Revolut, a banking giant seeking an excess of $40B valuation, is a top choice for many. In today’s fast-paced digital world, finding a reliable and versatile banking platform is crucial for managing your finances efficiently.

Revolut stands out as a top choice, offering a comprehensive suite of financial services, including seamless currency exchange, investment opportunities, and travel perks. With its user-friendly app and innovative features, Revolut empowers users to take control of their financial lives, whether it’s for everyday transactions or global investments.

This review will explore Revolut’s offerings, helping you determine if it fits your do-it-yourself investing needs.

Reader’s note: The numbers, facts, and figures provided in this article were accurate at the time of publishing.

What is Revolut?

Revolut is a global neobank and financial technology company headquartered in London, UK. Launched in 2015 by Nik Storonsky and Vlad Yatsenko, it has rapidly grown to serve over 40 million personal customers and more than 500,000 business customers worldwide.

According to the company website, the platform supports users in 160+ countries and regions and offers services in 36 in-app currencies.

Revolut offers a wide array of financial products, including traditional banking services, currency exchange, debit and credit cards, virtual cards, and Apple Pay. Additionally, it provides innovative financial tools such as interest-bearing “vaults,” personal loans, and buy-now-pay-later options where it holds a banking license.

Revolut offers investors stock, cryptocurrency, and commodities trading. The platform also extends its services into human resources and other sectors.

The European Central Bank granted Revolut a full banking license in 2021, making its banking services available in 30 countries. By 2022, customer deposits had soared to £12.6 billion ($15.5 billion), and the company had doubled its workforce to over 7,500 employees in more than 25 countries.

Designed with travelers in mind, Revolut allows spending in over 90 countries without foreign transaction fees, using a real exchange rate without additional charges. It complies with the Payment Card Industry Data Security Standard (PCI DSS), ensuring secure transactions.

Despite its extensive offerings, Revolut does not yet have a UK banking license as of 2024, which limits certain consumer protections available to traditional UK bank customers.

Who is Revolut best suited for?

Revolut can be a valuable tool for a variety of financial needs, but it is particularly useful for these individuals:

- Frequent travelers: Revolut’s zero foreign transaction fees, multi-currency management, and integrated travel insurance make it ideal for frequent international travelers.

- Budget-conscious spenders: With built-in budgeting tools, fee-free transfers between Revolut users, and the ability to earn cashback rewards, Revolut can help you stay on top of your finances.

- Tech-savvy investors: Revolut offers commission-free fractional share trading of US stocks and limited cryptocurrency buying/selling, all within a user-friendly app.

- People who want to simplify finances: Revolut consolidates features like budgeting, currency exchange, international transfers, and virtual cards into one platform, streamlining financial management.

Pros and cons

Pros:

- International money transfers: Send and receive money internationally at competitive exchange rates with fee-free options for Revolut users.

- Multi-currency management: Hold and exchange over 150 currencies with competitive rates, eliminating the need for multiple travel cards.

- Zero foreign transaction fees: The free plan allows you to spend abroad in your chosen currency without hidden weekday charges.

- Integrated budgeting tools: Track spending habits, set budget categories, and receive real-time notifications to manage your finances effectively.

- Discounted stock trading: Invest in fractional shares of US stocks with commission-free trades (minimum investment amounts may apply).

- Travel insurance: Purchase travel insurance directly within the app, covering medical emergencies, trip cancellations, and more (premiums apply).

- Discounted lounge access: Enjoy access to airport lounges at a discounted rate with some Revolut plans.

- Built-in rewards programs: Earn cashback or other rewards on purchases with select retailers through partnered programs.

- Virtual disposable cards: Generate secure, single-use virtual cards for online transactions, enhancing security.

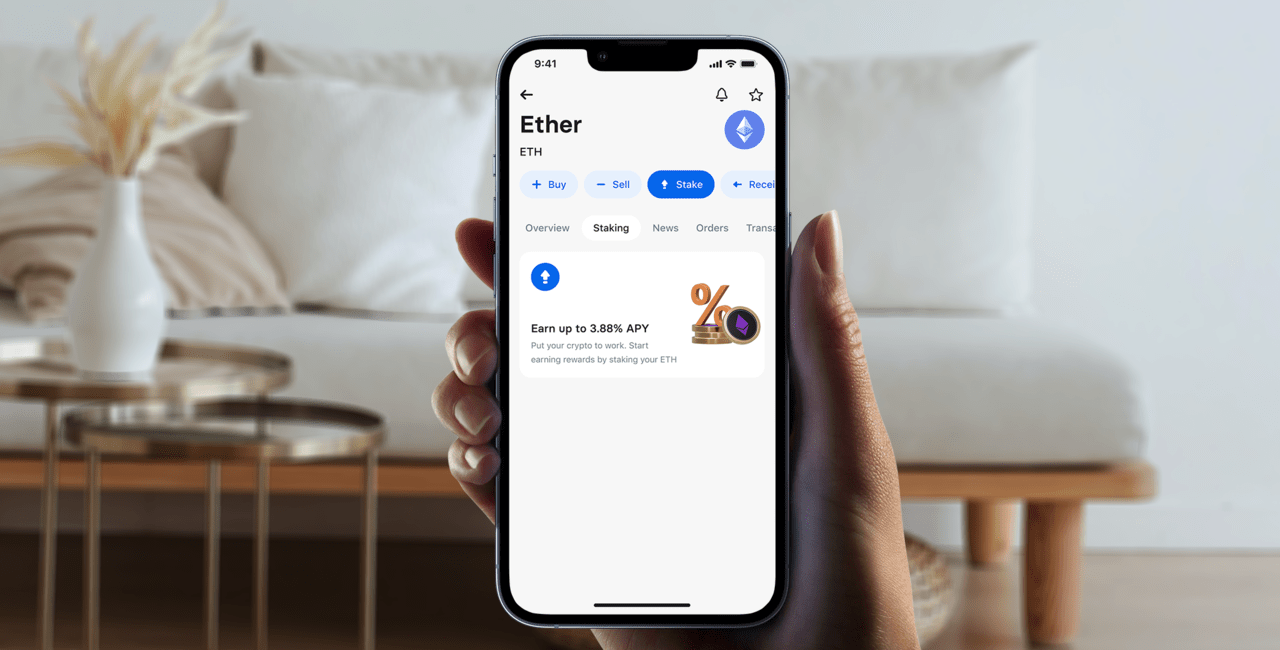

- Crypto trading (limited): The inclusion of partnerships with exchanges like KuCoin has enhanced the convenience for users to directly buy, sell, and hold a limited variety of cryptocurrencies within the Revolut app. (regulations may vary).

Cons:

- Dissatisfactory customer support: Revolut relies primarily on in-app chat support, which may not be ideal for everyone and could lead to longer wait times.

- Limited account features: Revolut doesn’t offer some traditional banking features like overdrafts or safety deposit boxes.

- Confining account fee structure: Free tier limitations can be restrictive. Upgraded plans with higher monthly fees unlock additional features.

- Weekend currency conversion fees: Free currency exchange limits may not apply on weekends, potentially incurring small fees.

- Lower interest rates (on savings): Revolut’s savings accounts may offer lower interest rates than traditional banks.

- Geographic restrictions: The availability of features and services may vary depending on your location. Some regions might not offer the full suite of plans.

- Account freezing potential: Revolut has been known to freeze accounts for suspicious activity, which can be inconvenient while rectified.

- Regulation concerns: As a relatively new financial platform, Revolut may be subject to evolving regulations that could impact its services.

Revolut plans: Finding the right fit

Revolut offers tiered plans to suit your financial needs. Choose from free basic features or upgrades for perks like travel insurance, airport lounge access, and even cashback offers. This table gives a quick rundown of each plan’s offerings.

| Feature | Standard | Plus | Premium | Metal | Ultra |

|---|---|---|---|---|---|

| Price | Free | £3.99/month | £7.99/month | £14.99/month | £45/month (introductory offer) |

| Fees | Weekend and currency conversion fees | Lower weekend and currency conversion fees, ATM fees after £200/month | Free weekend and currency conversion fees, ATM fees after £400/month | Free weekend and currency conversion fees, ATM fees after £600/month, priority customer support | Free weekend and currency conversion fees, concierge service, unlimited lounge access, travel insurance |

| Benefits | Basic account for everyday spending | Larger free ATM withdrawals, currency exchange on weekends, cashback offers, travel insurance | Larger free ATM withdrawals, currency exchange, cashback offers, medical insurance, airport lounge access (limited visits) | Larger free ATM withdrawals, priority customer support, concierge service, travel insurance, metal card, cashback offers | Extensive travel insurance, concierge service, unlimited lounge access, metal card, cashback offers, interest on vaults |

| Minimum funds | No minimum | No minimum | No minimum | No minimum | No minimum |

| Interest (AER) | No interest | No interest | No interest | 0.10% (limited amount) | 1% (limited amount) |

Note: Prices and some benefits may vary depending on the location. Always check the latest information on the Revolut website before signing up for a plan. Standard overdraft charges apply to extra fees.

Revolut key features and benefits

Revolut offers a wide range of features to manage your money, send and receive payments internationally, invest, and more.

For the Revolut review, we provide a breakdown of the Revolut app offerings and features segmented by category to help you see how it can fit your financial needs:

Earning features:

| Feature | Description |

|---|---|

| Free Money Transfers (37 Currencies) | Send money internationally with no fees. |

| Fee-Free Spending (Over 140 Currencies) | Spend abroad without currency exchange fees. |

| Real-Time Exchange Rates | Get the best exchange rate when converting currencies. |

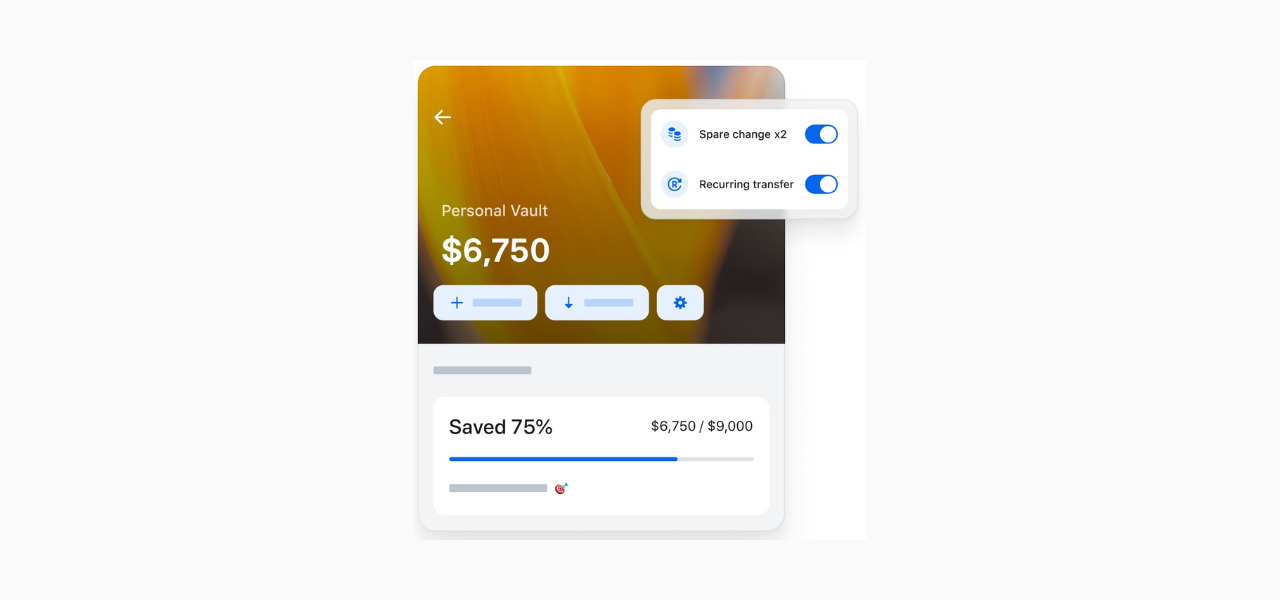

| Spare Change Round-Up | Automatically save the difference from rounded-up purchases. |

| Revolut Rewards (limited availability) | Earn cashback points on purchases at select retailers. |

Saving & budgeting features

| Feature | Description |

|---|---|

| Multi-Currency Account | Hold and manage multiple currencies in a single account. |

| Savings Vaults | Create separate pockets within your account to save for specific goals. |

| Budgeting & Analytics | Track your spending habits and set budgets for different categories. |

Investing & trading features

| Feature | Description |

|---|---|

| Stock & ETF Investing | Invest in a variety of stocks and ETFs with fractional shares. |

| Cryptocurrency Exchange | Buy, sell, and hold various cryptocurrencies. |

| Commodity Trading | Trade gold and silver with competitive rates. |

| Currency Exchange Lock-In | Guarantee an exchange rate for future currency conversion. |

| Trading Tools & Charts (Premium/Metal plans) | Analyze markets and make informed investment decisions. |

Account management & security features

| Feature | Description |

|---|---|

| Linked Accounts | Connect your Revolut account to your other bank accounts. |

| Disposable Virtual Cards | Generate secure virtual cards for single-use online transactions. |

| Card Freezing | Lock your Revolut card instantly if you misplace it. |

| In-App Chat Support | Get help from Revolut’s customer support team directly in the app. |

| Security Features | Secure your account with PIN, fingerprint or face recognition login. |

Premium features (available on Premium and Metal plans):

| Feature | Description |

|---|---|

| Travel Insurance | Purchase travel insurance directly through the Revolut app. |

| Airport Lounge Access | Enjoy discounted access to airport lounges. |

| Metal Card | Get a premium metal card with exclusive benefits. |

| Priority Customer Service | Get faster response times from customer support. |

Revolut offers (other features)

| Feature | Description |

|---|---|

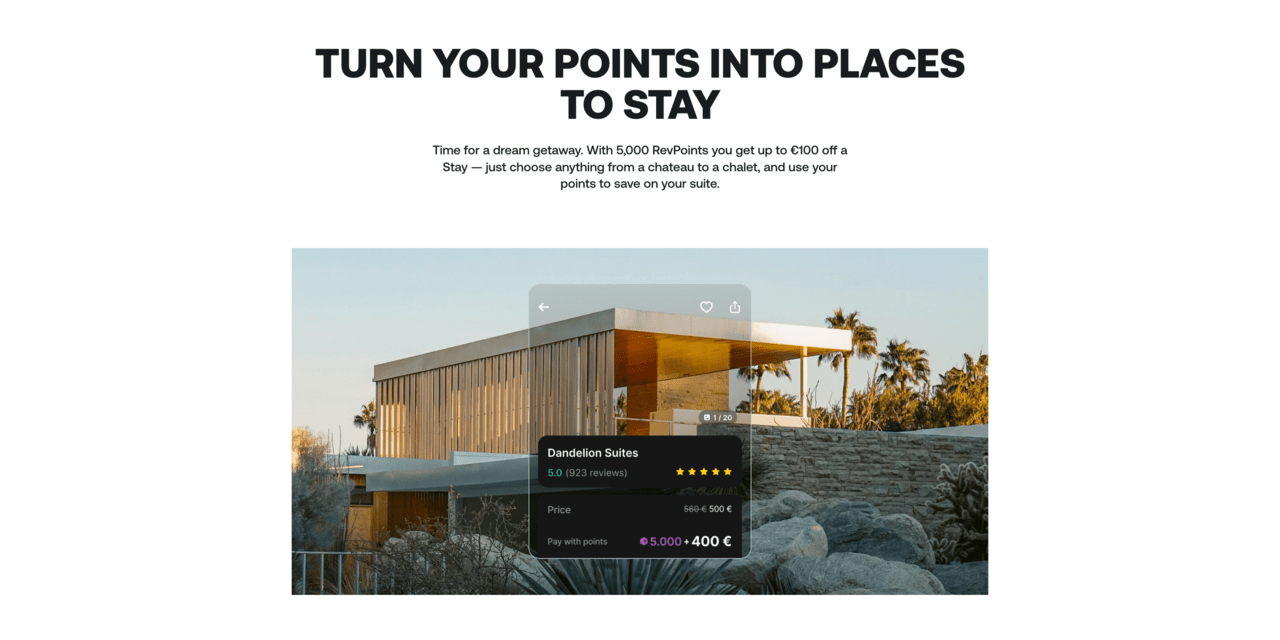

| Travel-friendly Features (limited availability) | Manage travel essentials like booking hotels and experiences. |

| International SIM Data Plans | Purchase data plans for your phone when traveling abroad. |

| Joint Accounts | Manage your finances together with another person. |

| Revolut for Teens (16-17) | Prepaid card with spending controls for teenagers (with parental guidance). |

| Group Payments | Split bills and collect money easily from friends. |

| Salary Advance (limited availability) | Get a portion of your salary early (subject to eligibility). |

| Bill Pay (limited availability) | Set up automatic payments for your bills directly from your Revolut account. |

| Donations | Donate directly to charities through the Revolut app. |

Revolut App review

Revolut’s mobile app revolutionizes financial management on the go, catering to budget-conscious users and frequent travelers.

Available on both Google Play and the Apple Store, Revolut offers dedicated apps for UK customers and global users.

The app’s core features include multi-currency management, which allows you to hold and exchange over 30 currencies at interbank exchange rates, saving money on international transactions.

It also boasts robust budgeting and analytics tools, enabling users to set spending limits, track expenses, and gain insights into their financial habits.

Peer-to-peer payments are seamless, with instant transfers to friends and family, regardless of location. Users can also manage their spending with virtual cards for online purchases and physical cards for everyday transactions.

On select premium plans, frequent travelers can enjoy free ATM withdrawals, travel insurance, and airport lounge access within set limits.

Unique features like vaults for separate savings goals, weekend currency exchange at interbank rates, and disposable virtual cards for added security set Revolut apart. The app also supports investing in stocks, fractional shares, cryptocurrencies, and commodities trading in gold and silver, though availability may vary by region.

Revolut’s user ratings

| Platform | Rating | Number of reviews |

| Google Play | 4.4/5 | 2.8M |

| Apple Store | 4.9/5 | 725k |

| Trustpilot | 4.1/5 | 153K |

Revolut review: Customer satisfaction

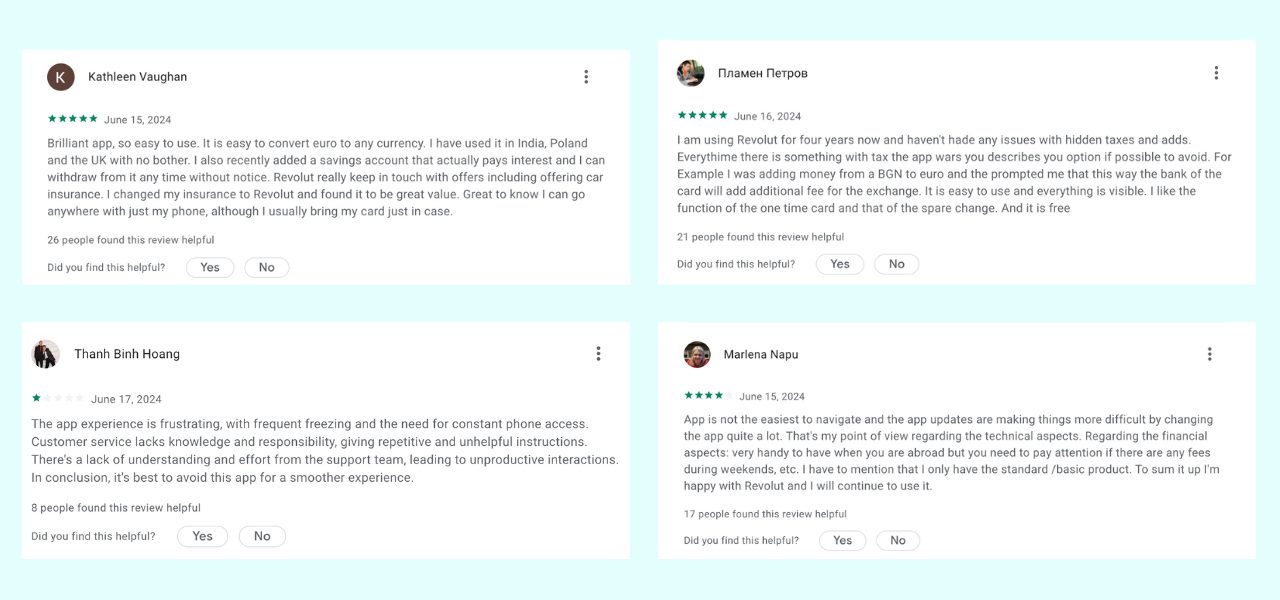

Revolut has garnered mixed reviews from its users, highlighting its strengths and areas for improvement.

On the positive side, many customers praise Revolut for its exceptional services in travel, international transfers, and online purchases. Users frequently highlight the app’s great rates, slick interface, and effective budgeting tools.

One long-term user, who has held an account for eight years, reports never encountering any issues. Another user who switched to Revolut as their main account notes mostly positive experiences despite recognizing that improvements could be made to the paid plans.

However, several users caution against using Revolut as a primary bank account. One user recounted being locked out of their account for four months without a clear explanation, warning that relying on Revolut as a main bank could lead to significant issues.

Another user pointed out the hidden fees and unfavorable exchange rates introduced over time, which they feel are buried deep within the terms and conditions.

Additionally, numerous accounts show funds being frozen for weeks for arbitrary reasons, leaving some users without access to their money.

Despite these concerns, many customers continue to use Revolut for its convenience, particularly for splitting rent, bills, and sending money to friends.

Users advise keeping only small amounts in the account and maintaining a backup plan to mitigate potential risks. While Revolut offers valuable services, users should exercise caution and not depend on it as their sole banking solution.

Final thoughts: Is Revolut right for you?

Revolut is a versatile digital banking platform with features designed to cater to various financial needs, from currency exchange to investments.

For frequent travelers and those who regularly engage in international transactions, Revolut offers significant benefits such as competitive exchange rates, ease of use, and additional perks like travel insurance and airport lounge access, particularly with premium plans like Revolut Metal.

However, the platform may not be ideal for everyone. Users who do not travel frequently or require additional features may find the monthly fees for premium plans unnecessary.

Additionally, there have been reports of accounts being frozen for prolonged periods, which raises concerns about using Revolut as a primary bank account. While Revolut excels in offering innovative features and convenience, it is essential to maintain a backup plan and not rely solely on it for all banking needs.

Revolut provides a user-friendly entry point with options for stock trading, cryptocurrency, and commodities for those seeking a do-it-yourself investing platform. However, seasoned investors may eventually need a more comprehensive brokerage service.

In conclusion, Revolut is a powerful tool for specific use cases, particularly for international spending and basic investments. It offers a range of features that can complement traditional banking but may not yet be robust enough to replace it entirely.

Evaluate your financial needs and usage patterns to determine if Revolut aligns with your banking and investment goals.

This review article is just one piece of a comprehensive series of analysis articles designed to assist you on your investment journey. Find more review articles on ValueWalk.

Revolut FAQs

Revolut is a financial app that offers debit cards, currency exchange, budgeting tools, and investment options.

It’s popular for its user-friendly interface and features targeted towards travelers, like fee-free spending abroad. However, it doesn’t provide a full traditional banking experience.

Revolut is a licensed financial institution in many countries but not a bank.

They hold your funds in segregated accounts, and their app offers security features like PIN and fingerprint login.

While generally considered trustworthy, there have been account closures due to suspicious activity, so be mindful of their terms of service.

Revolut and Monzo are popular digital banking options but cater to slightly different needs.

Revolut shines for travelers with its multi-currency features and fee-free spending abroad. Monzo might be better for everyday banking in your home country, with features like check deposits and overdrafts.

While convenient, Revolut doesn’t offer some traditional banking features like cash deposits or credit facilities.

Customer support experiences can vary, and there have been cases of account freezes due to strict anti-fraud measures.

Absolutely! Revolut is a favorite among travelers for its competitive currency exchange rates, fee-free ATM withdrawals (up to a limit), and multi-currency spending on your card. The app also allows easy international money transfers and budgeting tools to track travel expenses.

References: