Published as part of Financial Stability Review, November 2019.

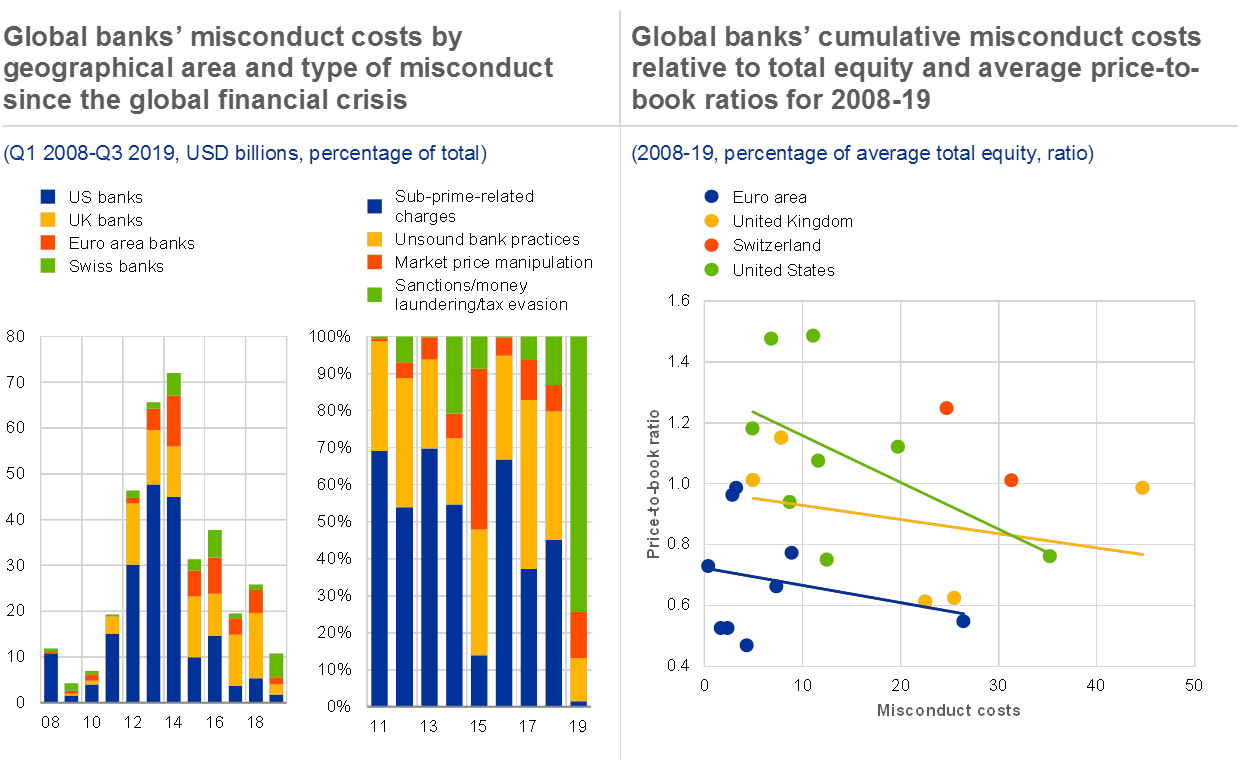

Past misconduct by banks has weighed on global bank profitability and equity positions over the last decade, with the related costs amounting to over USD 350 billion or 15% of total bank equity. While US banks were particularly hit by misconduct costs in the immediate aftermath of the global financial crisis, European banks have been more exposed since 2015 (see Chart A, left panel). In terms of the underlying misconduct, charges related to sub-prime lending predominate, but misconduct costs related to sanction violations, money laundering and tax evasion have picked up more recently (see Chart A, left panel). Euro area banks’ net income could have been one-third higher over the same period without these misconduct costs, potentially helping strengthen capital buffers, if earnings were retained.

Misconduct costs may also affect bank stock returns and market valuations. They do this both directly, via adverse reputational effects, and indirectly, through heightened provisioning needs, higher compliance costs and, thus, lower profit expectations.[1] This relationship appears to hold within individual countries, signalling that investors discriminate based on misconduct costs after controlling for common macro-financial factors (see Chart A, right panel).

Chart A

European banks’ balance sheets and equity valuations have been more affected by misconduct costs in recent years than those of their US peers

Sources: Authors’ compilation based on publicly available information from regulatory, bank and law firm notices and Bloomberg.Notes: Left panel: Misconduct costs comprise damages, fines, settlements and litigation costs above USD 1 million for a sample of 26 global banks headquartered in the United States (8), the United Kingdom (5), Switzerland (2) and the euro area (11). Sub-prime-related charges cover misconduct costs related to the issuance, structuring, marketing and sale of residential mortgage-backed securities and collateralised debt obligations, and to the underwriting, origination and servicing of mortgage loans. Unsound bank practices include the mis-selling of payment protection insurance, disclosure, reporting and compliance failures, as well as investment advice failings. Market price manipulation comprises fraudulent behaviour in interest rate, foreign exchange, swap, gold and silver price fixing. Sanctions, money laundering and tax evasion reflect the failure to comply with international sanctions, anti-money laundering failures and banks’ involvement in or assistance of tax evasion.

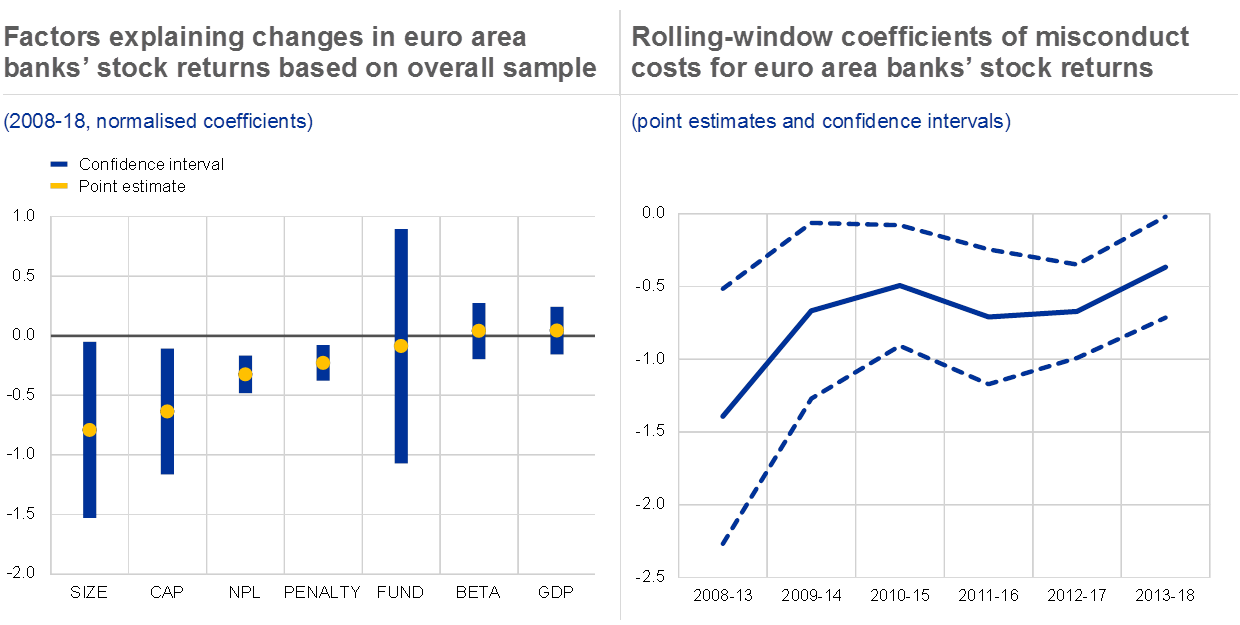

Analysis of a unique dataset of major global banks’ misconduct costs indicates that financial penalties have a large impact on euro area banks’ expected equity returns. Eight euro area banks included in the sample, of which seven are classified as global systemically important banks, were affected by misconduct costs between January 2008 and September 2019. The data contain information on all fines with a minimum threshold of USD 100 million and their settlement date, with the rationale being that higher fines are more likely to trigger stock market reactions than smaller ones. Both full-sample and rolling-window panel regressions are employed to estimate the impact of misconduct costs on euro area bank equity returns, controlling for other bank-specific factors.[2] In the overall sample, standardised coefficients indicate that a one standard deviation increase in misconduct costs is associated with a 0.2 standard deviation drop in equity returns. The impact of misconduct costs on stock returns has been comparable to that of NPL stocks, while being markedly lower than that of bank size and leverage (see Chart B, left panel). A rolling-window regression indicates that the relationship between misconduct costs and stock returns was stronger during the crisis than in the following years (see Chart B, right panel). Even though time fixed effects remove at least parts of the impact of business cycle dynamics, the larger coefficient at the beginning of the sample likely indicates that investors are more concerned about penalties during times of stress.

Chart B

Euro area bank stock returns appear to be sensitive to misconduct costs, while also being driven by other bank-specific variables

Sources: Bloomberg and authors’ calculations.Notes: Left panel: All variables are standardised before running the regression to make results comparable across variables. The independent variables are: (1) PENALTY: total financial penalties relative to total assets; (2) CAP: equity/total assets; (3) SIZE: log of total assets; (4) NPL: non-performing loans/total loans; (5) FUND: deposits/total funding; (6) BETA: banks’ equity beta from a market model of monthly returns, where the market is represented by the local market index; and (7) GDP: year-on-year real GDP growth. The panel regression also includes additional controls such as bank profitability, the price-to-book ratio, operating expenses and risk-weighted assets. Right panel: The coefficients are based on a six-year rolling-window panel regression with bank-specific control variables, and bank and time fixed effects. Heteroscedasticity-robust standard errors are computed. Solid lines represent coefficient estimates, while dashed lines indicate the 90% confidence intervals.

As past misconduct cases are uncovered, conduct redress may put further pressure on euro area bank valuations. This highlights the importance of implementing good governance practices and sound internal controls, the monitoring of which has been a top priority of the Single Supervisory Mechanism in recent years. Swift investigation and closure of misconduct cases could help dispel at least part of the uncertainty surrounding euro area bank profitability prospects and keep reputational damage associated with misconduct costs in check. Regulators and supervisors should monitor banks to ensure that they adopt behaviours and internal practices with the aim of limiting the potential for misconduct.