While it may seem like it takes only minutes for an American citizen to open an account, it can take non-U.S. citizens a lot longer due to more paperwork. You’ll have to meet more requirements if you want to start saving (and spending) dollars in the U.S. Here’s what it means if you’re a new to the U.S. and you want to open a bank account.

Key Takeaways

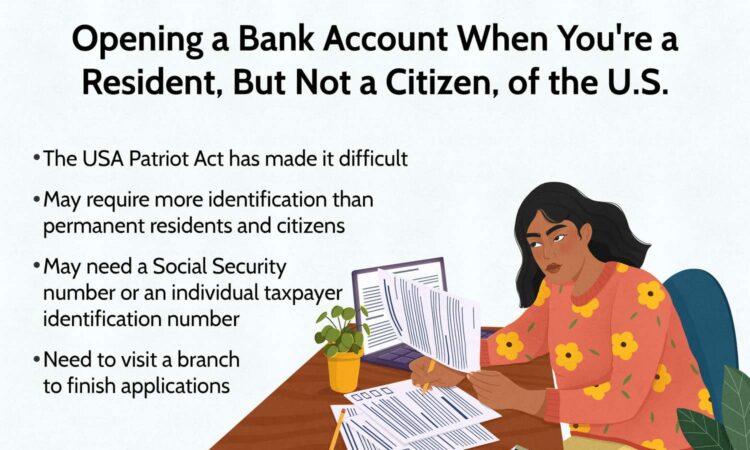

- Banks require all account applicants to show proof of identity and an address.

- Newcomers require more identification than permanent residents and citizens.

- Anyone opening an account may need a Social Security number or an individual taxpayer identification number.

- Although many banks allow customers to open their accounts online, nonresidents may need to visit a branch to finish their applications.

- The citizens of some nations may face additional hurdles.

How Opening a Savings Account Works in the U.S.

A U.S.-based bank account can help you pay bills, get a U.S.-based ATM and debit card, receive funds via direct deposit, and more easily transfer money using apps like Venmo, which only works for people physically located in the U.S. with a U.S. phone number.

While you can open an account, the rules are different for non-citizens due to federal regulations. According to the U.S. government, foreign individuals wishing to open U.S. bank accounts can be divided into resident and non-resident aliens.

A non-resident alien is someone who:

- Isn’t a non-U.S. citizen

- Isn’t a lawful permanent resident of the U.S. during the calendar year and doesn’t meet the substantial presence test.

- Hasn’t been issued an alien registration receipt card, also known as a “green card.”

According to the Federal Financial Institutions Examination Council (FFIEC), non-resident alien banking system deposits in the U.S. range from hundreds of billions of dollars to about $1 trillion.

But banks and credit unions must follow stricter guidelines when verifying the identity of a non-American account applicant, whether you’re an international student, business owner, or H1-B visa holder.

If you’re a legal permanent resident, though, it will probably take you the same amount of time to open your account as a citizen.

The laws governing bank accounts for foreigners are federal, but their application is local. Banks and credit unions have different document requirements and processes for non-American citizens who open accounts. Check in advance about what’s required before you begin the process, especially since you’ll almost certainly be applying in person at a brick-and-mortar location.

What You Need to Open an Account

The bank or credit union is required to gather proof of the following from you:

- Name

- Birthdate

- Address

- Identification number of some type

Validating documents provide the proof necessary, as explained further below. You’ll have to bring originals because photocopies are not accepted. In addition, many banks and credit unions may require a minimum deposit to open an account.

Identification

Applicants for a bank account need to show photo identification. This must be an unexpired government-issued identification that shows your nationality or residence. The identification must have a photograph. For U.S. citizens, this could be a driver’s license or passport. For non-U.S. citizens, options could include:

- A valid foreign passport

- Alien identification number from a green card

- Border Crossing Card-DSP-150, with photo

- Other U.S. Visa

- Consular identification (CID) card

- Other government-issued ID from your home country, as long as it includes a photo and shows proof of your nationality

Proof of Physical Address

You should bring proof of your current U.S. address, such as a utility bill with your name and address or a letter addressed to you. If you’re a student or employed, you might bring documents regarding your workplace. For example, some credit unions only allow you to join if you live or work in the credit union’s service area.

Social Security Number or ITIN

You can open an account that does not pay any interest if you don’t yet have a Social Security number (SSN) or individual taxpayer identification number (ITIN). But you must pay U.S. taxes on any earnings if you want to earn interest. Certain resident and nonresident aliens unable to obtain Social Security numbers may file IRS form W-7 to get an ITIN.

Some banks may also require you to bring your home country’s tax ID or federal ID number to open an account.

Most nonresident aliens need to walk into a bank branch in order to open an account. Even if you’re able to begin opening your account online, you’ll probably be required to appear in person to complete your application. Heightened post-2001 security led to the near-elimination of online applications for foreign accounts, due to the fear of terrorism-related money laundering. That makes it difficult to apply to many online-only banks.

Minimum Deposits

Minimum deposits vary by institution but are usually modest. Some initial bank deposits range between $5 and $50, while others have higher requirements. It all depends on where you bank.

Challenges With Opening an Account

Some newcomers may face additional challenges depending on their nationality, immigration status, income source, or the financial services they want to perform. You may go through other requirements, or your account may be flagged as higher risk due to the following:

- Your home country

- Your job—for example, any non-U.S. government responsibilities, authority, or influence

- Banking products and services used, or unusual account activity

- Forms of identification you provide

- Your sources of wealth and funds

Some nations and their citizens are subject to special Office of Foreign Assets Control requirements. For example, certain Cuban nationals in the U.S. with a non-immigrant status might be able to open a bank account. But the Cuban national could only use the account while in the U.S. The person could not access the U.S. account to make and receive certain payments if visiting or residing in Cuba. This rule helps the U.S. bank observe sanctions against Cuba.

As another example, an international student might need to bring proof of identification and U.S. immigration status, a university identification card, letter of enrollment, and government identification documents. Even with these documents, you may find that only larger or university-affiliated institutions will accept your account application.

Can I Open a Bank Account Without SSN or ITIN?

Opening a bank account without a Social Security number (SSN) or individual taxpayer identification number (ITIN) may be possible. However, if you get a bank account that pays interest (such as a high-yield savings account or interest-earning checking account), you will need an ITIN. Any interest you earn is subject to U.S. taxes—even if it’s just $10.

Can I Open an Online Bank Account if I’m Not a U.S. Citizen?

Due to federal regulations and internal bank policies, you may find it difficult to open an account with an online bank if you’re a non-resident alien. The online bank may only open accounts for citizens or legal permanent residents in the United States with proof of a U.S. street address.

Can a Tourist Open a U.S. Bank Account?

It may be possible to open a U.S. bank account, but much depends on the bank’s policies and any background checks. A bank might require you to have a U.S. physical address to open an account. Be sure to call or ask in advance, then visit the bank branch in person. Bring any required documentation such as a tourist visa, a type of nonimmigrant visa for people who wish to temporarily enter the U.S—usually for business, medical reasons, or vacation. You may find it easier to open a U.S. bank account with a multinational financial institution.

Investopedia / Yurle Villegas

The Bottom Line

Opening a bank account as a foreign national involves more effort, and perhaps more stress, especially for those who lack resident-alien status.

If you’re still living in your home country, consider seeking out a U.S-based multinational bank that has branches where you live and opening an account with them before you leave. Such a move at a foreign branch bank provides international applicants with the opportunity to build up a business relationship with the institution that should simplify applying for a U.S. account at one of its branches in the U.S.