Stocks and bonds slumped as investors speculated that more central bank speakers today will echo the hawkish message from Federal Reserve Chair Jerome Powell.

The Stoxx 600 shed one per cent, reinforced by poor earnings reports. Diageo Plc plunged 16 per cent after the U.K. distiller cut its profit outlook and Richemont lost 6.8 per cent as revenue from luxury watches unexpectedly fell. Energy shares rose along with oil, with West Texas Intermediate climbing back above US$76 a barrel.

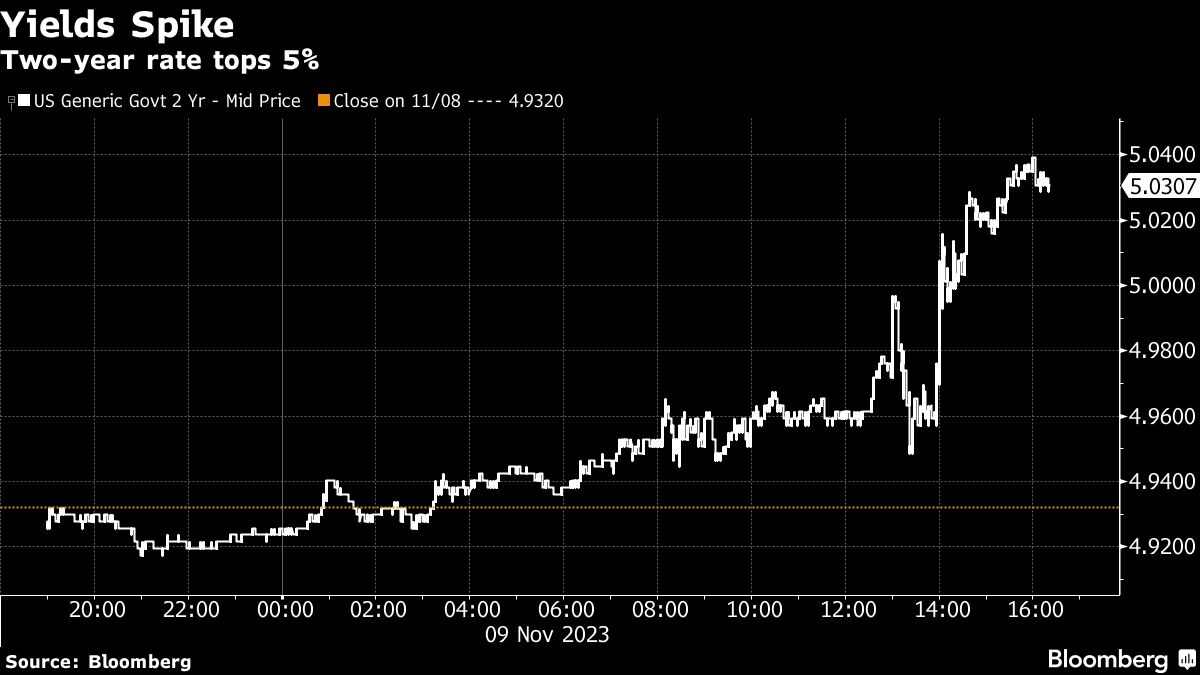

Bonds were broadly weaker. The two-year Treasury yield held above five per cent and the rate on 10-year German bunds added nine basis points.

Investors are now waiting to hear from European Central Bank President Christine Lagarde, who will participate in a fireside chat later on Thursday. Comments are also due from from Dallas Fed President Lorie Logan, her Atlanta counterpart Raphael Bostic and San Francisco Fed’s Mary Daly. Markets were rattled yesterday after Powell said officials won’t hesitate to tighten if needed.

“Powell’s speech was a sort of a talk-tough moment as central banks have to convince the market there will be no pivot coming tomorrow morning,” said Erick Muller, head of product and investment strategy at Muzinich & Co. in London. “Each time they see markets pricing too many rate cuts, you will hear this kind of speech saying, ‘stop right there’.”

In US premarket trading, digital advertising firm Trade Desk Inc. slumped 27 per cent after issuing a weak sales guidance, which it blamed on broader economic pressures. Shopping website Groupon Inc. tumbled 37 per cent after announcing a poor third-quarter result and an equity offering.

Nasdaq 100 index futures slipped 0.2 per cent, signaling the tech benchmark will extend yesterday’s 0.8 per cent retreat.

In commodities, gold dropped 0.3 per cent. The metal is set for a second weekly drop after fears eased that the Israel-Hamas conflict will broaden into a region-wide war.

Key events this week:

- ECB President Christine Lagarde participates in fireside chat, Friday

- U.S. University of Michigan consumer sentiment, Friday

- Dallas Fed President Lorie Logan and her Atlanta counterpart Raphael Bostic speak, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures fell 0.1 per cent as of 6:52 a.m. New York time

- Nasdaq 100 futures fell 0.2 per cent

- Futures on the Dow Jones Industrial Average were little changed

- The Stoxx Europe 600 fell 1.2 per cent

- The MSCI World index fell 0.4 per cent

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro was little changed at US$1.0677

- The British pound fell 0.1 per cent to US$1.2208

- The Japanese yen was little changed at 151.47 per dollar

Cryptocurrencies

- Bitcoin rose 1.4 per cent to US$37,059.25

- Ether rose 2.2 per cent to US$2,103.6

Bonds

- The yield on 10-year Treasuries advanced two basis points to 4.64 per cent

- Germany’s 10-year yield advanced nine basis points to 2.74 per cent

- Britain’s 10-year yield advanced seven basis points to 4.34 per cent

Commodities

- West Texas Intermediate crude rose 1.4 per cent to US$76.63 a barrel

- Spot gold fell 0.6 per cent to US$1,947.69 an ounce