A money order works just like cash-you pay for it ahead of time and send it to whomever you need to pay.

That kind of commitment can cause stress, especially if the money order doesn’t ultimately end up where it’s supposed to go. Tracking orders, then, can give you peace of mind, or help you figure out what to do if your funds are lost, stolen or damaged.

What is a money order?

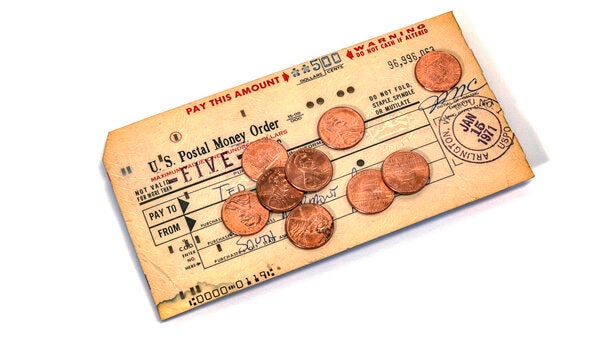

A money order “is another physical monetary instrument much like cash, checks or cashier’s checks,” said Kasey Ring, president of Upward Personal Finance. “It’s a piece of paper that acts like an exchange instrument for cash.”

It’s safer than cash because only the person to whom you send it is able to use it. It’s also typically less expensive than cashier’s checks.

How a money order works

You can go to several issuers to get a money order, including the United States Postal Service (USPS), most banks and credit unions, large retailers and stores including Western Union and MoneyGram.

No matter which outlet you choose, you’ll have to provide details about the recipient to ensure the payment gets to the right person and can be tracked. You’ll need to give their name and address, the payment amount, your name and address and what the payment is for.

The vendor will most likely charge a fee, which you pay for on top of whatever amount you’re sending. You can pay with cash or debit, but typically you can’t use a credit card to purchase a money order.

The fees themselves are typically nominal. For example, the USPS charges $1.75 for money orders up to $500, $2.40 for orders between $500.01 to $1,000 and only $0.60 for money orders issued by military facilities.

Limits on how much you can send in a money order depends on the vendor. You can send only up to $1,000 per order via USPS.

How does money order tracking work?

All vendors provide a receipt that will have the information you need to track a money order.

“Always copy or capture the image of your money order, and put a memo or reference line on them for your records and future references.” Said Ohan Kayikchyan, a certified financial planner and founder of Ohan the Money Doctor.

It also serves as proof of value in case the money order is lost, stolen or damaged.

Ways to track a money order

The main way to track your money order is through the provider. The company’s name will be on your receipt as the “issuer” and is typically your bank, USPS or a money-sending business. The provider isn’t a reseller or a third party, like a supermarket or convenience store.

All issuers have a customer service available and some offer online tracking through their websites or mobile apps.

A second way to track a money order is by tracking the physical package that contains it, such as the envelope or box in which you sent it. Most mail services offer tracking numbers as an option when you mail a package.

How can I track my money order?

1. Gather information

If you have your money order receipt, you’re good to go. Yet, if you lost the receipt, you may be able to file paperwork instead.

You’ll need information about exactly when and where you made the purchase and how much it was for. For example, Western Union has a Money Order Custom Request Form, but it’s not guaranteed and requires the original store receipt, up to eight weeks processing time and a $30 fee.

2. Contact the issuer

Depending on the issuer, call the customer service number, go online or log into the mobile app. Remember the issuer is not the reseller or the third party.

Here’s how to contact three of the most popular money order providers.

USPS

To track the status of your USPS money order, visit the USPS website and enter the following information, which can be found on your money order receipt:

- Serial number.

- Post Office number.

- Dollar amount.

Western Union

There are several ways to check the status of your money order with Western Union:

- You can call customer service at 1-800-325-6000.

- If you sent the money in the Western Union app or online, you can check the status on your account’s history page.

- If you purchased the money order in-store, you can visit the track-a-transfer page.

MoneyGram

Go online to check the money order status or call 1-800-926-9400. You’ll need your exact order amount, as well as the money order number that can be found on your receipt.

Get a refund or replacement (if necessary)

If a money order goes missing, whether it was lost or stolen, your ability to recover the funds will vary based on the vendor. You could file for a cancellation, refund or replacement. You’ll need to provide as much information as possible and you may have to pay a fee.

What if my money order goes missing?

Each provider handles a missing money order a bit differently.

USPS

As a sender, you can’t stop payment, but you can replace it. Be warned that this process takes time. It can take up to 30 days to confirm the loss of a money order, then up to 60 days to investigate it. Plus, it requires a $14.60 replacement fee.

As a receiver, if the money order arrives damaged, USPS will replace it for free. You just have to take the damaged money order and the receipt to your local Post Office to get a replacement.

Western Union

The Western Union website offers a self-service form that you can complete if your money order goes missing or you would like to request a refund.

This method will work as long as you have a scanned copy or photocopy of either the money order receipt or the money order itself, and you must also include a $15 non-refundable processing fee.

In the case that you don’t have the receipt, you can submit the Money Order Research Request form, along with a $30.00 processing fee.

MoneyGram

If your money order status says it’s eligible for replacement, you can submit the Money Order Replacement form online (mailed requests are not accepted). You must pay a processing fee of $18 and you can expect the process to take seven business days.

How to cancel a money order

If the vendor allows cancellation, contact them, provide the money order details and request a cancellation.

It’s usually possible to cancel only if it hasn’t been cashed, but, even then, you may not get a full refund. For example:

- USPS don’t allow you to stop payment of a money order. It can only be replaced if it’s lost or stolen.

- Western Union does offer the option to cancel a money order, which can be done via its website or app, in person at the issuing location or via telephone at 1-800-325-6000.

- MoneyGram also allows users to cancel a money order online or by telephone at 1-800-926-9400. However, if you decide to cancel the order more than one hour after it’s sent, you’ll still have to pay the associated fees.

Protecting yourself from money order fraud

While money orders are generally a safe way to send and receive funds, they are often used as part of bank scams.

- Don’t send money to anyone you haven’t met in person. Scammers often contact victims online to request money using money orders.

- Always keep your receipt. It serves as proof of purchase and is vital if you need to track, replace, or cancel your money order.

- Examine the paper. Check for any discoloration and ensure it includes security features like watermarks.

- Never accept a money order for more than the required amount. It’s often a sign of fraud.

Frequently asked questions (FAQs)

A money order refund is the return of the funds you used to purchase said money order. To get a refund, you must first cancel the money order. Note that cancellations are not allowed by all vendors. If the vendor allows cancellations, you will likely have to forfeit any associated fees and receive only the amount sent.

There is usually a small fee to send a money order. USPS charges $1.75 for money orders up to $500 and $2.40 for amounts between $500.01 to $1,000. Western Union and MoneyGram fees may vary based on the amount, the send method (online or in-person), as well as the current exchange rates if the transfer is international.

Some banks will allow you to deposit a money order using their mobile app using their mobile deposit feature. Check with your financial institution to see if online deposits are accepted.

It depends on the money order issuer. USPS does not accept credit cards as a form of payment for money orders. Western Union and MoneyGram may accept credit cards for online transfers, but you will usually have to pay an additional fee.