This is the last instalment in a three-part series examining how new European Union rules affecting artificial intelligence will affect development and the use of AI and what this means for the private banking and wealth management community.

This is the last instalment in a three-part series examining

how EU legislation affects the world of AI. (See parts one

and two.)

Artificial intelligence (AI) continues to be the focus of

increasing public attention; board members at wealth management

firms and financial institutions around the world need to take AI

technologies seriously. This article – from compliance,

regulatory, and legal experts – includes discussions on

AI’s impact on financial services and wealth management firms,

what firms in the industry can do, and suggests a potential path

forward. In light of recent stories and euphoria concerning AI

and its reported capability to drive the biggest labour market

shift since the industrial revolution, we are writing three

articles on the topic from personnel at CMS Law (Charles

Kerrigan and Isabel Neelands) and AI &

Partners (Sean Musch and Michael Charles

Borrelli).

AI is a topic of such significance that it needs thorough

consideration. Readers are aware that we have to provide

actionable ideas as to what the problems are, and suggestions

about how to deal with them.

(The editors are pleased to share this content, and invite

feedback. As ever, any views of outside contributors are subject

to editorial disclaimers. We invite debate and feedback, so

please email tom.burroughes@wealthbriefing.com.

)

AI has global implications, requiring robust

safeguards

Reduced concern of unilateral regulatory

consolidation

The European Commission’s proposed Harmonised Rules on Artificial

Intelligence (the EU AI Act) aspires to establish the first

comprehensive regulatory scheme for artificial intelligence, but

its impact is felt beyond the EU’s borders. Indeed some EU

policymakers believe it is a critical goal of the EU AI Act to be

the first to set a worldwide standard on AI regulation, to the

extent that some refer to a “race to regulate AI” (1). This

framing implies that there is both value in regulating AI

systems, and that being among the first major governments to do

so will have broad global impact to the benefit of the EU

– often referred to as the “Brussels Effect.”

However, while some components of the EU AI Act will have

profound effects on global markets, Europe by itself will not be

setting a comprehensive new international standard for AI.

Firms with cross-border operations need to take

note

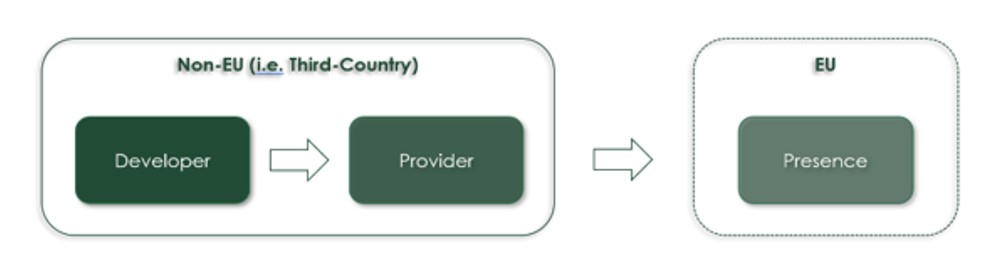

The EU AI Act will affect non-EU businesses even if they do not

have a legal presence in the EU. The global scope is due to the

European Commission’s heightened concern about the possibility

for harm embedded in AI systems and its potential impact on the

fundamental rights, safety, security, and freedoms of

individuals.

While multinational AI providers may be glad to have one set of

rules, the extraterritorial scope will raise potential compliance

challenges, particularly for providers of high-risk AI systems

established outside of the EU who may not be aware of or able to

determine where the outputs of their AI systems are used (see

Figure 1).

It is possible that output of the AI system will be used in the

EU by users of the AI system without the provider’s knowledge.

Figure 1: Extra-Territorial Application of the EU AI

Act

Lots of AI-fuelled exciting opportunities

exist

Ongoing compliance remains paramount

The key takeaway from our exploration of the EU AI Act”s

implications is the importance of proactive measures. Firms, as

always, must diligently assess their AI systems and processes,

ensuring full alignment with the EU AI Act’s guidelines to

mitigate potential risks and liabilities.

Moreover, by prioritising compliance, they can safeguard their

reputation and enhance client confidence in an increasingly

AI-driven landscape.

Power of partnerships

Navigating the complexities of AI regulation calls for

collaboration and expertise. Partnerships with AI compliance

specialists provide organisations with access to deep knowledge

and experience in AI compliance. Use of AI compliance specialists

can be seen as a strategic move, providing invaluable reassurance

in an increasingly complex business world. By leveraging the

expertise of trusted advisors, firms can navigate AI regulation

successfully, empowering them to make the most of AI’s

transformative capabilities.

Proceed with caution, with an innovation-first

mindset

As we look forward, the potential of AI across industries is both

thrilling and promising. Under the regulatory framework provided

by the EU AI Act, the global economy is primed to embrace AI

responsibly, ensuring transparency, fairness, and

accountability.

Organisations will be empowered to make well-informed,

data-driven decisions, driving enhanced client experiences, and

delivering tailored solutions that cater to individual needs and

aspirations. We can all agree that the future of AI is built on a

foundation of compliance, collaboration, and responsibility. By

proactively embracing the EU AI Act, businesses can unlock the

true potential of AI, redefining the landscape and elevating the

industry to new heights of success.

Footnote:

1,

https://www.fca.org.uk/insight/ai-transparency-financial-services-why-what-who-and-when