- DIY investors can now invest in IPOs through Lloyds and PrimaryBid tie up

- But Lloyds says many still aren’t aware that they can do so

- We explain how it works, and whether it is a good time to back an IPO

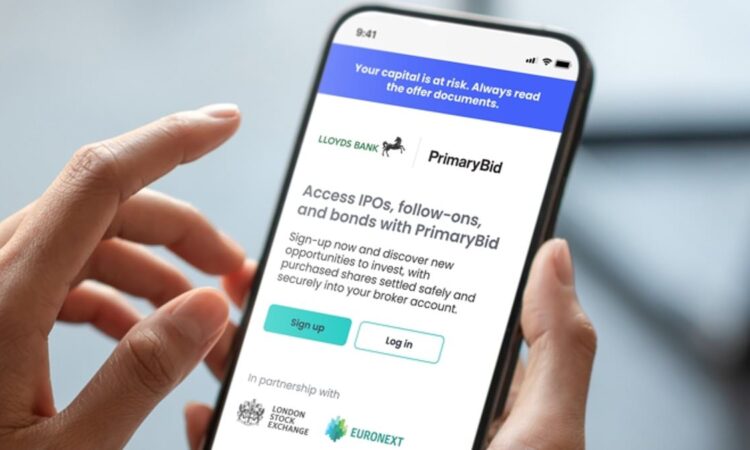

DIY investors will now be able to invest in company IPOs via Lloyds Bank.

The bank has partnered with tech firm PrimaryBid to allow retail customers to invest in IPOs, following the launch of its ‘ready-made investments’ service for Lloyds Bank, Halifax and Bank of Scotland customers.

Shares brought through PrimaryBid can be settled directly into customers’ Lloyds share dealing account.

Announcing the launch, Lloyds Bank said that DIY investors’ awareness of being able to invest in IPOs is still very low.

We look at whether it is a good time to back newly-listed firms, and how easy it is to do so.

Is now a good time to invest in IPOs?

Lloyds Bank says that on average ‘there are over 500 IPOs and follow-ons per year in the UK’.

But 2023 has been a very muted year for IPO activity in the UK.

Laith Khalaf, head of investment analysis at AJ Bell says: ‘This comes as no surprise given the weak economic backdrop, combined with the continued valuation premium that can be achieved by listing in the US.

‘Investors need to consider each IPO on its own merit, and be sure they are acting based on a sound investment case rather than getting carried away by hype.’

Related Articles

HOW THIS IS MONEY CAN HELP

Kit Atkinson, head of retail capital markets at Peel Hunt says: ‘2021 was a record-breaking year for IPOs but many companies that came to market during that period have suffered from falling prices which have made some investors wary of committing to companies lacking a track record on the public markets.’

The only notable UK IPO this year was for payments provider CAB Payments, which included a retail offer.

There have been other deals such as the re-IPO of Zegona Communications, but volumes are significantly down on previous high points.

As for upcoming IPOs in the coming one to two years, Atkinson says: ‘We are hopeful for a more active environment next year, as private equity portfolios age and their managers look to exit investment, interest rates stabilise and the cost of living crisis abates.

‘The familiar rumoured names are those of Revolut, Monzo, Starling Bank and Brewdog, however there can be no certainty that these deals will come to market.’

Lee Wild, head of equity strategy at interactive investor says: ‘At the moment, there are too many examples of bad IPOs (Deliveroo, Aston Marti, THG…). The tide will turn, but probably not until the uncertainty around interest rates and recession is resolved.’

Investing in IPOs can provide the opportunity to buy into shares at a discounted price, but they are not sure bets.

Investors should make sure they understand a company, its past performance, its plans for the future and the risks associated with an investment.

How easy is it to invest in IPOs?

If a company is making a retail offer as part of its IPO you should be able to invest through your chosen stockbroker or an investment platform such as Hargreaves Lansdown, Interactive Investor or AJ Bell.

There is also now the option to invest via banks through tie-ups like Lloyds’.

If you do invest via your broker, it is usually possible to invest through your Isa or Self Invested Personal Pension.

Khalaf says: ‘When IPOs are offered to retail investors it’s really easy for them to apply, and they can usually do so in a Sipp or Isa to protect future gains and dividends from tax.’

However, relatively few IPOs make it to sale to the general public because the investment banks who underwrite them tend to prefer to offer them to fund managers and institutional investors.

Khalaf adds: ‘Companies could be missing out on a trick here as a public IPO widens the shareholder register, and particularly for consumer-facing companies can create a buzz around the brand. Building shareholders and customers can go hand in hand.’

Atkinson says: ‘It should be relatively straight forward to invest in an IPO if the company has chosen to include a retail offer as part of the structure, this is not mandated so is at the discretion of the IPO-ing company and their advisers.’

‘Companies with strong brands or a significant public profile would be most likely to incorporate a retail offer but it is increasingly common for non-consumer facing issuers to provide a route for individual investors to participate.’

There are several regulatory changes under consideration at present which should improve the availability of company fundraises, both IPOs and follow-on offerings, to retail investors.

The Prospectus Regime Review and the Secondary Capital Raising Review advocated for changes to the public offering process to broaden access.

What about fees?

Customers who invest in IPOs with Lloyds Bank invest at the same price as institutional investors – with no additional fees and no stamp duty – as this is not levied on primary markets deals.

Where a platform, like AJ Bell for example, is appointed as an intermediary – a commission will be paid to them by the company or their appointed agents and in that case their normal dealing charge will not apply.

Khalaf says: ‘Usually private investors get access to IPOs through an intermediary offer, where a broker normally receives commission from the issuing company, which means investors don’t have to pay the standard rates of broking commission on buying or selling shares.

‘They also don’t pay stamp duty so there is a saving versus buying on the secondary market. Once they hold the shares then standard platform charges will apply.’

Your broker will tell you what fees they are charging on any transaction and investors should check their website or terms of business.

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.