By Kevin Peachey, Cost of living correspondent

BBC

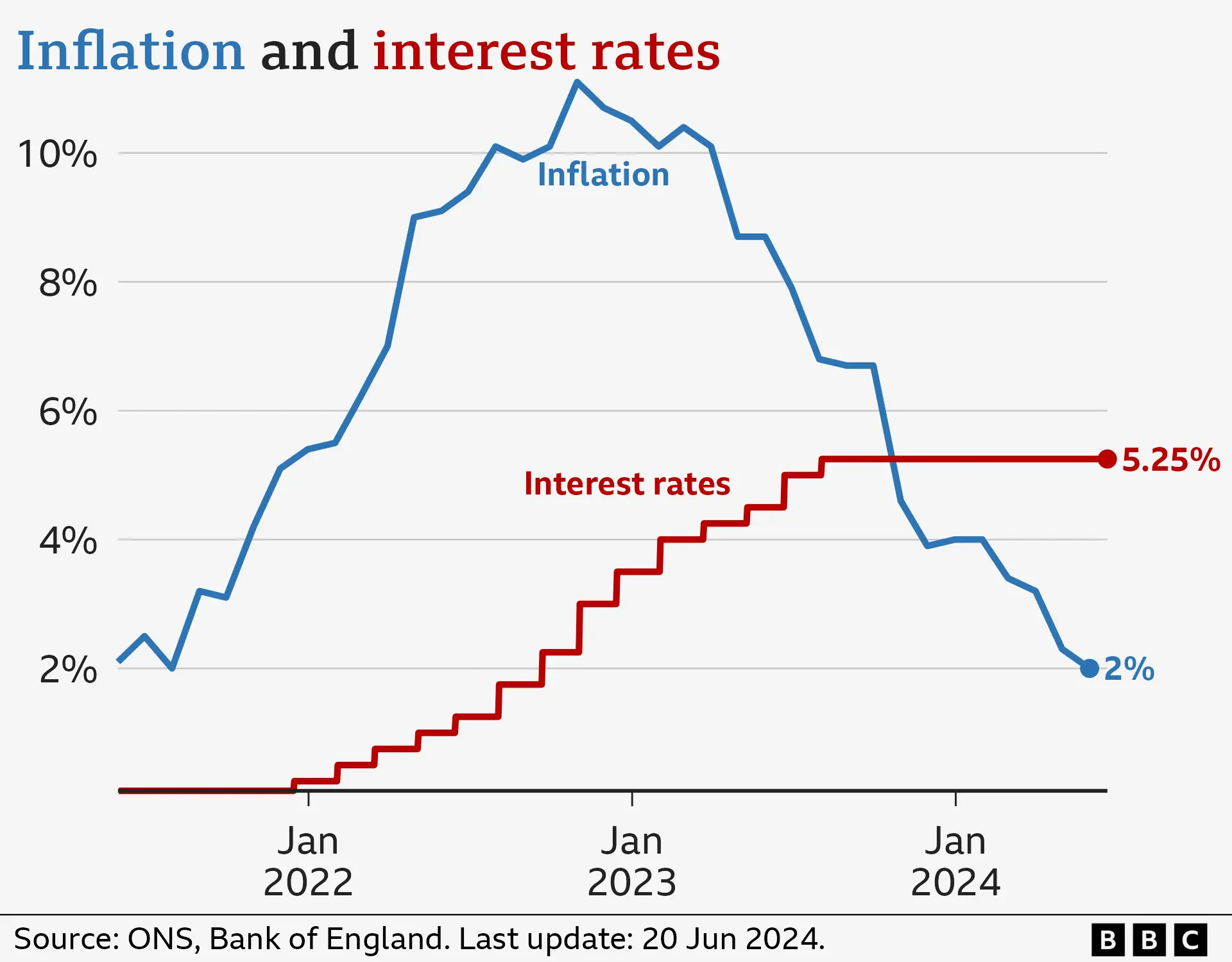

BBCThe Bank of England has held interest rates at 5.25% for a seventh time in a row.

UK inflation hit the Bank’s target of 2% in May, but rates are not expected to come down until the Bank is confident that price rises are stable.

So, in turn, analysts believe people may have to wait a while yet for the cost of mortgages to fall significantly.

Interest rates affect mortgage, credit card and savings rates for millions of people across the UK.

What are interest rates and why do they change?

An interest rate tells you how much it costs to borrow money, or the reward for saving it.

The Bank of England’s base rate is what it charges other lenders to borrow money.

This influences what other banks charge their customers for loans such as mortgages, and the interest they pay on savings.

When inflation is high, the Bank – which has a target to keep inflation at 2% – may decide to raise rates.

The idea is to encourage people to spend less, to help bring inflation down by reducing demand.

Once this starts to happen, the Bank may hold rates, or cut them.

When will UK interest rates go down?

The current Bank rate of 5.25% is the highest level for 16 years.

However, it was significantly above this for much of the 1980s and 1990s, hitting 17% in November 1979.

There have been questions about why interest rates have not been cut, given inflation is now far below its peak of 11.1% in October 2022.

However, the Bank also considers other measures of inflation when deciding how to change rates, and some of these remain higher than it would like.

As a result, previous thoughts of a spring cut were revised, but there are hints of the possibility of an interest rate cut in August.

The Bank has to balance the need to slow price rises against the risk of damaging the economy, or cutting rates only to have to raise them again shortly afterwards.

How much could interest rates fall?

Although UK inflation has hit the Bank’s target of 2%, it is expected to rise a little over the course of the year before settling back down in early 2025, so it is difficult to predict exactly what will happen to interest rates.

But the organisation, which advises its members on how to improve their economies, acknowledged that the Bank had to balance the risk of not cutting too quickly before inflation is under control.

How do interest rates affect me?

When interest rates rise or fall, around 1.2 million people on tracker and standard variable rate (SVR) deals usually see an immediate change in their payments.

But more than eight in 10 mortgage customers have fixed-rate deals. While their monthly payments aren’t immediately affected, any future deals are.

Mortgage rates are much higher than they have been for much of the past decade, with the average two-year fixed rate now at just under 6%, according to the financial information service Moneyfacts.

This means homebuyers and those remortgaging have to pay a lot more than if they had borrowed the same amount a few years ago.

About 1.6 million deals are expiring in 2024, according to banking trade body UK Finance.

You can see how your mortgage may be affected by interest rate changes by using our calculator:

Bank of England interest rates also influence the amount charged on credit cards, bank loans and car loans.

Lenders can decide to put their rates up if they expect higher interest rates from the Bank of England. However, if rates fall, interest payments may get cheaper.

Getty Images

Getty ImagesThe Bank of England interest rate also affects how much savers can earn on their money.

Individual banks and building societies have been under pressure to pass on higher interest rates to customers.

There are some good deals on the market and experts say customers should shop around, as money may be in accounts paying little or no interest.

Are other countries raising their interest rates?

In recent years, the UK has had one of the highest interest rates in the G7 – the group representing the world’s seven largest so-called “advanced” economies.

In June, the European Central Bank (ECB) cut its main interest rate from an all-time high of 4% to 3.75%, the first drop in five years.

In March it had suggested there could be three cuts in 2024.