In Cuba, sanctions imposed by the United States more than 60 years ago have failed to dislodge the communist regime — but they’ve made it more difficult to get critical medical supplies to the island.

In Iran, U.S. sanctions that date to the 1970s have not forced out Tehran’s theocratic rulers — but they have pushed the country to forge close alliances with Russia and China.

In Syria, dictator Bashar al-Assad remains in power despite 20 years of U.S. sanctions — but the country is struggling to rebuild from civil war, and more Syrians than ever are expected to need critical humanitarian assistance this year.

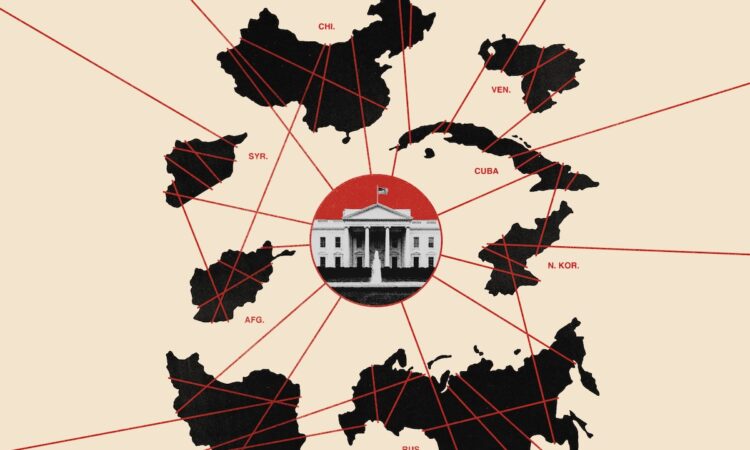

In country after country, sanctions have emerged as the key instrument of U.S. foreign policy.

Today, the United States imposes three times as many sanctions as any other country or international body, targeting a third of all nations with some kind of financial penalty on people, properties or organizations. They have become an almost reflexive weapon in perpetual economic warfare, and their overuse is recognized at the highest levels of government. But American presidents find the tool increasingly irresistible.

By cutting their targets off from the Western financial system, sanctions can crush national industries, erase personal fortunes and upset the balance of political power in troublesome regimes — all without putting a single American soldier in harm’s way.

But even as sanctions have proliferated, concern about their impact has grown.

In Washington, the swell of sanctions has spawned a multibillion-dollar industry. Foreign governments and multinational corporations spend exorbitant sums to influence the system, while white-shoe law firms and K Street lobbying shops have built booming sanctions practices — in part by luring government officials to cash in on their expertise.

Elsewhere, sanctions have pushed autocratic regimes into black market trade, empowering criminal networks and gangs of smugglers. U.S. adversaries are ramping up their efforts to work together to circumvent the financial penalties. And like military action, economic warfare can leave collateral damage: Sanctions on Venezuela, for instance, contributed to an economic contraction roughly three times as large as that caused by the Great Depression in the United States.

Sanctions — or even just the threat of them — can be an effective policy tool, a way to punish bad behavior or pressure an adversary without resorting to military force. Sanctions have allowed U.S. governments to take moral, economically meaningful stands against perpetrators of war crimes. They helped bring an end to South Africa’s apartheid regime and contributed to the eventual overthrow of Serbian dictator Slobodan Milosevic. Even when they fail, proponents say, they can be preferable to the alternative, which might be doing nothing — or going to war.

Still, North Korea has been sanctioned for more than a half-century without halting Pyongyang’s efforts to acquire nuclear weapons and intercontinental ballistic missiles. U.S. sanctions on Nicaragua have done little to deter the authoritarian regime of President Daniel Ortega. Two years of sanctions on Russia over its invasion of Ukraine have degraded Moscow’s long-term economic prospects and raised the costs of military production. But these sanctions have also spawned a “dark fleet” of ships selling oil outside international regulations, while bringing the Kremlin into closer alliance with Beijing.

Alarm about sanctions’ rise has reached the highest levels of the U.S. government: Some senior administration officials have told President Biden directly that overuse of sanctions risks making the tool less valuable. And yet, despite recognition that the volume of sanctions may be excessive, U.S. officials tend to see each individual action as justified, making it hard to stop the trend. The United States is imposing sanctions at a record-setting pace again this year, with more than 60 percent of all low-income countries now under some form of financial penalty, according to a Washington Post analysis.

“It is the only thing between diplomacy and war and as such has become the most important foreign policy tool in the U.S. arsenal,” said Bill Reinsch, a former Commerce Department official and now the Scholl chair in international business at the Center for Strategic and International Studies, a Washington-based think tank.

“And yet,” Reinsch said, “nobody in government is sure this whole strategy is even working.”

‘Start pounding things with this hammer’

Economic warfare has been around for millennia: Ancient Athens imposed trade sanctions on its adversaries in the 5th century B.C., and U.S. presidents have restricted foreign trade since the dawn of the republic. In 1807, Thomas Jefferson closed U.S. ports to export shipping and restricted imports from Britain. Today’s sanctions have their foundation in laws passed during the Cold War and World War I.

Saddam Hussein’s invasion of Kuwait in 1990 gave rise to a new form of the weapon: an international blockade of exports to Iraq. After the Gulf War, comprehensive sanctions made it impossible for Iraq to export oil or import supplies to rebuild its decimated water and electrical systems, and illnesses such as cholera and typhoid surged.

At the same time, with the collapse of the Soviet Union, the United States was emerging as the world’s unrivaled superpower, both financially and militarily. Governments and banks around the world were dependent on the U.S. dollar, which remains the dominant currency on Earth.

Today, the dollar buys access to the American economy but also undergirds international trade even when there is no connection to an American bank or business. Commodities like oil are priced globally against the greenback, and countries trading in their own currencies rely on dollars to complete international transactions.

That financial supremacy creates a risk for U.S. adversaries and even some allies. To deal in dollars, financial institutions must often borrow, however temporarily, from U.S. counterparts and comply with the rules of the U.S. government. That makes the Treasury Department, which regulates the U.S. financial system, the gatekeeper to the world’s banking operations.

And sanctions are the gate.

Treasury officials can impose sanctions on any foreign person, firm or government they deem to be a threat to the U.S. economy, foreign policy or national security. There’s no requirement to accuse, much less convict, anyone of a specific crime. But the move makes it a crime to transact with the sanctioned party.

Coming under U.S. sanctions amounts to an indefinite ban from much of the global economy.

“

“It is the only thing between diplomacy and war and as such has become the most important foreign policy tool in the U.S. arsenal. And yet, nobody in government is sure this whole strategy is even working.”

Bill Reinsch,

a former Commerce Department official and now the Scholl chair in international business at the Center for Strategic and International Studies

The system built slowly. Initial targets (in addition to communist Cuba) were drug cartels in places like Mexico and Colombia and rogue regimes like Libya. As recently as the 1990s, the Treasury Department’s Office of Foreign Assets Control (OFAC) was responsible for implementing just a handful of sanctions programs. Its staff fit comfortably in a single conference room. One of its major responsibilities was blocking American sales of Cuban cigars.

All that changed after the terrorist attacks of Sept. 11, 2001. Congress enacted legislation to compel financial institutions to maintain records of consumer transactions and hand them over to law enforcement. Suddenly, U.S. officials had volumes of information on the world’s banking customers, just as the rise of digital banking gave new insights into the worldwide flow of money.

As the Treasury Department became a key player in the global war on terrorism, U.S. policymakers began to understand the power of the nation’s financial hegemony. Experts urged a more sophisticated approach than the blunt embargo used in Iraq. “Smart sanctions,” these advocates hoped, would be more precise, applying maximum pressure by cutting off only malicious actors.

Proof of concept soon materialized. In 2003, North Korea alarmed the world by withdrawing from a nuclear weapons treaty. Treasury officials under President George W. Bush not only targeted the Macao bank that processed payments for Pyongyang, but also threatened any banks that traded with that one.

North Korean officials howled — and the measures stymied Pyongyang’s finances. The episode was a revelation for Treasury staffers: America appeared to have cowed a foe halfway around the world without firing a single bullet or spending a single penny.

“It was a pivotal moment,” said Kristen Patel, who served in senior roles at the Treasury Department’s Financial Crimes Enforcement Network from 2015 to 2017 and now teaches sanctions policy and illicit finance at Syracuse University. “Treasury got the go-ahead to start pounding things with this hammer.”

‘Every Little Thing We Do Is Sanctions’

The playbook soon shifted to include bigger targets and more aggressive enforcement. In 2010, President Barack Obama worked with Congress to approve sanctions designed to force Iran to give up its nuclear ambitions. The Justice Department began levying billions of dollars in fines on Western banks that defied Treasury prohibitions.

These sanctions applied not just to Iran, but also to firms trading with Iran, undercutting Tehran’s links to international markets. Iranian leaders buckled, deciding to seek a nuclear deal that promised an end to financial isolation.

This display of power led to fresh demand. By Obama’s second term, sanctions had been imposed on a growing list that included military officials in the Democratic Republic of Congo, suppliers of the Yemeni military, Libyan officials connected to Moammar Gaddafi and — after a brutal crackdown on civilian protesters in Syria — President Bashar al-Assad.

Congress got in on the act, flooding the State Department and the White House with requests for sanctions that, in some cases, appeared intended to cut off foreign competition to home-state industries.

In 2011, at a holiday party in the Hotel Harrington in downtown Washington, Adam Szubin, then director of OFAC, sang a song titled “Every Little Thing We Do Is Sanctions” to the tune of “Every Little Thing She Does Is Magic” by the Police, Szubin confirmed in an email.

Some experts saw the surge as spiraling out of control.

“Smart sanctions were meant to be a buffet of choices where you fit the particular imposed sanction to the offense and vulnerability of the country,” said George Lopez, a sanctions scholar at the University of Notre Dame who is widely credited with helping to popularize the idea more than 20 years ago. “Instead, policymakers walked into the buffet and said, ‘I’m going to pile everything onto my plate.’”

In 2014, Russia’s illegal invasion and annexation of Crimea from Ukraine presented Treasury with a huge challenge. Countries like North Korea and Iran were viewed as serious national security threats, but nobody believed they were integral to global finance. Now Treasury was forced to confront one of the 10 biggest economies in the world. A wrong move could send global markets reeling.

Treasury aides who had once labored in obscurity took recommendations directly to Cabinet officials, who were simultaneously hearing from alarmed Fortune 500 CEOs and the heads of Wall Street banks. Sanctions were suddenly a key feature in the reemerging “great power” competition among Washington, Beijing and Moscow.

“You’d get requests and comments from seemingly every corner of the government: ‘Why have you not imposed sanctions on these people? And what about those people?’” said Adam M. Smith, who served as senior adviser to OFAC and director for multilateral affairs on the National Security Council during the Obama administration.

“Regardless if you were a Democrat or a Republican, the thought process was always: Why would you not continue to do this?” Smith said.

Challenges emerge as sanctions rise

But government officials began to notice problems with Treasury’s complicated new regime. Sanctions on Russia targeting allies of President Vladimir Putin and state banks had no apparent effect on control of Crimea. European leaders grew angry over fines levied on their banks. Wall Street power brokers started to grumble about the costs of complying with the dizzying new instructions.

The number of sanctioned entities appeared to be growing too fast for OFAC to keep up. Nuance bred confusion; requests for clarification poured in, and the number of lawsuits against the agency tripled. Turnover intensified, as the rising stakes allowed Treasury staffers to bolt for private-sector paydays that could quadruple their earnings.

A more existential challenge emerged, as well: The power of sanctions lay in denying foreign actors access to the dollar. But if sanctions make it risky to depend on dollars, nations may find other ways to trade — allowing them to dodge U.S. penalties entirely.

In March 2016, Obama Treasury Secretary Jack Lew warned publicly of “sanctions overreach” and the risk that their “overuse could ultimately reduce our capability to use sanctions effectively.”

And yet the incoming Trump administration again found new uses for the financial weapon as it applied more sanctions than ever. As president, Donald Trump used sanctions for retribution in ways never conceived — ordering them, for instance, on officials with the International Criminal Court after it opened a war crimes investigation into the behavior of U.S. troops in Afghanistan.

The Trump administration also hit Venezuela with crippling sanctions, aiming to discredit the dictatorship of Nicolás Maduro and encourage an opposition movement. The penalties failed to oust Maduro — and are now often blamed for exacerbating one of the worst peacetime economic collapses in modern history.

“The abuse of this system is ridiculous, but it’s not Treasury or OFAC’s fault: They are good professionals who have all this political work being shoved on them. They want relief from this relentless, never-ending, you-must-sanction-everybody-and-their-sister, sometimes literally, system,” said Caleb McCarry, who served as a senior staffer to the Senate Foreign Relations Committee and was the State Department’s lead on Cuba policy during the George W. Bush administration. “It is way, way overused, and it’s become out of control.”

Reform plans shelved

By the time of Biden’s inauguration, a consensus had emerged among his transition team that something had to change.

In the summer of 2021, five Treasury staffers worked up an internal draft proposing to restructure the sanctions system. It ran roughly 40 pages, according to two people involved, and would have represented the most substantial revamp of sanctions policy in decades.

But like the three previous administrations, Biden’s team found the power difficult to give up.

Treasury staffers watched their bosses take out key parts of their plan, including a provision that would have created a central coordinator, said the people familiar with the document, who spoke on the condition of anonymity to reflect confidential discussions. By the time Treasury publicly released its “2021 Sanctions Review” in October that year, the 40-page draft had dwindled to eight pages and contained the earlier document’s most toothless recommendations, the people said. (Two people familiar with the matter blamed internal disagreements with the State Department for the extent of the changes and said Treasury leadership also opposed the revisions. A State Department spokesman declined to comment.)

Four months later, Russian troops marched into Ukraine, and Biden unleashed an unprecedented volley of more than 6,000 sanctions in two years. And not only on Russia: The Biden administration has penalized targets including Israeli settlers in the West Bank, former government officials in Afghanistan, alleged fentanyl dealers in Mexico and a North Macedonian spyware company. Meanwhile, sanctions that Biden had said he would ease, such as those imposed by Trump on Cuba, were largely maintained under pressure from Capitol Hill, despite the view among top administration officials that the embargo is counterproductive and a failure.

The Biden administration has taken steps to mitigate unintended consequences. Last year, Treasury announced it had hired economists to staff a new division analyzing the economic impact of sanctions. Humanitarian groups have praised Biden administration efforts to ensure that critical medical supplies and food can enter countries under sanctions. And some of critics’ worst fears have not materialized: The dollar remains the world’s top reserve currency, at least for now.

“Sanctions are an important tool that can help promote our national security, but they should only be used as part of a broader foreign policy strategy,” Deputy Treasury Secretary Wally Adeyemo said in a statement. “The 2021 Treasury Sanctions Review has provided a useful road map to help us refine the use of this important tool.”

But other problems appear to be getting worse. Current and former U.S. officials describe OFAC’s workload as overwhelming, the agency inundated with tens of thousands of requests from the private sector. Some White House officials have outsourced national security questions to nonprofits, as they brainstormed scenarios in which sanctions would have to be massively ramped up to confront U.S. adversaries, according to two people familiar with the matter, who spoke on the condition of anonymity to describe internal talks.

In late 2022, senior White House advisers again held discussions about reforming U.S. sanctions. In closed-door talks that included Biden, aides talked about the need to set guidelines for economic statecraft, including limiting the use of sanctions to moments when “core international principles that underpin peace and security are under threat,” one of the officials said.

But those ideas were shelved in the face of more pressing demands.

“The mentality, almost a weird reflex, in Washington has just become: If something bad happens, anywhere in the world, the U.S. is going to sanction some people. And that doesn’t make sense,” said Ben Rhodes, who served as deputy national security adviser in the Obama administration.

“We don’t think about the collateral damage of sanctions the same way we think about the collateral damage of war,” Rhodes said. “But we should.”

About this story

Design and development by Stephanie Hays. Illustrations by Chantal Jahchan. Photo editing by Haley Hamblin. Design editing by Betty Chavarria. Visual editing by Karly Domb Sadof. Graphics editing by Kate Rabinowitz.

Editing by Mike Madden and Lori Montgomery. Copy editing by Feroze Dhanoa and Brian Malasics.

Project editing by Ana Carano. Additional production and support from Jordan Melendrez, Sarah Murray, Megan Bridgeman, Kathleen Floyd, Jenna Lief and Alisa Vazquez.

Methodology

To examine the rise of U.S. sanctions, The Post obtained and analyzed 30 years of historical data scraped from the Treasury Department’s Office of Foreign Assets Control by Enigma Technologies, a data and entity resolution company that specializes in sanctions screening and business intelligence. Reporters compared U.S. sanctions with those issued by other authorities using data provided by Castellum.ai, a compliance platform covering global sanctions, export controls and other financial crime risks.

The Post used the Global Sanctions Database, an academic project coordinated by the Hochschule Konstanz University of Applied Sciences, the Austrian Institute of Economic Research and the Drexel University School of Economics, to determine which countries were subject to U.S. sanctions from 1950 to 2022. The World Bank income classification framework helped reporters assess whether low-income countries had been targeted more than others; the bank’s regional classification helped illustrate which regions had been targeted.