A higher-than-expected US inflation reading this week makes a Bank of England rate cut at the next two meetings “less likely,” experts have said.

Official data showed an inflation reading of 3.5 per cent for the year to March, which was higher than forecast.

Traders slashed bets on the US Federal Reserve – the American equivalent of the Bank of England – cutting rates in the near future. A cut in July was expected to be a near certainty, but bets on this reduced to around half after the the inflation figures were released on Wednesday.

The European Central Bank has also opted to hold interest rates on Thursday, with its next meeting in June.

Economists have said that if the Fed delays interest rate cuts, that could have a knock-on effect in the UK. If the Bank of England cut rates before the Fed, there is a risk of it devaluing the pound which could fuel further inflation.

The next Bank of England Monetary Policy Committee (MPC) meeting – where decisions over whether to change rates are taken – is at the start of May. This is followed by a meeting in June, and a further one in August.

Any delay to a widely anticipated rates cut will be a blow to the Prime Minister who is relying on a change of economic fortunes to boost his hopes of being re-elected.

Rishi Sunak said in April that he wanted to hold an election when people “feel that things are improving”. A cut to interest rates filtering through to mortgage rates would add weight to his argument that the UK had turned the corner.

With rates still high, mortgage holders with tracker mortgages, which tend to follow the base rate, and those on fixed-term contracts coming to an end are still being hit with higher monthly payments.

If a rate cut is delayed until August, it would come uncomfortably close to the expected general election date of October or November for its impact to be felt in people’s pockets or to help the wider economy.

The Bank has also come under pressure from some Conservative MPs who believe a rates cut would help boost the UK’s flat economy.

In March former Cabinet minister Sir Jacob Rees-Mogg told i: “I would urge the Bank to cut interest rates now. It was slow to increase them and it now seems stubborn in keeping them at current levels.”

But Megan Greene, who sits on the rate-setting MPC told The Financial Times that rate cuts should remain “a way off” amid persistent inflationary pressures.

What the economists say

Edward Jones, a Professor of Economics at Bangor University said the Fed was not previously under pressure to cut rates, and that it certainly “won’t be looking to cut now.”

“For the UK, the Bank will not want to be one of the first major banks to cut rates – though I know the Swiss bank has already done so. The Bank of England will be looking at the Fed and European Central Bank. I still think we won’t see a cut until August.”

Stephen Millard, deputy director at the National Institute of Economic and Social Research said he expected a cut to come in June but added the US data reduced the prospect of drop sooner.

“US inflation numbers will reduce the likelihood of a Fed cut when they next meet. In turn, this may well reduce the likelihood of an MPC cut in May as it could use the Fed not cutting as a reason not to cut themselves.

“If the MPC cut when the Fed hasn’t that could put downwards pressure on the exchange rate, which could lead to upwards pressure on inflation.”

Chris Martin, a Professor of Economics at the University of Bath said June was still the most likely date for a cut, but added: “I think the US data do make a rate cut here in the next couple of months a bit less likely. But only a bit.”

Stephen Yiu, lead manager of the Blue Whale Growth Fund said it was “completely right” that the Bank of England would not want to create a gap between US rates and UK rates.

“I don’t see any reason why the Bank of England would be cutting rates when the Fed isn’t.

“We probably will not see a Fed cut at either of the next two meetings, and so there’s no urgency for the Bank of England to cut rates. The economy is not in a deep recession here, it’s fairly stagnant but there is not that urgency, though of course there are some political considerations too.”

Sir Charles Bean, former deputy governor at the Bank of England said the US inflation figure made a June cut “marginally” less likely.

“In so far as the unexpectedly high US inflation prints lead US market interest to rise, then it may also lead the Dollar to appreciate, including against Sterling. That in turn will raise UK import prices and add a little to inflationary pressure here, so potentially also raising the profile of UK interest rates. But the effect will be pretty small.”

Ruth Gregory, deputy chief UK economist at Capital Economics said she still expected a cut in June.

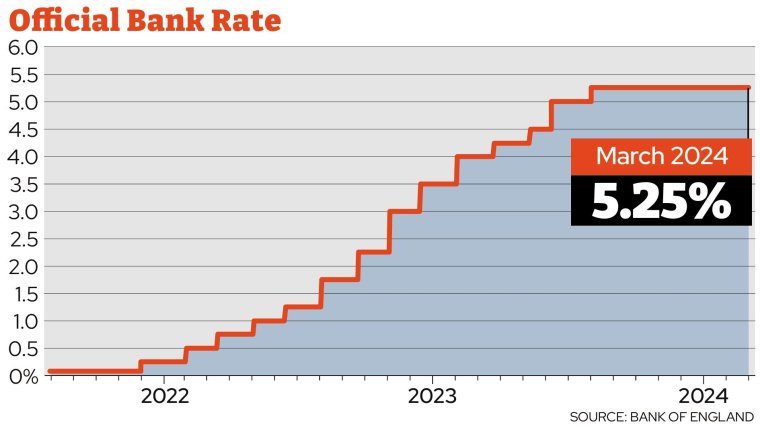

“Even if the US Federal Reserve leaves its policy rate unchanged for longer than we expect, our forecast that inflation in the UK will be lower than in the US suggests this won’t prevent the Bank of England from cutting rates from 5.25 per cent to 5 per cent in June and to 3 per cent next year. But the Bank will be alive to the risk that inflation proves more resilient as it has in the US.”

Willem Buiter, a former member of the Bank of England MPC said that even before these recent US inflation data, the chance of a Bank of England cut in June was “effectively zero.”

“I don’t think the behavior of the Fed, except to the extent it influences the external economic and financial environment of the UK, is a material influence on how the MPC thinks and votes.”

Why does US inflation affect UK interest rates?

Higher-than-expected US inflation decreases the chances of a rate cut in the UK in the near future.

If a country has high interest rates relative to another, this can often lead to increased foreign investment where the rates are higher, as an investor can make more money lending than they can if rates are low.

This can have a negative effect on the strength of the currency in the country with lower rates.

So if rates in the US were not lowered, lowering UK rates would risk weakening the pound, which could be inflationary.