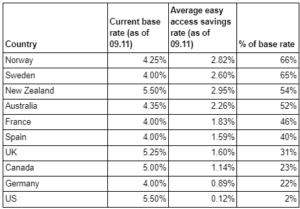

The interest rates offered on easy access savings accounts by some of the largest banks in the UK are significantly lower than in other European countries, despite the UK having a higher base rate.

The average interest rate offered by five of the UK’s biggest banks is just 1.6%. This is under a third (31%) of the current base rate, as set by the Bank of England, which was held at 5.25% on Thursday 2nd November.

The personal finance comparison site, finder.com, collaborated with the smart money app, Plum, to compare how easy access savings rates (or the closest equivalent) from large banks around the world compared with the local base rate.

They analysed easy access savings rates (or the local equivalent) in 10 countries around the world, finding that the UK’s average interest rates are the 4th lowest when compared to the local base rate.

The country that topped the list was Norway, where the average interest rate available is 2.82% – two-thirds (66%) of the country’s 4.25% base rate.

Another Scandinavian country, Sweden, came in second place with an average interest rate of 2.6%. Their base rate is 4%, making the average interest rate 65% of the base rate.

New Zealand, which has a comparatively high base rate of 5.5%, takes third place. The average interest rate from 5 of its largest banks is 2.95%, which is 54% of the base rate.

What countries have lower interest rates than the UK?

Despite having the joint-highest base rate of 5.5%, the USA came bottom of the interest rate comparison table. The average interest rate available from 5 of their largest banks is a miserly 0.12% – just 2% of the base rate.

Like France, Germany uses the ECB’s interest rate of 4%, yet only offers average interest rates of 0.89%, which is almost 5 times lower (22%) than the base rate and the second worst in the study.

Canada also comes out worse than the UK. Here, the average interest rate available is 1.1%, despite the base rate being almost 5 times higher at 5% (making the average rate 23% of the base rate).

Finder.com’s UK & US CEO, Jon Ostler, said: “There has been a growing number of organisations and politicians calling for the UK’s top banks to pass on higher interest rates to customers and this research will only add to this clamour. Even if the UK was towards the top of the global comparison table it wouldn’t be acceptable, however our banks are offering significantly lower interest rates vs the base rate than all but one of the European countries we looked at.

“As a consumer, there are a few things you can do to combat low interest. There are savings and investment platforms that offer much better savings rates on products that are regulated by the FCA. You can also take advantage of a range of generous switching offers from the big banks, which can help make up for the lower interest you will earn.”

Plum’s CEO and Founder, Victor Trokoudes, said: “While the UK’s big banks have been quick to increase interest rates on loans and mortgages, they have been far slower in boosting interest rates on savings accounts, effectively devaluing people’s hard-earned savings. The cost-of-living crisis shows little sign of abating, making it all the more disappointing that not only are many banks not sharing more of the base rate with customers, but they appear to be sharing less than their European counterparts.

“Borrowers are paying more while savers see minimal benefits, highlighting that the business models of the major banks are inherently misaligned with the interests of their customers. That’s why it’s so important that the public know that there are other options out there. We’ve recently launched Plum Interest which allows people to earn higher returns that are more closely aligned to the Bank of England base rate”.

For more detail on the joint research and the banks involved in the study between Finder and Plum, visit: https://www.finder.com/uk/global-savings-rates-uk-vs-the-world