Joe Biden is pushing to secure international support to expand the World Bank’s lending capacity, as Washington comes under intense pressure to fund the fight against climate change and offer a viable alternative to China’s economic influence.

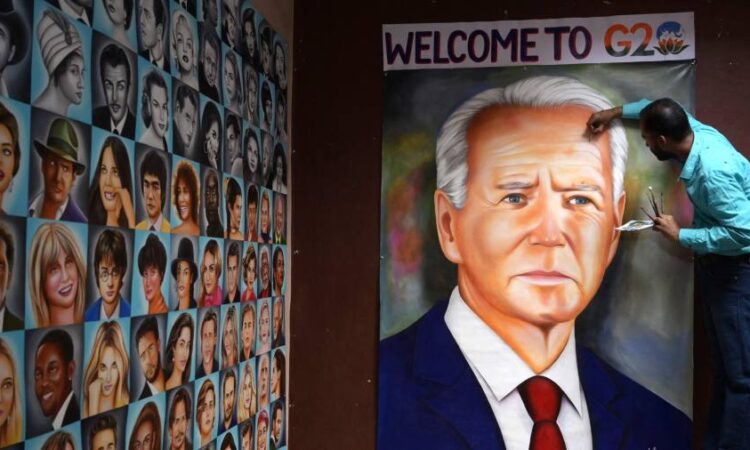

The US president and top officials in his administration have placed efforts to enhance the financial firepower of the multilateral lender at the top of the agenda at the G20 leaders’ summit due in New Delhi this weekend.

The US plan would enlarge the World Bank’s lending capacity for middle-income and low-income countries by $25bn, US administration officials have said. That figure could increase sharply, to more than $100bn, if other nations make similar pledges, which is Washington’s goal starting at the G20 and in the coming weeks.

“We’re working to make sure other partners follow our lead,” Jake Sullivan, the US national security adviser, told reporters this week.

While the backing of other nations — and the US Congress — is far from guaranteed, the need for the Biden Administration to counter Beijing’s efforts to broaden its economic alliances around the world is becoming more urgent.

The recent Brics summit in South Africa, as well as a perception in some countries that Washington has been disproportionately helping Ukraine at the expense of other needy nations, have raised the issue of development finance higher on the US agenda.

Meanwhile, emerging economies have been struggling to cope with rising interest rates, high energy prices and mounting costs associated with climate change. That has left them clamouring for financing on better terms.

“It’s not just a question of responding to China, it’s a question of addressing long-standing global challenges,” Janet Yellen, the US treasury secretary, told reporters on Friday in New Delhi. “We are hopeful that other countries, depending on their financial capacity, will join us and we can scale that up.”

Sullivan has insisted the plan to increase the World Bank’s coffers was not “against China”. But he has also said it was “critical” for countries to have alternatives to Beijing’s Belt and Road Initiative, which has lent on opaque terms.

The White House has said countries such as Colombia, Peru, Jordan, India, Indonesia, Morocco, Nigeria, Kenya, and Vietnam might all benefit from more lending from the World Bank.

The Indian presidency of the G20 has embraced the plan.

“What India has done is to bring in the concerns and priorities of the global south and to try and move them beyond standard approaches to address the real issues,” said V Anantha Nageswaran, Modi’s chief economic adviser. “For multilateral development banks, for example, we cannot wish away the 800 pound elephant in the room: the financing capability of these institutions.”

Part of India’s mission in the finance track negotiations, Nageswaran said, was “to strengthen multinational development banks by confronting the core issues, not ducking them”.

The plan is set to be reflected in the final communique, according to a draft seen by the Financial Times. The document, due out on Sunday, states that the group is “working to deliver better and more effective MDBs [multilateral development banks] with increased lending capacity, improved responsiveness and accessibility, and enhanced operating models”.

But it is not certain how many, if any, specific pledges the Biden administration will secure alongside its own, either at the G20 or at the forthcoming World Bank and IMF annual meetings in Morocco next month.

In addition, the US will need congressional approval for its own tranche of the extra World Bank funding, which could be a hard sell with Republicans in control of Congress. The White House has formally asked lawmakers to provide $2.25bn to the World Bank, which with leverage would allow for the $25bn expansion in lending.

European officials said that while there was broad support among EU member states for increasing the World Bank’s funding, there was no consensus on the amount, the timing, and whether it would come hand-in-hand with a long-discussed reform of the bank’s governance.

Climate Capital

Where climate change meets business, markets and politics. Explore the FT’s coverage here.

Are you curious about the FT’s environmental sustainability commitments? Find out more about our science-based targets here

For the EU, reform is the more pressing priority. Its council president Charles Michel is preparing to use the UN general assembly later this month to push for widespread support on an adjustment to the way multilateral development banks are run.

The adjustment would increase the voice of global south countries in institutions that have historically been dominated by US and EU officials, said two people with knowledge of the plans.

“The fundamental point . . . is the question of international financial governance,” said one senior EU official who spoke of “fragilities” around developing countries’ trust in the existing frameworks.

“The plan is to be inclusive. There is a sincere and legitimate impression in a big part of the world that they are not part of these decisions,” said the official, who is involved in G20 preparations. “There is a problem with the Bretton Woods institutions and there is a need to reform these institutions.”

However, the US — as the largest shareholder in the IMF and the World Bank, effectively giving it veto power on major decisions — is expected to be very cautious about reform that would increase the voting power and influence of China.

In addition to the push for more World Bank lending, Biden has also asked Congress to bolster the IMF’s preferential fund to help low-income countries so it can expand its lending by $21bn.

Biden is also expected to ask G20 countries to provide “meaningful debt relief” for struggling economies between now and the IMF and World Bank meetings. That would require the co-operation of China, the largest bilateral creditor to many distressed states.

China’s president Xi Jinping will not attend the G20 summit, sending his deputy and Beijing’s head of economic policy Li Qiang in his place.

Wang Yiwei, a professor at Renmin University, said there were doubts over what this year’s conference could achieve, with many of the attendees distracted by domestic issues. “Even if Xi did go, he would not have so many important decisions to make,” Wang said. “The interest of many leaders will be inward on their election campaigns.”

A revamped World Bank may still not be sufficient for the US to shift the balance of economic power in the developing world.

“China is a very big fish,” said Karen Mathiasen, a former US Treasury official and now a project director at the Center for Global Development. “The demand for financing is so in excess of what the MDBs are providing.”

Additional reporting by Joe Leahy in Beijing