By GWEN MURANAKA, Rafu Senior Editor

A tour of Little Tokyo’s most important sites was part of a day of reaffirming a commitment to the Japanese American community last month by MUFG and U.S. Bank.

Andy Cecere, U.S. Bank chairman, president and CEO, and Masatoshi Komoriya, group deputy chief operating officer-international, deputy regional executive for the Americas, and executive chairman of the Board of Directors of MUFG Americas Holdings Corp., were among the executives who visited the Japanese American Cultural & Community Center, Japanese American National Museum, Japanese Village Plaza, and the Go For Broke Monument and other historic locations on Sept. 18.

The tour was conducted by George Tanaka, U.S. Bank managing director, Japan Practice, and Nancy Okubo, U.S. Bank segment manager, Japan Practice.

On First Street North, they stopped at legacy businesses such as Fugetsu-Do Confectionery. At JANM, they were guided through the “Common Ground” exhibition, which tells the history of Japanese Americans.

In many ways, the development of banks has followed the development of the Japanese American community. Bank of Tokyo of California opened its branch in Little Tokyo in 1952 with Matsujiro Takeshita as its first president. The bank was created shortly after the 1951 signing of the San Francisco Peace Treaty, which re-established peaceful relations between Japan and the Allied Powers.

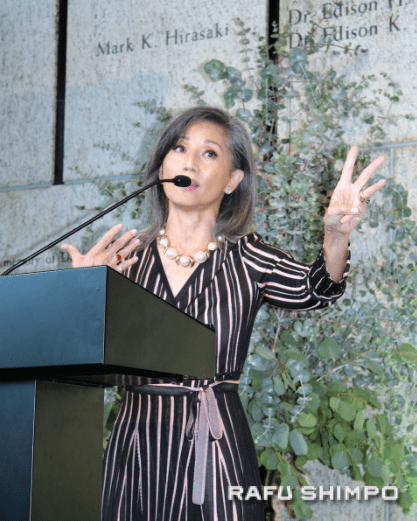

At a reception at JANM emceed by actress and activist Tamlyn Tomita, Cercere said that he was moved by what he had seen and that U.S. Bank would continue the traditions carried on by MUFG and Union Bank.

“We are deeply committed to the Japanese American community and tonight’s event is just one example that we can express our appreciation for your business and the important role you all play in California,” he said.

“The past will never be forgotten. I learned a lot today and it is all about the community. Our opportunity to partner with you is critically important.”

The evening function, attended by more than 250, came just over 10 months after the close of MUFG’s sale of MUFG Union Bank’s core regional banking franchise to U.S. Bank.

The event was held to recognize the importance of the strong partnership that the two institutions have with the Japanese American community, build personal connections with bank partners and clients, and express appreciation for the contributions the Japanese American community in California has historically made.

According to Komoriya, the sale of its U.S. regional banking franchise does not diminish the bank’s loyalty to the Japanese American community. MUFG will continue to support the community through participation with organizations such as JANM, the JACCC, the U.S.-Japan Council and Japan House Los Angeles.

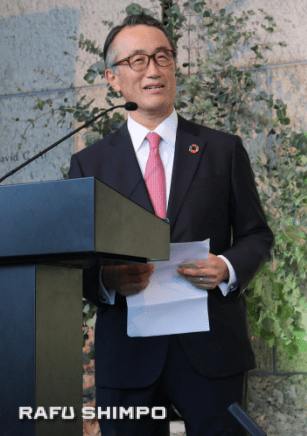

“While MUFG’s core business strategy in the Americas is centered on corporate and investment banking, we recognize the strength that comes from the relationships we keep and the clients, colleagues, and communities we support,” said Komoriya. “This is a sentiment that is echoed by our U.S. Bank partners.”

Kanetsugu Mike, chairman of MUFG, said, “The legacy that MUFG helped build and its loyal customer base remains in very good hands. But let me assure you, MUFG is not leaving. We treasure our relationship with this community and will keep supporting its businesses, programs, events and volunteer work. That is why both MUFG Tokyo and MUFG America have contributed to the renewal of this great exhibition hall and are honored to support the vital work of JANM.”

He noted that when Bank of Tokyo returned to California after the war, Keisaburo Koda of Koda Farms drove up and down the state in his Cadillac, urging other farmers to buy shares in the bank.

Kanetsugu said the Japanese American community is “powerful proof that banks and communities grow hand in hand.” He shared the story of a customer who recalled his banker, Takito Yamaguma:

“He said he felt his banker, Mr. Takito Yamaguma, a great community leader who is still well remembered, was guided by personal relationships based on spirit aspects of traditional Japanese culture. I believe he was talking about the spirit of relationship banking that MUFG has always valued. I am confident that U.S. Bank will carry on this spirit of relationship banking, banking with integrity and responsible banking with community in mind.”

Tanaka, a Union Bank managing director who now leads U.S. Bank’s Japan Practice, said U.S. Bank is continuing to foster relationships within the community, supporting numerous organizations and events. He said he is proud of how the two banks have worked together to ensure that customers continue to have the support they need.

“Our goal at U.S. Bank is to ensure that we continue to provide our Japanese and Japanese American clients with the financial tools necessary to succeed,” Tanaka said. “At the same time, we will continue to collaborate with MUFG to seek new opportunities to serve our customers.”

Yamaguma’s granddaughter Kelli-Ann Nakayama is chief development officer at JANM. She said she was moved by Mike’s words and the long history of the bank in the JA community. A native of Kumamoto Prefecture, Yamaguma was with Yokohama Specie Bank before World War II and was active in numerous organizations, including the Japanese American Citizens League and Los Angeles-Nagoya Sister City Affiliation.

“As a banker, he was the one who helped Bank of Tokyo get their license to open their first office here in the United States, and he went on to open a bunch of other branches for Bank of Tokyo and stayed with the company for decades,” Nakayama noted. “He said it was the proudest moment of his life to get that license for them.”

Photos by GWEN MURANAKA/Rafu Shimpo (except where noted)