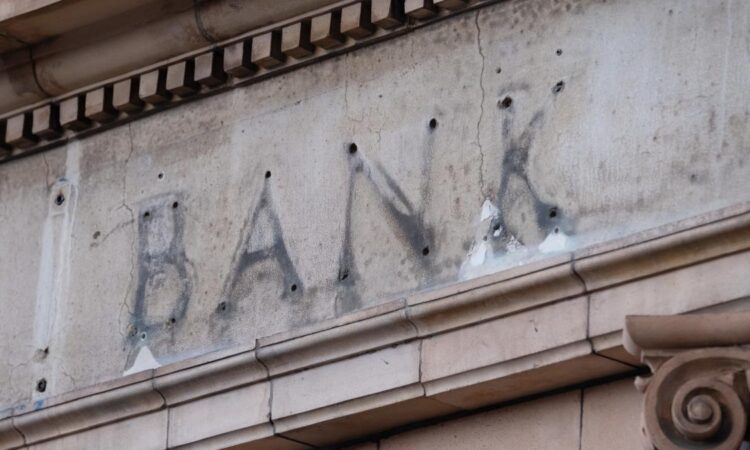

More than 5,000 bank and building society branches have closed over the past seven years, according to analysis from Which?

The consumer group counted 5,162 bank and building society branches which have closed since January 2015.

A further 206 branches are set to close by the end of 2023, according to the Which? findings, as of mid-December 2022.

Rocio Concha, Which? director of policy and advocacy, said: “The shift to paying digitally has made life more convenient for millions, yet there remains a significant minority for whom cash is still vital as they are not ready or willing to make that switch.

“Those who rely on cash need protection from bank branch and ATM closures, with a minimum level of free access to cash guaranteed to ensure they don’t have to pay to withdraw their own money. But protecting access to cash is only useful if it is still widely accepted as a payment method.

“While businesses are best placed to decide whether or not to accept cash, we mustn’t sleepwalk into a situation where cash users struggle to make purchases or are excluded from certain services.

“The Financial Conduct Authority should therefore play a proactive role in monitoring levels of cash acceptance, regularly publishing data and taking action where appropriate.”

The Government has said it will legislate to protect the future of cash.

While some shops are still “cash only”, people may find they cannot use cash at all in some other places.

ATM network Link recently found that nearly half (45%) of people have been somewhere where cash has not been accepted, or has been discouraged.

Graham Mott, director of strategy at Link, said: “Despite all the talk about the death of cash, I think it is worth reminding ourselves of how important cash is.

“Compared to 2021, the number of transactions this year is up around 5%.

“Year-on-year we’re also seeing people take out more cash when they visit cash machines.

“To date, around £80 billion has been withdrawn from Link machines this year, and next year we are only expecting a small reduction of 3% to 5% on 2020’s figures.”

The Post Office has an agreement with many banks which allows people to do their everyday banking over its counters.

Ross Borkett, head of banking at the Post Office, said: “Post Office data shows many more families on low incomes are turning to cash to budget in light of cost-of-living increases and the added financial pressures in the run-up to Christmas.

“It also remains critical that local businesses can deposit their takings easily in their local branch to maximise the time they can spend trading during these challenging times.

“Post Offices is at the centre of communities providing cash services – we handle over £3 billion worth of cash every month and postmasters are ready to continue supporting customers through Christmas and the new year.”

He added: “Last year, on Christmas Day alone, almost £2.5 million in cash was deposited and withdrawn by personal and business customers.”

Initiatives such as cashback in shops without the need to make a purchase and banking hubs – whereby several banks share the same space – have also been launched to help fill gaps in the cash system.

Natalie Ceeney, chair, Cash Action Group, said: “Over the next 12 months we will be opening a lot more banking hubs.

“There are four hubs now up and running, and another 25 in the process of being set up, and as Link independently assesses the needs of communities across the UK we expect this volume to ramp up significantly.

“But as well as banking hubs, we are developing standalone deposit services particularly to support small businesses, and are encouraged by the growth in cashback without purchase which means that even the smallest communities can enable local cash withdrawals.

“We expect our services to be supporting hundreds of communities within the next few years.”

Financial inclusion campaigner Lord Holmes, who is vice chair of the All-Party Parliamentary Group on FinTech, said: “Since Covid, we’ve seen a big shift towards digital payments and wider digital services.”

He said that while there can be benefits to this, “the problem is what happens if they become digital-only?”.

He added: “Payments is a good example. For some businesses, it makes complete sense, but others are becoming cashless because it is problematic to get to the bank.”

Trade association UK Finance’s figures show that 1.1 million people mainly use cash when doing their day-to-day shopping.

A UK Finance spokesperson said: “The overall number of cash payments decreased by 1.7% last year and we expect cash usage to continue to fall, with cash forecast to account for 6% of all payments made in the UK by 2031.

“The banking and finance industry is committed to preserving access to cash for those who need it, including through banking hubs, free ATMs, enhanced Post Office services and cashback without purchase.”

Regarding bank branch closures, the spokesperson said: “While many customers are opting to use mobile and online banking to manage their money, the banking industry is committed to ensuring that people can do their banking face-to-face too.

“Whenever a bank branch closes, Link independently assesses the local community’s cash access needs and will commission any new services required, which can include a banking hub.”

The spokesperson said the industry is “fully behind” getting banking hubs up and running as quickly as possible, adding: “In addition, customers can do their day-to-day banking at thousands of post offices across the country.”

Here are the cash withdrawals followed by the cash deposits made on Christmas Day in 2021, according to the Post Office:

– England, £584,152, £1,067,774

– Northern Ireland, £17,247, £67,767

– Scotland, £190,851, £227,929

– Wales, £89,238, £94,365