between £20,000 and £30,000 and reduced further for those earning commensurately higher amounts.

About a quarter of workers in employment said they did not have an emergency fund, while this figure rose to 46% of the job-seeking unemployed.

Lisa Caplan, director of OneStep Financial Planning at Charles Stanley, said: “Saving into a rainy day pot is not always people’s first priority, but those who have managed to prepare will be grateful for it during the cost-of-living crisis.

“As ever though, we are seeing common themes when we look at who slips through the net. The picture is less positive for women, low-earners, and those looking for work.”

23 August: Building Society Passes On Latest 0.5% Rate Hike

Nationwide Building Society has announced it will raise interest rates on all variable rate savings accounts from 1 September 2022.

These accounts are seeing interest rates rise by 0.50%, in line with the latest bank rate increase:

- Flex Regular Saver rate rises to 3.00% AER

- Start to Save 2 rate rises to 3.00% AER

- Future Saver rate rises to 2.00% AER

- Junior ISA rate rises to 2.00% AER

- Child Trust Fund rate rises to 2.00% AER

- Smart Limited Access rate rises to 1.50% AER

- Flex Instant Saver rate rises to 1.00% AER

The 1 Year Triple Access Online Saver will offer a new rate of 1.75% AER for the next 12 months, while the 1 Year Triple Access Online ISA rate is set to rise to 1.50% AER.

Nationwide’s Flex Saver and Flex ISA accounts will see the largest increase of 0.55%, taking rates to either 0.65%, 0.70%, or 0.75% AER depending on the account balance.

The Help to Buy ISA will undergo a slightly more modest rate increase of 0.40% to 1.75% AER. The Loyalty Saver, Loyalty ISA and Loyalty Single Access ISA accounts will see rates rise by 0.35% to 1.60% AER.

Rates on Nationwide’s easy access accounts — the Instant Access Saver, Instant ISA Saver and Cashbuilder — are set to rise by 0.15% to either 0.25%, 0.30% or 0.35% AER depending on the account balance.

Tom Riley, director of banking and savings at Nationwide, said: “As a mutual we are always keen to support savers and pay the best rates we can sustainably afford, which is why we are increasing rates on all variable rate accounts, particularly regular savers, loyalty and children’s accounts as well as our popular Triple Access Accounts.”

Banks generally have been criticised in recent weeks for not passing on rate increases to their customers following increases in the Bank of England bank rate, which now stands at 1.75%.

There is speculation that the rate could rise to 2.25% when the Bank next announces its new level on 15 September – an increase that would heap more pressure on institutions to pay more to savers.

5 August: Bank Rate Rises – But Savers Still Battle Inflation

The Bank of England’s recent hike in interest rates from 1.25% to 1.75% will be welcome news to debt-free savers who have been battling against historically-low interest rates for well over a decade.

However, with inflation currently at a 40-year high of 9.4% – eroding the value of savings faster than at any time in the past four decades – it becomes especially important to shop around for the best deals, even if savings providers pass on the full rate increase.

Sarah Pennells, consumer finance specialist at Royal London said: “[Savers] will be encouraged that savings rates, if passed on fully, will see rates come out of the doldrums.

“But banks and building societies don’t necessarily raise interest rates on all their savings products and may not increase them by the same amount, so it’s worth waiting a few weeks before checking comparison websites and best-buy tables to see if you can get a better interest rate.”

Kevin Brown, savings specialist at Scottish Friendly, said: “Anyone still able to save should be encouraged to do so as rates are likely to rise. But be aware that if the gap to inflation widens, returns in real terms will continue to fall.”

He added: “The best way to combat that may be to consider investing some of your money”.

Newcastle Building Society has already announced it will pass on the full rate increase to ‘99% of its customers’, while Coventry Building Society has committed to increasing its savings rates from 1 September.

The latest 0.5 percentage point increase marks the biggest single leap the BoE has implemented since 1995, and takes the Bank rate to its highest level in 14 years.

21 July: NS&I Boosts Rates To Deliver Competitive Offer

National Savings & Investments (NS&I) has increased interest rates across a swathe of products to bring them into line with competitor offerings.

The interest rate paid on Direct Saver, Income Bonds, Direct ISA and Junior ISA, will increase from today (21 July 2022).

The interest rate paid on Guaranteed Growth Bonds, Guaranteed Income Bonds and Fixed Interest Savings Certificates will increase from 1 August 2022. These products are not currently on sale, so the new rates are only available to existing customers.

More than 1.3 million people will see a boost to their savings as a result of the increases.

The rate on the Direct Saver and Income Bonds products will more than double from 0.50% to 1.20%, the Direct ISA from 0.35% to 0.90%, and the Junior ISA from 1.50% to 2.20%.

More substantial increases are taking place on guaranteed and fixed interest products. For example, three-year Guaranteed Income Bonds are increasing from 0.36% to 2.50%.

Details of the changes can be found here.

Earlier this year NS&I increased the Premium Bonds prize fund, which improved the odds of winning from 34,500 to 1 to 24,500 to 1 and saw an additional 1.4 million prizes paid out in June.

11 July: Cost-Of-Living Crisis Bites Into Savers’ Lockdown Gains

Financial gains made by UK savers during lockdowns imposed on them by the Covid-19 pandemic have been slashed back as a result of the ongoing cost-of-living crisis and need to meet rising prices, according to wealth manager Quilter.

Research carried out on behalf of the company found that just over half (53%) of the nation set aside money in savings and investments during the spate of coronavirus lockdowns that were imposed on the country during 2020 and 2021.

Quilter said that baby boomers – those born between 1946 and 1964 – were most likely to have saved money during pandemic-enforced lockdowns. Of this cohort, well over half (59%) said they were yet to dip into those funds.

In contrast, the wealth manager found that around one-in-seven (15%) of those who had saved money during lockdowns had already spent the cash they had put to one side.

In addition, more than a third of people (39%) told Quilter that they had already made a significant dent in their savings, with many spending up to three-quarters of the money they had squirreled away.

Quilter added that nearly half (46%) of Brits with lockdown savings had needed to dip into their money in the second quarter of this year. This was a significant increase compared with the first three months of 2022, thanks mainly to rising food costs followed closely by soaring fuel prices.

Ian Browne, financial planning expert at Quilter said: “While many people were able to save during the lockdowns and have had those funds to fall back on during the cost-of-living crisis, almost half were unable to save in the first place and could be left in a financially vulnerable position.”

“Even those who were able to put some money aside have seen their savings rapidly swallowed up by rising costs, particularly on day-to-day bills such as food, car fuel and heating and electricity.”

16 June: Take Advantage Of Bank Rate Hike, Savers Told

Financial experts have urged savers to take advantage of today’s decision by the Bank of England (BoE) to raise the Bank Rate by a quarter of a percentage point.

As expected, the BoE hiked interest rates from 1% to 1.25% which means bad news for mortgage customers on variable rate deals, but offers a glimmer of hope to savers looking to make maximum use of their money held on deposit.

With the latest data showing that consumer prices rose by 9% in the year to April, finding the highest-possible rate is vital for savers if they want to partly offset high inflation levels.

Alice Haine, personal finance analyst at the investment platform Bestinvest, said: “For cash savers, an interest rate rise is always a good thing, as they can secure higher rates on their savings pots – that is of course if they have spare cash to save in the first place.

“Saving rates have been creeping up to the highest levels seen in a decade, with some accounts now offering up to 1.56% for easy access accounts and up to 3% for fixed-rate products.

“Every penny in additional interest is a bonus when high inflation is eating away at the purchasing power of incomes. With many households dipping into emergency pots to meet rising food, fuel and energy bills, you need to make sure your money is working as hard as it can.”

Myron Jobson, senior personal finance analyst at interactive investor, said: “Higher rates mean savings will earn more – although some banks and building societies have been fiendishly slow in passing on recent hikes to the base rate.

“With the rate of inflation now higher than the best savings deal in the market, any money in savings loses purchasing power over time – but it still pays to pick the most competitive account.”

Les Cameron, financial expert at M&G Wealth, said: “While today’s announcement is no surprise, what remains to be seen is whether this rise will translate to higher rates available to savers or to increased borrowing costs.

“Reviewing your finances to make sure you’re prepared for the future has never been more important and, for many, that will involve seeking some form of professional financial advice.”

15 June: UK Savers Rely On Savings In Summer

UK consumers are more likely to dip into their savings in August than in any other month of the year, according to Atom Bank.

The research, which analysed customer savings habits between May 2020 and April 2022, also found that the 1st is the most popular day of each month to make a savings withdrawal.

Since going on holiday was the ‘top savings goal’ among Atom customers, it is likely that many August savings withdrawals are being put towards topping up travel expenses.

Aileen Robertson, head of savings at the bank, said: “A common mistake people make when saving for a holiday is not accounting for enough spending money, which may result in unexpected additional expenses while you’re away.

“It’s useful to plan ahead — research which excursions you might want to take and how much on average they cost, factor in transport costs for the whole trip and consider what you’re likely to spend on food and drink.”

However, in the midst of the ongoing cost-of-living crisis, many others are likely to be using savings to make ends meet.

Ms Robertson said: “Many people with good intentions to save are likely feeling worse off right now, and tapping into savings may be seen as the only way to beat the current cost of living squeeze.”

The bank also found that savers tended to withdraw relatively small amounts, with 25% of customers taking out £80 or less.

8 June: 50,000 Lifetime ISA Holders Use Funds To Buy First Home

Sales of stocks and shares individual savings accounts (ISAs) surged during the pandemic, in stark contrast to cash ISAs, which saw their popularity plummet over the same period, according to the latest figures from HM Revenue & Customs (HMRC).

ISAs are tax-efficient wrappers that enable holders to shelter a certain amount of money each year – currently £20,000 – from income tax, dividend tax and capital gains tax.

HMRC says investors opened nearly 3.6 million stocks and shares ISAs during the 2020/21 tax year, a period that coincided with the most disruptive period of the Covid-19 pandemic.

This is an increase of around 860,000 accounts compared with the previous tax year, representing an extra £10 billion in investments year-on-year.

HMRC says the number of cash ISAs opened during 2020/21 fell by 1.6 million to just over 8 million. This meant that the share of cash ISAs as a proportion of the overall number of ISAs sold fell from 75% in the tax year 2019/20 to 66% in 2020/21.

Overall, around 12 million ISAs were taken out during the tax year 2020/21 equating to around £72 billion in cash terms. This compares with the 13 million accounts taken out in the previous tax year.

HMRC figures also reveal that 50,800 people made withdrawals from their Lifetime ISA (LISA) to buy a home in 2020/21, an increase of 15,000 on the previous tax year.

LISAs allow people over 18 and under 40 to save, tax-free, for their first home or to supplement their retirement earnings. HMRC says that the average LISA withdrawal was £13,192 in 2020/21, a £700 increase on the previous year.

Bestinvest’s Adrian Lowery says the figures show how households channelled lockdown savings towards investing: “During the pandemic savings boom many households looked towards investments, rather than cash savings, with the Bank of England having slashed interest rates to an all-time low of 0.10% in March 2020.”

24 May: NS&I Adds £40 Million To Premium Bonds Prize Fund

National Savings and Investment (NS&I), the Government-backed bank responsible for Premium Bonds, has announced an increase to its prize fund rate from 1.00% to 1.40%, with effect from next month.

It will mean an additional 1.4 million prizes will be issued in June’s monthly draw out of an increased prize pot worth £40 million.

The majority of these extra prizes will be valued at £25 or £50, but the number of higher value prizes is also increasing. For example, there will be 98 prizes of £10,000 in each monthly draw from June, compared with the current 58, and 40 prizes of £25,000 compared to the current 24.

The odds of each £1 Premium Bond number winning a Premium Bonds prize will also change from 34,500 to 1 to 24,500 to 1.

Ian Ackerley, chief executive of NS&I said: “The new prize fund rate ensures that Premium Bonds are priced appropriately when compared to the interest rates offered by our competitors.

“It also ensures that we continue to balance the interests of savers, taxpayers and the broader financial services sector.

Premium Bonds, which are held by over 21 million people in the UK, were first introduced in 1956 as an alternative way to invest money. Rather than earning interest every month like regular savings accounts, purchasing a Premium Bond means being entered into a monthly prize draw for cash sums.

These sums range in value from £25 to £1 million, which winners receive tax-free. Every £1 invested in Premium Bonds is equivalent to one entry into the prize draw, but the minimum investment level is £25. Savers can cash out a portion or all of their bonds at any time.

Although investors do not earn monthly interest, the total value of the prize fund increases at a fixed rate, which is occasionally adjusted in line with inflation and interest rates, both of which have been climbing.