Klarna has introduced open banking-powered settlements in the UK, enabling consumers to pay directly from their bank accounts instead of using debit cards.

This move marks a significant shift in the global payments and shopping solutions provider’s ambition to create a future-oriented payments network. Open banking settlements simplify and secure transactions for consumers while providing insights into spending habits.

Established in 2005, Klarna has focused on accelerating commerce and now boasts more than 150 million active users worldwide and facilitates 2.5 million transactions daily.

Open banking settlements have been introduced for Klarna’s Pay Now instant payment option, with plans to extend this feature to Pay in 30 and Pay in 3 later in 2024. This launch is poised to significantly boost open banking adoption in the UK, where approximately five million Britons utilise open banking payments monthly.

Outside the UK, Pay Now by bank is already live in 10 countries around the world and is regularly used by over 20 million consumers each month.

Pay by bank

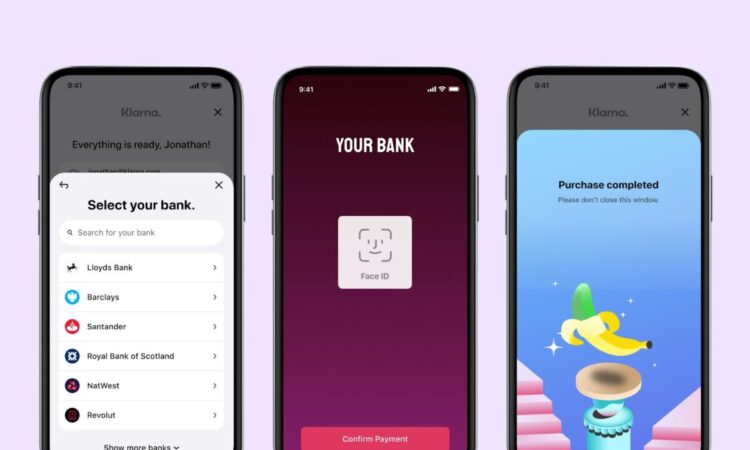

To complete a payment, consumers select ‘Pay by bank,’ redirecting them to their mobile banking app for a swift and secure transaction.

By linking their bank account to Klarna, consumers gain access to spending insights and budgeting tools within the Klarna app. Moreover, sharing bank data enables Klarna to make more informed lending decisions based on the consumer’s actual spending habits, ensuring a tailored fit with their budget.

Wilko Klaassen, VP, open banking at Klarna, said: “Open banking offers a huge opportunity for Klarna to reduce the cost of payments to society by cutting out the established card payment networks, and using up-to-date bank account data to make ever better lending decisions. This new launch builds on the success we have seen in 10 countries across Europe and will give UK open banking a major boost.”