Several US banks added to their provisions for credit losses in the third quarter amid concerns about a potential slippage of credit quality from pristine levels.

Of the 50 banks that reported third-quarter earnings as of Oct. 20, half logged higher provisions quarter over quarter and more than half increased their provisions year over year, according to an S&P Global Market Intelligence analysis. Also, the majority of the 50 banks booked quarter-over-quarter and year-over-year increases in their net charge-offs.

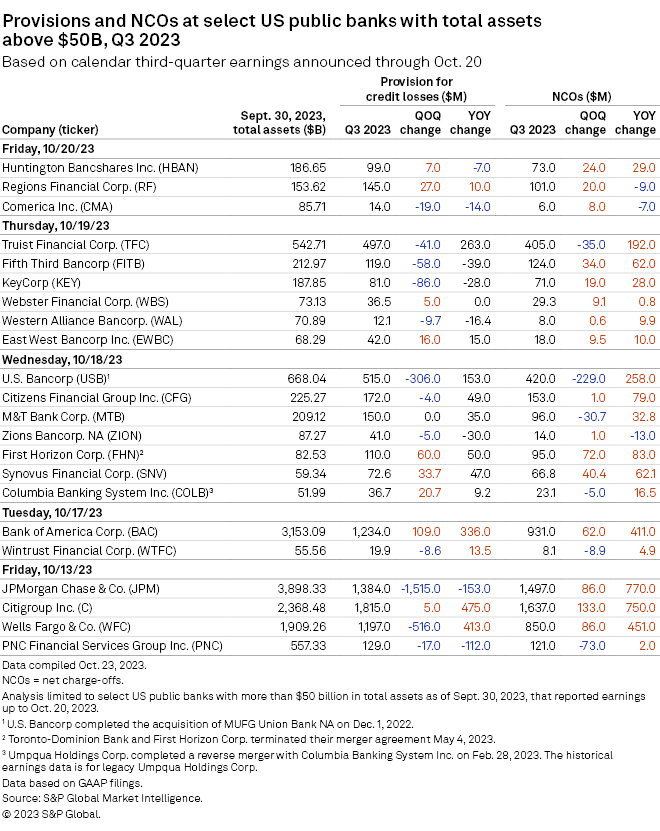

At $50 billion-plus banks

Among the banks with more than $50 billion in assets, Citigroup Inc. reported the highest provision at $1.82 billion, up 0.3% from the previous quarter and 35.4% from a year ago. The company’s cost of credit rose 35% year over year mainly due to continued normalization in net credit losses and volume growth in cards in Personal Banking & Wealth Management.

Citi is well reserved for the current environment, with more than $20 billion of total reserves, CFO Mark Mason said on the company’s third-quarter earnings call.

“While the macro and geopolitical environment remains uncertain, we feel very good about our asset quality, exposures and reserve levels, and we continuously review and stress the portfolio under a range of scenarios,” Mason said.

JPMorgan Chase & Co.’s provision was $1.38 billion, a decline of 52.3% quarter over quarter and 10.0% year over year. When asked about where he is seeing softness in credit, CFO Jeremy Barnum said, “Actually nowhere, roughly, or certainly nowhere that’s not expected.”

“[W]e continue to see the normalization story play out in consumer more or less exactly as expected. And then, of course, we are seeing a trickle of charge-offs coming through the office space,” Barnum said on the company’s third-quarter earnings call.

Some of the banks in the group mentioned adding reserves for their commercial real estate portfolios, such as Salt Lake City-based Zions Bancorp. NA, which recognized $3 million in losses on two office loans in the Southern California market.

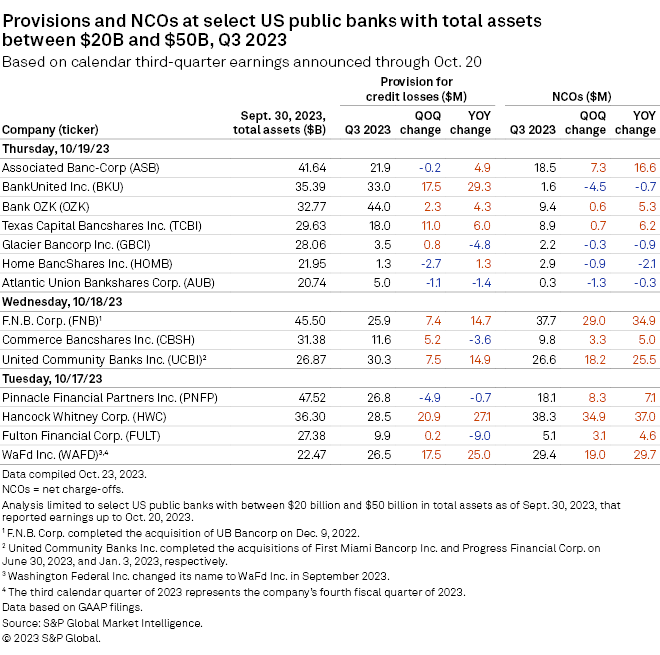

At $20 billion to $50 billion banks

Little Rock, Ark.-based Bank OZK booked a provision of $44.0 million, the highest provision among banks with assets between $20 billion and $50 billion. The bank’s third-quarter provision represented a 5.4% increase from the linked quarter and a 10.7% increase from the prior-year period.

Green Bay, Wis.-based Associated Banc-Corp’s provision was $21.9 million, down 0.7% sequentially but up 29.1% year over year. In the quarter, the company logged moderate increases in nonaccrual loans, delinquencies and charge-offs.

“We anticipated these shifts as a sign of normalization back to pre-pandemic levels as opposed to an indication of broader issues in the portfolio,” Associated Bank NA Chief Credit Officer Patrick Ahern said on Associated Banc-Corp’s third-quarter earnings call.

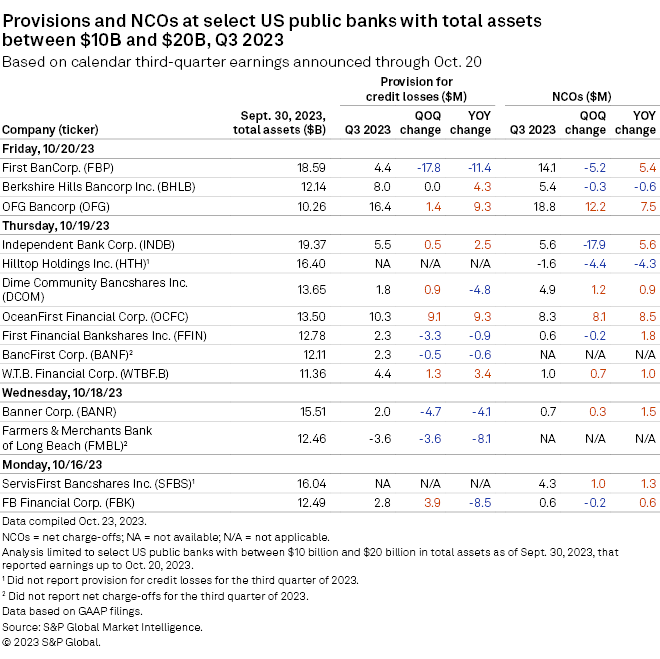

At $10 billion to $20 billion banks

Among banks with assets ranging from $10 billion to $20 billion, Puerto Rico-based OFG Bancorp reported the highest provision at $16.4 million, up 9.2% quarter over quarter and 130.8% year over year.

OceanFirst Financial Corp. logged the second-highest provision at $10.3 million, an increase of 736.7% sequentially and 912.1% year over year. The Red Bank, NJ-based company saw a spike in net charge-offs during the quarter largely due to an office CRE loan participation, though executives said they are not concerned about their overall portfolio.