Mr Healy will next month head to Europe in a bid to woo new investors to the business. The Judo management team toured Japan and London in May to meet other investors.

He admits he is frustrated with the weakness in the share price, and hopes a more long-term focus can help arrest the slide. “We are going to talk to other large institutions who are familiar with the challenger banks and talk to them about the attractiveness of Judo,” Mr Healy said.

Analysts remain bullish

Bain Capital – also behind IPO-hopeful Virgin Australia – owns about 9 per cent of Judo. Singaporean sovereign wealth fund GIC owns 7 per cent, while fund management firms Fidelity and ECP both hold about 5 per cent each. Mr Healy said the support of these big backers was “refreshing”.

Judo also counted UniSuper among its backers, but the superannuation giant sold 85 per cent of its shares in May. UniSuper declined to comment. Mr Healy declined to comment on the specific reason for the sell-down, but said he was “not concerned about their underlying reason for exiting Judo”.

Judo is performing relatively well. While it is yet to deliver a return on equity above the cost of capital, the company has increased its cash tax profits to $74.3 million and reduced its cost to income ratio by over 20 per cent.

The analyst consensus is still a buy. “We think if Judo can meet its target of low-to-mid teens ROE then at that stage it should trade at a price to book value at or above 1 times,” Morgans analyst Nathan Lead said.

“At current prices, this should generate double-digit annualised returns,” Mr Lead said.

However, he pointed to “unease over [Judo’s] full exposure to the SME lending market in the context of cash rate increases” which, when combined with the limited guidance Judo provided at its full-year results, had unsettled the market.

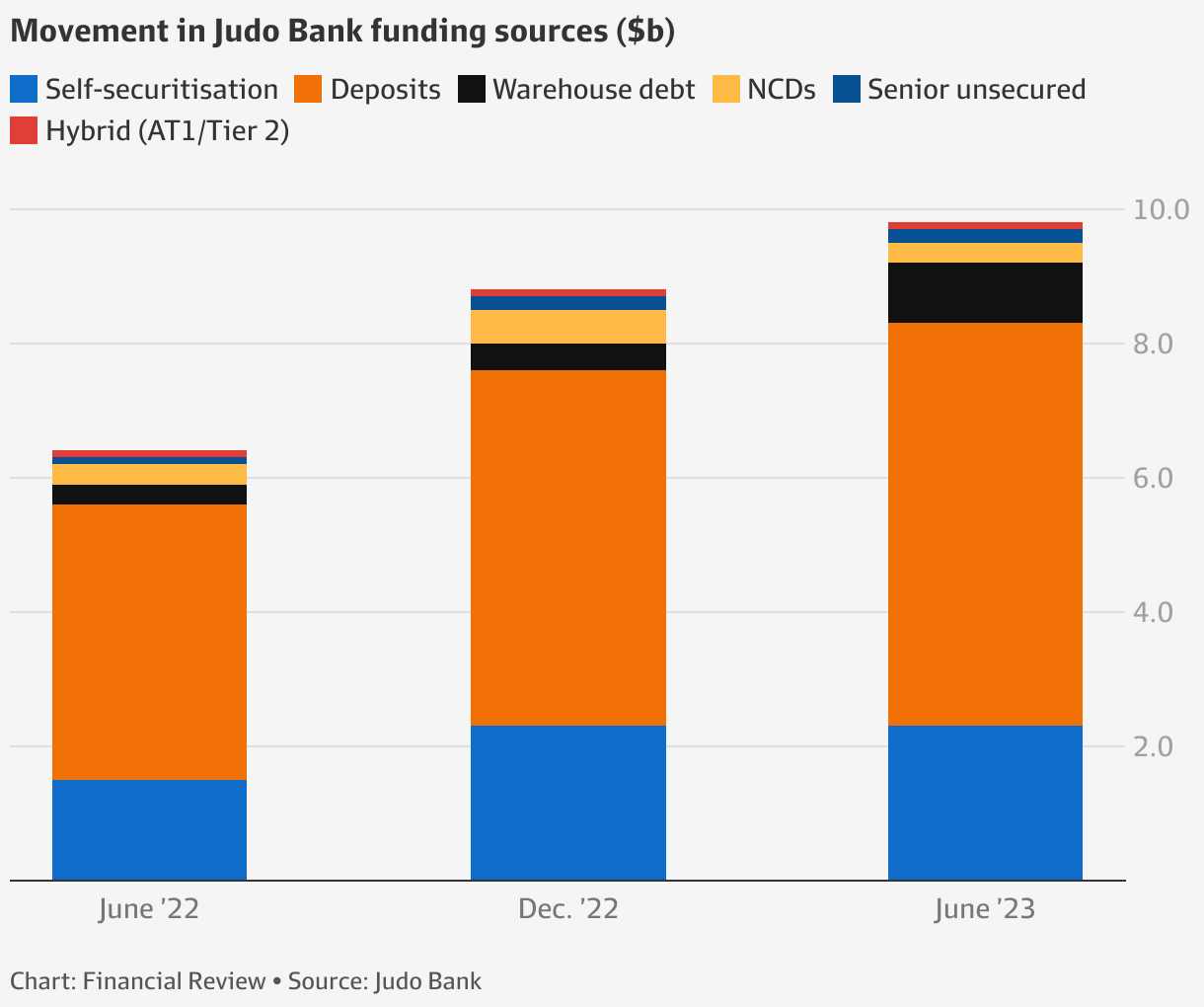

Investors and watchers point to myriad reasons for this, ranging from an overambitious valuation on listing to poor communication. The elephant in the room is the $2.8 billion of ultra-cheap funding from the Reserve Bank that Judo will have to refinance before the end of June with more expensive deposits and warehouse funding deals, crunching margins.

Judo’s net interest margin in the 2023 financial year was 3.29 per cent, but it has not yet fully quantified the hit this will take from its refinancing activity.

Mr Healy said he was taken off guard by the market’s reaction to the bank’s disclosures over its refinancing of the RBA’s term funding facility, believing Judo had always made clear that 2024 was a “transitional year”.

“We felt the market knew what TFF we had,” he said.

“We have always said that we are transitioning, and we will get net interest margins back above 3 per cent. We have a lot more flexibility on how we place risk and how we can pass on higher funding costs as well.”

First hybrid bond

Mr Healy also argued that the company’s $2.5 billion valuation at IPO was appropriate, and based on work by joint lead managers Barrenjoey, Citi, Credit Suisse and Goldman Sachs.

He told investors this week that the bank had enough committed funding to repay the RBA funding “at will”. He did not provide fuller guidance for the 2024 financial year at the annual meeting, but argued this was because of legal constraints as Judo launched its first hybrid bond deal during the week.

“We have guidance on our longer-term scale metrics,” he said. “I can’t think of how clearer we could have been.”

The company aims to have a return on equity in the low-to-mid teens, a cost-to-income ratio around 30 per cent, and a net interest margin greater than 3 per cent when it reaches full scale around financial year 2026.

“Our business is absolutely the same as before the price correction,” he said.

Despite his frustration, Mr Healy remains confident in the business. Asked if there was a route back to $2.10 for Judo, he was emphatic. “Yes – absolutely. Well above that,” he said.