I was de-banked… just like Nigel Farage! Landlord left ‘incandescent’ with rage after Barclays closes family business account ‘with no warning’

A retired accountant was left ‘incandescent’ with rage after a bank shut down his family business account after 85 years.

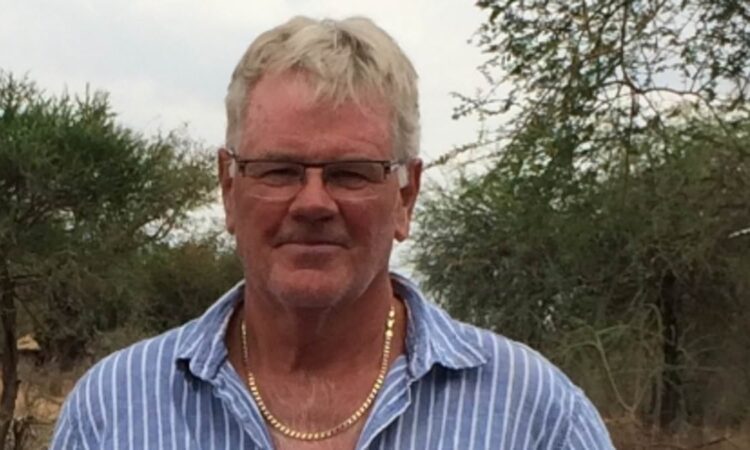

Clive Sparks, 73, was furious when his family property letting business was thrown into ‘chaos’ after Barclays suddenly ‘de-banked him’ – and announced it was to close the account.

Despite a flurry of phone calls and form-filling Barclays shut the account after just 14 days.

The move left his firm struggling to pay builders and provide a means for tenants to pay their rent.

Mr Sparks, of Seaford, East Sussex has condemned a culture of cost-cutting in banking and demanded an explanation from the bank.

His plight follows that of politician and I’m A Celeb star Nigel Farage who found himself at the centre of his own ‘de-banking scandal’ in July this year.

The former UKIP leader was sent an email from Coutts bank informing him his account would be closed, with no explanation provided.

‘It’s a disgrace,’ Mr Sparks said. ‘My family firm has banked with Barclays for 85 years so to shut down the account without an explanation or any proper notice is just crazy. I just don’t know why they did it.

‘My sister, Judy, and I were furious as it left a lot of people in the lurch, and we had to try and sort out a lot of problems as a result.

‘Everything was in chaos. In the end I was forced to open a business account with an online bank just so we could sort things out.’

His family firm, Allan & Attwood Ltd, has traded since 1938 using Barclays for all their banking needs. It was founded by Mr Sparks’ great aunt and passed down to him and his sister Judy.

The company manages a small property portfolio in Plymouth and Birmingham which it rents out to tenants.

The first inclination that something was amiss came when his sister had a call from a property agency saying they could not pay rental income from their tenants into their business account.

When Mr Sparks called the bank to find out why he was told he needed to fill in some new documents.

But then in September the bank wrote to say it was going to close the account in a fortnight.

Mr Sparks immediately called them and, after being passed from department to department, he was told there was nothing wrong with the account and it was a mystery as to why it was being shut down.

‘No-one could explain what the problem was and why they suddenly felt impelled to close the account.

‘When I told them I needed access to the £7,000 that was in the account Barclays told me they’d send me a cheque to Allan & Attwood. I asked them what good that would be if I wasn’t able to put it into a bank account. I just can’t believe the idiocy.’

He said several of his colleagues has also experienced the sudden closure of their business accounts in recent months.

Mr Sparks said: ‘It’s endemic. There seems to be a huge number of people affected by this move among banks to shut down accounts they don’t like. It is very, very worrying.’

He said: ‘Ours is quite a small family business bringing in just £18,000 a year and I feel Barclays probably had a look at it and realised it wasn’t making them a huge amount of money and they decided to close it.

‘The new culture in banking – where everything is done online and all the banks are shutting – is so counter-productive. It doesn’t work properly and is not fit for purpose.

‘People need face-to-face contact so their personal financial circumstances can be properly understood. The decision-making and the software that banks now rely on doesn’t work.’

Mr Sparks and his sister have now been forced to set up an online business account with Monzo.

He has asked Barclays for a full explanation into why the account was just down and the bank has launched an inquiry.

He said: ‘They have told me they will look into it but it will take around eight-weeks to get an answer. I’m intrigued by what they’re going to say.’

After the Daily Mail contacted Barclays the bank telephoned Mr Sparks, apologised for closing the account and offered to reopen it, according to the businessman.

He said: ‘An exec told me the decision to close the account was automated but they couldn’t tell me why that was. I declined the offer to reopen the account.’

A spokesperson for Barclays said: ‘As part of our ongoing responsibility to help prevent financial crime, and to meet our regulatory obligations, we are required to keep up to date information regarding our customers’ accounts.

‘In this case, after 18 months of repeated attempts to contact the customer, including through online banking, email and post, we did not receive all of the necessary information relating to their Barclays Business account, leaving us no alternative but to close the account.

‘We fully understand the issues this can cause customers and we worked hard to avoid the last resort of account closure. As a gesture of goodwill we have offered to re-open their account to allow more time for the information to be shared, which has been declined.’