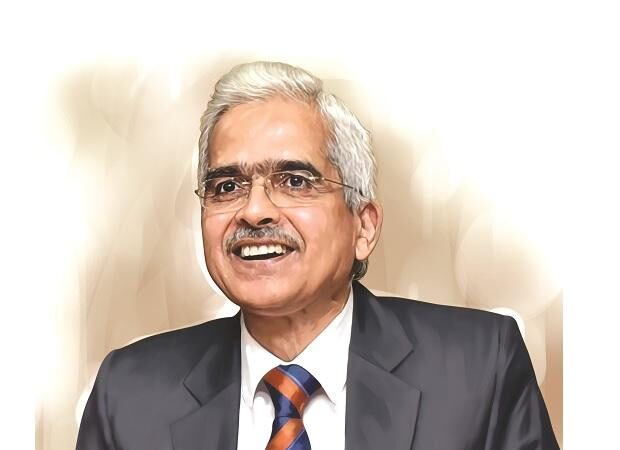

Reserve Bank Governor Shaktikanta Das on Saturday exuded confidence that India will continue to be the fastest growing major economy with a likely growth rate of 7 per cent in 2022-23 on the back of strong macroeconomic fundamentals and financial sector stability.

Speaking at the HT Leadership Summit 2022, Das emphasised that the country’s economy remains resilient, supported by the banking and non-banking sectors.

Das said the entire world has withstood multiple shocks. “I call it triple shocks of COVID-19 pandemic, then the war in Ukraine, and now the financial market turmoil.”

The Governor said the financial market turmoil is mainly emanating from the synchronised monetary policy tightening across the world by central banks, especially those in advanced countries, led by the US Fed, and the spillovers are being felt by the emerging market economies, including India.

He further said in this kind of successive turmoils, European Union is facing a recession situation, but there are possibilities that it will avoid that. The US is holding stable, but there are other countries where the growth has slowed down.

“So far as India is concerned, economy, overall macroeconomic fundamentals, the financial sector stability, all these aspects remain resilient. The banking sector that is the financial sector is stable because of all the parameters with regard to banking or the non-banking lenders or the other major financial sector players,” he said.

The growth numbers are looking good in the current context, he noted.

“Our estimate is that India will grow by about 7 per cent. The IMF has projected that India will grow by about 6.8 per cent in the current year. And that puts India among the fastest growing major economies in the world,” he said.

Das, however, added that India has a major challenge with regard to inflation.

Retail inflation in September increased to 7.4 per cent from 7 per cent in August on higher food and energy costs.

“We expect the October number which will be released on Monday… to be lower than 7 per cent. So therefore, inflation is… a matter of concern with which we are now dealing and dealing effectively,” he said.

The Governor also said India is taking over the presidency of the G20 at a time which is perhaps the most challenging year in modern times.

India is assuming Presidency of G20 with stronger macroeconomic fundamentals compared to many other countries, Das said.

Referring to observations made in certain quarters that the RBI is using the forex reserves indiscriminately, Das said “it’s not so”. The reserves are being accumulated for ‘rainy days’, he added.

“And when it rains, I have said it earlier also, you have to pick up your umbrella and use it. We didn’t pick up reserves just to keep it as a showpiece in the Reserve Bank of India. And even at this point of time, our reserves are very comfortable,” he said.

India’s foreign exchange reserves dropped by USD 1.087 billion to stand at USD 529.994 billion for the week ended November 4 on a sharp decline in the gold reserves.

In October 2021, the country’s forex kitty had reached an all-time high of USD 645 billion.

(Only the headline and picture of this report may have been reworked by the Business Standard staff; the rest of the content is auto-generated from a syndicated feed.)